Share

The events market is experiencing strong growth post-Covid, fueled by a surge in proprietary and B2B events as companies aim to boost competitiveness. This trend presents significant growth avenues for event service providers. However, not all service providers are equally well-positioned to unlock the higher growth segments of the market. A clear understanding of each vendor’s right-to-win and core customer base will enable investors to identify the best opportunities for success.

This article explores the event services providers landscape and highlights factors to consider for potential investments.

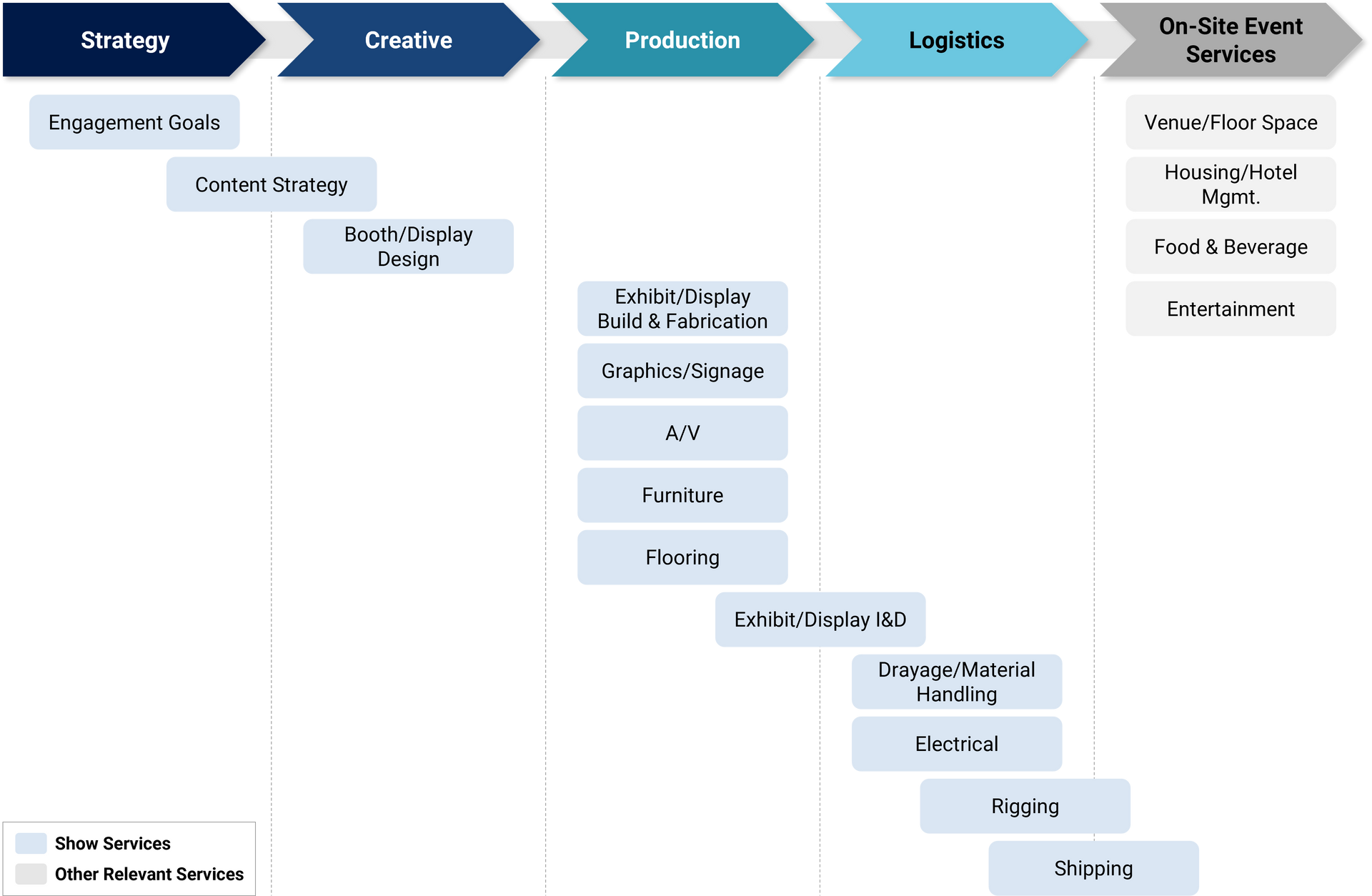

Although various suppliers serve the event management lifecycle, show services (e.g., booth design, A/V, drayage, etc.) make up a large portion of organizer and exhibitor spend.

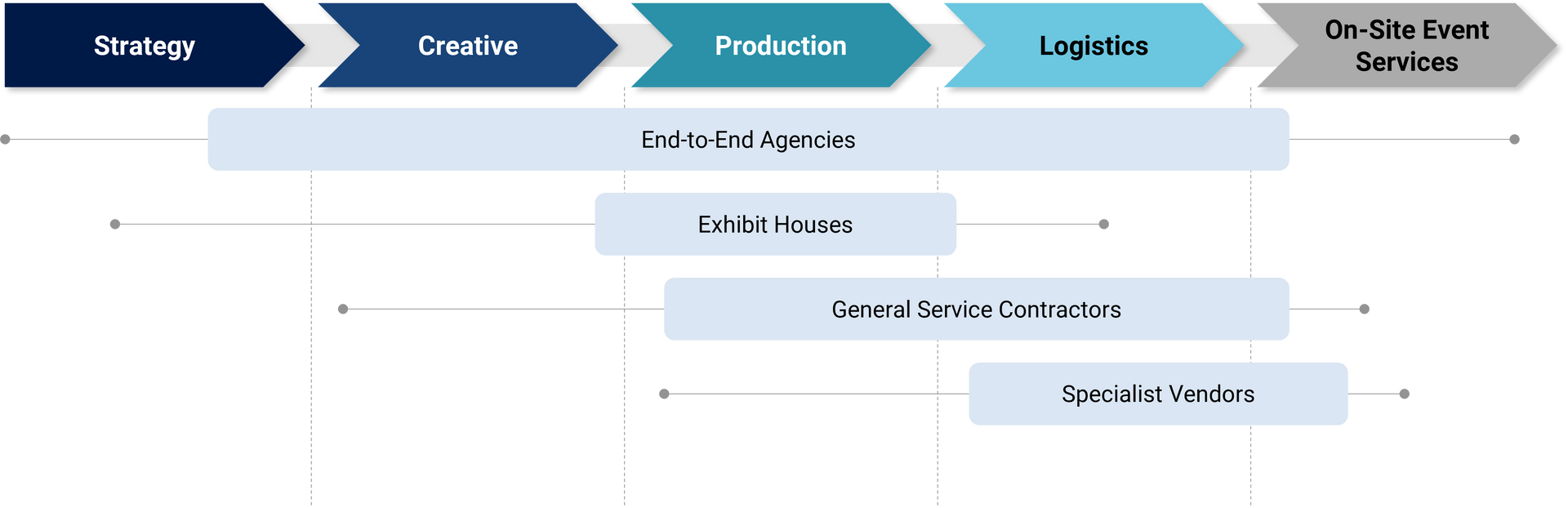

Show services can be served by a variety of vendor types, differing in the breadth and depth of services they can provide customers:

End-to-End Events Agencies:

E.g., George P. Johnson, Opus, Czarnowski, Sparks, Spiro, MC2, ImpactXM

Provide comprehensive support across the event management value chain. Their services often encompass strategic planning, visual design, exhibit fabrication, logistics coordination, etc. Agencies serve as a single point of contact for customers, addressing most or all of their show requirements internally or via contracted relationships.

Exhibit Houses:

E.g., Taylor, Skyline, Orbus, Absolute Exhibitions

Support exhibitors primarily with the design, build, and installation/dismantling of booths/exhibits. Large players also may have event planning and handling capabilities.

General Service Contractors (GSCs):

E.g., Freeman, GES, Shepard, Fern, The Expo Group

Authorized by trade show organizers to provide non-discretionary services to exhibitors (e.g., rigging, drayage, electrical). Most also have additional capabilities to support exhibitors with production, I&D, furniture, A/V, etc. Market leaders further have strategic and creative capabilities and can serve exhibitors across the events value chain.

Specialist Vendors:

Miscellaneous vendors, including events-focused providers like Nth Degree, Cort, GCL, TTi, CCR, etc.

Specific providers for individual services (e.g., transportation, A/V, furniture rental, I&D, etc.).

Market Dynamics:

Historically, trade show net square footage (i.e., square footage purchased by exhibitors) has grown at a 1-3% annual growth rate, typically following underlying economic indicators. Demand for show services (typically served via GSCs and exhibit houses) is grows nearly 1-to-1 with square footage sold, given these services are largely tied to the size of the physical exhibit space – e.g., material handling, rigging, furniture/carpet, exhibit booths.

However, square footage is not expected to fully recover until 2027 as exhibitors re-strategize event budgets and become more efficient with booth space by increasingly utilizing enhanced tech and A/V, resulting in a decrease in booth-specific expenditure. Some service providers can supplement depressed volume recovery with products untethered to square footage (i.e., design/creative services, A/V, digital signage). Still, square footage is the primary driver across most revenue streams for GSCs and exhibit houses.

At the same time, the rise of proprietary events (e.g., B2B events, brand activations), used by companies to remain competitive and signal creativity to customers, is driving the need for more strategic show services. Providers who can manage the event, while also providing strategic/creative support (i.e., agencies), are strongly aligned to the growth of proprietary events.

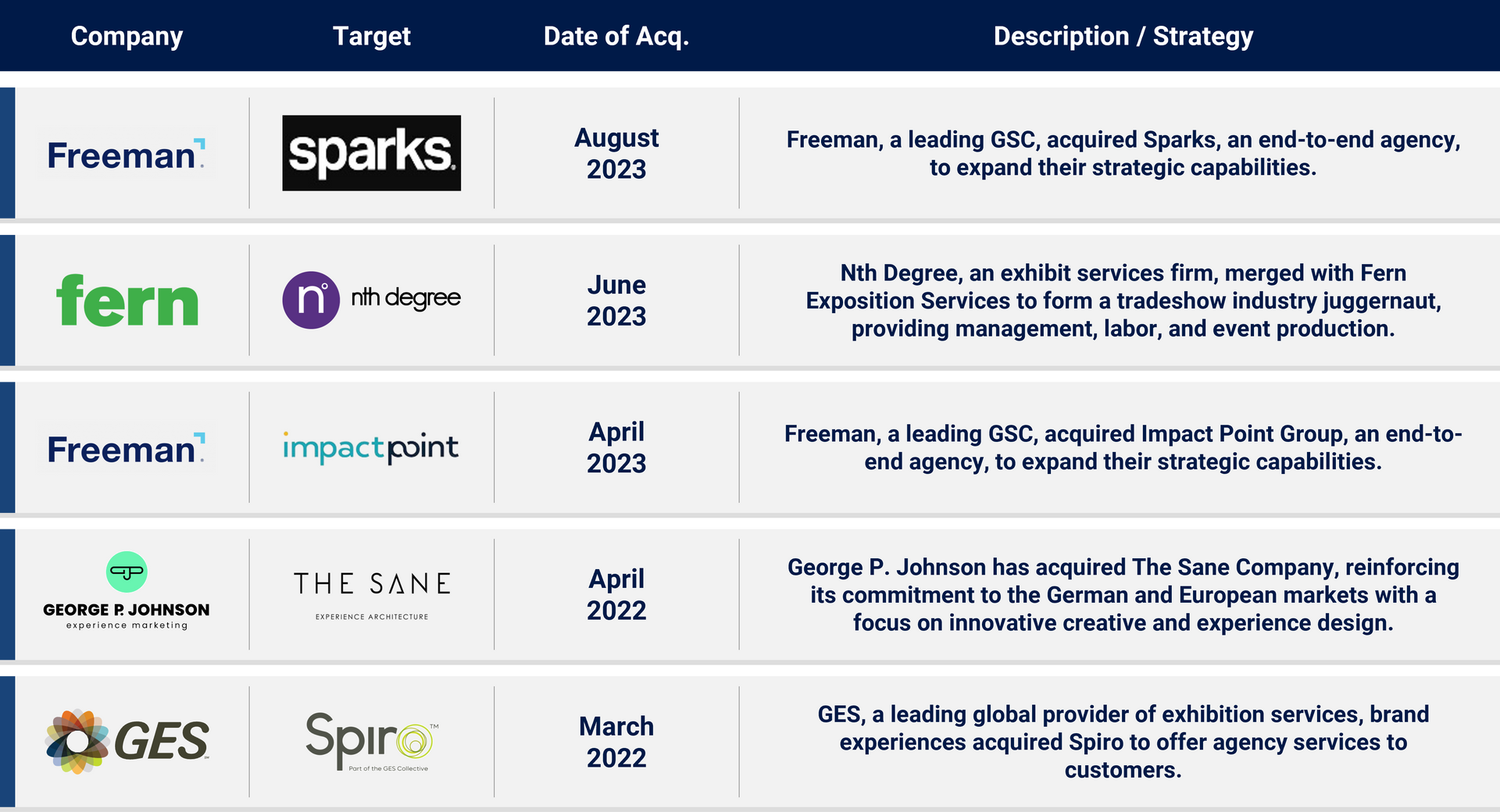

Given these dynamics, many vendors traditionally focused on the legacy exhibition market have expanded their services to offer agency-like offerings and serve a wider range of event and customer segments.

Drivers of Differentiation:

As more service providers enter the agency space, the market remains fragmented, with each provider’s right-to-win depending on its services and target clients. Primary drivers of differentiation include:

- Services offered – Agencies specializing in ‘creative’ services have stronger differentiation and typically achieve higher gross margins (50%+). Other agencies that focus on ‘program management’ (i.e., coordinating logistics across vendors and running the event) are less differentiated, and yield lower gross margins (30-50%). That said, many program management agencies have the opportunity to increase customer share-of-wallet via service expansion.

- Experience with specific customer and event segments – Clients highly value agencies with relevant end-market experience, particularly in key sectors like pharma, tech, and auto, and with similarly sized companies or events. This is especially critical for large-scale events, where proven ability to manage complex logistics is essential.

- Reputation – An agency's general reputation and industry awareness are crucial factors for consideration

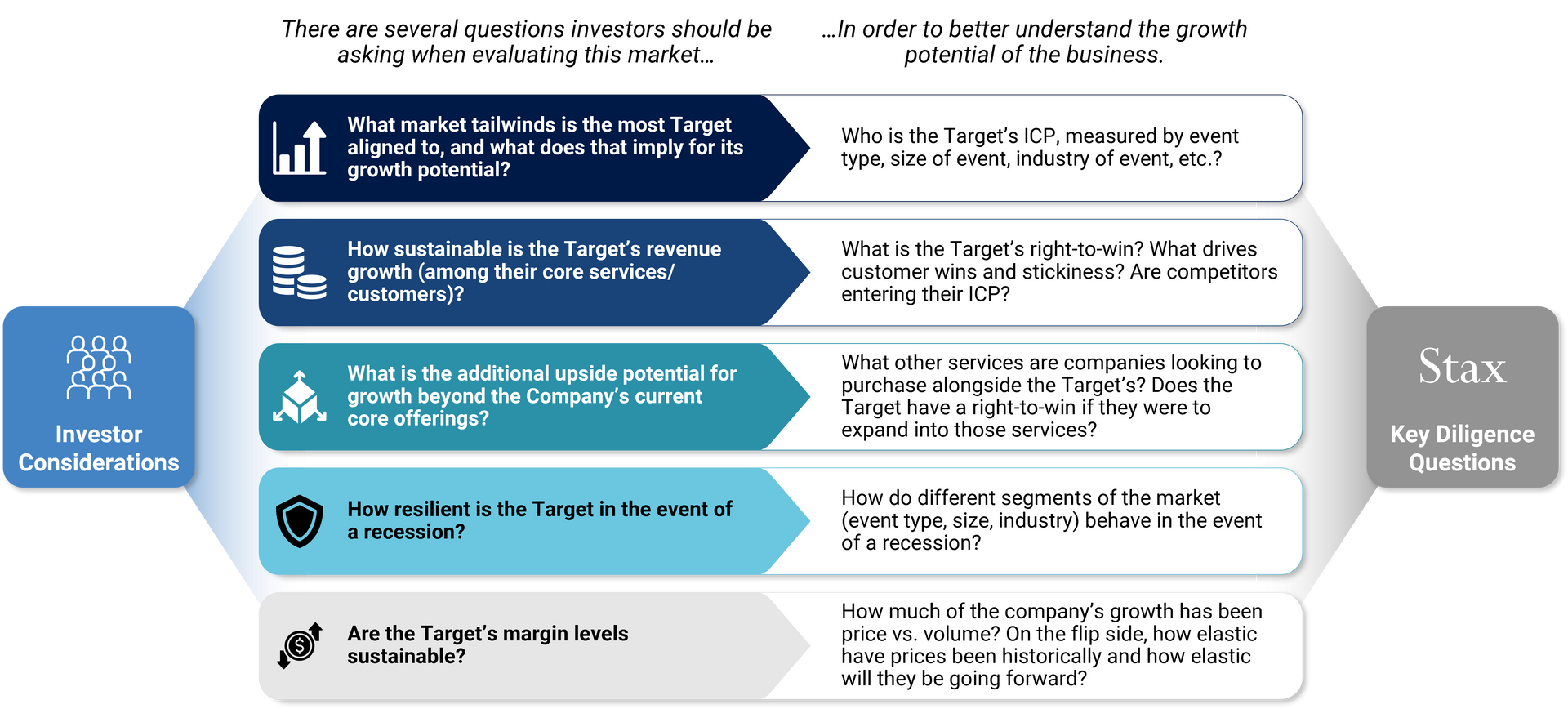

As investors consider entering the show services market, a few questions are critical to ensure the Company can grow at- or above-market rates.

Conclusion

Having supported numerous event service providers spanning the value chain for buy-side, sell-side/exit planning, and strategy engagements, Stax has extensive experience supporting diligence and strategy engagements in the exhibitions and live events industry, including the leading GSCs and agencies. To learn more about Stax visit www.stax.com or click here to contact us directly.