Insight from Data and Analytics

Insight from Data and Analytics

Midcap Companies and Their Equity Sponsors are Ready to Have a Discussion about Harnessing Their Own Data

I have been working with private equity-backed companies and private equity deal teams for almost 25 years. For the last 20, only a small subset of management teams were both interested in extracting real data and insights from their systems and willing to invest the resources, time, and effort in the process. OR they would have liked to undertake such a project but did not have anyone on the team who could take on the challenge, and therefore it was a non-starter.

In our experience, a big hold up to starting the process is the inability to extract and clean the data. Worse, we see a lot of ineffective consulting which delivers high-level analysis on partial or un-clean data. At best it provides directional answers for one-time use. At worst it provides incorrect answers due to poor data quality AND after the initial analysis, no way to continue building because no one can back-track and fix what’s wrong in data collection, so all future data is flawed.

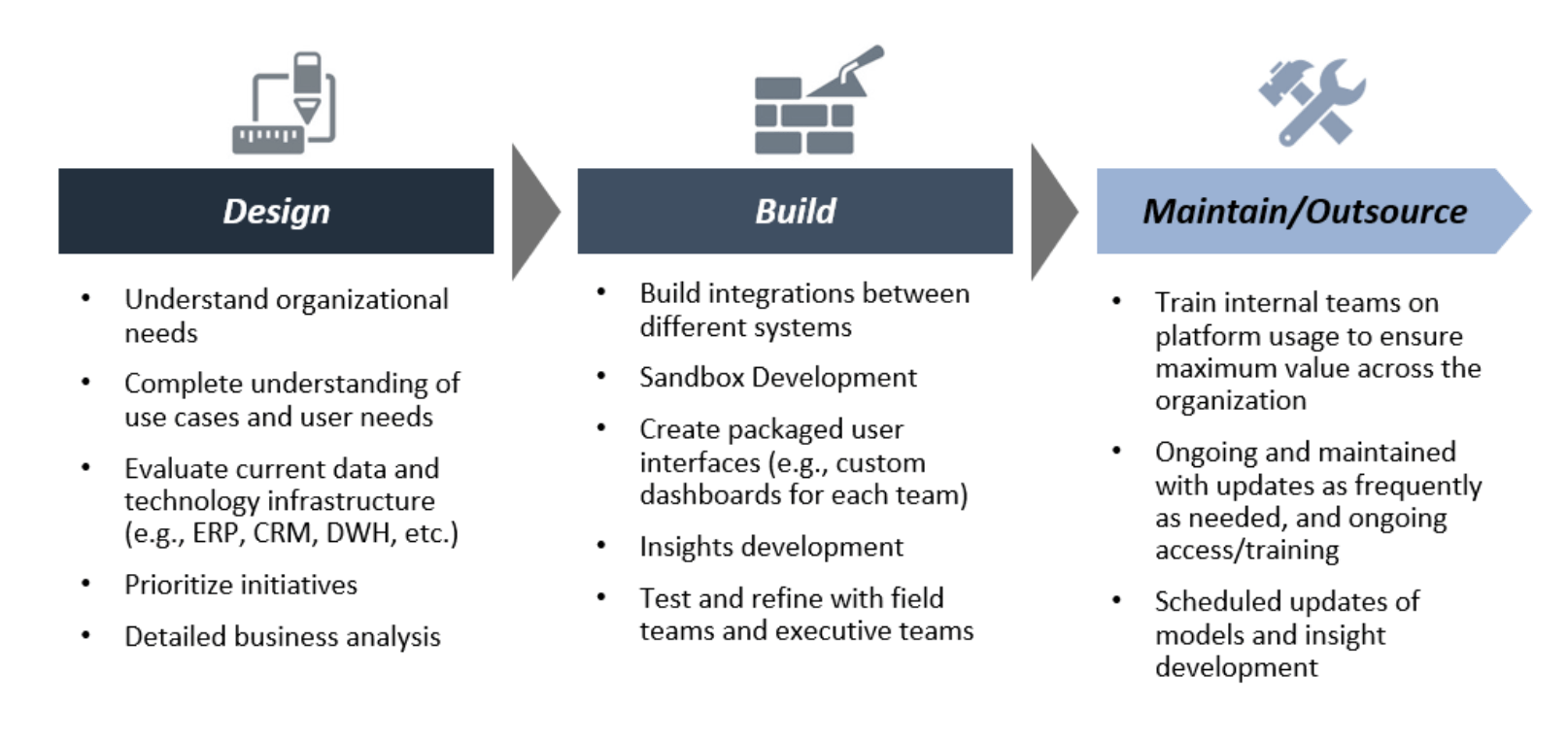

But the tide is turning, a lot of clients are interested in having a real discussion, and more are willing to make the investment to develop a culture of making more data-driven decisions. If they do not have someone in Ops, Sales, or the CFO’s office who has the in-depth knowledge to lead such an effort, executives are more comfortable with trusted hands leading the way to accomplish these tasks. Some clients want a design, build, and transfer approach while others want the design, build, and maintain from the outside until they develop the internal resources to manage the effort. Some clients want a project, while others want a third-party to develop and manage the functional capability.

The Stax process has always been fast-paced to gather insights and gain quick wins; to develop a light-tech layer for rapid deployment, low cost, high flexibility, and easy maintenance for the client. Once we provide management teams with unique insights and a platform to quickly develop more insights, their appetite increases creating a virtuous cycle within the organization for data, more data-driven decisions, and continuous improvement.

It is the combination of business consulting, a technology skillset, and data and analytics that develops actionable insights. We have invested heavily in the technology and team to ensure proper data extraction, cleaning, and how best to link data and improve client systems, which allows you to aggregate your data with confidence. This unique approach creates a powerful analytic base which we can develop insights in an integrated way for the management team; which leads to faster learning and a more engaged team in determining what drives their success.

PE-backed companies can start this process early in ownership, mid-stage, or at a re-underwriting, and even around exit planning to identify profit improvement for the next stage of ownership and to create more value in the exit process. Our clients have utilized our experience around sector and company forecasting, sales and marketing, product and customer profitability, optimization of location businesses, and FP&A to name a few of the practical applications.

Some elements are unique to a sector or company, such as developing KPIs, but the core process, technical needs, and experiential requirements remain consistent. In our experience, what speeds this process is a cross-functional consulting team with business consulting, technology, and data and analytics skills.

Our teams work in parallel with:

- Executive teams - what is important for the business, their key questions, and what we hypothesize will be answerable with internal data and external data.

- Client technical teams - understanding current reporting, workflows and data systems, from which we extract, clean, and analyze data.

We also find clients need to be creative about data sourcing (it is everywhere), vigilant on data cleansing, both exhaustive and critical when analyzing data, and create lots of cycles (early, mid, and late stages) for reviewing with analytics/cross-functional client teams and industry experts. And all along the way, we work closely with the client to see how they run the operation and what will make the results actionable, and how to put the system in place to be sustainable for continued analytics.

We generally get the client’s initial reads within 6 weeks, deep answers in 8 weeks, deploy a built-in analytics platform to the client within 3 months and ramp up training in 4 months. Just enough time to go from one board meeting to answers by the second to full implementation by the third, and culturally a more data-driven company within a year.

A handful of things are changing:

- More management teams understand they are sitting on a mountain of data and do not have the internal resources; if you can offer them quick wins in 2-3 months and a platform they can keep growing with, then they are really interested.

- Equity sponsors are now hiring data scientists so that they have someone internal who can talk the talk with a specialized consulting firm like Stax.

- More teams have past experience and/or the COO, CFO has a team that can help gather the data and has an interest in bringing this type of learning to their firms.

It is easier to design, build, and maintain/transfer than ever before, and as someone who has been selling data-driven consulting for 25 years, it is nice to see how much value can be created so quickly for our clients.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy