Share

The construction industry has long been associated with conventional methods and the slow adoption of modern technologies. However, in recent years there has been a notable shift towards digitalization. Companies are eagerly embracing innovative tools and practices to enhance efficiency, productivity, and commitment to sustainability.

While many credit the advancement of construction technology to new heavy machinery, it is crucial to acknowledge the concurrent progress in interconnected technologies. These tools have extended their influence from on-site applications to remote offices and meeting rooms—marking the onset of a new era of digital progress in the construction field.

According to an assessment conducted by McKinsey, the key areas of focus within the global construction technology industry encompass:

- 3-D Printing, Modularization, and Robotics

- Digital-Twin Technology

- Artificial Intelligence (AI) and Analytics

- Supply Chain Optimization and Marketplaces

Delving deeper into each of these technological advancements reveals their impact on the construction sector and their potential for shaping the industry’s future.

Present Rate of Adoption & Outlook

The digital transformation of the Architecture, Engineering, and Construction (AEC) sector began approximately a decade ago, but in recent years it has gained significant momentum. While the current adoption of technology varies among construction and engineering firms, there is an increased commitment and intent to incorporate more technological solutions in the future.

Building Information Modeling (BIM) and the use of construction management cloud software are identified as pivotal technologies that can serve as catalysts for the adoption of more advanced digital solutions, contributing to their relatively higher usage.

Several ongoing developments indicate this upward trajectory will continue. Although the AEC technology sector is advancing, it has not yet reached the scale and sophistication observed in well-established software markets like logistics, manufacturing, or agriculture.

AEC tech companies face obstacles in achieving streamlined growth, largely due to dynamics within the AEC customer base. These include fragmentation, modest IT expenditures in comparison to other industries, and deep-rooted traditional work processes.

However, despite these challenges, there are several favorable factors driving the expansion of the AEC technology industry. These factors are contributing to sustained growth, even in the face of short-term economic slowdowns.

Trends and Drivers

The Substantial Benefits for Businesses

Research indicates that those who easily adopt digital tools are already experiencing noticeable improvements in their overall business performance.

The primary advantages reported by businesses that have adopted technology include:

- Enhanced Productivity (34%): Implementing digital tools leads to increased efficiency and productivity in construction processes.

- Improved Customer Experience (33%): The use of technology to enhance the overall experience for customers and clients.

- Increased Staff Safety (33%): Digital tools contribute to a safer work environment, reducing the risk to employees.

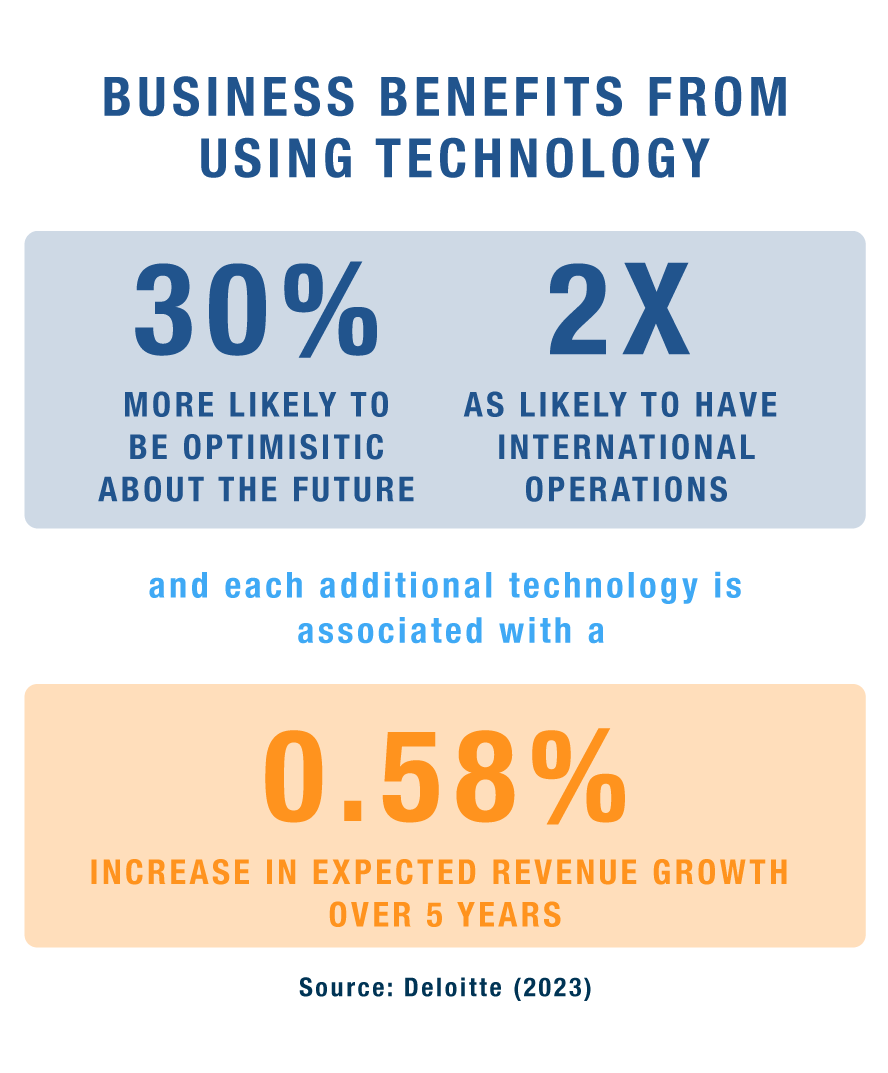

The same report found that businesses using six or more technologies were 30% more likely to be optimistic about the future. Economic modeling supported this, showing that each extra technology adoption could mean an additional $580,000 per year in revenue growth for a company with a $100M annual revenue—further strengthening the fact that digital tools can offer a significant boost to construction businesses.

Navigating Challenges from Economic Headwinds

The construction and engineering sector has faced significant obstacles in recent times. Covid lockdowns disrupted worksites and investments, and the aftermath brought supply shortages, soaring material costs, along with severe labor shortages. These challenges have impacted profits and could potentially result in more business closures.

Additionally, the industry's ongoing supply issues now contend with the added complexity of higher interest rates and is expected to slow down future projects, at least in the short term.

To tackle these challenges, a diverse array of technologies can enhance business efficiency, quality, and safety in construction:

- Cloud-based construction management software allows real-time document sharing and access, even on-site at construction locations.

- Data analytics tools provide project managers and clients with in-depth project progress insights.

- Construction wearables, like exoskeletons, enhance employee safety in tasks involving heavy lifting or repetitive actions.

These technologies offer solutions to navigate the hurdles and drive progress in the construction and engineering sector.

Contribution to the Advancement of Environmental Sustainability

Innovative construction technology is driving sustainability in this sector, optimizing material use, energy, and waste reduction while managing resources efficiently. This technology also enables renewable energy integration, real-time monitoring, and eco-friendly certifications.

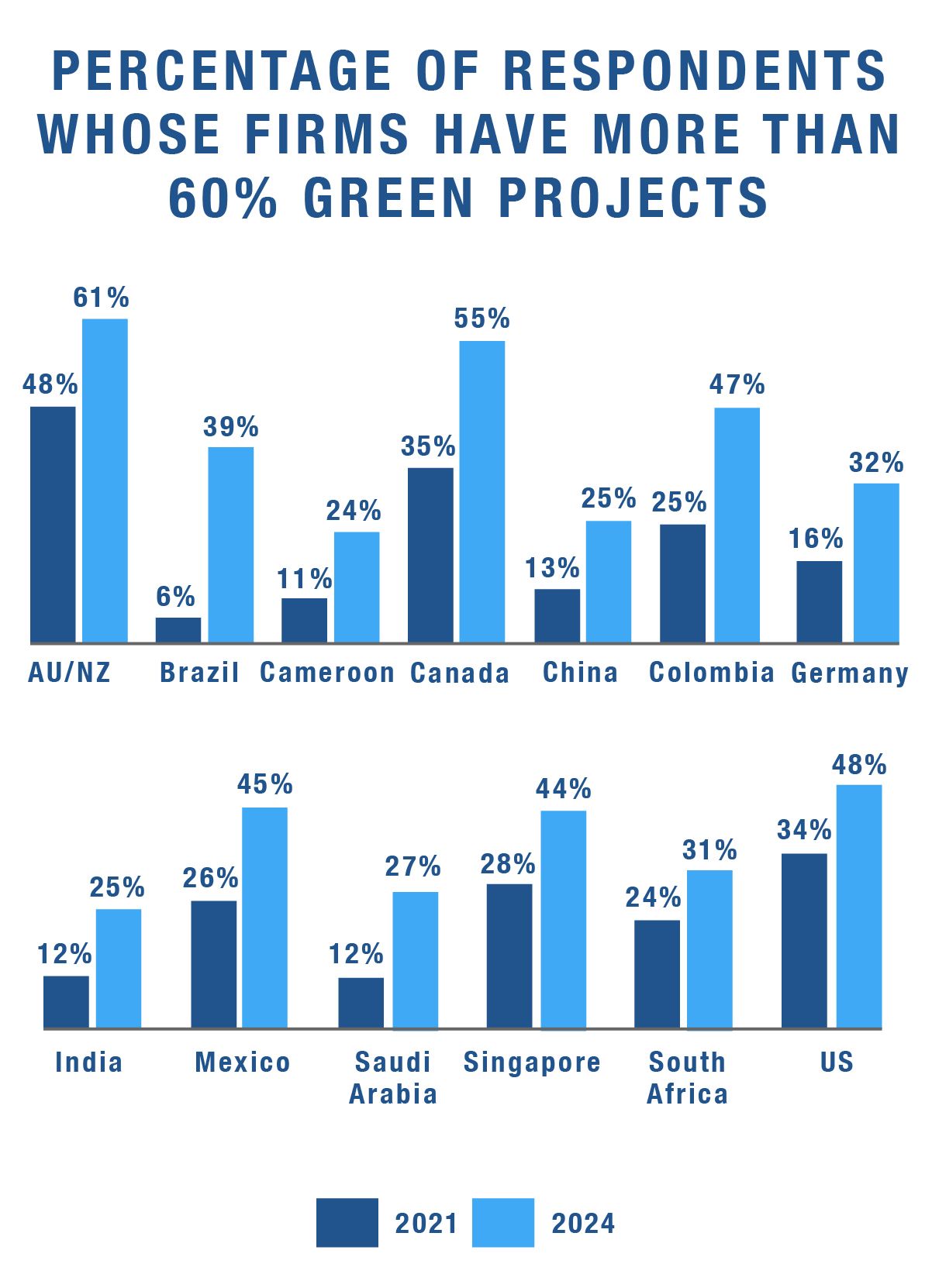

The 2021 World Green Building Trends Study by Dodge Construction Network assessed the current and future adoption of green building practices. Their research indicated that Australia, New Zealand, Canada, and the U.S. are leaders in current green projects. Meanwhile, Brazil, Colombia, Canada, and Mexico are expected to see significant growth in green projects.

Construction Technology Stimulus Initiatives

Various countries and regions have launched construction technology stimulus initiatives to boost efficiency, productivity, and sustainability in the industry. One instance is the Infrastructure Investment and Jobs Act (IIJA), which includes two key initiatives for technology adoption in construction:

- Advanced Digital Construction Management Systems (ADCMS): This program focuses on advancing construction technology, including BIM and 2D/3D modeling, with a five-year budget.

- Technology and Innovation Deployment Program (TIDP): TIDP emphasizes research and development in the highway and transportation sector, with an annual allocation for pavement technology research.

These initiatives collectively allocate $550M to promote the use of construction technology in government-funded projects, driving technological advancements in the construction industry.

Heightened Regulatory Compliance Rigidity

Construction is heavily regulated in many countries, with strict safety and environmental standards. Due to advancements in technology, companies can adhere to these rules much easier, saving both time and money.

For instance, many places now require a detailed look at a building's environmental impact, including its carbon emissions, which introduces the need of a building’s Life Cycle Assessment (LCA). Specialized LCA software makes this process possible while ensuring accuracy.

Conclusion

As regulatory compliance becomes more stringent, technology plays a pivotal role in ensuring adherence to these rules. The use of specialized software and the adaptation of building practices to meet environmental standards will continue to shape the industry's future. The evolution of construction and building technology is undoubtedly paving the way for a more efficient, sustainable, and compliant construction sector.

Stax has deep expertise within the construction and building industry, providing invaluable insights to both investors and businesses alike. Project-related experience includes comprehensive market analyses, identifying promising investment opportunities, and delivering data-driven insights. The firm serves a diverse range of investor interests, with a particular emphasis on upstream assets, including input suppliers and manufacturers.

Learn more about Stax and our expertise or click here to contact us directly.

Sources

- Mark Erlich, “Can the Construction Industry Be Disrupted?,” Harvard Business Review, July 2023.

- David Rumbens, John O’Mahony, Nick Hull, Victor Pham, Dominic Behrens, Mia Lo Russo and Clare Lei, “The State of Digital Adoption in Construction Report 2023,” Deloitte Access Economics, March 2023.

- Michelle Meisels, Paul Wellener, and Kate Hardin, “2024 engineering and construction industry outlook,” Deloitte, 2022.

- Katy Barlett, Jose Luis Blanco, Brendan Fitzgerald, Josh Johnson, Andrew L. Mullin, and Maria João Ribeirinho, “Rise of the platform era: The next chapter in construction technology,” McKinsey & Company, October 2020.

- Jose Luis Blanco, David Rockhill, Aditya Sanghvi, and Alberto Torres. “From start-up to scale-up: Accelerating growth in construction technology,” McKinsey & Company, May 2023.

- Jennifer Anderson and Donna Laquidara-Carr, “World Green Building Trends 2021,” Dodge Construction Network, April 2021.

- Matthew Thibault, “What contractors need to know about IIJA’s construction tech carve-outs,” Construction Dive, July 2022.

- Planradar Australia, “From Complex to Simple: How Technology is Transforming Compliance in Construction,” Building Connection, March 2023.