Share

With the current markets, a logical, near-term question is how to optimize CapEx and inventory to save money before eliminating jobs. Because it is a largely analytic effort with data that can be sourced remotely and management interviews that can be done over the phone or video, we find these projects have always been done without travel or limited travel. Businesses that lend themselves to this effort can range from industrial, rental, and service businesses that require equipment to any MRO supply and inventory-heavy business. This includes manufacturing equipment, fleets, testing equipment, and all kinds of equipment utilized to support and service customers.

Any growing or recently acquisitive company probably has been so focused on growth trajectory and with so much inexpensive debt, hasn’t needed to focus on CapEx or optimizing inventory. This also may have been less of a priority, given the challenge that underlying data often lies in multiple, disparate systems.

When we say CapEx and inventory, it isn’t just the total spend, it’s the specific spend on items that require capital. How many of these, and how of those do we really need to own? The real value is getting beneath the averages to get down to the items you need to have, the number you don’t need to own, and the cost-benefit of choices you can make around each of them – including when to buy, lease, short-term rent, or move assets around your own organization.

We like these types of projects because they allow us to quickly identify tangible profit opportunities, and build dashboards to see tradeoffs in profitability, so that field teams can make fast decisions ultimately improving financial performance.

Typical questions which can be answered include:

- What is the bare minimum of CapEx for each type of unit/asset, and what is my ability to stretch this number and what are the cost tradeoffs?

- What is the profit-maximizing level of CapEx – presuming there are sufficient levels of cheap capital, and what’s the converse, meaning what’s best to do with limited capital?

- Where are the edge cases and peak/trough cases, where I might want to own less, and rent/lease capacity, trading off less gross profit for a service opportunity, but saving significant CapEx.

- How does this impact service levels and are there cases where, if I shift customer demand slightly, would I receive profit per unit?

- Is there a chance I will lose customers if I don’t have the resources or products at the right time?

- Is it the same cost to serve all customers, or are some customers clearly more costly or unprofitable based on their usage patterns?

- Are there some customers with whom it is worth discounting or peak pricing based on the availability of equipment? As customers understand both a surge-pricing model and are cost-conscious, they might appreciate options?

Typical Process for a Mid-Cap Company in 2-4 months

What’s the dashboard view? Imagine fully mapped out analysis and a dashboard showing you all the inputs that you can change, and the results so that you can run tradeoffs. Multi-dimensional sensitivity analysis which a management team can utilize to have a data-driven discussion. Then imagine you can have multiple versions – some that might be used by management to set guidelines, and others with those guidelines can be utilized in the field to make day-to-day decisions.

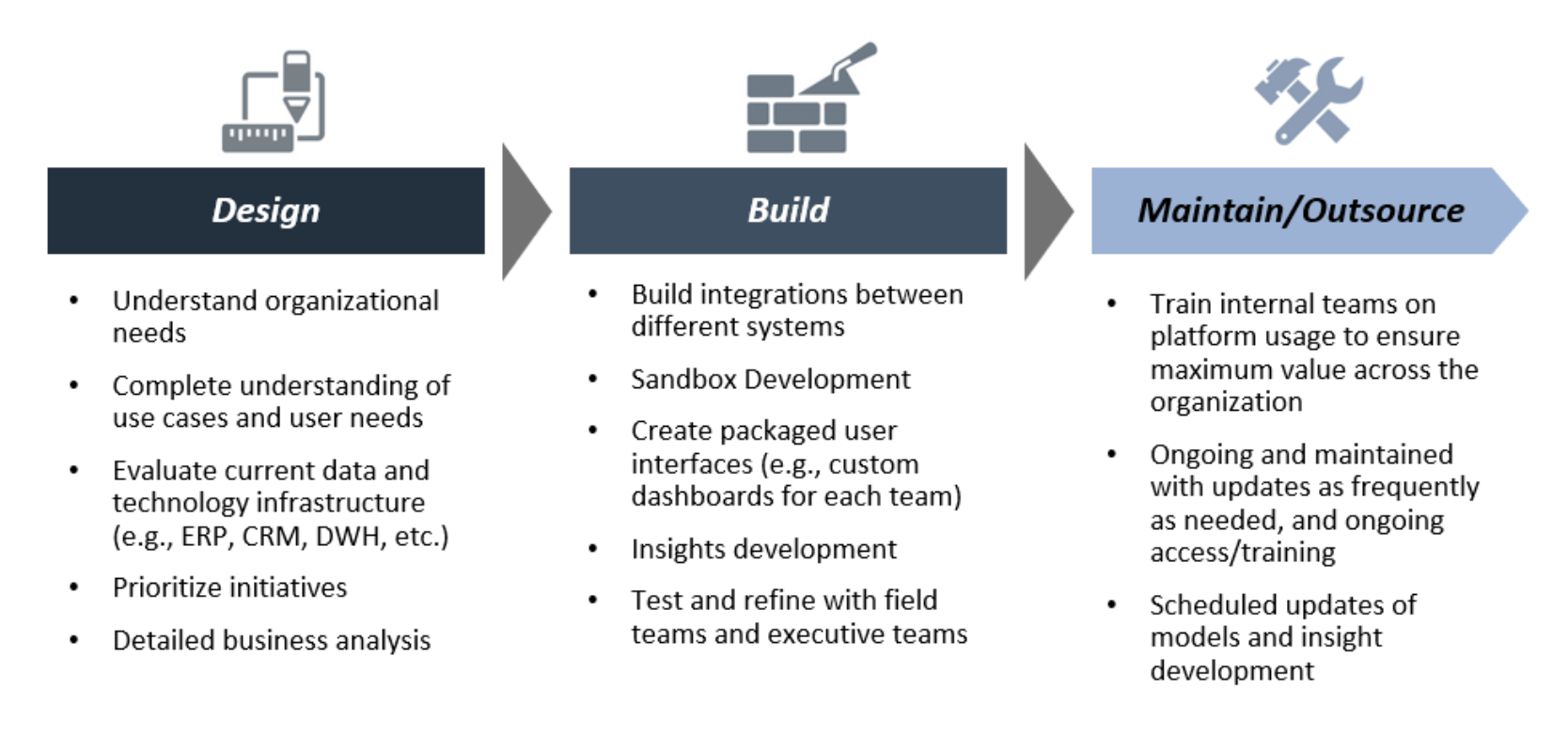

Is it easy? Depends on your definition of easy and who you are asking. This process can be done quickly, in a collaborative manner that gets quantitative and actional answers and excellent buy-in from operating teams. This in turn, drives immediate and long-term value. The Stax approach is to set up a deep analysis and create a technology platform, typically a dashboard we develop with clients that they can utilize immediately without hiring additional staff. We call the process “design, build, transfer and/or maintain.”

Process and Customization for Effective Implementation

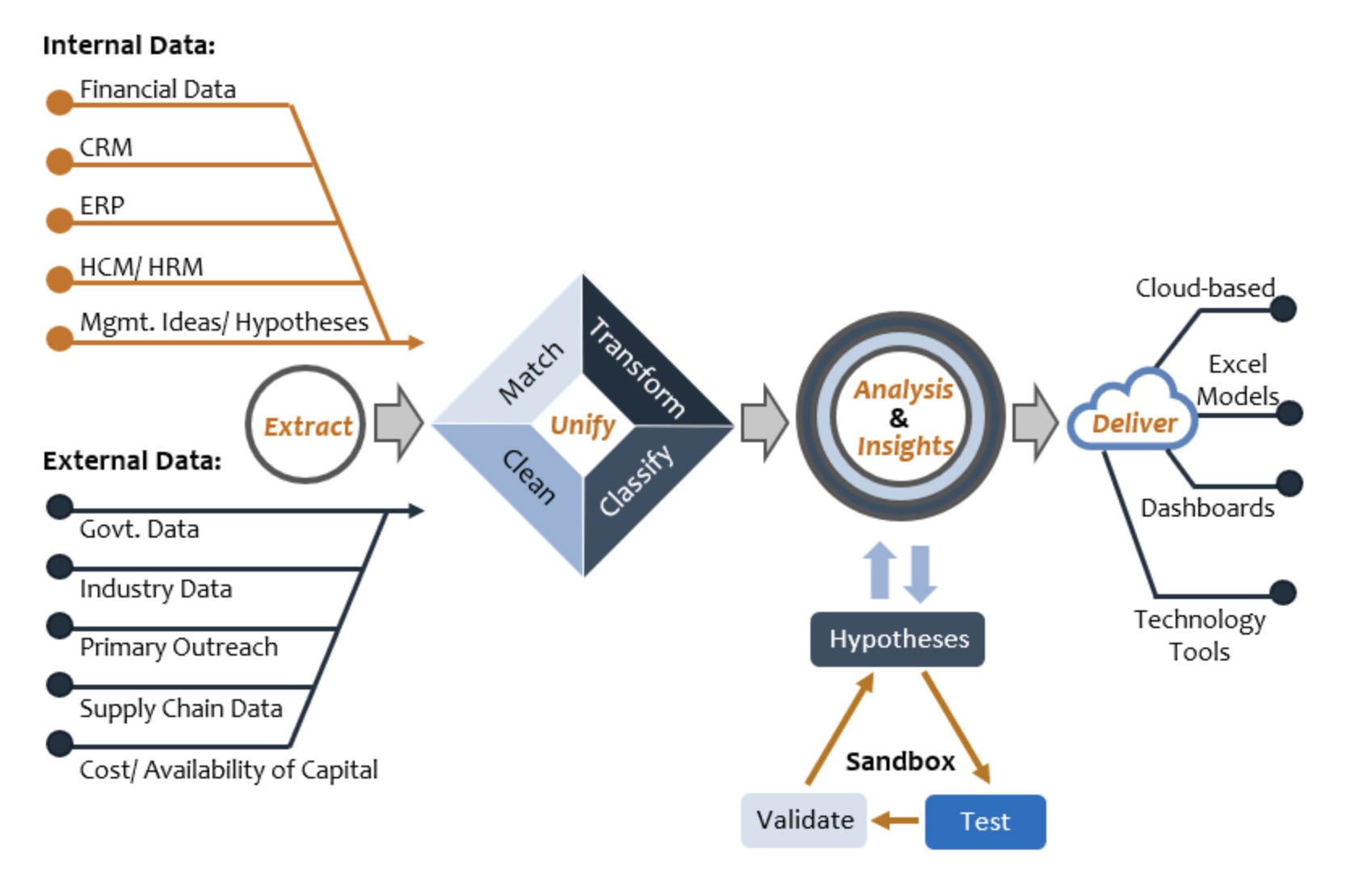

Stax's team structure includes the best of traditional strategic consulting teams and development of business insights, technical teams on data extraction/cleaning/matching, data science teams, and technology/data visualization teams. All coupled with an embedded understanding of private companies, private equity and debt markets, the availability of capital for various investments, and how management teams are measured. We’re well versed at engaging with management teams on the financial implications and field teams in providing actionable tools to ensure constructive implementation.

Why do we like this type of project? It typically frees up capital and improves profits. These projects give teams more control to make decisions. The projects are relatively quick and can be done effectively even from remote locations thanks to technology and ultimately, they provide field-level and board-level results.