Share

Introduction: Capital Markets Regulatory Reporting Software

Capital markets operate under stringent regulations such as MiFID II and EMIR, aimed at ensuring stability, transparency, and investor protection. In highly interconnected, high-stakes markets, these regulations are essential for maintaining financial stability by controlling systemic risks, safeguarding the broader financial ecosystem, and reinforcing investor confidence.

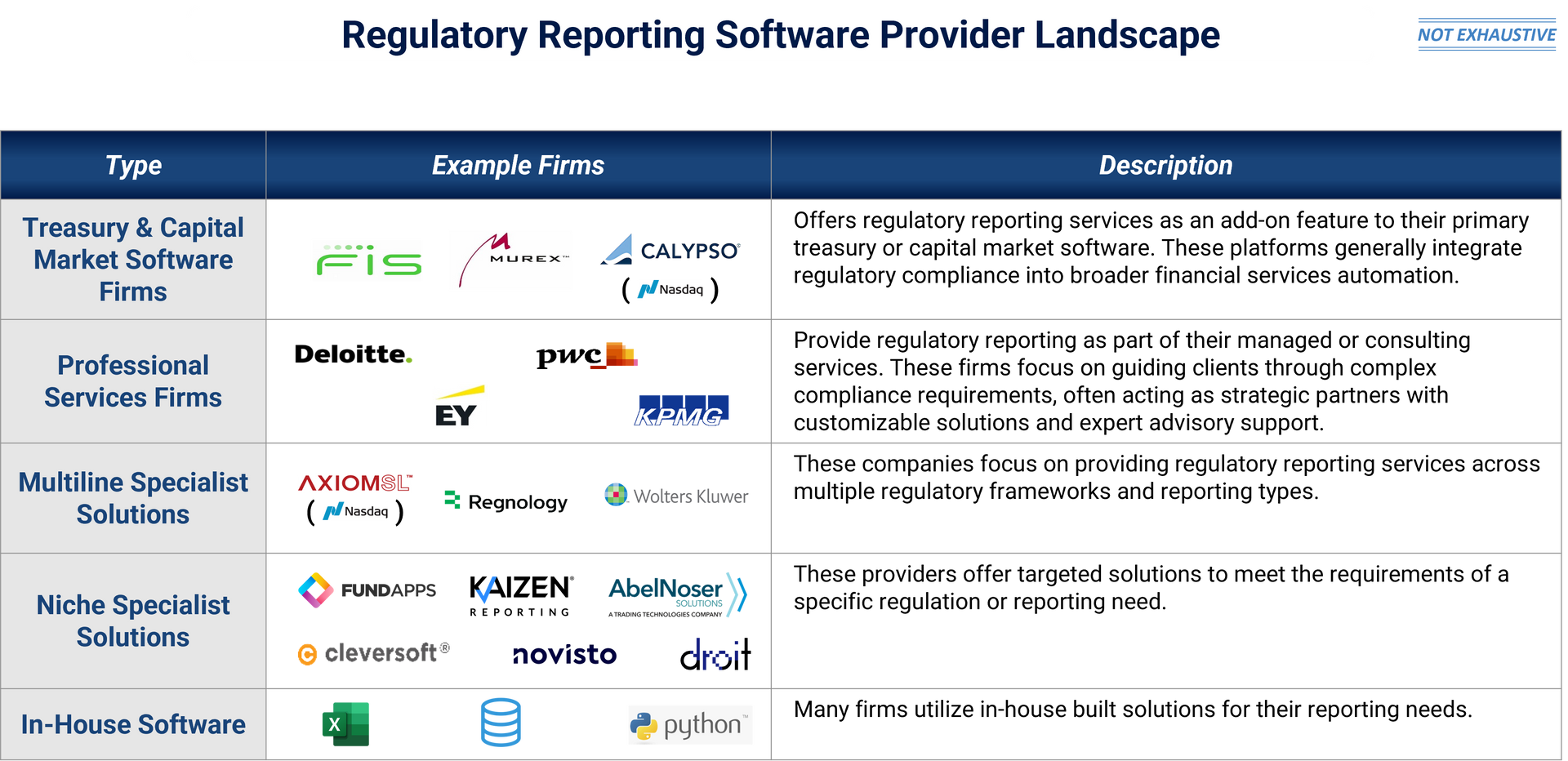

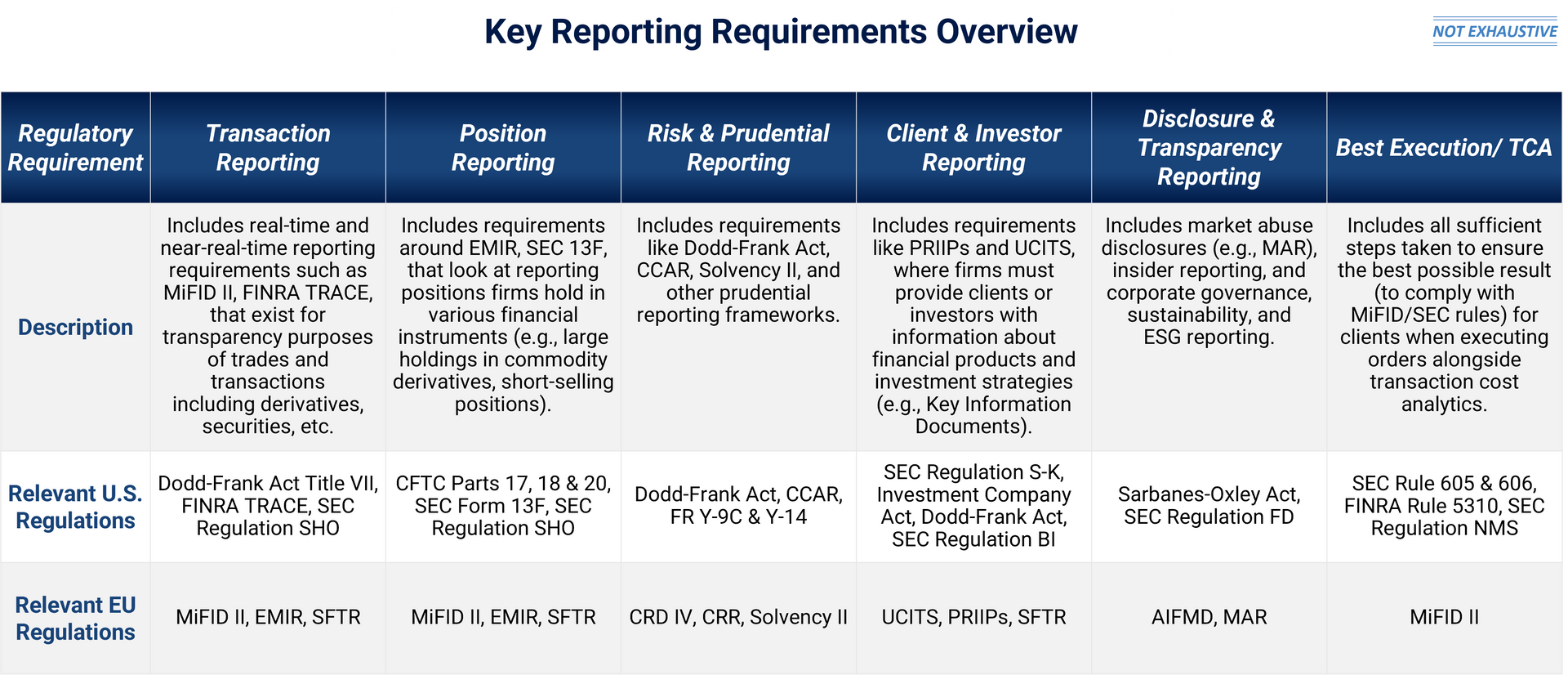

To ensure full compliance, companies must navigate a complex array of regulatory filings, which Stax categorizes into six key reporting areas:

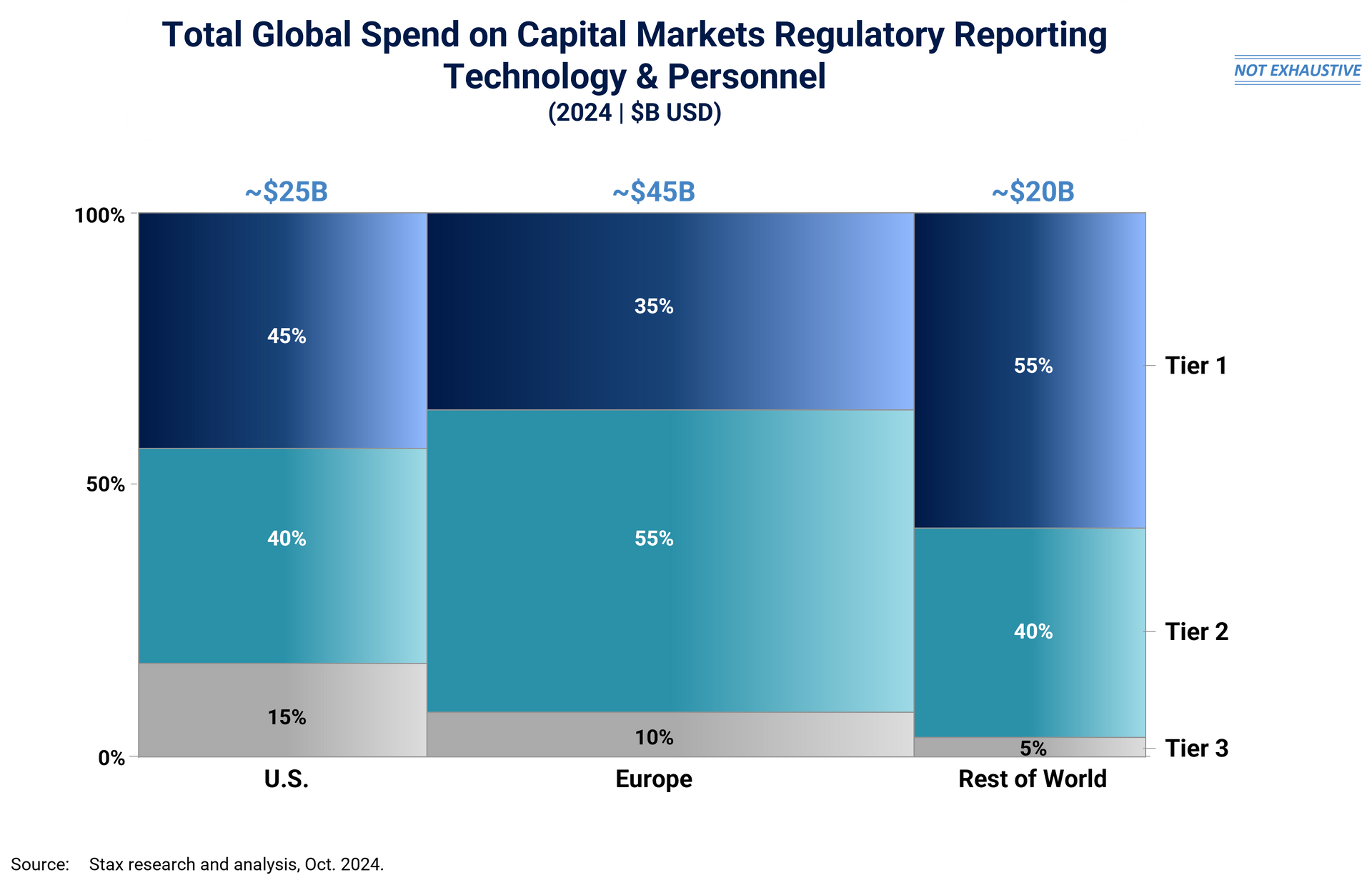

The significant volume and frequency of these reports drives significant spending on regulatory reporting. Stax estimates that the total global expenditure on regulatory reporting activities within capital markets, encompassing both personnel and technology spend, is approximately $90 billion.

Market Context

Currently capital market participants use different approaches and provider types to meet these reporting requirements:

As regulations become increasingly stringent—such as the aforementioned MiFID II, EMIR Refit, and Basel III—banks and asset managers are facing heightened compliance challenges. These new and evolving requirements are driving up compliance costs and demanding extensive operational changes. With regulators enforcing rules more rigorously than ever, there has also been a sharp increase in penalties resulting from non-compliance, with the recent years setting records for enforcement actions across both the SEC and CFTC.

Beyond monetary fines, the reputational risks of non-compliance are equally critical. For instance, a poor transaction reporting record can damage relationships with both regulators and counterparties, leading to a loss of clients and revenue for financial institutions. Failed compliance often also leads to increased regulatory scrutiny and extensive remediation efforts, such as re-reporting trades for up to five years, which can require substantial time and resource commitments, adding further pressure on stretched compliance teams.

As regulatory requirements grow increasingly complex, capital market participants are increasingly leveraging specialized third-party software solutions to implement more robust, scalable compliance measures. These solutions proactively address compliance risks, ensuring smoother operations and a more reliable compliance record. Key benefits include:

- Higher Accuracy and Fewer Errors: Domain-specific precision minimizes errors and ensures accuracy for complex, compliance-driven markets.

- Regulatory Assurance: Continuous updates and alignment with evolving regulations enhance compliance confidence and reduce penalty risks.

- Cost Efficiency & Quick Implementation: Reduced customization needs, and less manual oversight make these solutions cost-effective and easy to deploy.

- Reduced Manual Oversight: Automated processes and exceptions handling streamline operations and lower operational risks.

- Scalability & Adaptability: Modular design allows for seamless adjustments to growth or regulatory changes, ensuring long-term competitiveness.

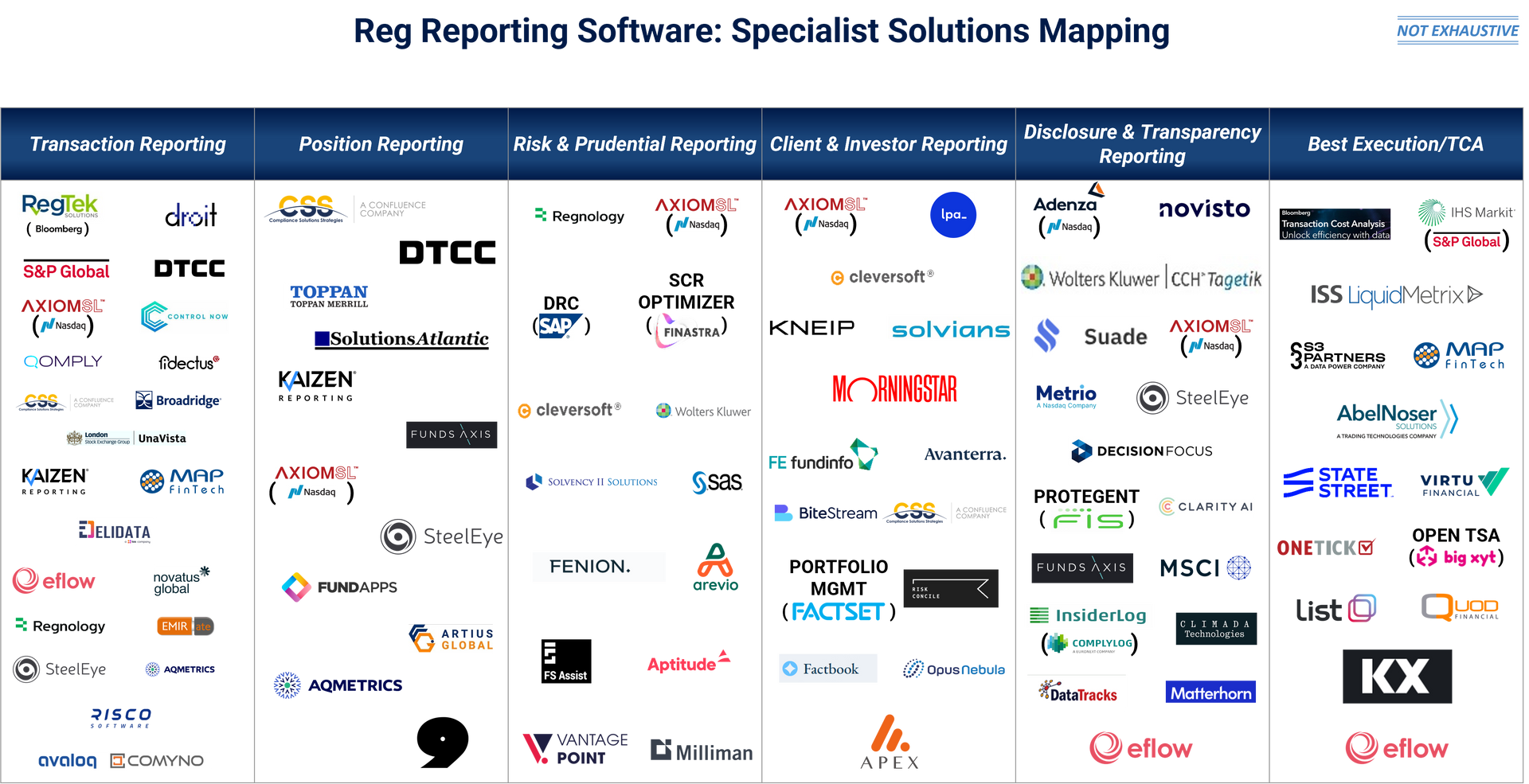

The provider landscape for specialized solutions is highly fragmented, with players focusing on different reporting segments, regions, regulations, client type, client size, etc.

PE Interest and Activity in Specialist Reporting Solutions

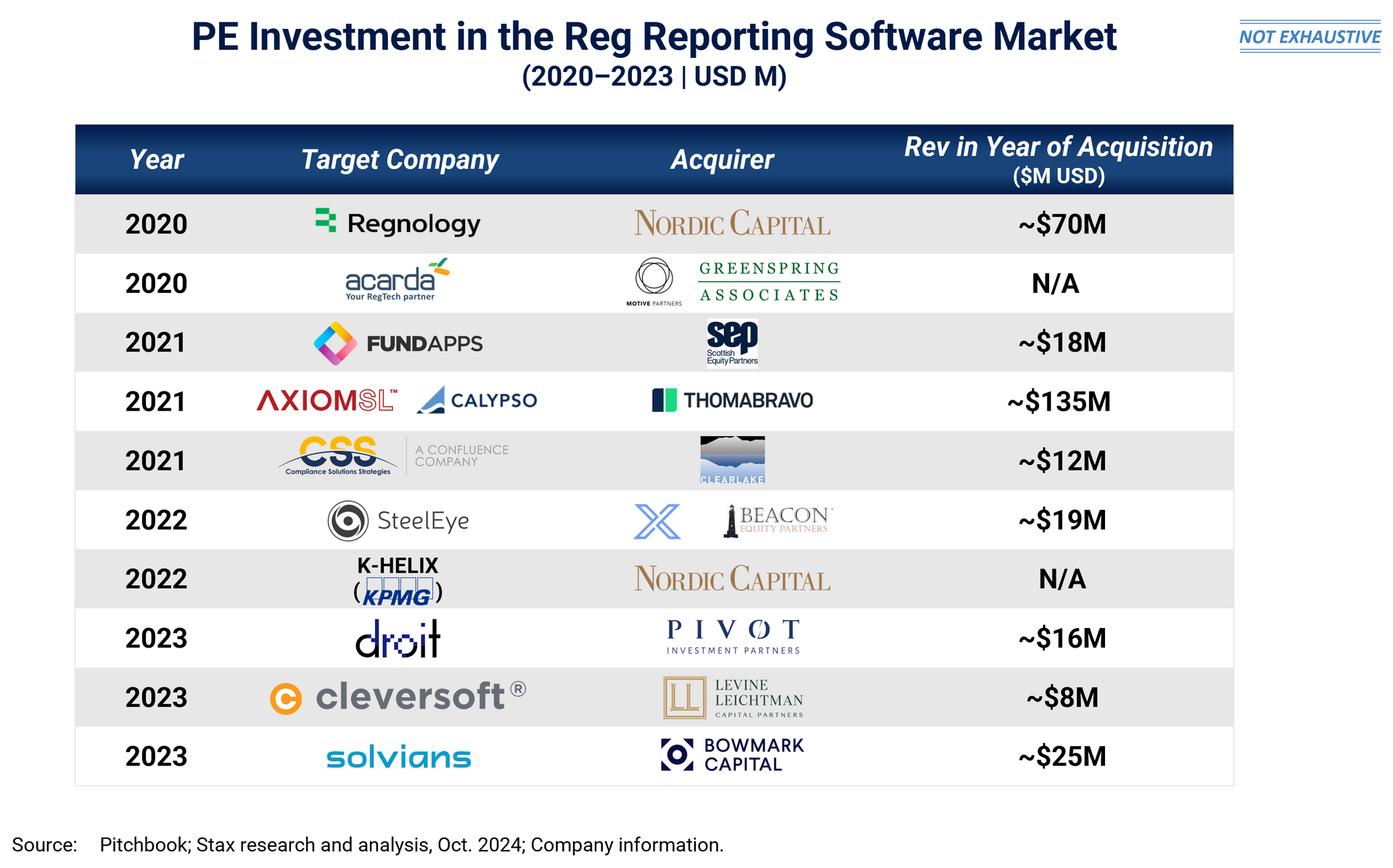

These businesses present compelling investment opportunities for PE funds and have seen strong PE interest and activity.

- Strong Market Demand & Growth Potential: Regulatory and operational pressures drive ongoing demand for specialist solutions to replace non-specialized and/or in-house solutions, offering clear growth opportunities and promising returns for investors.

- High Recurring Revenue: Subscription-based models ensure stable, predictable revenue, with steady demand even in economic downturns. Deep client integration reduces switching risks and enhances long-term revenue potential.

- Competitive Moat Through Expertise: Specialist solutions dominate niche markets with tailored compliance features, creating high entry barriers for competitors and fostering strong client retention.

- Platform Play & Acquisition Potential: PE investors can use specialist solutions as platforms for bolt-on acquisitions, expanding capabilities and building comprehensive offerings in a fragmented market.

- Attractive Exit Opportunities: High demand and growth prospects provide multiple lucrative exit options, including sales to PE firms, strategic buyers, or IPOs, maximizing investment appeal.

Investment Considerations for PE

1. Addressable Market Opportunity

- Market Size: The Total Addressable Market (TAM) for regulatory reporting solutions varies significantly— we have seen $150 million to $10 billion—depending on factors such as reporting type, geographic scope, regulatory regimes, etc. Accurate market sizing is essential to ensure alignment with the investment thesis.

- Whitespace Opportunity: Market penetration varies across segments, for example, areas like Best Execution/TCA have relatively higher penetration of third-party solutions, although not necessarily specialist solutions. Evaluating whitespace requires looking beyond industry level adoption to understand customer adoption, as many firms may not fully utilize third-party technology across all of their needs.

2. Competitive Differentiation

- Identifying Key Competitors: Although there are numerous providers in the market, our experience shows typically only 4-5 key competitors emerge, based on their specialization in client type, size, and service offering. Identifying these key players is essential to assess the solution’s right to compete and succeed.

- Brand Reputation: Beyond technical capabilities, brand reputation is critical. Clients value providers with a track record of success with similar customers in comparable situations. Additionally, using well-established providers often attracts less regulatory scrutiny, making brand strength a significant differentiator.

- Product Capabilities: Key features that enhance attractiveness include comprehensive asset class coverage for streamlined reporting, seamless data integration for efficient handling of large volumes, and automation to reduce manual effort and compliance costs. Scalability ensures adaptability to regulatory changes, while cloud-based (SaaS) deployment offers flexibility and cost savings.

- Regulatory Expertise & Adaptability: Clients prioritize vendors with senior leadership that has deep regulatory knowledge and a demonstrated ability to stay ahead of regulatory changes, ensuring compliance and reliability.

3. Growth and Profitability

- Revenue Growth: Company’s revenue trajectory should ideally showcase rapid growth that aligns with regulatory changes and ongoing adoption trends. Consider growth drivers such as increased business with existing clients, acquisition of new logos, and distinguish between organic and inorganic growth, as these companies are often acquisitive.

- Profitability: Analyze profitability or the path to break-even, noting that regulatory software firms typically incur high R&D expenses to maintain a competitive edge.

4. Prioritization of growth opportunities

- Increase Share of Wallet: Many clients do not fully leverage third-party solutions or use the same vendor across all reporting needs, such as reporting all transactions through one provider. Strategic account management can drive increased share of wallet by expanding the vendor’s footprint within existing clients.

- Cross-Sell and Upsell: Leverage existing relationships to introduce complementary products and higher-value offerings, maximizing revenue potential from each client.

- Expand Regime Coverage: Broadening coverage to include additional regulatory regimes can unlock new revenue streams and make the solution more attractive to clients seeking comprehensive compliance across multiple jurisdictions.

- Geographical Expansion: With capital markets heavily concentrated in the U.S. and Europe, there is an opportunity to leverage existing relationships to enter new geographies. Successful international expansion often requires establishing a local presence to drive growth.

- Broaden Client Type and Size Coverage: Tailoring the product to address the unique needs of different client segments, such as banks versus asset managers or creating lighter versions for smaller, Tier 2 clients, opens new market opportunities.

- Acquire Players in the Same Niche: In a fragmented market, acquiring competitors can enhance scale and market presence.

- Acquisitions in Adjacent Segments: With overlapping decision-makers and a preference among smaller clients for simplified, one-stop-shop solutions, acquiring adjacent technologies can deliver significant value and streamline the tech stack for customers.

Conclusion

Private equity interest in specialist regulatory reporting solutions remains robust, driven by strong market demand, high recurring revenue, and significant growth potential. These businesses offer compelling investment opportunities as regulatory and operational pressures encourage the shift from non-specialized to advanced solutions. Additionally, these solutions present attractive platform plays for bolt-on acquisitions in a fragmented market and offer multiple exit strategies, from strategic sales to IPOs.

Key investment considerations include accurately sizing the addressable market and evaluating whitespace opportunities to align with the investment thesis. Competitive differentiation is crucial, focusing on identifying key players, brand reputation, and product capabilities. Revenue growth should be analyzed alongside drivers like client expansion and new logo acquisition, distinguishing between organic and inorganic growth. Prioritizing growth opportunities—such as increasing share of wallet, cross-selling, expanding regime and geographic coverage, and strategic acquisitions—can maximize returns and strengthen market positioning.

To learn more about Stax and our expertise, visit www.stax.com or click here to contact us directly.