Share

The swift advancements in financial technology, information, and communication has facilitated the rapid global flow of funds. Additionally, globalization has led to larger, more widespread, and intricate supply chains. These factors collectively pose significant challenges, even for the most resourceful and committed organizations in their efforts to identify and prevent financial crimes.

Financial crime consists of unlawful movement of money or assets, which is typically associated with activities such as money laundering, bribery, and corruption. Perpetrators of these illicit financial practices often support more severe offenses like slavery, drug trafficking, and prostitution. In essence, financial crime involves the illegal appropriation of funds or property from others for personal gain. Some of the prominent forms of financial crime include:

- Money laundering

- Terrorist financing

- Fraud

- Bribery

- Corruption

- Market abuse

- Insider trading

- Tax evasion

- Embezzlement

- Counterfeiting

- Identity theft

- Electronic crime

In the face of increasingly sophisticated financial crimes, organizations are striving to strike a balance between efficient and effective risk management. In today’s intricate and ever-evolving global landscape, financial crimes stand out as a significant systemic risk to the world economy, leading to severe consequences for both businesses and communities.

Illicit activities can be orchestrated by a wide variety of individuals from both external and internal sources, including some in leadership roles within the organization. Perpetrators of financial crimes encompass a diverse range, from small-scale offenders to formidable global crime syndicates. These categories include organized criminals involved in large-scale operations, individual criminals, including unaffiliated hackers and stakeholders without ties to the organization, business leaders, which may involve executives or board members engaging in embezzlement or misrepresentation of the organization's performance; and lastly, employees who may pilfer funds while taking steps to conceal their actions.

Innovations

The scale of financial crime is staggering, with estimated annual costs ranging from US$1.4T–US$3.5T, rendering it an unsustainable issue. Financial institutions are dealing with compliance costs and the ongoing threat of money laundering, creating a growing need for transformative innovation.

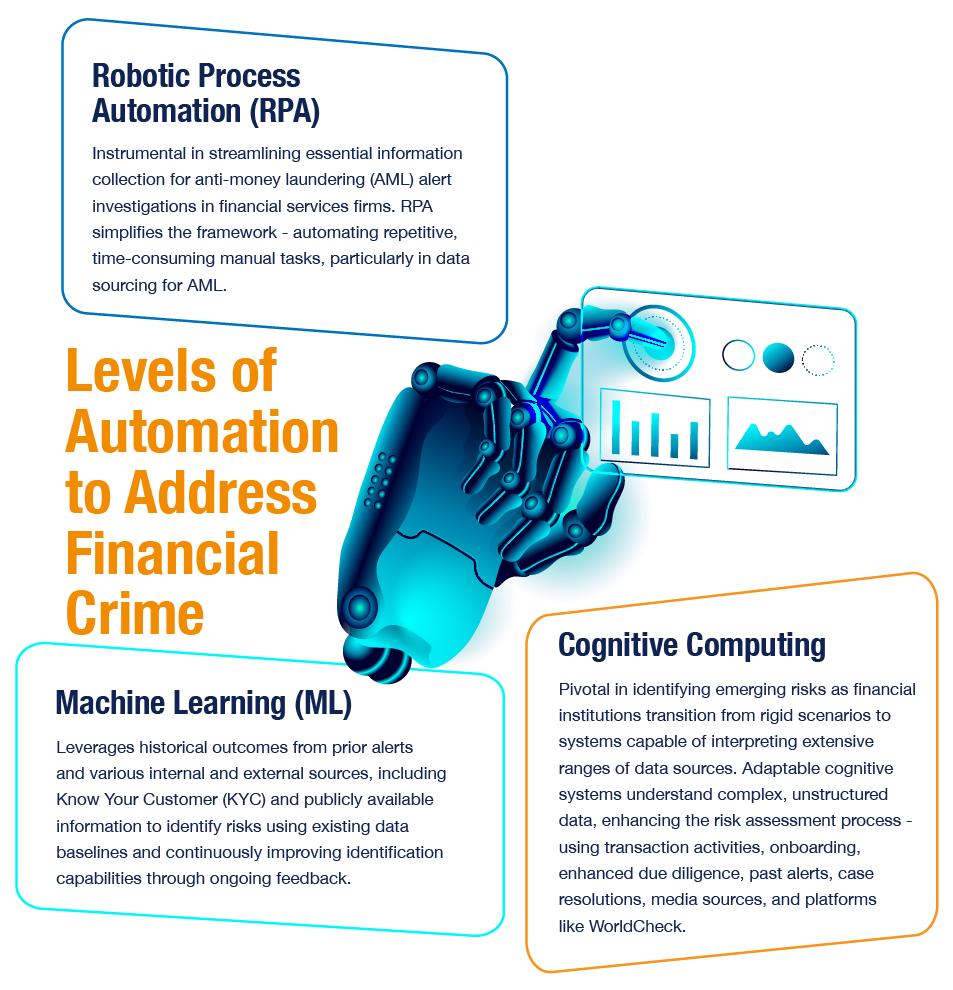

The rapid growth of emerging technologies creates new opportunities for safeguarding against financial crime. Combining these defensive technologies provides an opportunity to disrupt the financial crime landscape while reducing costs. These technologies can be leveraged in new and novel ways to improve both the effectiveness and efficiency of first-generation financial crime platforms. Innovation in combating financial crime is crucial—while technology may evolve gradually, criminals adapt quickly, becoming increasingly intelligent and sophisticated.

This transformation has largely been driven by powerful AI techniques such as advanced anomaly detection, ensemble modelling, and network analytics. The industry is now well-positioned to harness the advantages of these advanced analytics.

M&A Activity

Private equity firms can invest in companies focused on combating financial crime through several channels:

- Financial Intelligence Services: Supporting firms providing financial intelligence to law enforcement and regulators. This includes collecting and analyzing financial data, offering insights into criminal money laundering, and financing terrorism.

- AML and Compliance Leaders: Backing companies adopting AML and compliance best practices, including strong controls and employee training.

- Enhancing Financial System Resilience: Investing in companies dedicated to fortifying the financial system against financial crime. This includes developing advanced detection and prevention methods and promoting education and awareness about financial crime.

Financial crime presents intricate challenges in our globally interconnected society. A wide array of illegal activities, including money laundering, fraud, and corruption, pose significant repercussions for economies and communities worldwide. The substantial annual costs, estimated at US$1.4T–US$3.5T, accentuate the urgency of addressing this unsustainable dilemma.

In response, the financial services sector is actively embracing transformative innovation to combat financial crime. Rapid technological advancements, particularly those driven by AI, have opened new avenues for detection and prevention. Technologies like machine learning and cognitive computing empower organizations to adapt and effectively counter evolving threats.

Furthermore, PE firms stand to benefit by capitalizing on opportunities in this sphere, investing in technology solutions, compliance services, and organizations dedicated to fortifying the financial system against financial crimes. As the landscape of financial crime continually evolves, innovation and strategic investments emerge as pivotal factors in safeguarding our financial institutions and the global economy.

Sources

- York, Tyler. “What Is Financial Crime Risk Management (FCRM)?,” Splunk, Aug. 17, 2023.

- DeParis, Stephen, Nicole Stryker, Michelle Harman, and Andrew Epstein. “Intelligent Automation in financial crimes,” KPMG, 2018.

- “Innovations in Financial Crime," EY. Accessed Sep. 2023.

- “Disrupting Financial Crime," EY. Accessed Sep. 2023.