Share

From the hyped-up activity in 2021, the private equity (PE) industry has witnessed a slowdown in 2022 with the onset of the recessionary concerns in the U.S. However, notwithstanding interest rate and inflationary pressures, industry activity is still running ahead of the pre-Covid high seen in 2019. Supported by ample dry-powder and new funding options, the PE industry continues to invest in high-growth and resilient industries, particularly within the tech, healthcare, and industrial sectors.

A possible U.S. recession on the cards in 2023

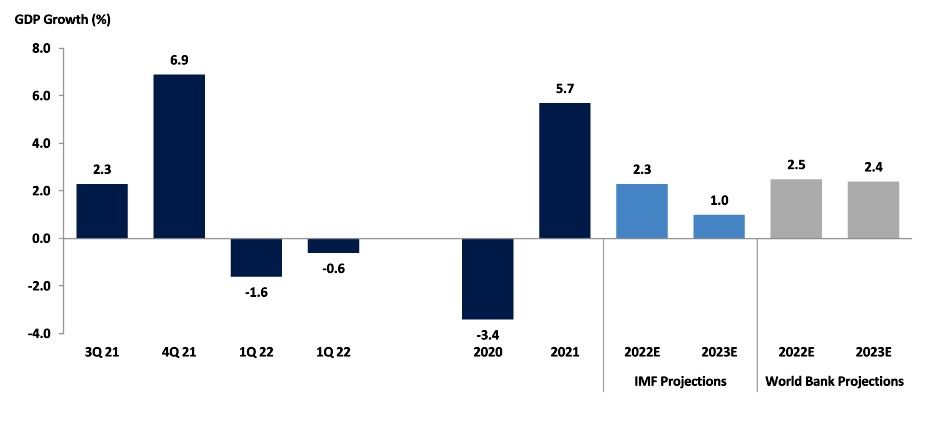

Both the World Bank and the International Monetary Fund (IMF) have raised expectations of a global recession, citing the impact of further shocks to the world economy following on from the global pandemic.

Similarly, the conversation around a potential U.S. recession continues to gain momentum. With a GDP decline in the first half of the year and key measures of growth continuing to provide mixed signals, a growing pool of economic experts predict that a U.S. recession may be on the cards in the 12-month period ahead.

According to a survey of 49 economists in the U.S. conducted by the Financial Times together with the Initiative on Global Markets, over two-thirds are of the view that a recession would materialize in 2023.¹

World Bank and the IMF have issued muted growth expectations for the U.S. economy, with a recent IMF estimate indicating a mere 1% GDP growth rate for 2023.²

Recessionary expectations in the U.S. fueled by a number of factors including:

- Higher-than-expected inflation across the globe,

- A worse-than expected economic downturn in China owing to COVID-19 outbreaks and ensuing lockdowns, and

- The overwhelmingly negative outcomes of the conflict in Ukraine

U.S. M&A activity persists amidst recessionary pressures

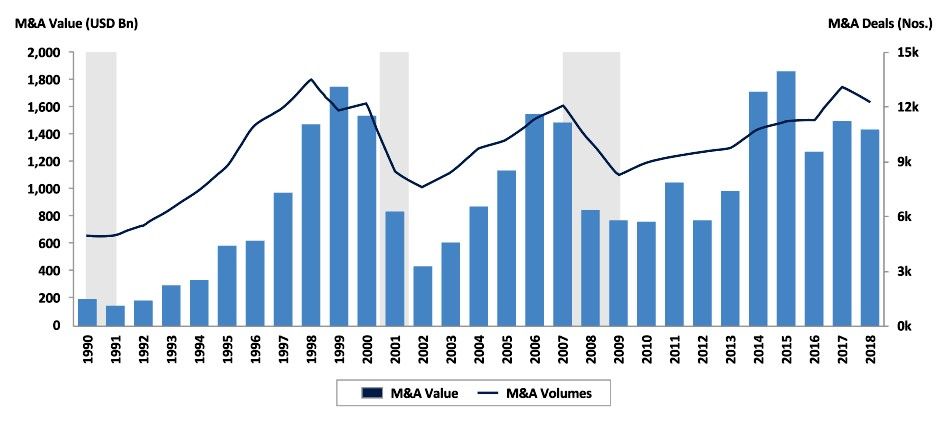

Historically, recessionary conditions have taken a toll on the total value and volume of deals attributable to U.S. acquirers, taking several years to mend.⁴

Recessionary expectations in the U.S. fueled by a number of factors including

- Higher-than-expected inflation across the globe

- A worse-than expected economic downturn in China owing to COVID-19 outbreaks and ensuing lockdowns

- The overwhelmingly negative outcomes of the conflict in Ukraine

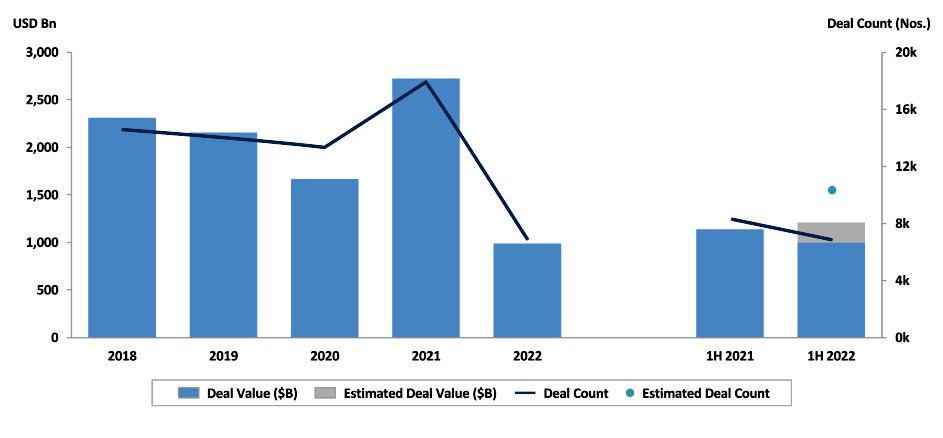

Turning to 2022, a similar slowdown has taken place, with the number of deals and deal values in the U.S. continuing to slowdown gradually.

Major headwinds such as inflation, geopolitical tensions and pandemic-induced supply chain bottlenecks have contributed to a decline in North American M&A activity.

Despite the surrounding uncertainty however, M&A activity persisted in 1H 2022, with PE firms and strategic buyers looking to benefit from volatility in the market. Globally, sixteen mega-deals (over USD 5 billion) closed in Q2 2022, with an aggregate deal value of USD 207.3 billion.⁴

Palash Mishra, Stax Managing Director notes that “there are still resilient industries with bright spots that will keep investors interested. Additionally, well-capitalized companies may now be challenged with achieving growth targets, which may make M&A more necessary to help drive continued company expansion. However, deals in this environment will necessitate investors adjust their current process to navigate current market conditions more successfully.”⁵

Deal activity remains resilient amidst interest rate pressures; PE firms seek alternative funding.

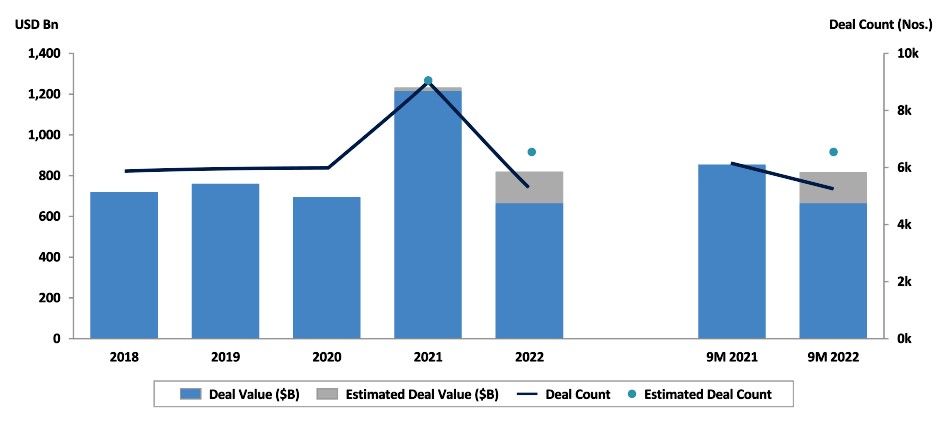

The first 9 months of 2022 saw PE firms in the U.S. completed nearly 6,500 deals, amounting to a combined value of USD 820 billion. A large number of these deals were negotiated in either 2021 or early 2022, prior to macro conditions turning bearish.⁶ However, interest rate pressures finally caught up with the industry during the second quarter of 2022, making deals costlier.

Deal values were down 4% YoY while deal count picked up by 6% YoY during the first 9m of 2022, amidst rising finance costs

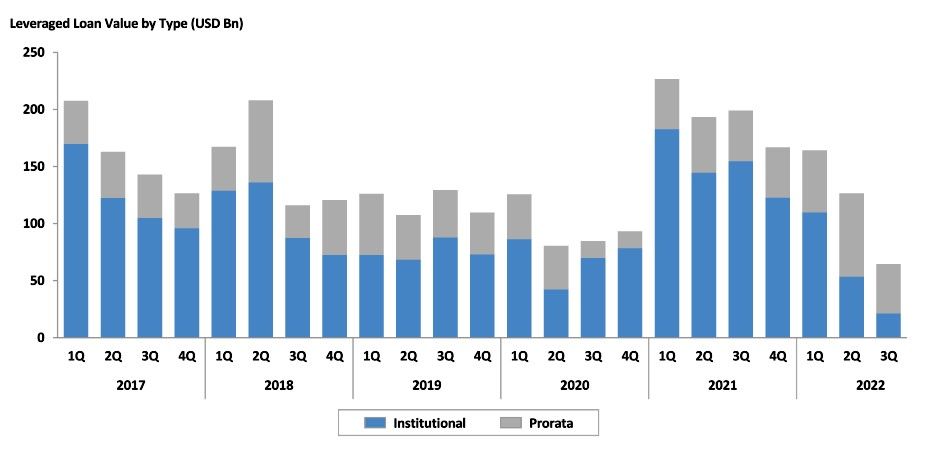

In particular, the leveraged loan-market, a major source of funding for PE deals, is witnessing a slow-down coinciding with the interest rates hike. With most leveraged buyouts (LBO) funded in a 30:70 equity-to-debt split, PE firms are now looking at alternative equity funding methods, bypassing traditional bank facilities. Some of the more notable take-private deals announced in 2H 2022 have taken non-bank methods to finance deals.⁷

- In 3Q 2022, institutional issuance dropped to the lowest level since late 2009. As a result of difficulties in raising debt capital, LBO backed deals are taking a longer time to close out

- Many PE firms are now looking towards alternative funding options, in particular private debt, as means of tackling high borrowing costs in traditional funding

Additionally, PE firms are also now switching focus to add-ons, with smaller transactions being easier to fund. During 2022, add-ons were nearly 78% of the buyout deals with PE firms more focused on scaling their existing investments to add revenues or create cost synergies.⁶

Receding valuations limits exit market

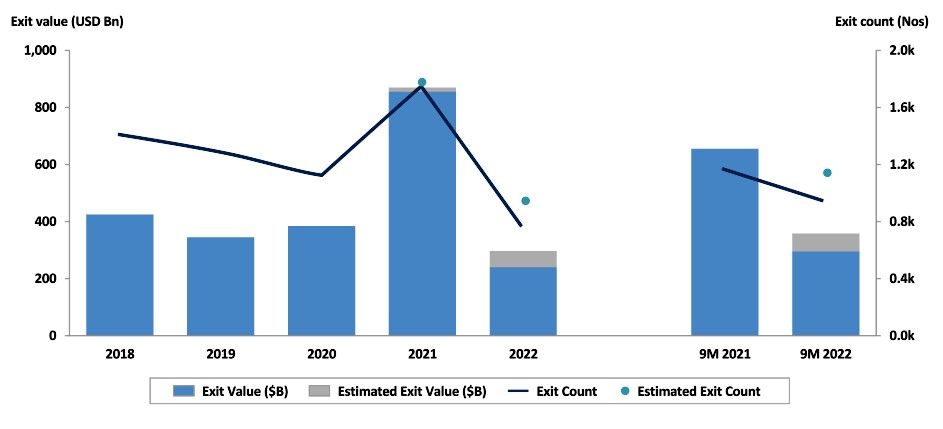

Furthermore, the valuation drop in private and public markets implies that sponsors are opting to hold portfolio entities where possible, as opposed to selling assets at less favorable values.

While IPOs account for only around 4-5% of exit count, on a value basis, IPOs account for one-third of exit values. This has reduced the opportunity for public listings, standing in the way of a major driver of exits within the PE industry.⁶

As a result, PE firms are opting to spend more time to ensure their portfolio entities are recession-proofed to the best possible extent.

U.S. exit values drop 55% in 2022 YTD while exit count declined by 19%, with IPOs accounting for just 2% of total exits. Corporate and sponsor acquisitions picked up the slack. Sector wise, business products & services led the exit market, followed by technology

A substantial amount of dry powder still left on the table

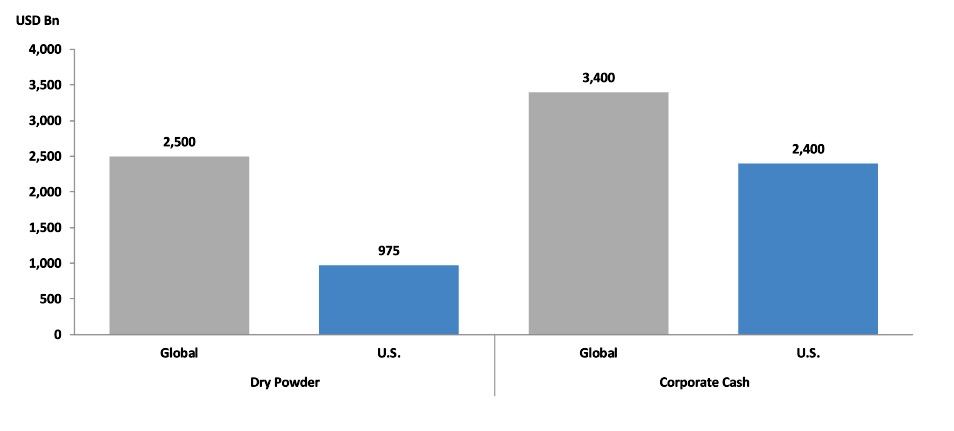

Notwithstanding the valuation adjustments and market volatility, dealmakers are unearthing growth opportunities. Most firms are viewing the market turbulence as a means of securing more reasonable valuations versus the hyped-up estimates of 2021.⁸ A slowing business cycle may also lead to a buyer’s market, making way for aggressive roll-up and consolidation strategies.

Additionally, in contrast with prior recession periods, two factors continue to aid M&A activity: cash levels in the corporate sector are at record-highs, with companies taking decisive steps to strengthen cash piles given uncertainties relating to the pandemic. In addition, a significant volume of dry powder continues to exist in the PE ecosystem.⁹

Record levels of U.S. PE dry powder and corporate cash has thus far enabled deal activity to continue amidst uncertain macro conditions in 2022

PE industry focused on overarching investment themes

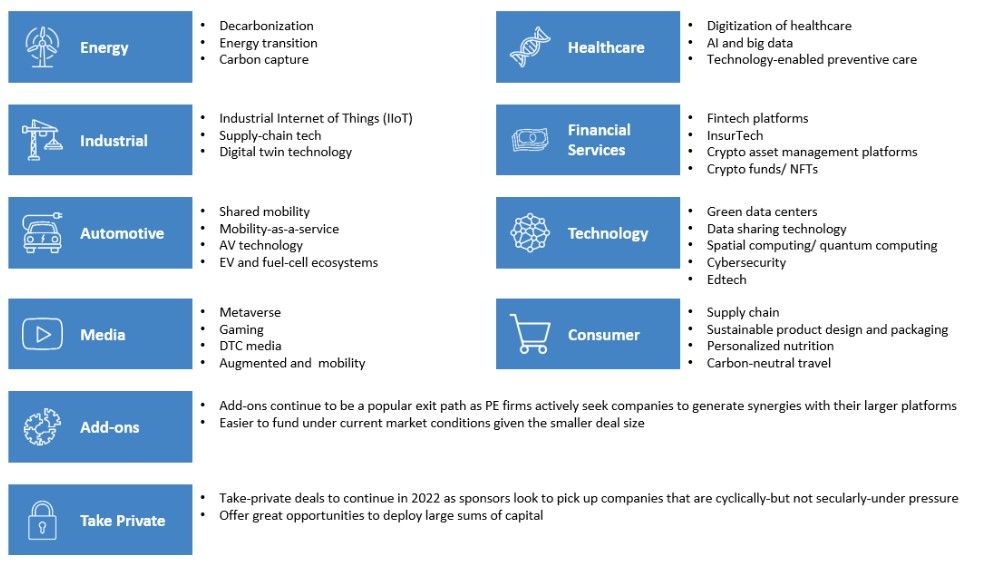

As recessionary concerns loom, the PE industry is being far more selective and cautious of investment opportunities. More-often than not, 2022 has seen investments focused on non-cyclical and non-discretionary or high-growth industries.

Mishra comments, “Investment theses that are underpinned by a secular growth story, whereby a company’s growth is driven by underlying technological and demographic trends, independent of business cycle fluctuations, are more advantageously positioned. For example, digital transformation, cloud computing, cybersecurity, and automation (e.g., workflow, industrial tech), are durable growth trends that will prevail over current economic conditions.”⁵

Alluding to this trend, Stax Senior Managing Director, Paul Edward also notes, “More private equity firms are now being built and funds being raised on the back of themes, not just to ‘get smart people, give them money, and they’ll do it right.’ But themes – what are we betting on? We’re seeing themes that equity sponsors are looking to underpin their interest within the deployment of capital. Frequently, we’re being asked to validate those themes, provide a viewpoint as to yes, this makes sense.”¹⁰

Investing for resilience and growth; opportunities still available across a number of key sectors

Corporates are likelier to tighten the purse strings in the leadup to a potential recession. However, this does leave the door open for the PE sector to dip into its cash reserves for a number of investment opportunities still available.

Across the industries digitization, cybersecurity, blockchain, artificial intelligence, automation and ESG investing are key areas of focus

Further changes are noted in the PE industry, as PE firms are looking to build technology and other back-office competencies in-house or turn to outsourcing whether it be offshore or nearshore. PE clients are also looking to build small in-house teams for analytics, towards supporting due diligence and holding an advantage in the bid process via identifying trends. Additionally, operating partners are displaying an increased preference for advisors to offer multiple capabilities and provide greater breadth of sector expertise.¹¹

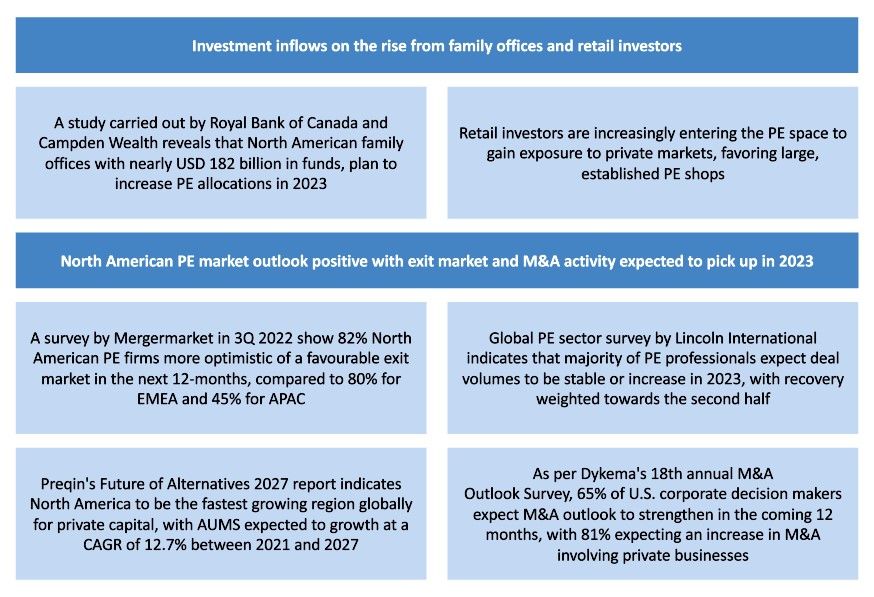

Number of positive indicators for the PE sector heading into 2023

The investing climate may prove challenging for PE firms, as rising debt costs and difficulty in exiting impact their performance. That said, the record levels of dry powder could mean continued deal activity, with due diligence being a vital safeguard against volatility.

References

- What a Recession Actually Is—And How to Know If the U.S Is Entering One, Solcyre Burga, Time, 2022

- World Economic Outlook Update July 2022 – Gloomy And More Uncertain, IMF, 2022

- Succeeding through M&A in uncertain economic times, PwC, 2019

- Global M&A Report – Q2 2022, PitchBook, 2022

- A due diligence checklist during recessionary environments for private equity investing in tech, Stax, 2022

- US PE Breakdown – Q3 2022, PitchBook, 2022

- Private Equity Turns to Direct Lenders as Leveraged Loans Dry Up, Chris Cumming, The Wall Street Journal, 2022

- US PE Breakdown – Q1 2022, PitchBook, 2022

- Charting new horizons M&A and the path to thrive, Deloitte, 2022

- Stax Boston Senior Managing Director Interview – Paul Edwards, Management Consulted, 2022

- US PE Breakdown – Q2 2022, PitchBook, 2022

Sources for the final chart

- Family Offices with $182 billion eye more big gains on PE bets, Benjamin Stupples and Amanda Albright, Bloomberg, 2022

- What Fundraising Woes? PE Giants Are Raking in Cash, Hannah Zhang, Institutional Investor LLC, 2022

- 2023 Global Private Equity Outlook, Dechert LLP and Mergermarket, 2022

- Private Equity Investors Are Split on M&A Outlook for 2023, Lincoln International LLC, 2022

- Private capital AUM set to double to over $18tn in next five years, Private Equity Insights, 2022

- 18th Annual Mergers & Acquisitions Outlook Survey, Dykema, 2022