Share

Overview

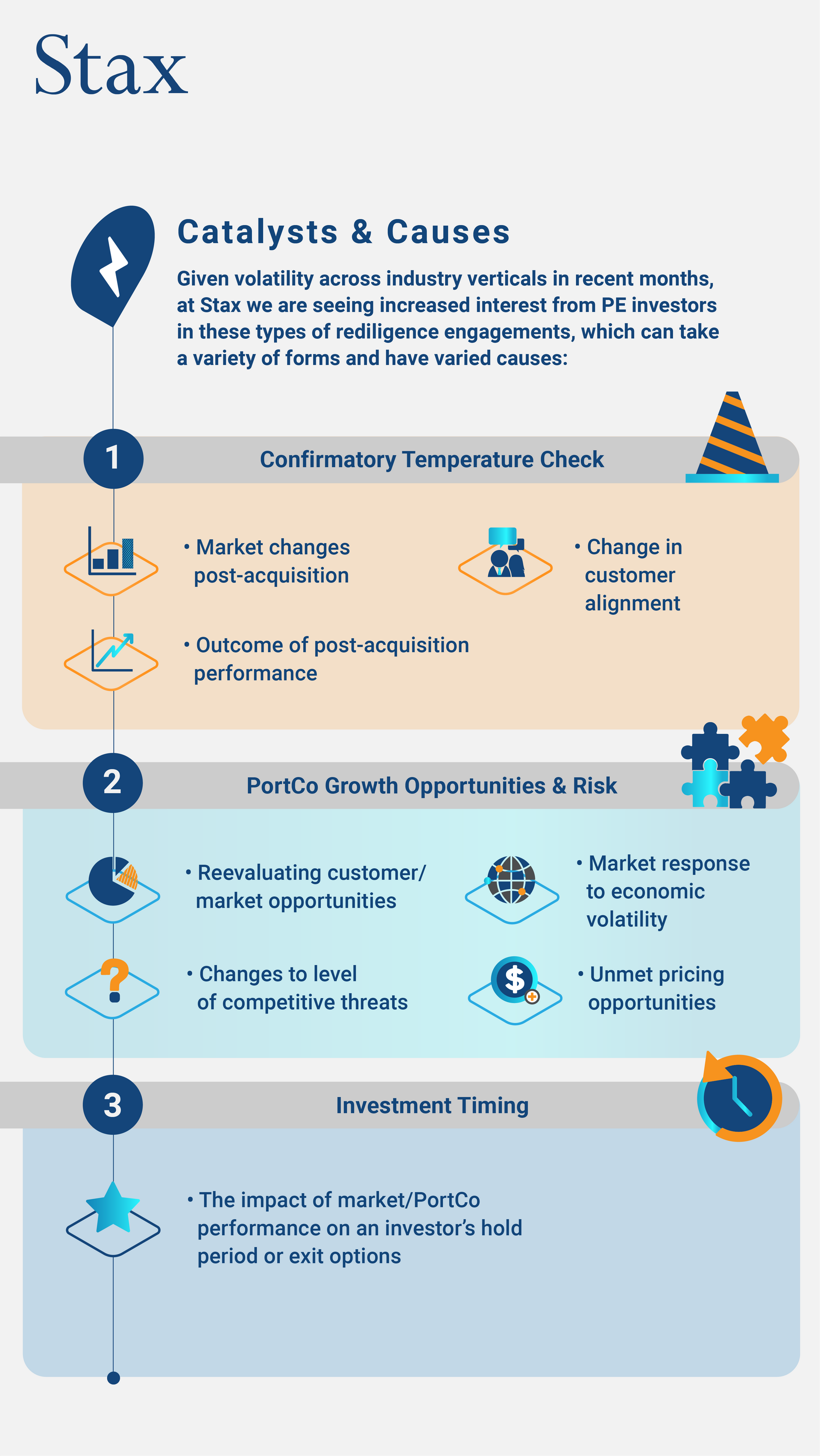

Given the unpredictability across markets and the importance of ensuring portfolio companies’ long-term visions align to the future states of their markets, it is important for private equity investors to periodically reassess their investments.

Specifically, reevaluating an assets’ alignment to how its market has evolved and how its strategic initiatives can provide significant value in informing necessary pivots or to validate existing strategic direction. Of the many benefits afforded by these reevaluations, the most valuable is ensuring that assets are ideally positioned and aligned to their markets and in the midst of growth trajectories with longevity at the point of exit.

Key Aspects of Rediligence

Focus Areas

Primarily, there are several broad areas of focus when approaching rediligence. Across different industries, these focus areas can vary depending on the portfolio company’s situation and the responses to the following example questions:

I. Market Overview

- What is the market opportunity? How is it expected to grow? How has this changed since acquisition?

- How much of the market is currently serviceable? How has this changed since acquisition?

- How aligned is the asset with key industry trends and dynamics? How has this changed since acquisition?

- How resilient is each industry likely to be during a downturn?

II. Competitive Dynamics

- How is the competitive landscape structured? What does relative market share look like across competitors? How has this changed since acquisition?

- How do competitors’ go-to-market strategies differ? What are the perceived strengths and weaknesses of the assets and competitors? Where do they win, where do they lose? How has this changed since acquisition?

- How well have acquired assets executed post-acquisition plans to improve competitive positioning?

III. Company Positioning

- What are the customers’ level of satisfaction with the products and/or services provided by the Target assets? How has this changed since acquisition?

- How entrenched are the assets among customers? How likely are they to consider switching to a competitor? How has this changed since acquisition?

- Are there any areas where each asset needs to redirect or refocus its go-to-market strategy to better align with a changing market?

Stax and Rediligence

In Stax’s experience, our client engagements deliver quantifiable value over the course of a hold period and at the point of exit. We have a prolific track record of providing investors with the information they need through our competitive, actionable, and data-driven insights. Here are a few recent examples of our engagements:

- For a large PE sponsor with an asset in the InsurTech space, Stax validated continued market runway leading to a longer hold period allowing the sponsor to pay down debt and multiply returns.

- For a large PE sponsor with an asset in the workforce and human resource management space, Stax established that the chief competitive rival was unlikely to take share from an asset, leading to a longer hold period that allowed the asset to more than triple revenues within 5 years.

- For a large PE sponsor with an asset in the oil & gas data science space, Stax established that current customers were splitting accounts with a key competitor and likely to churn in the near term. This led the sponsor to exit the business at peak value immediately before a lengthy decline in revenues.

Collectively, these engagements help provide PE investors with a degree of protection from PortCo strategy falling out-of-step with evolving market trends, which in some cases does not become apparent until the time comes to begin exit planning.

About the Author

Roy Lockhart is a Director in the Boston office with over a decade of experience providing strategic advice to a wide range of private equity firms, their portfolio companies, and large corporations. At Stax, Lockhart leads buy and sell-side/exit planning engagements as well as growth strategy development efforts providing data-driven analysis across a variety of sectors with an emphasis on software/technology and consumer/retail facing verticals.