Share

Key Findings

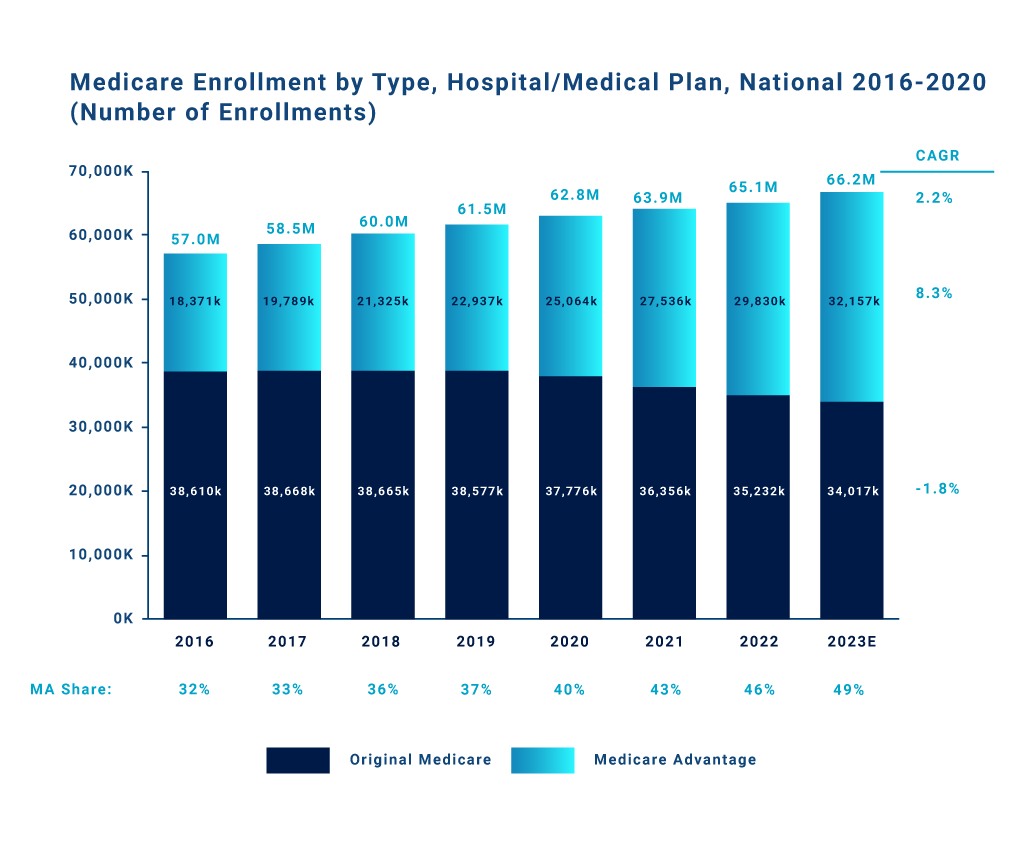

- Medicare Advantage has been steadily gaining share of enrollments among the rising Medicare-eligible population (versus traditional Medicare).

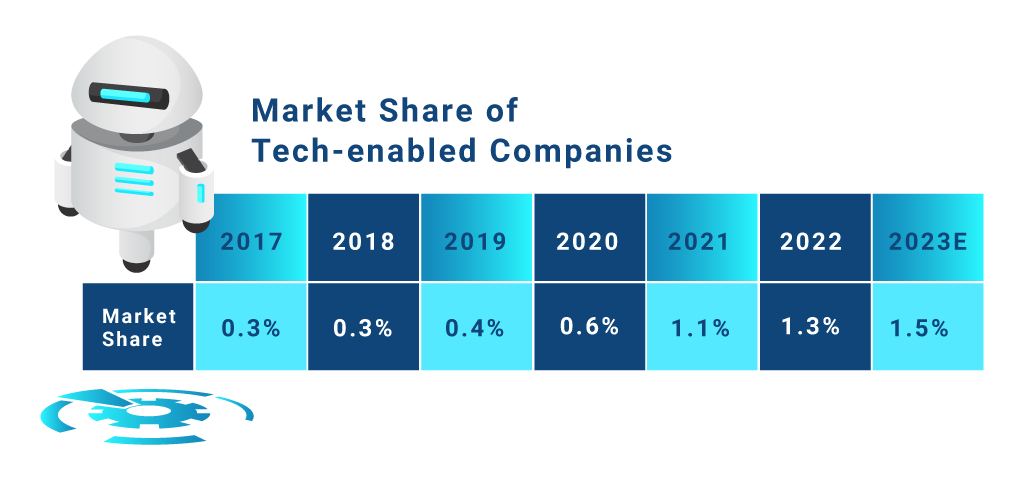

- While tech-enabled insurers within Medicare Advantage have seen rapid growth in the past few years, they’ve only scratched the surface in terms of market share (with only ~1.5% of current Medicare Advantage enrollments).

- Stax expects these players to continue to see rapid growth in the coming years, given their value proposition of enhanced agility, improved member experiences, and lower thresholds for value-based care (VBC) / risk-sharing agreements.

- Incumbents and other Medicare Advantage insurers are actively seeking ways to add/incorporate technology solutions to their offerings to stay competitive and better align to demand preferences.

Increasing Enrollment in Medicare Advantage

The Medicare-eligible population is increasingly enrolling in Medicare Advantage for the combination of richer benefits (e.g., dental, vision, hearing), lower member costs, and more inclusive plans. Government-funded incentives, such as bonus payments for high-star rating plans, also continue to promote Medicare Advantage.

The graph below illustrates the gradual but substantial shift to Medicare Advantage over the past several years. Given the steady progression of enrollment rates, alongside the aforementioned factors, we expect this trend to continue for the foreseeable future.

Advantages of Tech-Enabled Payors

Among Medicare Advantage plans, tech-enabled insurers have been gaining traction, and increased their market share by more than 2x over the past 3 years.

From Stax’s perspective, tech-enabled payors have some key advantages—such as customer experience, value-based care, and organizational agility—likely to continue driving their growth:

- Emerging tech-enabled players can give their customer service representatives more autonomy over resolving issues with a customer due to their smaller, leaner nature. Further, tech platforms can enable instant visibility to all customer reps. In addition, customer service reps can seamlessly collaborate across departments to resolve a variety of issues.

- Tech-enabled players have an inherently stronger value proposition for risk-sharing agreements, like VBC, compared to incumbents who require a minimum threshold. Startups pitch lower thresholds necessary for value-based care in order to get in the door with providers, offering a higher fee schedule with less patients.

Conclusion

Stax adapts to changing trends every day to provide our clients with current and actionable insights that aid in value creation. To learn more about Stax, visit www.stax.com or contact us here.