Share

Live entertainment giant Live Nation-Ticketmaster has been the subject of extensive media coverage of late, driven by the U.S. Justice Department opening an antitrust lawsuit against the globally leading promoter, operator, and ticketing provider of concerts and other consumer entertainment events.

Following Live Nation’s 2010 acquisition of Ticketmaster, the vertically integrated player has gone from strength to strength, consolidating its presence in the U.S. and globally. Today, it owns or operates 60 of the top 100 amphitheatres / concert venues in the U.S.

In this article, we analyse the recent scrutiny faced by Live Nation and explore whether these issues could have been anticipated over the past decade through an environmental, social, and governance (ESG) assessment preceding the current government investigation.

Why is Live Nation Being Sued?

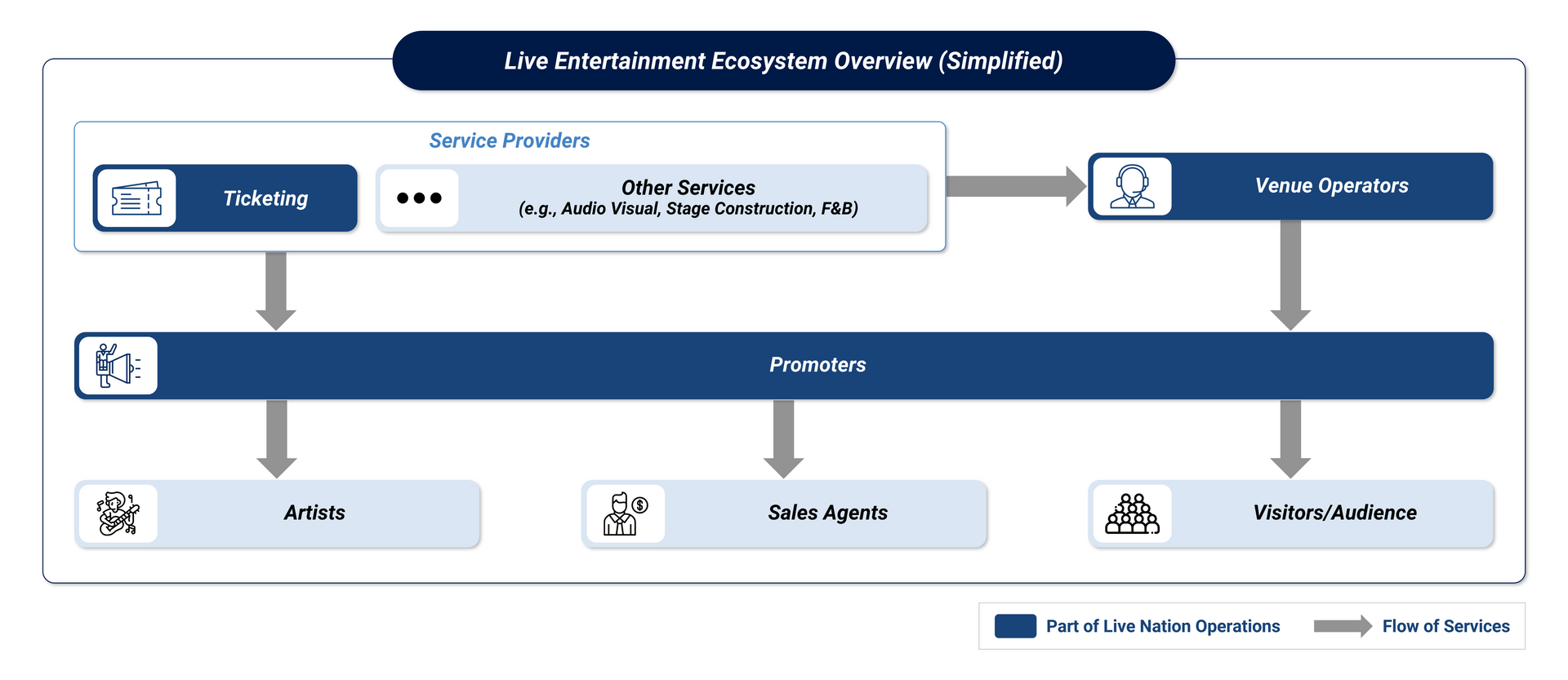

Over time, through both organic and inorganic routes, Live Nation has established market-leading positions in three key stages of the live entertainment value chain: event promotion, venue operations, and ticketing services. As event promoters, they are central to the live entertainment ecosystem by owning the brand IP behind events such as recurring music festivals and concert tours. They coordinate interactions among various stakeholders, including service providers, venue operators, artists, performers, and audiences, who ultimately generate the revenue.

Vertical integration between promoters and venue operators is common in the events industry, particularly in segments like exhibitions and conferences where it is often the prevalent model.

This integration offers natural synergies, such as prioritized date selection and reduced risks when launching new events. Despite these advantages, the large number of event venues, especially in major markets like the U.S., has traditionally fostered a highly competitive landscape. With a wide selection of suitable venues available for any given event, other promoters can typically operate without significant constraints from venue ownership. However, what distinguishes Live Nation is its substantial market share in both event promotion and venue operations, which raises concerns about the potential for anti-competitive practices.

Following its acquisition of Ticketmaster in 2010, Live Nation has significantly expanded its presence in the ticketing services sector of the ecosystem. Margins for ticketing services are substantially higher than those for event organizers. For instance, in 2023, Live Nation reported a 2% operating profit margin in its concerts division compared to 38% for ticketing. The ticketing business is characterized by high fixed costs, making scale a critical factor for increasing margins. According to the DOJ, Ticketmaster controls nearly 80% of the U.S. live concert market, granting it significant pricing power over competing promoters and creating an unfair advantage for its own concerts.

Given that much of Live Nation-Ticketmaster’s market consolidation occurred after the merger, determining whether antitrust rules have been violated will require examining internal business practices. Nonetheless, reputational risks have already materialized, leading to negative business outcomes, such as artists withdrawing from performances. Over time, this may impact audience retention. The Live Nation case highlights how ESG risks can translate into significant commercial impacts, emphasizing the importance of both identifying and addressing such risks proactively.

Could Live Nation's Current Risks Have Been Foreseen?

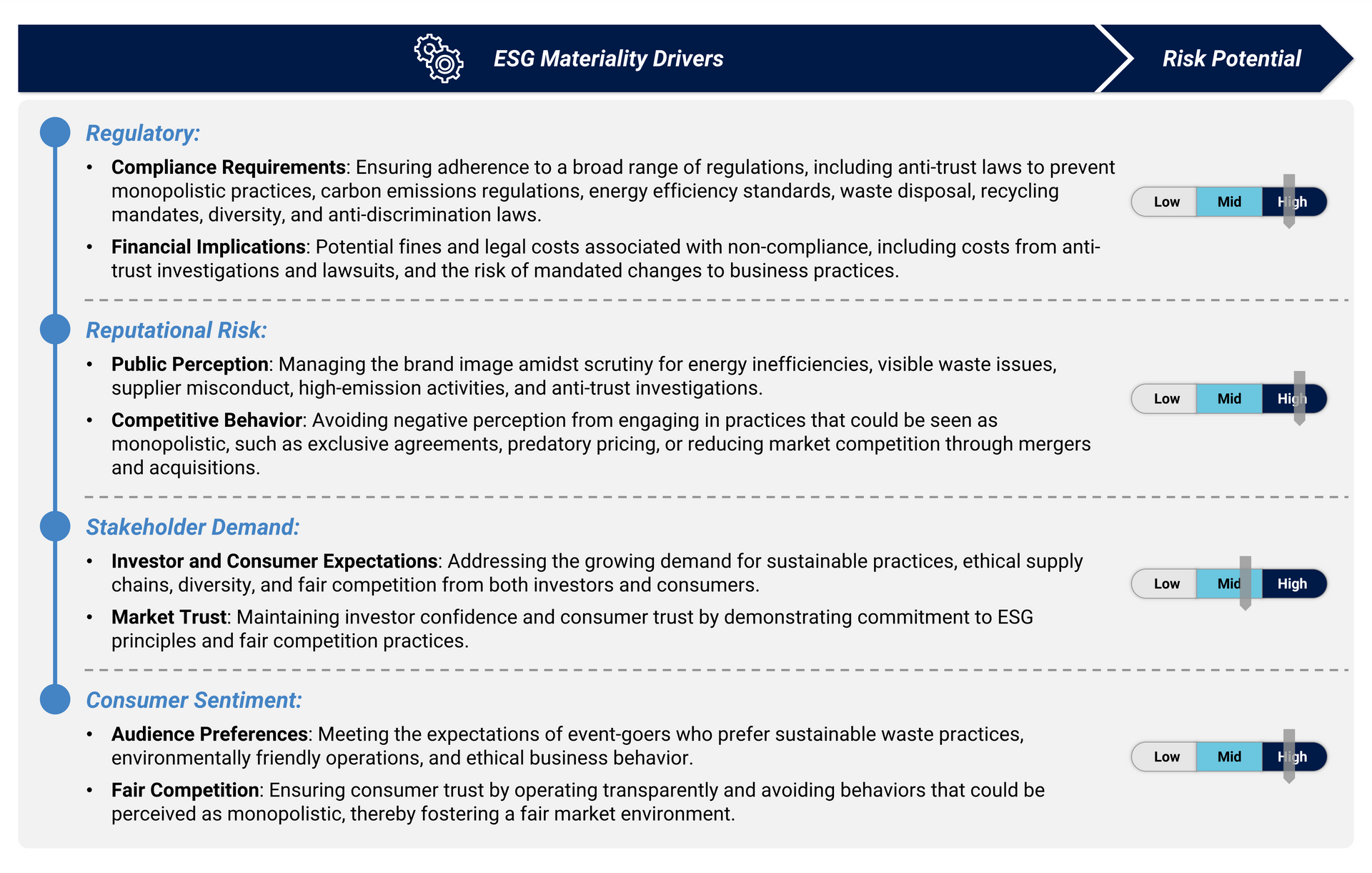

The scrutiny and subsequent antitrust lawsuit faced by Live Nation could indeed have been anticipated through a thorough ESG assessment. Stax's AI-enhanced ESG diagnostic tool identified four primary ESG materiality drivers that highlight the risks for Live Nation: regulatory, reputational risk, stakeholder demand, and consumer sentiment.

Regulatory Risks: Compliance with a broad range of regulations, including antitrust laws, was flagged as a significant risk. The U.S. Justice Department's lawsuit exemplifies how non-compliance can lead to substantial legal and financial repercussions.

Reputational Risks: Managing public perception, especially regarding energy inefficiencies and high-emission activities, was crucial. The negative media coverage surrounding Live Nation's market practices has damaged their brand image, leading to artists withdrawing from performances and potential long-term audience loss.

Stakeholder Demands: Investors and consumers increasingly demand sustainable practices and fair competition. Live Nation's market dominance and potential anti-competitive behavior have led to legal scrutiny and diminished stakeholder trust, demonstrating the importance of aligning business practices with these evolving expectations.

Consumer Sentiment: Meeting audience expectations for sustainable waste practices and ethical behaviour is vital. Concerns about fair competition and transparency have materialized, impacting consumer trust, and highlighting the need for fair market practices.

Conclusion

In conclusion, the risks Live Nation currently faces underscore the critical importance of comprehensive ESG due diligence before investment. Moreover, ongoing monitoring and reporting of ESG factors are essential to adapt to evolving risks and maintain sustainable business practices. The Live Nation case highlights how proactive ESG assessments and continuous oversight can protect against significant commercial impacts and help ensure long-term business viability. To learn more, reach out to Anuj A. Shah or Nikki Shah.