Share

In the final installment of this three-part series, we examine the growth levers available to B2B Events assets and how investors should go about assessing their robustness.

Over this three-part series, we provide actionable advice for investors seeking to perform Commercial Due Diligence (CDD) on B2B event organizers.

Introduction

The B2B events ecosystem is providing timely opportunities to investors, but how should investors go about assessing the quality of specific organizers? In this series of articles, we examined three areas that influence the attractiveness of B2B event organizers: the strength of underlying sectors served by organizers, organizers’ ability to serve customer objectives, and growth levers. In addition to a primer on the B2B events industry, we will provide actionable tips and areas to look out for when scoping a CDD engagement.

In the final article of this series, we explore the growth routes available to B2B event organizers, the factors determining whether an organic or inorganic growth strategy is best suited, and the implications of growth routes on the achievable quantum of growth.

What Growth Levers are Available to B2B Event Organizers?

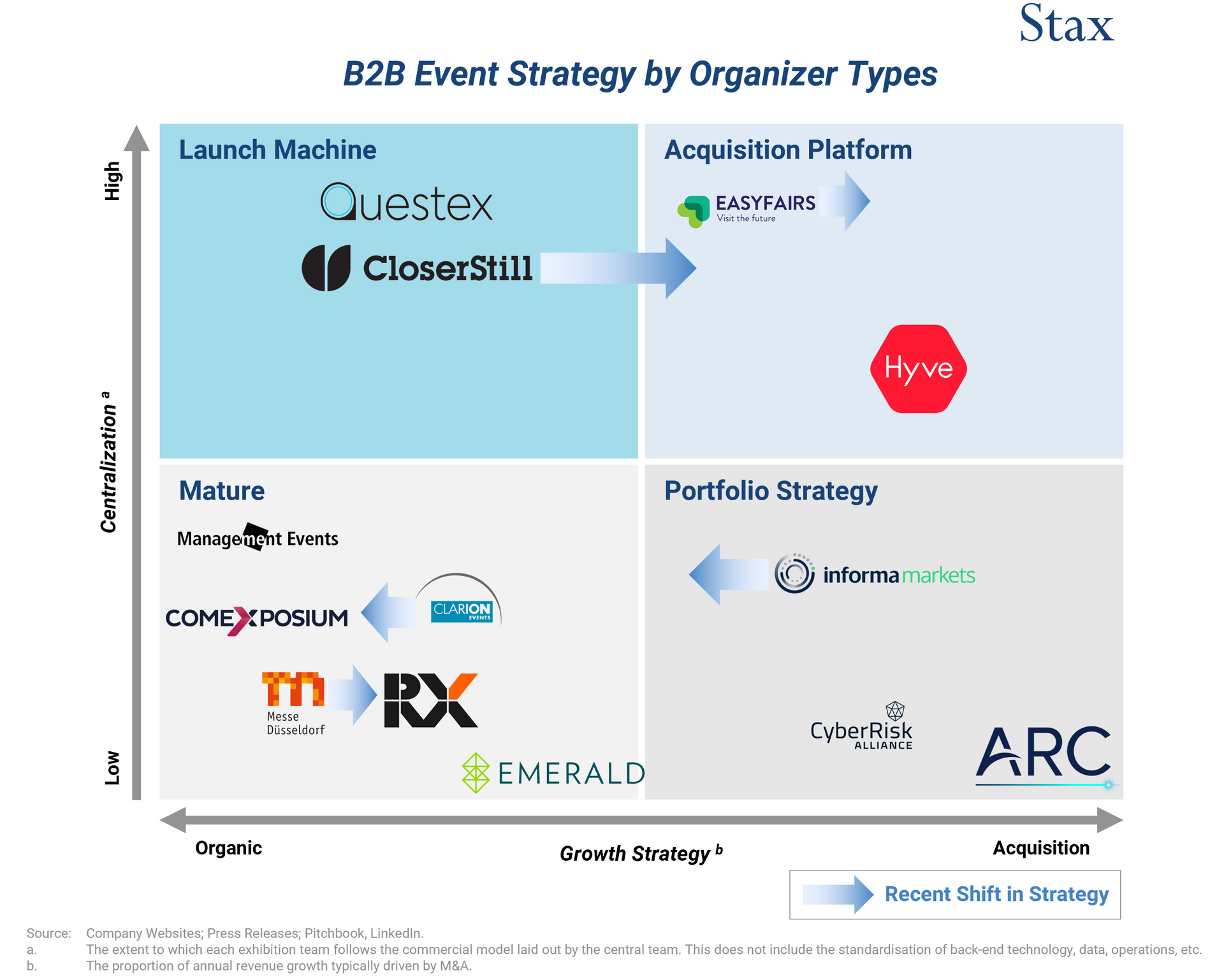

One of the main goals of a CDD is to understand the organizer’s current and potential growth strategy and quantify the growth potential. Evaluating the strength of a Target’s strategy can be approached in numerous ways. Here, we provide one example; using two metrics, we establish a framework with which we can assess investment targets, identify close competitors for benchmarks, and prioritize areas for in-depth research.

List of Services

-

1. Centralization of event organizationList Item 1

The extent to which each event team follows a commercial model laid out by the central team. This does not include the standardization of back-end processes such as technology, data, operations, etc.

-

2. Growth leversList Item 2

The share of growth driven through organic and inorganic routes.

What are the Different Growth Strategies?

Using the two aforementioned metrics, B2B Events organizers can be segmented into four distinct types: Acquisition Platform, Launch Machine, Portfolio Strategy, and Mature. We have positioned a sample of B2B event organizers on these axes:

B2B Event Strategy by Organizer Types

Centralization of event organization is typically implemented in the form of playbooks—a set of guidelines that are applied consistently to most (or all) events in the portfolio. Playbooks are typically used by organizers with a precise vision for the nature of their events and portfolios, which in themselves have a high degree of standardization in brand positioning and audience type (e.g., same level of seniority across events, similar-sized events, etc.) This can reduce launch risk and reliance on the quality of event management teams but requires a highly experienced leadership team to develop a playbook balancing prescriptiveness and flexibility.

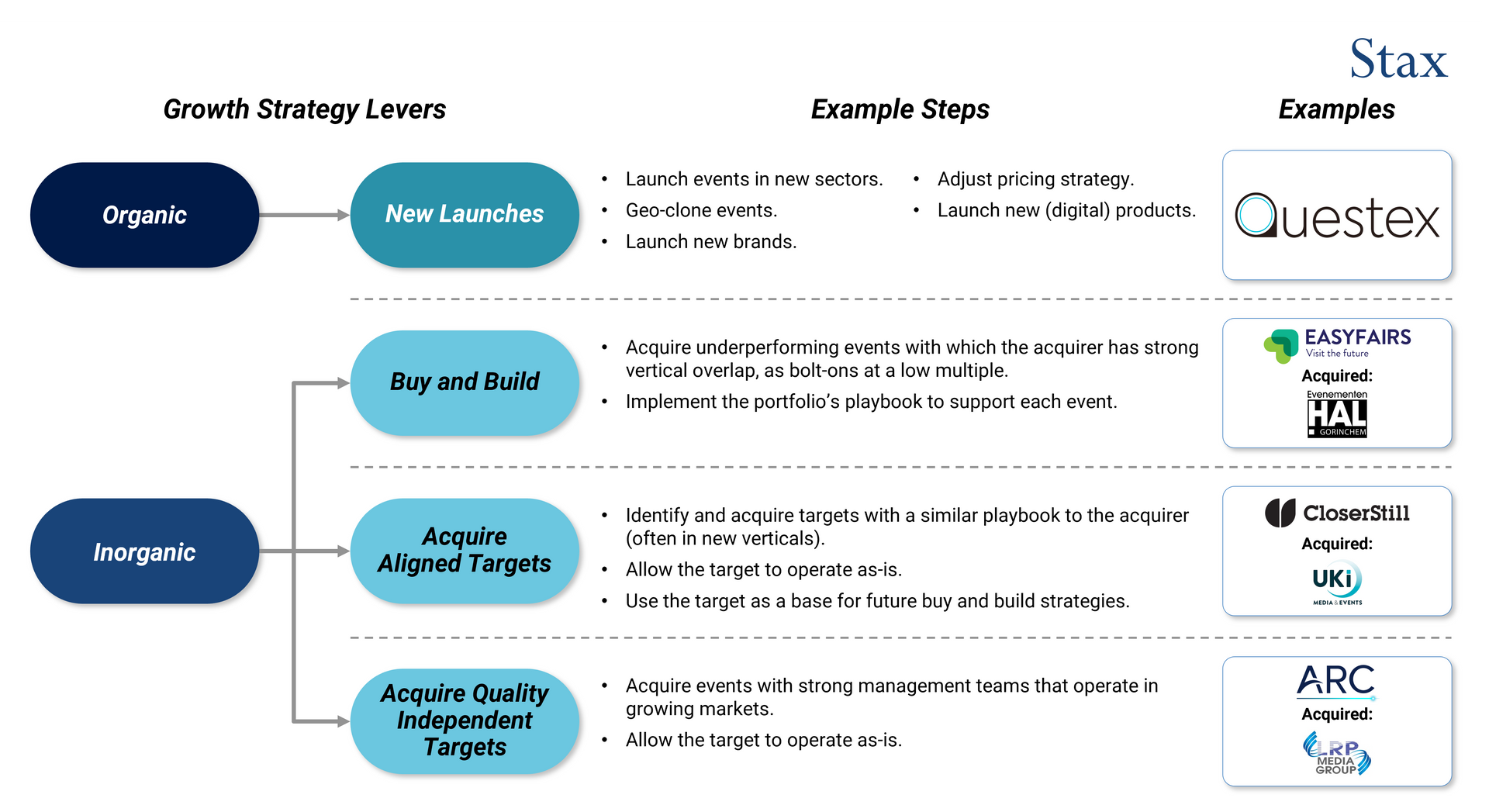

The use of organic versus inorganic growth levers is determined by the availability of capital, acquisition expertise, and targets, as well as strategic choices (need for speed, etc.). M&A can support the rapid expansion of vertical, geographic, and event-type coverage.

While organizers’ positions on the matrix are not static, there is substantial inertia. In particular, upward movement is rare, as a playbook cannot be easily introduced to a diversified portfolio. This reduces the pool of playbook-oriented organizers available for acquisition.

The main instances of movement on the matrix are horizontal, representing a shift in the mix of organic and inorganic growth. Private equity ownership can enable or catalyze such a rightward shift (i.e., increase in M&A), exemplified by the example of CloserStill Media benefitting from the capital injection from its PE owner, Providence Equity Partners. This represents a primary growth lever for PE owners.

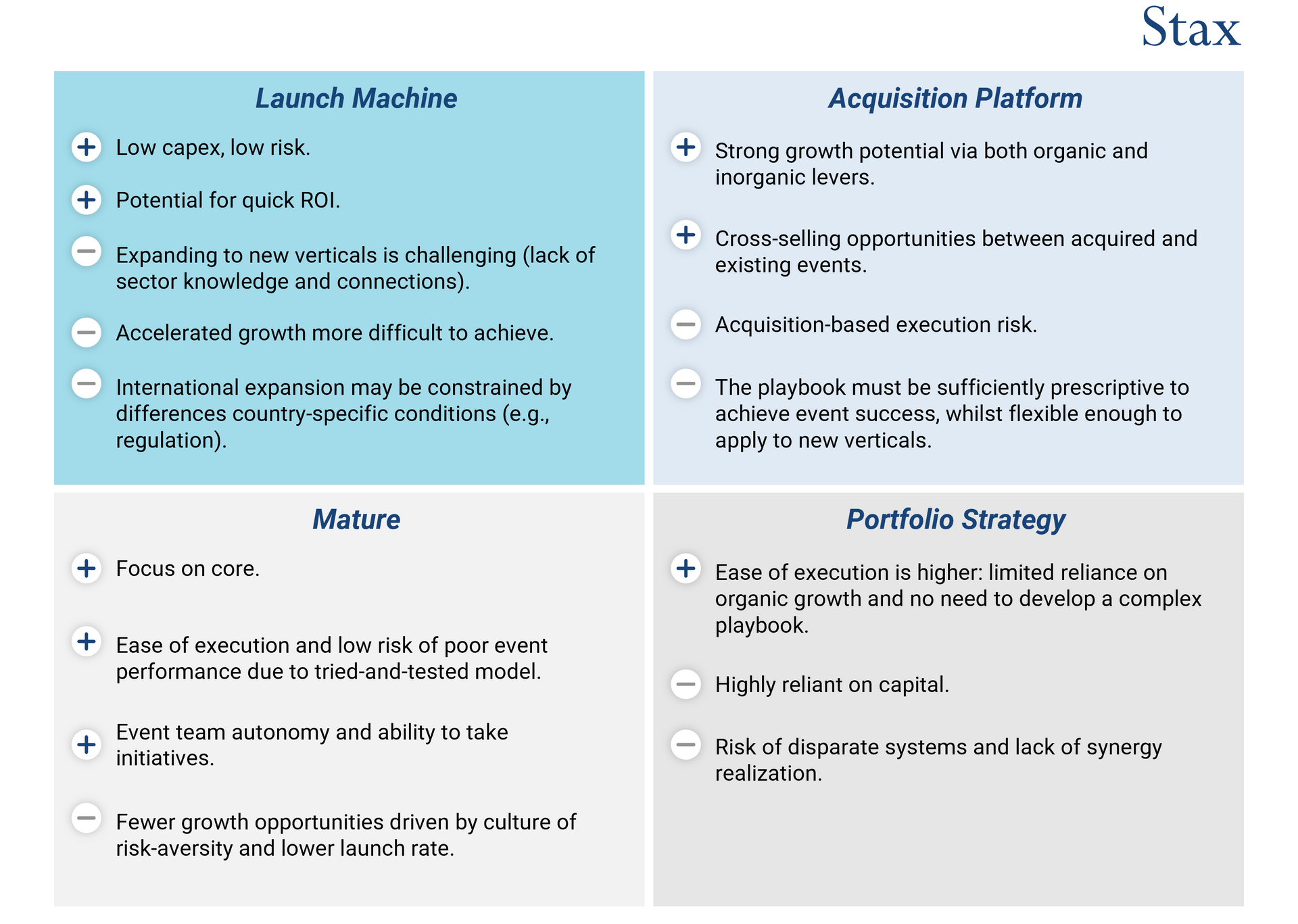

Broadly speaking, each of the quadrants shown above can be associated with a set of pros and cons. The identification of these four quadrants enables investors to validate the growth potential of an asset during a CDD in a robust and targeted manner. This includes asking the following questions:

1. Which quadrant is the organizer in today? Should it move over the hold period, and to where?

Is the organizer’s management team capable of developing an effective playbook to become an Acquisition Platform?

Is a single playbook sufficient for the entire portfolio? For example, does an organizer of education-focused events (e.g., congresses) require partnerships with local accreditors of CPE (continuing professional education) and thus regional playbook adjustment?

2. Which competitors are in the same quadrant? How do the organizer’s KPIs compare to peer benchmarks?

Does the organizer’s launch rate as a percent of portfolio match other Launch Machine players?

In the case of corporate events, does the organizer have differentiated access to thought leaders, in-house or through partnerships?

3. Do the strengths and risks associated with the organizer’s positioning match the investment thesis?

Is the PE sponsor willing and able to inject the capital required to drive growth for a Portfolio Strategy organizer?

In the case of meeting-based events such as executive summits relying on launch, is scaling the participant network within a constrained universe sufficiently viable?

4. Does the organizer’s strategic positioning align with its internal strengths?

Does a Launch Machine organizer have a market-leading playbook?

In the case of a mature organizer relying on organic growth driven by existing events, do the events occupy market-leading positions and is pricing an available lever for uplift straight to the bottom line?

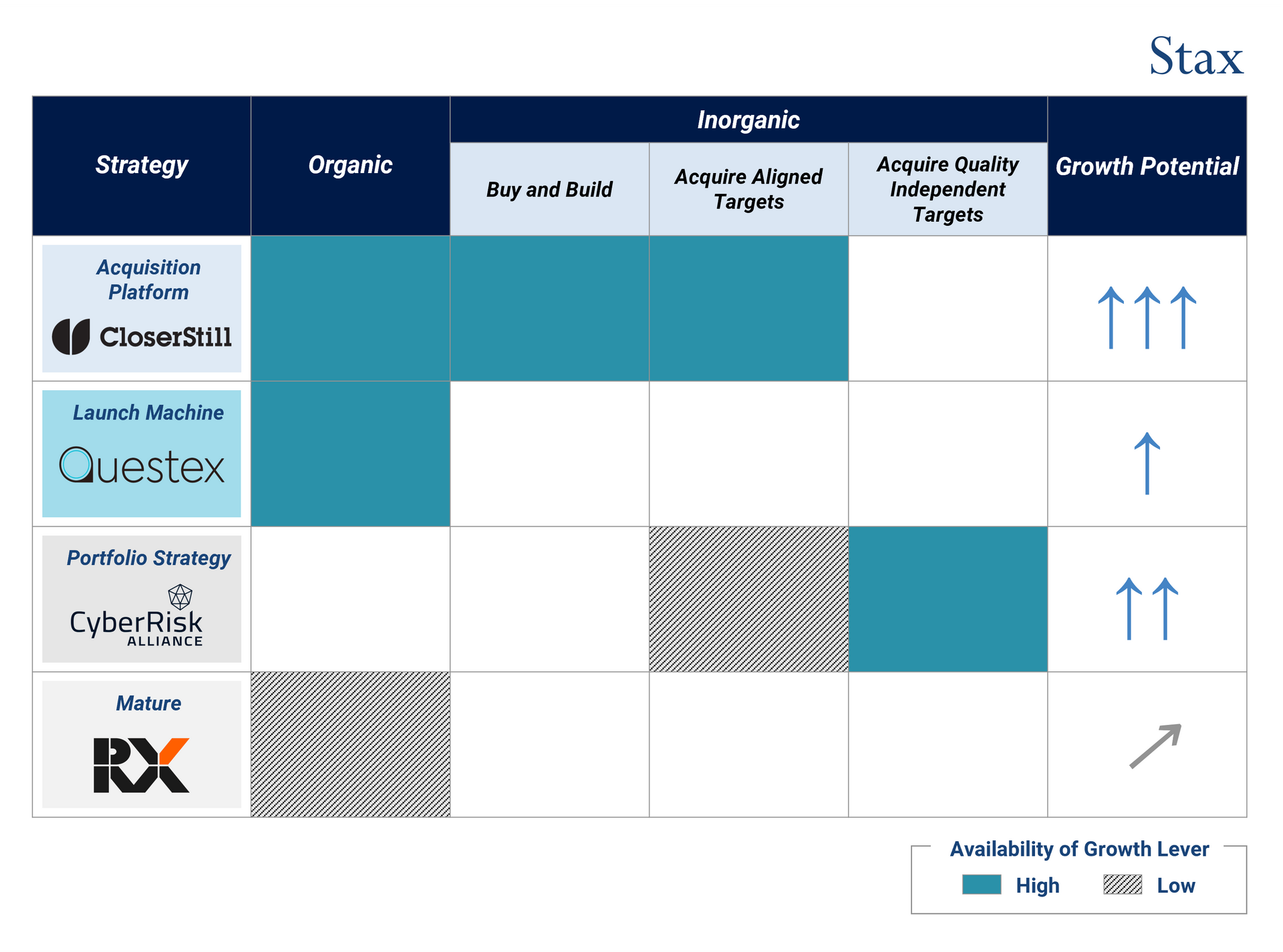

In addition, the organizer’s matrix positioning partly determines the availability of growth levers. We lay out the available growth levers below:

Each organizer type has a different set of available growth levers. The use of an effective playbook can enable organizers to maximize organic growth, either by effectively launching new events/geo-clones or transforming recently acquired events. The availability of inorganic levers also depends on the strength of the playbook: organizers following a Portfolio Strategy should acquire quality independent targets to achieve growth, as they cannot impose a playbook to transform events.

Meanwhile, an Acquisition Platform can choose to acquire and transform underperforming events or acquire events with a playbook that aligns with its own. Thus, an Acquisition Platform theoretically has the greatest breadth of available growth levers:

It is important to note that this analysis alone cannot define the growth opportunities for an individual organizer: a mature player may execute its strategy more effectively than an acquisition platform, leading to higher growth and lower risk. However, this analysis does help to frame each organizer and the landscape of growth levers available.

Conclusion

When conducting CDD on a B2B event organizer, investors should challenge management and third-party research providers to contextualize the organizer’s growth strategy within the competitive landscape. This will enable benchmark analysis, identification of risks, and assessment of growth potential.

Across this series of articles, we have examined three areas that influence the attractiveness of B2B event organizers (the strength of underlying sectors, their ability to serve customer objectives, and organizer strategy). These provide actionable guidance for investors when scoping and carrying out a CDD engagement.

Stax has 30+ years of experience evaluating providers in the events ecosystem spanning 30+ countries over five continents. This experience includes diligence work and value-creation engagements for 17 of the top 20 exhibition organizers, organizers of conferences, congresses, and meetings-based events, venue operators, event service providers, and event tech vendors. Visit us at

www.stax.com

to learn more about our services and expertise or click here to contact us directly.