Share

Technology has played a pivotal role in driving vehicle safety, efficiency, and performance. Growth of the automotive industry has been propelled by advancements in electric vehicles (EVs), connected cars and advanced driver assistance systems (ADAS). In conjunction, the automotive industry has also witnessed a rise in popularity of shared mobility and the personalization of the car-owning experience.

With increased R&D investments in cutting-edge technologies, the automotive industry is presenting a multitude of opportunities for investors to capitalize on the industry's growth potential.

Electrifying transportation: the rise of Electric Vehicles

The popularity of EVs has surged in the recent years due to advancements in battery technology, growing awareness of the environmental effects of gasoline-powered vehicles and government incentives to cut carbon emission. A report by Bloomberg anticipates that EVs will constitute 58% of global passenger car sales by 2040. This expansion is anticipated to be fueled by significant investments in EV technology from established automakers such as Ford and General Motors as well as Tesla, a household name for EVs.

Connected Cars: the future of smarter, safer driving

By enabling smarter, more efficient, and safer driving experiences, connected vehicles are anticipated to play a significant role in future transportation. A MarketsandMarkets analysis projects that the global market for connected cars will grow from $23.6B in 2021 to $56.3B by 2026, recording a CAGR of 19.1%. Manufacturers such as Tesla, BMW, and Audi are setting the standard for the connected vehicle market with cutting-edge features such as self-driving capabilities and over-the-air software updates.

Tighter safety rules and rising popularity of autonomous driving technology is expected to drive the expansion of ADAS industry. An analysis by MarketsandMarkets anticipates that the global ADAS market is predicted to increase by 9.7% CAGR from $30.9B in 2022 to $65.1B in 2030. Businesses such as Intel-acquired Mobileye, and Alphabet-owned Waymo are at the forefront of ADAS innovation.

Consumer Applications: the rise of the sharing economy

The emergence of the sharing economy combined with the growing acceptance of alternative modes of transport have propelled the growth of shared-mobility platforms. The conventional taxi industry has been disrupted by companies such as Uber and Lyft while new models for car ownership and usage have been developed by companies such as Zipcar and Car2Go. A Statista report estimates that the global car-sharing market will increase from $13.3B in 2023 to $16.9B by 2027 at a CAGR of 5.69%. Toyota, for example, has launched several initiatives to position itself as a leader in the future of mobility and adapt to changing customer preferences. In addition to making investments in ride-hailing platforms, Toyota has created its own service—"Japan Taxi,” and launched its own car-sharing service—"YUKO,” which allows users to rent cars on an hourly basis through a mobile app.

Data Analytics: personalizing the car ownership experience

Leveraging data collected from the vehicles themselves, automakers have started offering insurance and finance services directly to customers. For instance, Tesla tracks drivers’ real-time driving behavior utilizing the existing technology and offers personalized insurance rates which reflect their risk profile. Similarly, Ford Credit offers financing services based on data collected by vehicle sensors. These offerings reflect a broader trend in utilizing data analytics to personalize the car ownership experience.

The automotive industry is a complex and dynamic industry which requires the use of sophisticated software solutions to manage various aspects of the business. Inventory, sales, customer relations, and accounting needs of many types of dealerships are met by the Dealer Management System (DMS) supplied by companies such as CDK Global, Reynolds & Reynolds, and Dealertrack. Similarly, aftermarket software suppliers such as Epicor, Mitchell 1, and ALLDATA provide systems that enable aftermarket companies to manage inventory, track orders, and create invoices among other things. These software programs aid automobile companies in boosting productivity, cutting expenses, and maximizing profits.

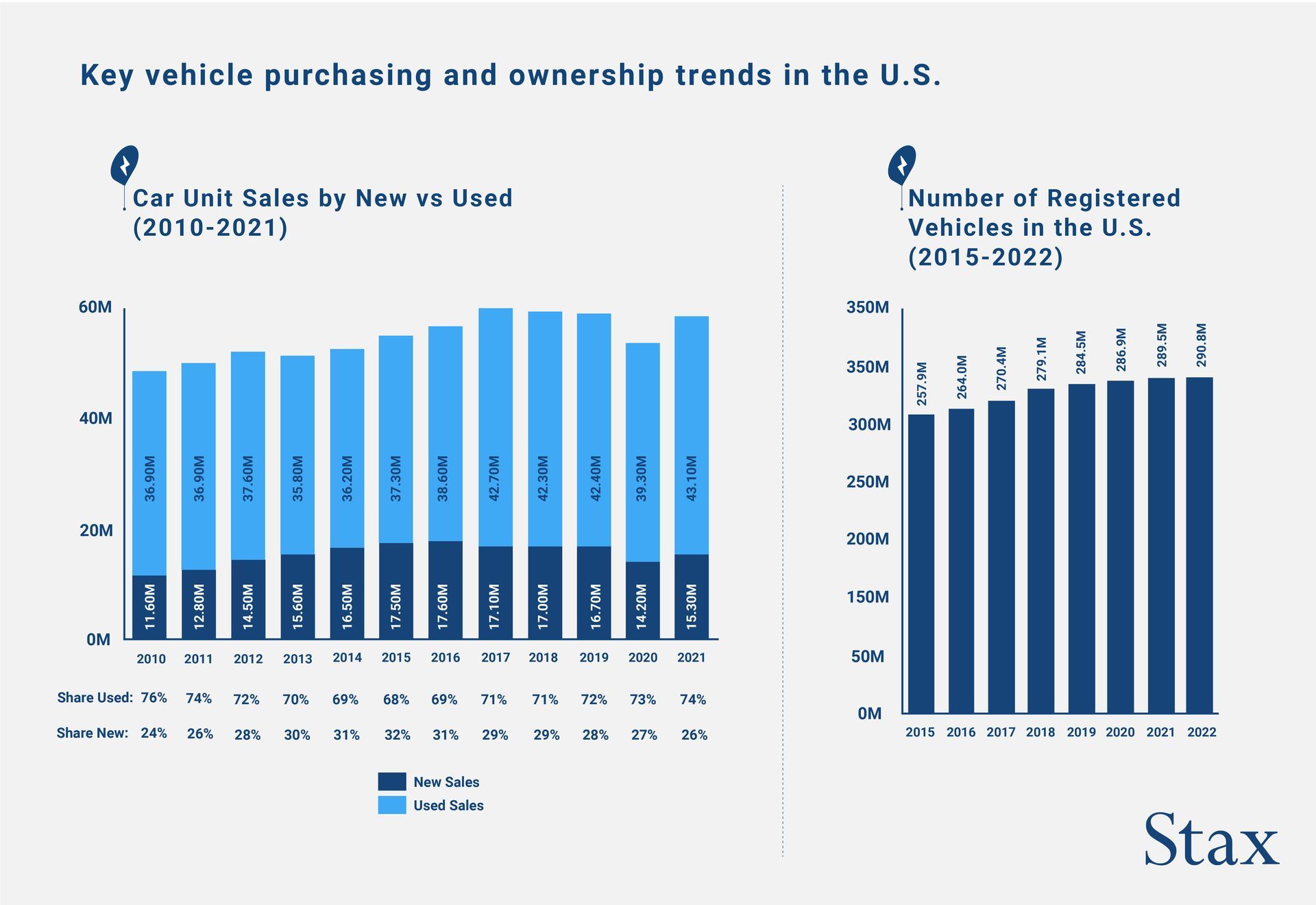

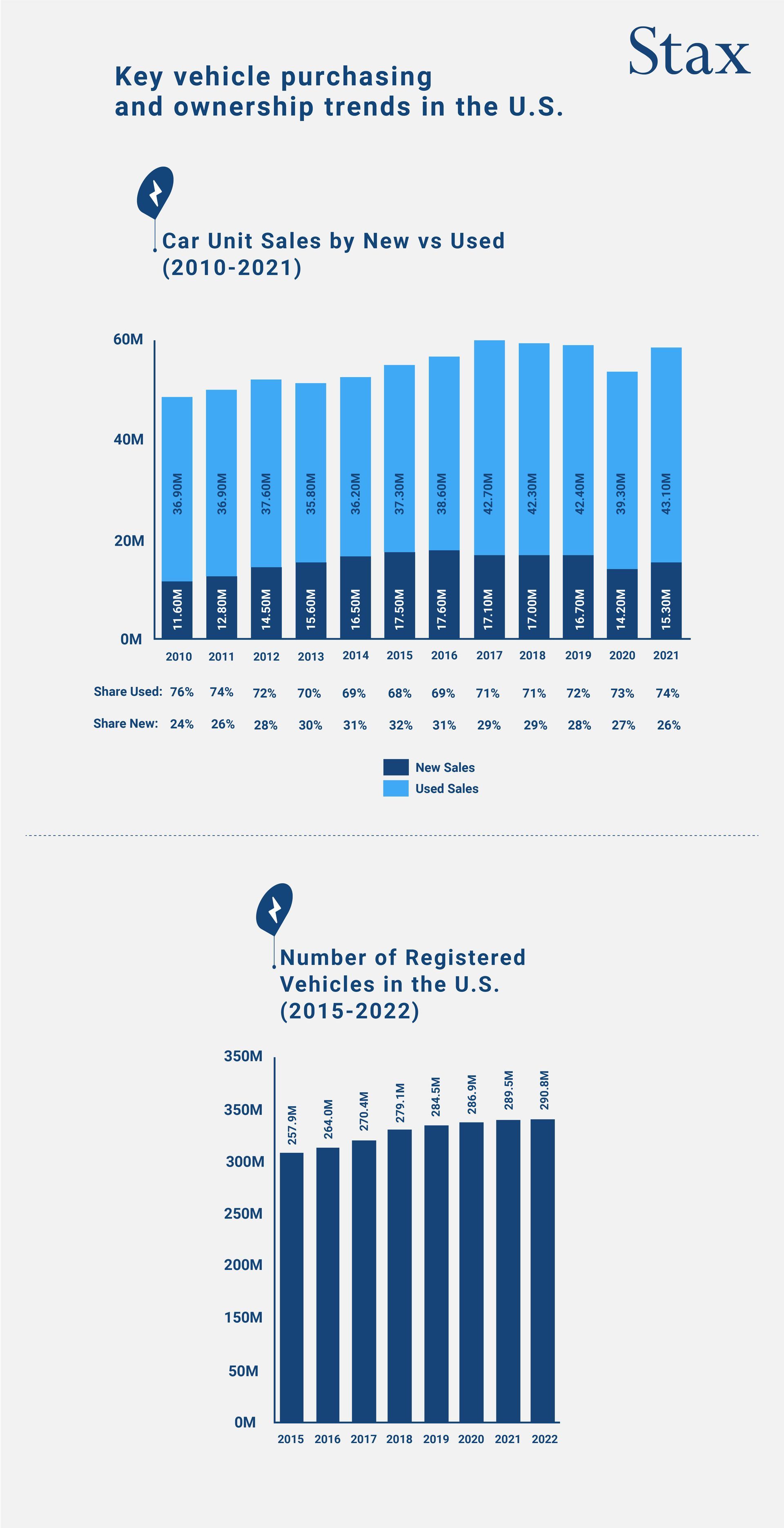

Overcoming obstacles: navigating the headwinds in today’s business environment

The global pandemic has caused shortage of raw materials, particularly of semiconductor chip—a necessary component in contemporary automobiles. Owing to this, a report by AlixPartners estimates that approximately $210B in revenue was lost by the global automobile industry in 2021. Despite some easing in 2023, it is anticipated that the impact would last the entire year, and market stabilization may not happen until 2024. Resultantly, the production capacity has been impacted, causing price hikes for both new and used cars. With customers finding it increasingly difficult to purchase new cars, some are turning to used cars as a more affordable alternative.

The automotive tech industry is also up against other obstacles such as cybersecurity risks and regulatory challenges. Regulations relating to safety, emissions, and cybersecurity are tightening, and automakers may find it costly and time-consuming to comply. Further, as vehicles become increasingly connected and reliant on software, they become more susceptible to cyberattacks that may compromise the safety of both drivers and passengers. Therefore, it is pivotal that automakers invest in robust security measures to protect against potential breaches. These regulatory and cybersecurity challenges add to the complexity of the automotive tech industry and make it more challenging for companies to innovate and stay competitive.

The automotive market is a complex and dynamic industry with various headwinds and tailwinds that can impact investment decisions. Private Equity investors require significant support to navigate through the complexities of the market, including supply chain intricacies, diverse end markets, and potential transformational changes in the automotive and automotive tech sectors.

Unlocking the value of the acquired firm is a crucial endeavor which requires focused effort and expertise once the investment has been made. Partnering with a company that has extensive experience in conducting due diligence on potential acquisitions and implementing value creation strategies is crucial because failure to do so could result in the investment being a sunk cost.

Sources

- "Connected Car Market by Service (OTA Update, Navigation, Cybersecurity, Multimedia Streaming, Social Media, e-Call, Autopilot, Home Integration, & Others), Form, End Market (OE, Aftermarket), Network, Transponder, Hardware, and Region - Global Forecast to 2025", MarketsandMarkets, 2020.

- "Driver Assistance System Market by Offering, Technology, Vehicle Type, EV Type, Application, Level of Autonomy, Component & Region - Global Forecast to 2025", MarketsandMarkets, 2020.

- "At Least Two-Thirds of Global Car Sales Will Be Electric by 2040", Bloomberg, 2021.

- "Car-sharing worldwide", Statista, 2022.

- "Toyota bets on future of taxis with ride-hailing app investment", Indian Express, 2018.

- "Yuko - Your Mobility Partner", Yuko, accessed March 2023.

- "Toyota cuts stake in Uber by more than half, looks to maintain ties", Reuters, 2022.

- "Getaround Announces Carsharing Partnership with Toyota", Getaround Press Releases, 2021.

- "Real-time Insurance", Tesla, March 2023.

- "Tesla partners with Markel to offer car insurance in US", Reuters, 2019.

- "GM Offers Use-Based Auto Insurance with Data from OnStar Vehicle", Bryan Cave Leighton Paisner, 2020.

- "GM to use data from connected cars for personalized insurance", Reuters, 2020.

- "Why Ford Credit?", Ford, accessed March 2023.

- "Mobility Experiment: Big Data Drive Dearborn", Ford Media Center, 2015.

- "Best Automotive Body Shop Software", GetApp, March 2023.

- "AllData Alternatives & Competitors", G2, March 2023.

- "Automotive Retailing Solutions", Reynolds and Reynolds, March 2023.

- "Is the chip shortage over?", TechRepublic, 2022.

- “Chip shortage expected to cost auto industry $210 billion in 2021", CNBC, 2021.