Share

Overview

Healthcare delivery is experiencing transformational change through population health management (PHM). It’s no secret that healthcare spending has grown exponentially, and spending is concentrated, as just 10% of patients account for 66% of healthcare costs. In an attempt to control costs, efforts are underway to identify and manage the most costly patients, and reimbursement arrangements are shifting from volume-based to value-based. These shifts are the underlying themes of PHM, and it’s changing how care is delivered, how providers are incented, and how results are measured.

Providers are aware of the concept of population health management, and many have strongly embraced it—including hundreds of major hospitals and health systems across the country which have formed accountable care organizations (ACOs) that typically involve some form of risk-sharing and/or shared-savings arrangements. Yet few are fully prepared to implement population health management. In general, while providers see PHM as the future, they currently lack essential tools and capabilities to prosper in this new environment due to the complexity and novelty of this approach to care delivery.

To assist providers in implementing population health management, an entirely new ecosystem of solution providers is rapidly developing, with emerging companies in areas such as population analytics, provider risk contract management, quality measurement, and patient engagement. To support population health management, we see significant and sustained growth in multiple segments.

This report highlights changes in healthcare delivery taking place, new opportunities that are emerging, and specific segments where growth and consolidation are likely in coming years.

Introduction to Population Health Management

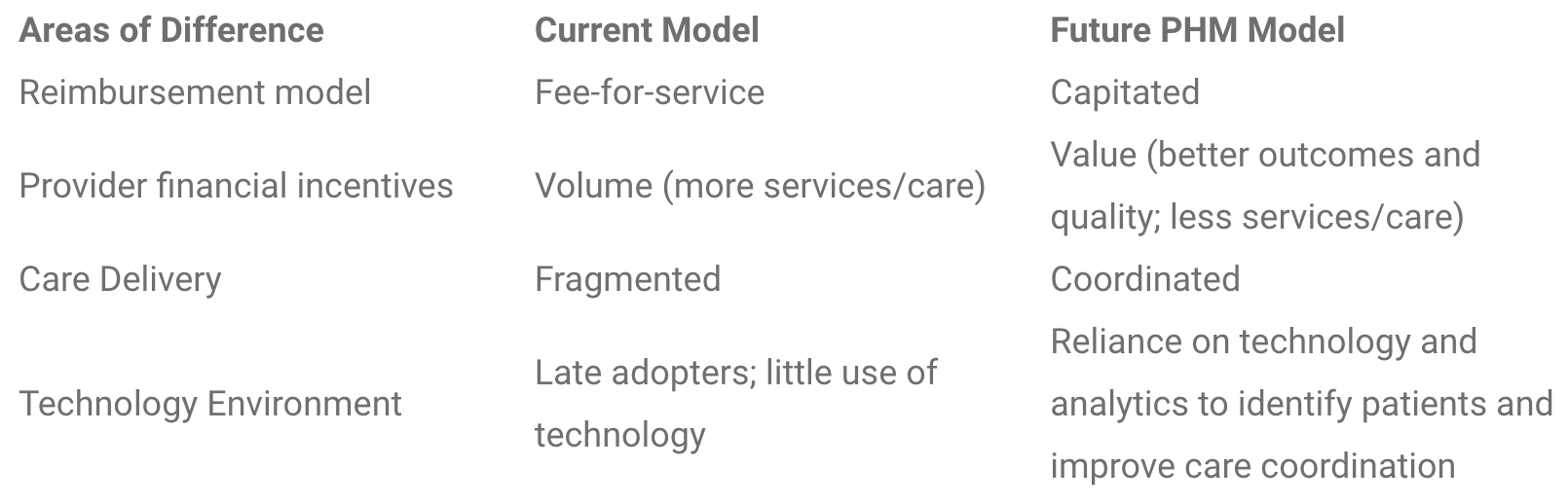

Physicians and hospitals are aligning to improve the overall health of populations rather than focusing on individual patients. The emphasis is on better medical outcomes and reduction in costs across the care continuum. Instead of providing more services to earn more through the traditional fee-for-service reimbursement model, providers will be rewarded for quality and cost efficiency, through value-based reimbursement models like capitation, global payment, bundled payment, and shared savings. This evolution is underway, further accelerated by the Affordable Care Act.

Improving the health of populations calls for population health management—a new care model that aims to keep communities of patients healthier through collaboration among providers, reduction in expensive interventions, tests, and hospitalizations, and more active involvement of patients in their own wellness. The PHM approach to care aims to reduce cost of care for the entire population, and ultimately encourage preventative health and optimal clinical outcomes. The concept of “PHM” has been increasingly discussed and implemented over the last several years. Stax defines "Population Health Management" as:

"A shared-accountability arrangement between healthcare delivery systems wherein providers have financial incentive to manage, measure, and optimize medical outcomes for a designated population at the lowest necessary cost."

It is well established that a small percentage of the population incurs the bulk of healthcare costs. The U.S. Agency for Healthcare and Research Quality (AHRQ) reported that in 2010 the costliest 10% of the population accounted for 66% of all healthcare expenditures. Population health is an approach that will enable providers to:

- Identify the riskiest patients

- Control costs through proactive intervention to keep those patients out of expensive emergency care and inpatient settings

Compensation for providers will no longer be based on each incremental patient service, but rather it will be determined by the clinical outcomes of a defined population. This is generally referred to as the shift from volume-based “fee-for-service” to “value-based” reimbursement. In a "capitated" payment model, a defined lump sum is paid from payer to provider to cover a defined set of healthcare services within a defined population. This is typically a "per member per month" payment.

Growth of ACOs

The transition to value-based payment models and the shift of risk from payers to providers has only recently begun to accelerate but is quickly gaining momentum. According to a 2014 research study across 350 healthcare provider organizations and 114 payers, 81% of providers and 90% of payers are already using some mix of value-based reimbursement combined with fee-for-service. The shift of risk is further evidenced by rapid growth in accountable care organizations (ACOs).

From early 2012 to Q3 of 2013, the number of ACOs in the U.S. grew from about 100 to nearly 490. As of late 2013, there were approximately 600 ACOs, covering about 18 million patient lives. Based on our forecasting model, Stax expects the number of ACO covered lives to grow to more than 95 million over the next five years.

Capabilities for Population Health Management

Population health management puts considerable pressure on providers to change the way they work together.

The complex coordination between providers, patients, payers, and employers—and the critical need for data accessibility and analytics—poses a host of challenges and concerns. Most providers need to add capabilities and are looking at significant investment in order to successfully implement population health.

PHM requires infrastructure and advanced IT systems that were not available 20 years ago. When the concept of capitated payments was introduced in the mid-1990s, capitation efforts were not as successful as intended, largely due to unpreparedness and lack of necessary data and technology required to make the model work. Whereas capitation in the past entailed essentially no more than a contractual agreement, today’s population health management requires fundamental reengineering of the care delivery model. Proactive interventions, care coordination, and patient engagement fueled by data will serve as the foundation of this redesign.

Today, healthcare delivery systems have access to better technology, “big data,” and advanced analytics that enable providers to strategically coordinate and provide the right care, at the right time, to reduce costs.

PHM Stimulates a New Space for Investment

Rapid growth in an ecosystem of PHM solutions is occurring as a result of the growth in capabilities necessary for health systems to practice PHM.

The ability to effectively identify and manage risk requires large-scale pooling and leveraging of electronic health records, insurance claims, and other clinical health-related data. Demand for non-traditional means of providing care will continue to rise (for example, wellness coaching, virtual care, and patient-centered medical homes). Further, advanced analytics capabilities are necessary for providers to mitigate risk, gauge improvements in patient care, and measure financial outcomes.

Stax believes the accelerating growth of ACOs and the overall trend towards population health management will create significant opportunity for population health support solutions, advisory services, and healthcare IT vendors.

The market for PHM solutions today is highly fragmented. While there are a number of players in the space, many offer solutions tailored to health plans, as payers have traditionally been the bearers of risk, or niche point solutions for providers. We believe there will be a significant increase in demand for PHM solutions among providers and employers, in addition to payers.

The Challenges

Providers are seeking a better understanding of the strategic, tactical, and financial implications of population health management. Based on extensive interviews with C-level and other senior executives within numerous hospitals, healthcare systems, and ACOs nationwide, Stax has identified the top concerns and challenges providers face when implementing (or thinking about implementing) population health management. These issues are common among the majority of providers:

- General lack of understanding of where and how to begin. Many hospital administrators have deep expertise in patient care but limited knowledge of how to transition from volume-based to value-based care delivery. Providers lack experience caring for populations, let alone managing the risk associated with value-based reimbursements.

- Lack of internal resources to execute such a major transition. Hospitals lack the necessary human capital, care management staff, and technology infrastructure. Also, providers lack the budget for PHM, particularly given recent investments in EHR implementation and ICD-10 conversion.

- Difficulty aggregating, extracting, reporting, and analyzing data. The fee-for-service reimbursement model does not call for providers to execute perpetual data analysis at the individual patient and population level. Hospitals lack the infrastructure and human capital to house and extract value from their data; they do not have the tools necessary to operationalize insights and to make data available in clinicians’ daily workflow.

- Inadequacy of electronic health records (EHRs). Most EHRs are not designed for PHM or for interoperability with other systems. EHRs often do not contain much information about the care that patients have received outside of a given provider organization. As a result, providers are faced with a challenge of gathering patient-centered data from multiple sources.

- Issues administering comprehensive, integrated care plans. With many patients having multiple providers—including primary care, specialty care, hospitals, and post-acute care settings—health systems face challenges in coordinating care: strategically, how to ensure all doctors and caregivers agree on the patient’s care plan; and tactically, how to communicate efficiently and share patient medical records.

- Lack of tools to engage patients. There is a lack of adequate resources and technology to effectively and efficiently engage patients in monitoring their own health conditions. Meaningful Use 3 mandates that patients have access to self-management tools (i.e. patient portals); however, the current offerings are not advanced or aggressive enough to stage proactive interventions, requiring more advanced patient engagement solutions.

- Inability to track cost savings. Hospital executives want to understand the expected ROI before investing in PHM, but struggle to see how they prove that the cost savings outweighs the investment.

- Confusion and apprehension when selecting PHM vendors. Many vendors in this space are relatively new or established vendors launching new products to meet demand for PHM support services. There are no “known commodities,” no dominant players, so it is difficult for providers to feel confident in vendor selection.

PHM Solutions

Solutions have been and are being developed to help providers engage in PHM and overcome the various challenges faced. These solutions range from risk analytics to wellness coaching to strategic advisory services. Stax segments the PHM solutions space into eight distinct but connected categories:

- Data Warehousing & Infrastructure

- Population Analytics

- System Performance Analytics & Management

- Care Coordination & Delivery

- Cost Analytics & Financial Support

- Provider Risk Contract Management

- Quality Measurement, Compliance, & Reporting

- Patient Engagement & Outreach

The market for PHM solutions is substantial and growing quickly, with an influx of new entrants. The following are snapshots of PHM capabilities required. Within each segment there is growing demand for third-party solutions and services:

Data Warehousing & Infrastructure

For the accountable care movement to succeed where HMOs failed, data integration and improved IT capabilities are vital. Population health management support relies on the ability to establish a data warehousing framework—analytic tools cannot function without it. Infrastructure that aggregates data from disparate systems in a digestible fashion is vital to PHM’s success.

Population Analytics

A bulk of healthcare spend is driven by a small portion of the population. To reduce healthcare spend, providers must be able to identify at-risk populations to provide proactive care, especially as providers accept more financial risk. Due to lack of experience in this area, providers need assistance with analytical tools and capabilities that will enable them to identify risky populations. This requires tools that stratify risky populations and provides predictive analytics, with the ultimate goal of cost reduction.

System Performance Analytics

Population health initiatives require that providers work together in creating a care network. To establish best practices and benchmark performance, it is important to monitor the organization at both an individual and system level. Providers need assistance and tools to manage their care networks, including utilization metrics, referral management, and efficiency benchmarking.

Care Coordination & Delivery

Care coordination is the necessary foundation for population health management. Providers need to collaborate across the care continuum as their bottom line depends on it. That is because payments will become performance-driven, based on reducing costs and improving care quality. This is not an easy task—the alignment of providers requires efficient information sharing. Tools that assist care delivery collaboration, improve workflow, and provide efficient information sharing are vital to population health management.

Cost Analytics & Financial Support

Cost reduction is essential for all healthcare systems and organizations. Healthcare providers must now think in terms of value-based payments rather than the traditional fee-for-service model. Tracking the cost of care delivery is now necessary to negotiate risk contracts. Additionally, systems need tools and support solutions to monitor costs and distribute bundled payments across systems or organizations.

Provider Risk Contract Management

Providers will continue to accept more financial risk in the future, complicating contractual agreements. Due to a lack of experience entering into risk-based contracts, providers need assistance negotiating and monitoring contracts with payers. These solutions include cost tracking, contract reconciliation, and contract negotiation tools.

Quality Measurement, Compliance & Reporting

Participation in ACO programs commonly requires providers to meet and report various quality metrics to receive savings Measurement input and reporting can be a cumbersome process, demanding integration of data from across the care continuum. Solutions that integrate the reporting process into the care workflow and automate reporting will assist compliance and ensure providers are compensated.

Patient Engagement & Outreach

To improve population health, patients need to accept increasing responsibility for their wellness. This requires a partnership between providers and patients, where providers encourage patients to take an active role in their health through education, engagement, and outreach tools. By accomplishing this, providers aim to keep populations healthier, reduce readmissions, and improve outcomes. Patient engagement solutions support these efforts, offering the means for providers to connect with patients on an ongoing basis. Providers can leverage a range of tools to support patient engagement including automated high-risk interventions and patient portals that facilitate educational and administrative functions.

Stax’s Perspective on the PHM Landscape

The market for PHM support solutions and services is highly fragmented. Players in this space range from industry giants, such as McKesson and Cerner, to smaller businesses offering niche PHM solutions. A wide range of capabilities and multiple applications is required to support PHM; a comprehensive solution would bridge across each of the eight PHM segments.

While a number of vendors offer specialized components, there is currently no single vendor with a complete PHM offering, and the landscape continues to change with new segments constantly emerging. While EHR systems are a good first step, most are not designed for PHM or for interoperability with other systems. More specialized vendors are developing innovative applications that will be needed for the success of PHM—examples of specialized vendor product offerings include advanced population analytics, risk stratification, actionable reporting, predictive modeling, patient engagement services, patient education, automated alerts, and quality improvement advisory services.

Stax has identified a number of specialized PHM vendors—offering technology, analytics, and consultative services—that are well-positioned to grow in this space. Vendors currently in the market with PHM offerings come from a variety of backgrounds, such as HIE, RCM, EHR, clinical point solutions, and claims-centric solutions. This market is in its early stages, and Stax expects the market will grow significantly over the next few years.

Demand for PHM solutions will grow as population health covered lives increase. Providers express desire for a “bundled” PHM solution—but healthcare executives planning to implement PHM solutions realize that in today’s market a comprehensive PHM solution would be extremely expensive and they may need to work with multiple vendors for specific capabilities (e.g., one vendor for risk analytics, a different vendor for patient outreach, a different vendor for data warehousing, etc.). Stax expects over time that the players in the market will consolidate to some extent such that individual vendors will eventually offer more complete PHM solutions—much like we have seen over the last decade in the RCM (revenue cycle management) space.

Key Takeaways and Implications

- While the concept of value-based payments is not new, population health management is still in its infancy for the vast majority of providers.

- This is not a passing fad considering extreme cost pressure, efforts by payers to shift financial risk, and ACA regulations. We expect significant growth over the next five years in population health management, in ACOs—and in technologies, solutions, and services for payers and providers of population health.

- The changing reimbursement models are prompting change in payer/provider relationships. To some extent, in the coming years, providers and payers may be competing with one another.

- The complexities of transitioning to population health management call for third-party experts and support solutions to facilitate change—from both a strategic and operational perspective. This translates to significant growth opportunities for vendors of PHM support solutions.

- We see the adoption of various PHM solutions as a progression over the next 1-5 years:

- Starting with investment in the most critical foundational components—i.e., data warehousing and data integration.

- Once IT infrastructure and data accessibility are in place (which have already seen significant progress in recent years, thanks to EHR meaningful use incentives), investment will likely be allocated to population analytics and care coordination solutions.

- As providers start to increasingly enter contractual risk-bearing agreements with payers, there will be increased adoption of solutions to help with risk contract management, system performance, and cost analytics.

Conclusion

The healthcare landscape is rapidly changing, with providers seeing the need to engage in population health management. However, while providers see this need and the opportunity that population health management provides, most lack the necessary capabilities and will need to build, outsource, or acquire these capabilities. This reality is spawning creation of an ecosystem of PHM solution providers that is poised for robust growth over the next five years.