Share

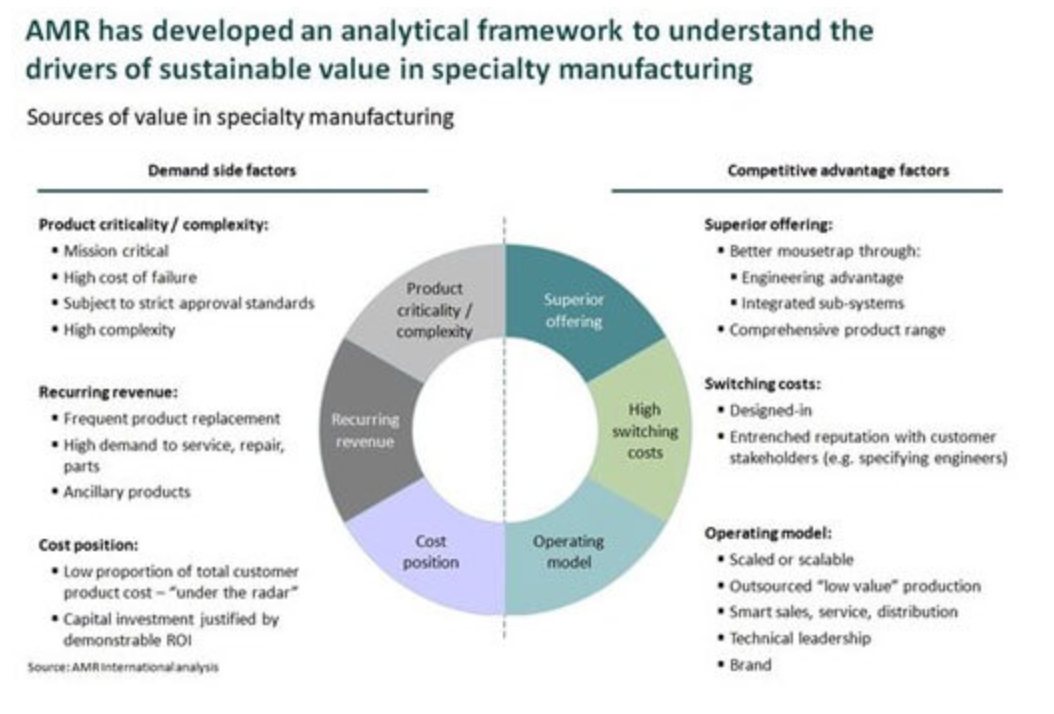

In 2012, AMR (acquired by Stax in 2022) published its white paper “How to achieve sustainable value in specialty manufacturing”. The purpose was to identify and assess the balance of factors that drive profitability and long-term value in specialty manufacturing. We were determined to provide a structure within which widely used truisms such as the importance of superior products or recurring revenue could be structured in a practical way.

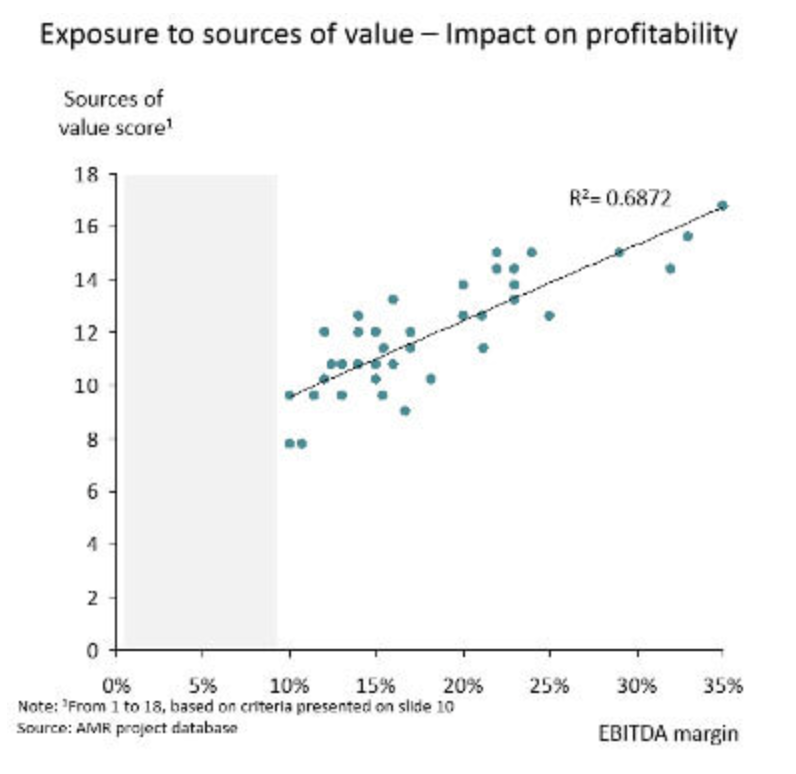

To create the framework, we examined hundreds of specialty manufacturing companies across a range of sub-sectors. We showed how strong value creation can be achieved through high exposure to a mix of defined demand side and competitive advantage criteria. Our “Sources of Value” (SoV) framework was then devised based on this analysis.

AMR’s SoV framework has now successfully supported strategy development across a variety of assignments in a range of niche industrial markets

For 50+ projects we have used SoV to support our clients’

strategic growth initiatives. We have road tested this unique tool while further developing our specialty manufacturing database. Over this broadened experience we have found a constant correlation between the SoV factors and margin over time.

Below are some examples of the SoV framework in action:

Group development strategy for a global industrial player

A comprehensive assessment of the flow control market and an approach to develop its fledgling flow control division was provided to the group. Our SoV framework was used in two ways: 1) to show that the sector supports sustained value through positive long term growth and margin drivers, and 2) to define a series of structured filters which prioritised areas of opportunity for growth via acquisition. The result included potential roadmaps for a build-out platform, and a sustainable pipeline of attractive targets.

Market mapping, business development strategy, and pre-exclusivity CDD in the vacuum automation and material handling sector

We supported a global industrial company in assessing the opportunities in an unfamiliar but adjacent market. Although some products at first appeared commoditized, our SoV analysis highlighted how value would continue to be sustainable in the wake of margin improvement from 23% to 29% over five years. Additionally, the framework provided a basis on which we could assess potential post-acquisition build-out strategies.

Strategic review of the global oil and gas, power generation and desalination market

In a strategic review of the oil and gas, power generation and desalination market on behalf of a global engineering company, our SoV analysis helped define how the existing business is currently positioned, and enabled identification of attractive (high growth, sustainable value) niche technology opportunities.

Results

The competition for attractive assets which drive sustained value remains high. The SoV analysis is a useful tool to use as a starting point. When combined with a deep understanding of the underlying market, customer needs and company positioning, the SoV framework becomes a powerful integrated approach.