Share

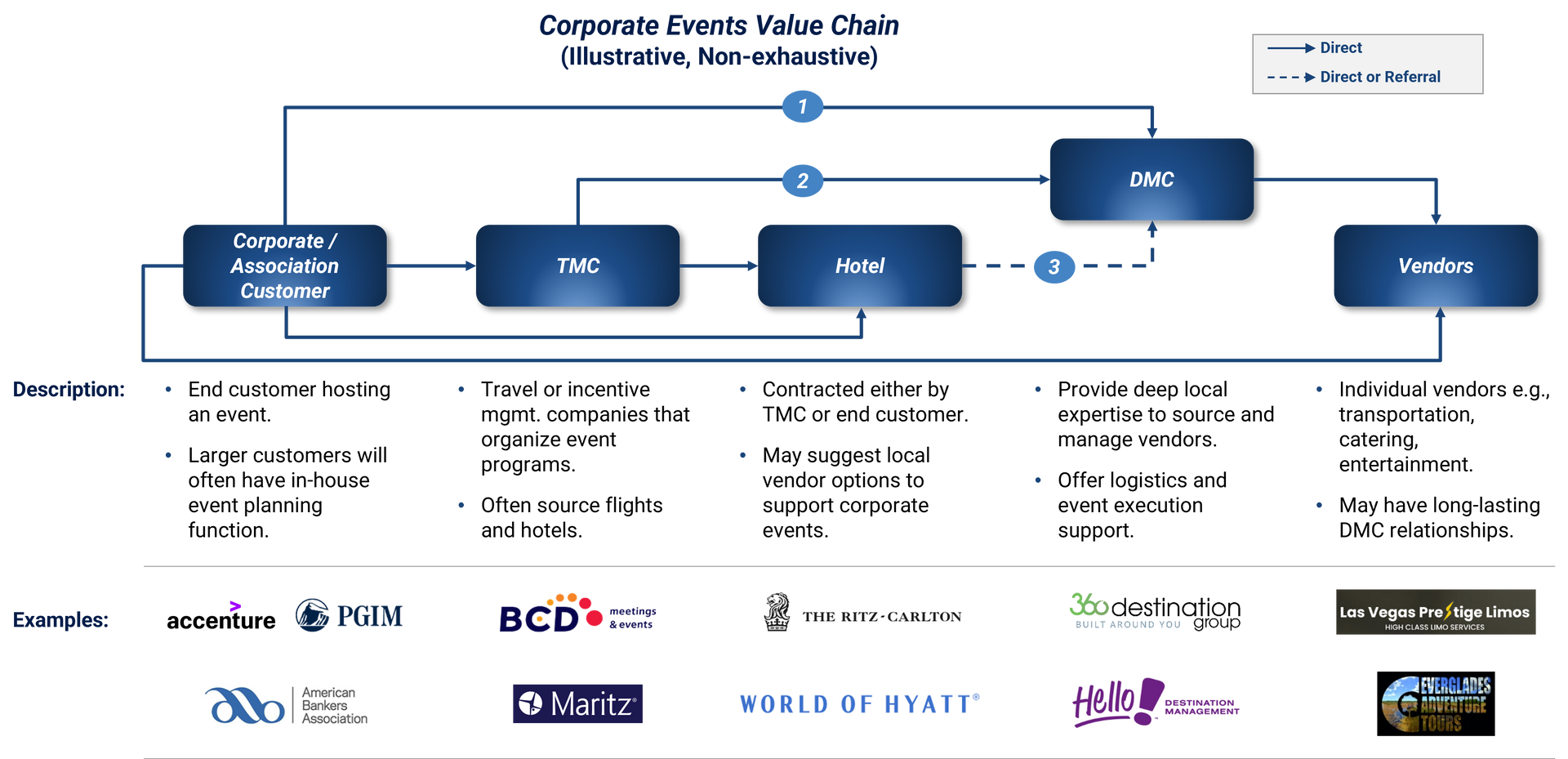

Destination Management Companies (DMCs) serve corporates across industries looking to organize company retreats, corporate meetings, incentive trips, and product launches. DMCs provide end-to-end event services from conception through production (i.e., event branding, décor, signage), vendor sourcing (e.g., catering, entertainment), logistics & transportation (i.e., shuttle buses to and from the hotel) and event execution support.

DMCs complement Travel Management Companies (TMCs) such as BCD and Maritz, who may sub-contract a DMC where they lack local expertise or require additional planning capacity.

Importantly, DMCs have deep local expertise and longstanding vendor and venue relationships, crafting tailored and memorable events. They add most value to situations where local expertise is required (i.e., the destination is unfamiliar to the in-house events planner) and / or within large and complex events that require dedicated third-party support.

Competitive Landscape

The DMC landscape is segmented between:

- National / International: The largest DMCs enjoy scale benefits including deep vendor relationships, strong brand awareness, and volume-based vendor discounts—making them well-suited to serve large-scale events and corporate clients.

- Examples: PRA, Ovation, Access, 360 Destination Group

- Regional: Deep expertise within a specific location or region (e.g., South Florida); often rely on hotel or other third-party referrals.

- Local: Small “mom & pop” DMCs that serve smaller or local companies, typically with a presence in a single city/destination.

What are the Potential Risks and Growth Opportunities in the Destination Management Company Market?

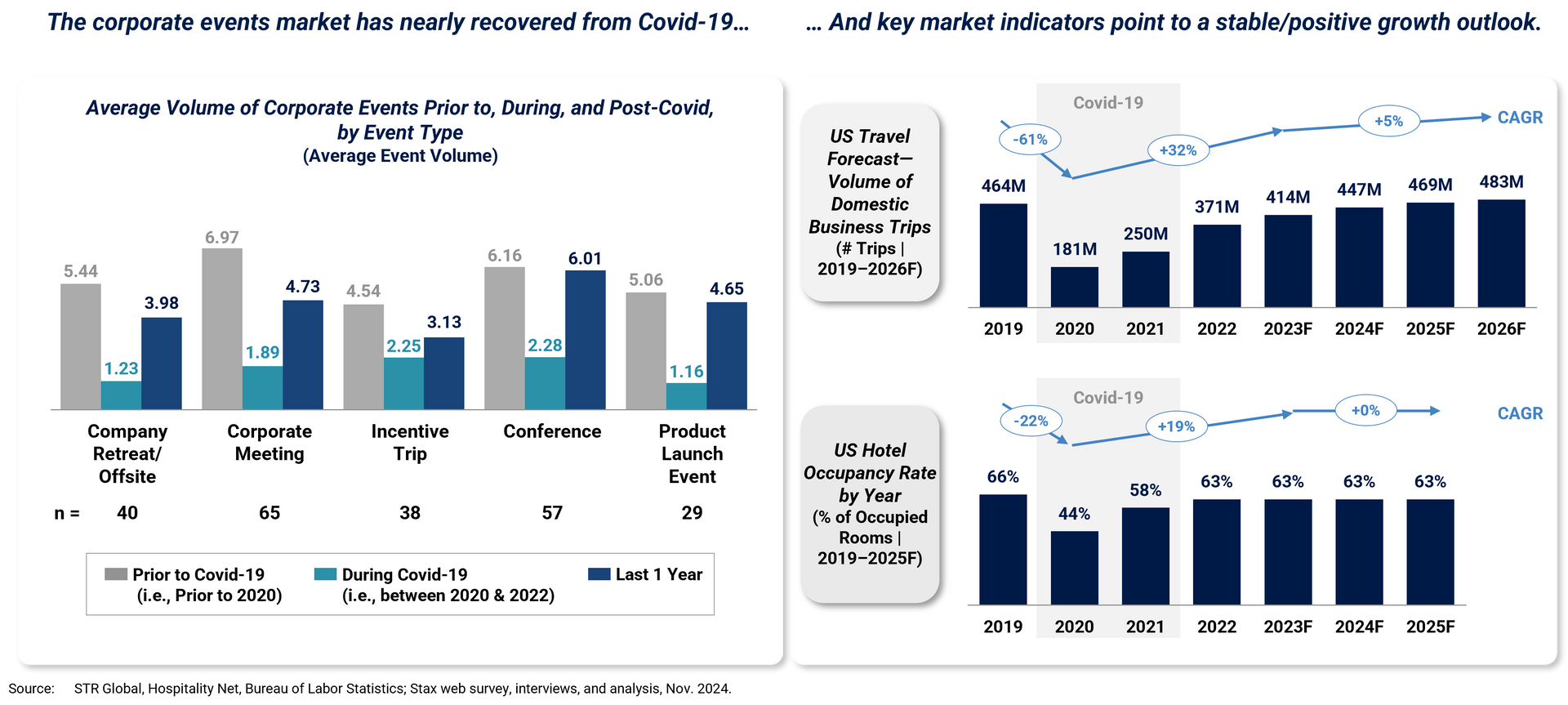

DMC demand is inextricably linked to corporate event volume, which has rebounded post-Covid as executives realize the need for face-to-face interaction to drive corporate objectives (e.g., improved employee engagement, morale). Further, these decision-makers are prioritizing corporate events that can incentive and reward top-performing employees, potentially driving revenue growth (i.e., by sufficiently incentivizing sales teams). These events are often in exotic locations with custom offsite activities and are therefore highly addressable for DMCs. Stax estimates the volume of corporate events addressable for DMCs will grow ~10% CAGR over the next five years.

Corporate events can be impacted by economic downturns, as they can be perceived as low-hanging fruit opportunities to cut costs. However, DMCs can in fact be hired as a means to cut in-house costs (i.e., as an alternative to salaried, in-house event planners); scaled national players can also offer favorable contracts and vendor discounts, potentially saving costs versus proprietary events.

What are the Opportunities to Drive Value in the Destination Management Company Market?

While DMCs will naturally benefit from organic growth in the corporate events market, there are a range of incremental growth levers for consideration (non-exhaustive):

- Moving upstream into Event Strategy: DMCs can build out Event Strategy capabilities, working with clients to design event concepts that align with the attendee profile, budget, and objectives; such services can help position the DMC as a strategic, long-term partner.

- Geographic expansion: Target up-and-coming destinations (e.g., secondary US cities, Europe) that can often be less expensive than traditional hotspots (e.g., Las Vegas, Orlando). Expansion through acquisition of an existing, well-connected DMC helps overcome barriers including lack of destination familiarity, limited vendor relationships, etc.

- Event type expansion: DMCs can consider expansion into adjacent large-scale event types such as tradeshows, conventions and sporting events. These events often require services that are highly addressable for DMCs (e.g., shuttle bus services, offsite activities).

Conclusion

Stax has direct experience in the DMC space, supporting HIG with their recent acquisition of 360 Destination Group. In addition, Stax has worked on multiple deals across the corporate events ecosystem and wider travel, tourism, and hospitality services sectors. To learn more about our experience, visit www.stax.com or click here to contact us directly.