Share

Rising Investment in Construction Technology

The Construction Technology space has seen increasing deal activity in the past several months, a trend we expect to continue for a variety of reasons:

- Usage/spend on construction technology is accelerating, with significant growth runway: The historical lag in technology adoption among construction firms has led to favorable dynamics where adoption/usage remains in its early stages (though commercial-focused firms tend to be slightly further along the adoption curve than residential focused counterparts).

- Fragmentation of demand and the subsequent need for software support create a range of opportunities: Vast use cases and specialized needs for workflow automation have resulted in a highly fragmented technology vendor landscape, with most providers serving singular functions. Further, the concentration of firms with fewer than 5 employees drives long-standing demand fragmentation.

- Labor and skilled resource limitations: The industry-wide shortage of skilled workers is a driving greater need for operational efficiency and thus reliance on technology.

- U.S. construction spending exhibits a strong growth trajectory: Witnessing 7% annual growth over the past 7 years and 10% growth p.a. in the last 3 years. Pockets of the market demonstrate stable performance during a downturn, particularly non-residential segments.

- Current risks for the overall construction industry do not pose a threat to tech providers: In fact, while construction firms face challenges of rising material costs and labor shortages, these same factors are serving as catalysts for increasing technology adoption.

- Significant optionality for growth and various investment strategies exists.

Market Context & Demand Trends

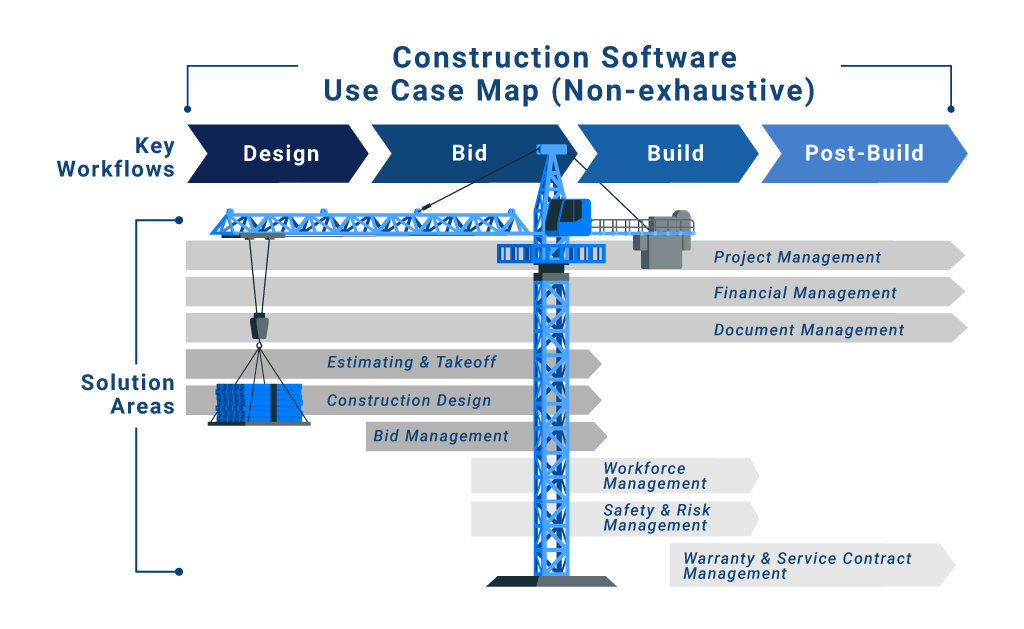

Construction firms have numerous specialized workflows spanning construction phases (pre-construction, during construction, and post construction), software/functionality types (accounting, CRM, construction management, etc.), and constituents (general contractors, sub-contractors, owners, etc.). Construction management software solutions are mission critical to construction firms and cover critical workflows that would otherwise be handled manually.

The industry at-large has been slow to “techify,” and while larger companies have demonstrated a strong appetite to spend on technology in recent years, most construction firms continue to rely heavily on manual workflows and purchase software in piecemeal fashion to address specific needs (e.g., job costing, scheduling, etc.).

A wide variety of construction workflows and use cases exist where technology/automation has been proven to drive value, as depicted in the following image.

Lack of tech investment to date is predominantly driven by technological immaturity and a lack of market education. Many firms are complacent with manual methods, have perceptions of an overwhelming/challenging implementation process, and despite potential ROI, see limited budgets as a barrier to tech adoption.

Overcoming barriers to adoption, such as increasing awareness and educating firms on the value/ROI of technology solutions—particularly to address key challenges or labor shortages and rising material costs—can likely result in significant spending growth.

Underlying U.S. Construction Industry Continues Along a Strong Trajectory

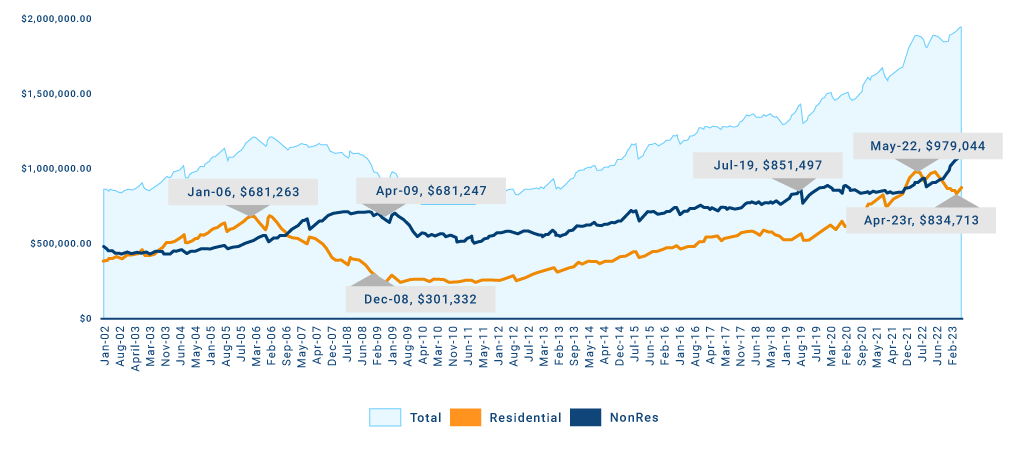

The U.S. construction industry has seen strong top-line growth over the past decade, with outsized growth in the past 3 years.

Residential construction saw the greatest boost during Covid (2020-22) as new home purchases boomed, with a notable increase in second-home purchases. That said, the overall construction market has exhibited relatively strong growth over the longer-term, and notable recession-resilience especially in the non-residential construction segment, which has remained largely stable through market slow-downs.

Effects of construction cyclicality vary by segment. While pressing end-market risks such as soaring costs and labor shortages impact end-market behavior, these same risks drive an increasing need for software to help streamline operations and reduce costs.

As such, the performance of a Construction Technology provider and growth outlook depends on the area(s) of the market where it plays (e.g., geography, residential versus non-residential, materials used). Understanding end-market dynamics and both short and longer-term trends is important to assessing the risks and growth outlook for an asset.

Opportunity Exists for Future Investors

Despite recent growth in deal activity in the construction technology space, there remains overwhelming opportunity for entry or continued expansion.

Widespread opportunities exist for players to consolidate point solutions to form formidable platform offerings. PE-backed platforms are accelerating their M&A activity, targeting small assets to incorporate or bolt-on.

Overall, market share balance between construction management solutions (platforms) and point solutions is constantly evolving. Assessing drivers of differentiation, defensibility, and risks to displacement is key to understanding the longevity of a company’s right-to-win and strength of position in the market.

Stax provides assessments and risk analysis through our use of data analytics and rapid, actionable insights to aid investors in gaining the most from their capital while remaining ahead of market trends. To learn more about Stax or our services, visit www.stax.com or click here to contact us.