Share

Recent changes in the ECB’s ownership rules for The Hundred franchises have created opportunities for private investors to acquire stakes in teams, marking a significant shift in the league's investment landscape. Potential investors approached by the ECB have included owners of Indian Premier League and Women’s Premier League franchises, as well as NFL owners and private equity funds — many of which will be signatories to the Principles for Responsible Investment (PRI). This commitment signifies that these firms have publicly pledged to integrate environmental, social, and governance (ESG) factors into their investment analysis and decision-making processes.

Upon learning about this development, and in line with a similar wave of investments into NFL teams in North America, Stax conducted a preliminary ESG due diligence on a selection of teams using our proprietary AI-ESG tool. Our aim was to identify the types of ESG issues that these potential investors are likely to further scrutinise as they explore these investment opportunities. Each team will have specific issues, but this aggregate view provides a framework against which future investment priorities might be evaluated.

ECB Director of Business Operations Vikram Banerjee, who is leading the process on behalf of ECB and the wider game, stated: “Since announcing our intent to launch this process, we’ve received a phenomenal level of interest from a diverse mix of investors globally. Our priority over the coming months will be to select partners that share our passion and vision for the future of The Hundred, with expertise to take the competition to the next level. Whether that's through creating unforgettable matchday events, engaging new fans, enhancing international awareness of the competition, or other areas.”

In our opinion, these “other areas” could potentially encompass new approaches to governance, sustainability, and community engagement—areas often overlooked for sports franchises but critical to long-term value.

This article will explore the key ESG factors likely to impact teams in The Hundred and how these investments could drive change within the league.

METHODOLOGY

To identify the material ESG factors for teams in The Hundred, we employed our proprietary AI-ESG diagnostic tool, which integrates advanced analytics and industry-specific datasets to pinpoint the most relevant ESG risks and opportunities. This diagnostic tool uses data-driven algorithms to assess and rank ESG factors based on their impact and materiality within the sports sector, capturing the latest trends and stakeholder expectations. In conjunction with the AI-driven insights, we leveraged Stax’s extensive value creation experience and our knowledge of PE investment strategies to ensure a holistic and practical approach. By combining data analysis with our industry expertise, we identified the most important ESG factors for teams and their investors, prioritisingthose that can deliver tangible and measurable results.

ESG INSIGHTS

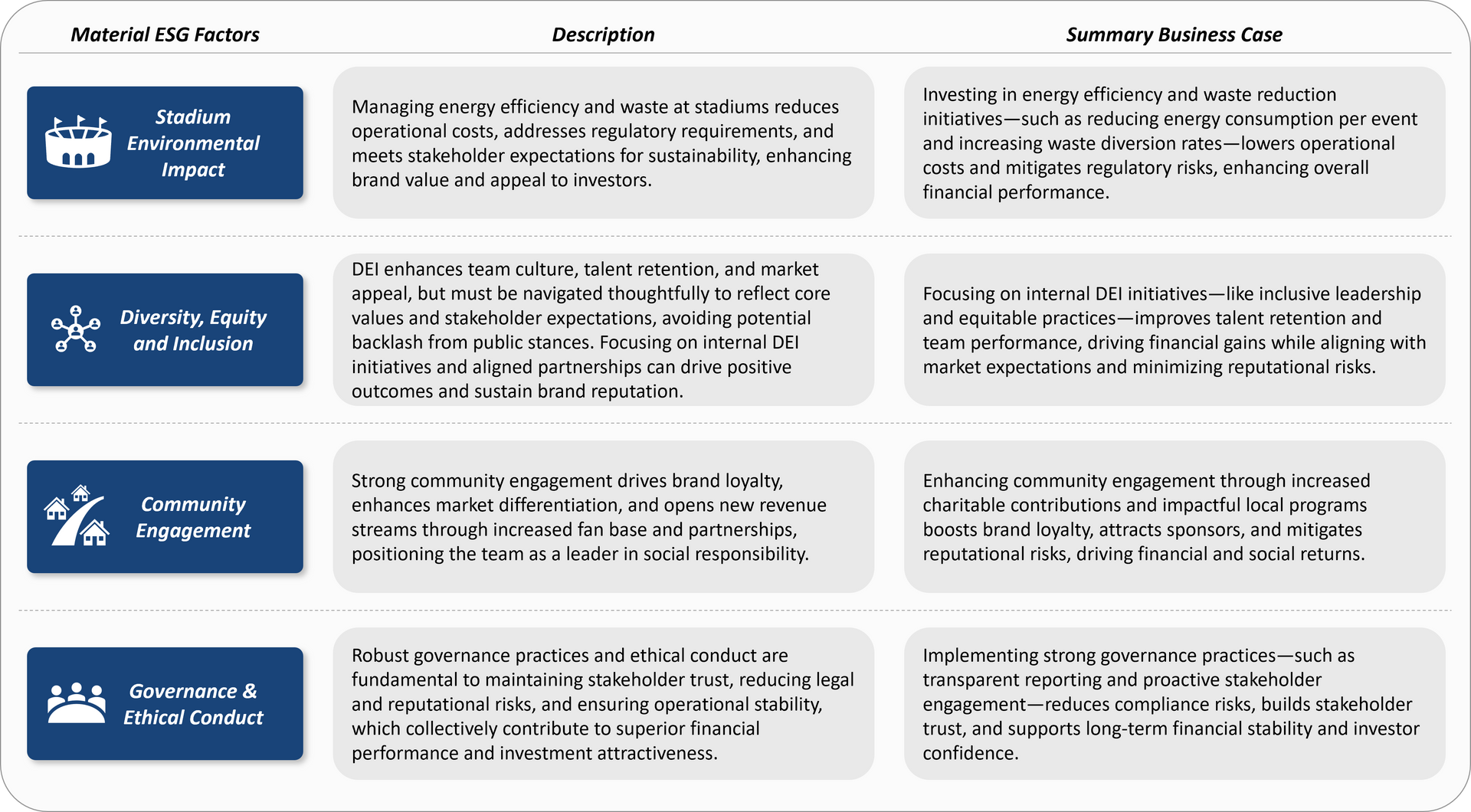

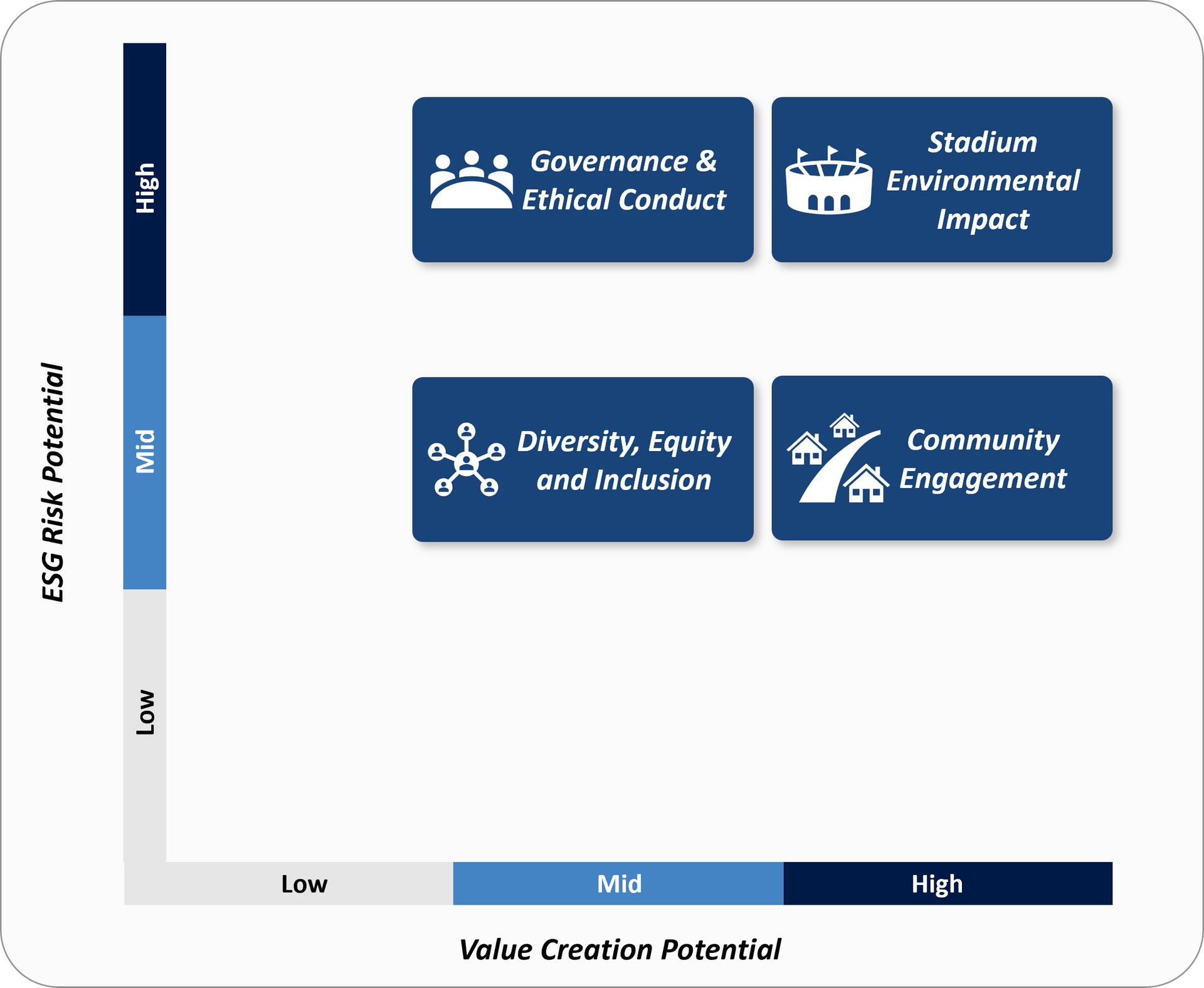

Our analysis uncovered four primary ESG factors that are critical for teams in The Hundred: Stadium Environmental Impact, Diversity, Equity, and Inclusion (DEI), Community Engagement, and Governance and Ethical Conduct.

For each factor, we assessed its potential risks—such as increased operational costs, regulatory pressures, and reputational challenges—as well as value creation opportunities, including cost savings, enhanced brand loyalty, and stronger stakeholder relationships. For instance, improving energy efficiency and waste management at stadiums directly lowers operational costs and attracts eco-conscious sponsors, while robust governance practises reduce compliance risks and build investor confidence.

Recognising these material ESG factors, however, is just the starting point to drive sustainable value creation. The next step involves creating a customised sustainability strategy that integrates these factors into the core business model while prioritising initiatives that offer the greatest impact. A focused sustainability roadmap should outline clear, actionable steps, timelines, and responsibilities, setting the stage for targeted improvements in both financial and ESG performance, directly linked to EBITDA growth. By prioritising and executing these initiatives, ESG commitments can be translated into measurable business results, enhancing resilience and unlocking new avenues for growth.

VALUE CREATION & FINANCIAL SUCCESS

New investors, whether existing sports franchise owners or private equity, have a unique opportunity to create significant value in The Hundred, even as minority owners. Their strategies can influence both on-field and off-field performance, resulting in improved financial outcomes. Key areas of focus include:

1. Operational Improvements: New investors can help teams in The Hundred improve operational efficiency through sustainable practises and technology adoption. For example, IPL investors are already accustomed to initiatives like the Green Protocol, which promotes bio-degradable packaging at matches, LED floodlighting, and renewable energy.

Rajasthan Royals have a partnership with Schneider Electric; Gujarat Titans are minimising scope 3 greenhouse gas emissions through collaboration with Gujarat Metro for transportation, the adoption of electric vehicles, and the use of public buses during the team's five home matches; all of which can lead to significant long-term value through enhanced brand reputation and new corporate partnerships. As more cricket teams plan stadium builds or major renovations, new investors can play a crucial role in integrating sustainability into these projects, thereby improving both environmental and financial performance.

Additionally, leveraging data analytics can provide teams with critical insights into energy consumption, crowd management, and resource efficiency, ultimately reducing costs and enhancing the fan experience. New immersive technologies, such as the fan experience offered by COSM—which, like the Vegas Sphere, merges entertainment with sports—provide innovative ways to engage fans, strengthen loyalty, and align with sustainability goals creating a more efficient and profitable operation.

2. Strengthening Community Relations: Building strong community ties are integral for a franchise cricket team’s success, as it fosters brand loyalty and creates revenue opportunities. Teams that prioritise community engagement, particularly through sustainability and inclusion initiatives, can forge deeper connections with fans and stakeholders. For example, Ryan Reynolds’ connection with the local Wrexham fan base; or on a global scale, during their investment period in Formula 1, CVC prioritising the “Fan Experience,” with expansion into new markets and improved broadcaster coverage through innovative digital platforms.

New Investors can leverage these consumer-focused strategies to help teams expand their reach, generate new revenue streams, and build long-term value beyond the traditional sports market.

3. Governance Enhancements: New investors, especially private equity investors, are known for their ability to instill robust governance frameworks, which can elevate leadership effectiveness and strategic direction for teams in The Hundred. By applying best-in-class governance practises, PE firms can optimise board structures, foster strategic alignment among stakeholders, and enhance decision-making processes—all of which contribute to building stronger organisations and increasing valuations.

Collectively, these areas provide new investors with a variety of avenues to elevate team valuations and portfolio performance. While The Hundred is distinct in its market dynamics and the value drivers for each team vary—ranging from finals success to marketability—the application of thoughtful ESG strategies and enhanced governance can yield substantial results.

Conclusion

The introduction of new investors, even as minority stakeholders, in The Hundred teams is poised to shift the league’s trajectory in subtle but impactful ways. While ECB chief executive Richard Gould indicated that one motivation for selling the team stakes was to raise funds to attract the world’s best players in a landscape awash with franchise leagues, the reality is that new investors are likely to seek value creation opportunities beyond the traditional playbook.

By implementing sustainable stadium operations, strengthening community relations, and enhancing governance practises, new investors have the potential to influence how teams operate, engage with stakeholders, and grow their valuations—all while maintaining the integrity of the league’s core values.

If you'd like more information or have any questions related to this report, please reach out to any of the authors:

To get more insight's from Stax, please subscribe here: