Share

Public Adjusters (PAs) work on behalf of property insurance claimants, offering independent damage assessments and helping to expedite the overall claims process. PAs can work for both individual Homeowners as well as Commercial claimants (e.g., businesses including offices, shops, factories, and HOAs).

PAs can be involved from the outset and support an initial claim, or in cases where the claimant is dissatisfied with the original carrier payout. Additionally, they bring specialized expertise in estimating specific perils (e.g., fire, flood, etc.), assessing building types (e.g., medical facility vs condominium), and by providing an in-depth understanding of local building codes and regulations.

Public Adjusters offer several value propositions:

- Increasing claim payouts (typically 25-75% uplift vs. original carrier estimates)

- Accelerating the claims process by providing estimating expertise during the cycle

- Providing customer support / service throughout the claims cycle

PAs will likely charge fees based on the percentage of the new payout (typically 10-20%). In some cases, especially where an old claim is being re-estimated, they may charge a percentage fee based on the incremental payout.

With expertise assessing the commercial attractiveness of multiple PAs across states and customer segments, Stax has observed the viability of PAs for investors and leveraged this experience to provide key insights, guiding clients to actionable results.

What is driving demand?

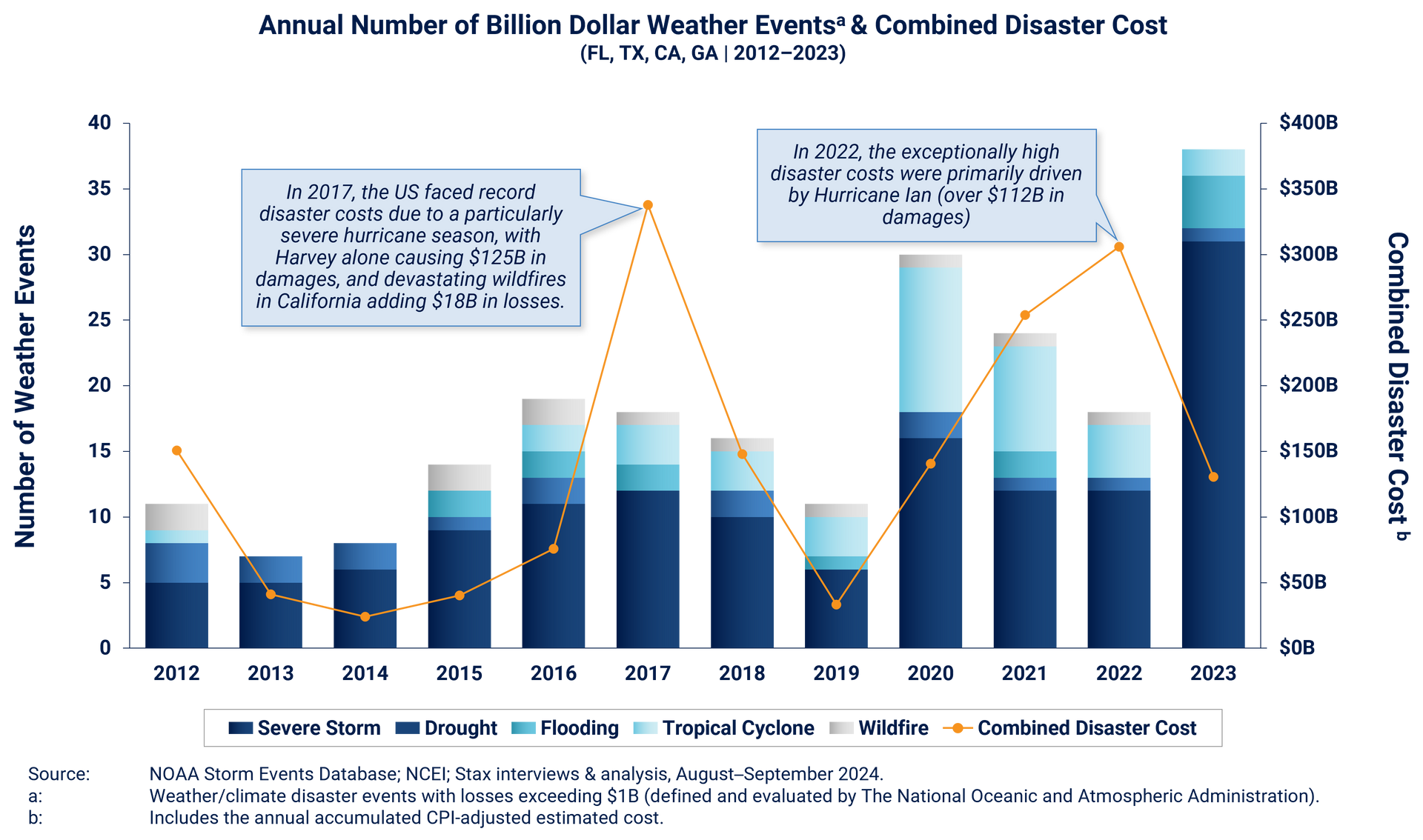

A rise in claim volumes and average value can be attributed to increasingly frequent and severe weather events (e.g., Hurricane Milton, Los Angeles Wildfires). In the last decade, the U.S. has seen an uptick in natural disasters and severe weather events, driven largely by climate change and increased development in vulnerable areas.

There has also been growing awareness of PAs and their value proposition. In most states, less than 30% of homeowner claimants are aware of PAs (a figure which varies for non-claimants), but this is likely to continue growing as firms invest in marketing efforts to expand awareness and educate a broader audience.

What are the market risks?

While most PAs operate ethically, some engage in questionable practices, such as aggressive sales tactics (e.g., door-to-door campaigns after a storm) or providing egregious claims estimates by over-inflating the extent of the damage and required repairs, material / labor costs, etc.

To address these concerns, several states are regulating the industry to discourage bad actor behavior and protect vulnerable homeowners through fee caps (e.g., maximum of 20% fees for non-catastrophic claims, 10% for catastrophic claims) to protect homeowners. As a result, some carriers are pulling away from high-risk markets like Florida and California or raising premiums/deductibles which may reduce coverage.

How is the landscape structured?

There are several different levels that players operate in:

- National: Scaled players that operate across the U.S. (e.g., Sill, Noble Public Adjusting); serves larger commercial customers as well as homeowners

- Regional: Typically focused on a specific state / region (e.g., Gavnat, Five Star Adjusting)

- Long tail: Localized mom and pop players that typically serve smaller homeowners claims

What is the opportunity?

There are multiple strategic and operational improvement levers for investors to be mindful of, including:

- Expand geographically to reduce seasonality risk by diversifying across climates and weather patterns.

- Optimize compensation model to incentivize accuracy and quality of service while minimizing risk of bad actors.

- Invest in ongoing training programs to enhance estimation capabilities and improve customer service.

- Enhance SEO/ SEM/other marketing initiatives to raise brand awareness.

Conclusion

Stax has significant experience working with clients looking to invest in the PA market, including recent diligence work on three PA firms with diverse geographical coverage and customer specialties. Additionally, our extensive experience across sectors such as restoration, landscaping, and related claims-driven services helps us assess and create value for our clients. To learn more about Stax, visit www.stax.com or click here to contact us directly.