Share

Neobanks, also known as "challenger banks," are fintech firms shaking up the banking landscape. They provide a range of banking services with a focus on digital technology and operate exclusively online. Unlike traditional banks, neobanks don't have physical branches, which reduces overhead significantly. They attract a tech-savvy younger demographic, particularly those who haven't been well-served by traditional banks in the past.

Market Size, Outlook, and User Count

Statista estimates that the global transaction value of neobanking was $3.34T in 2022 and is expected to grow at a CAGR of 18.16% from 2023 to 2027. The U.S. accounts for a large proportion of this transaction value, with transactions in 2022 of $1.08T and an expected CAGR of 16.12% from 2023-2027.

The penetration rate of neobanking globally was estimated at 2.5% (188.4M users) in 2022 and is expected to grow to 4.7% (376.9M) by 2027. In the U.S. the penetration rate is substantially higher than the global average at 12.4% (41.14M users) in 2022 and is expected to reach 22.8% (78.37M users) by 2027.

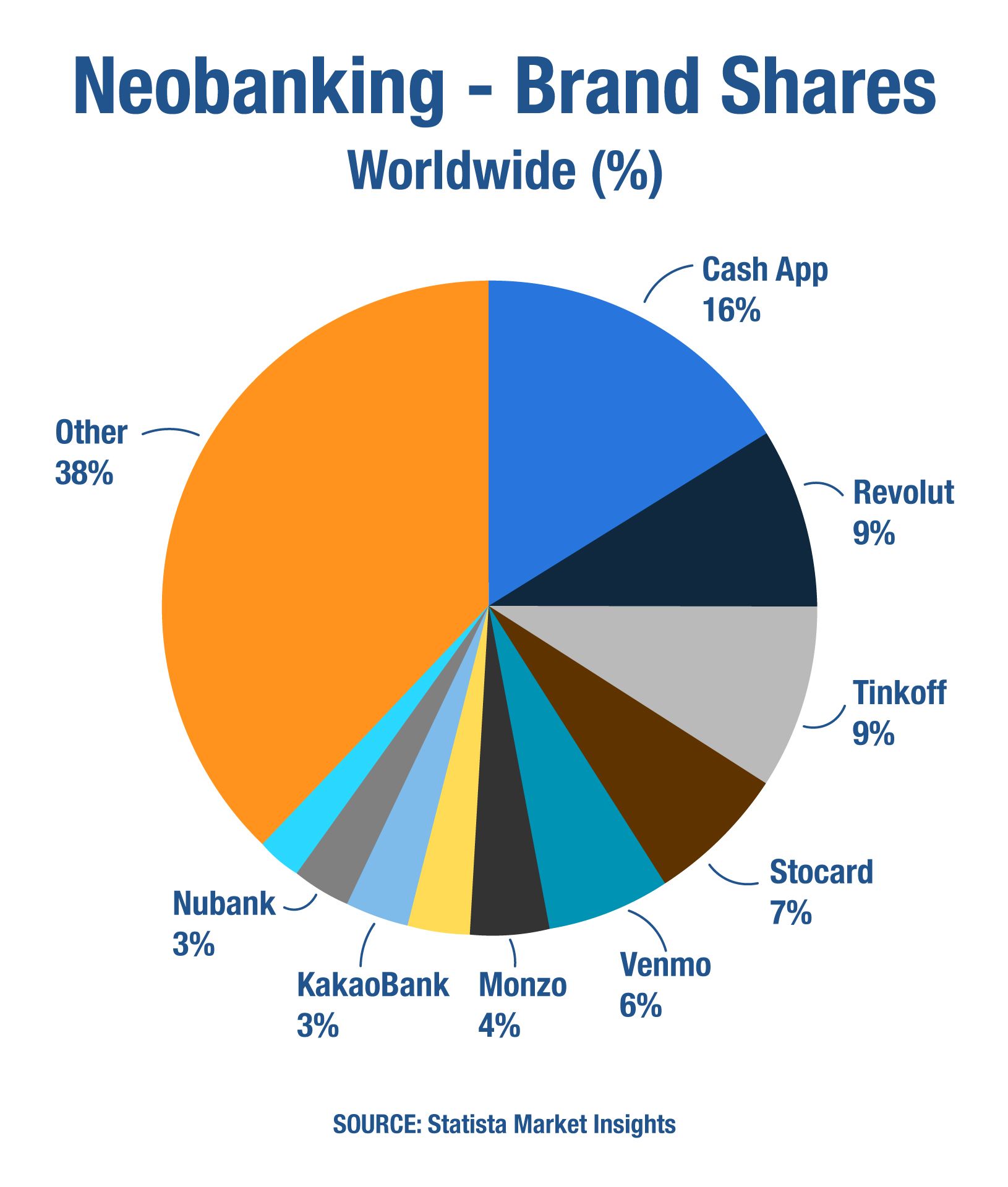

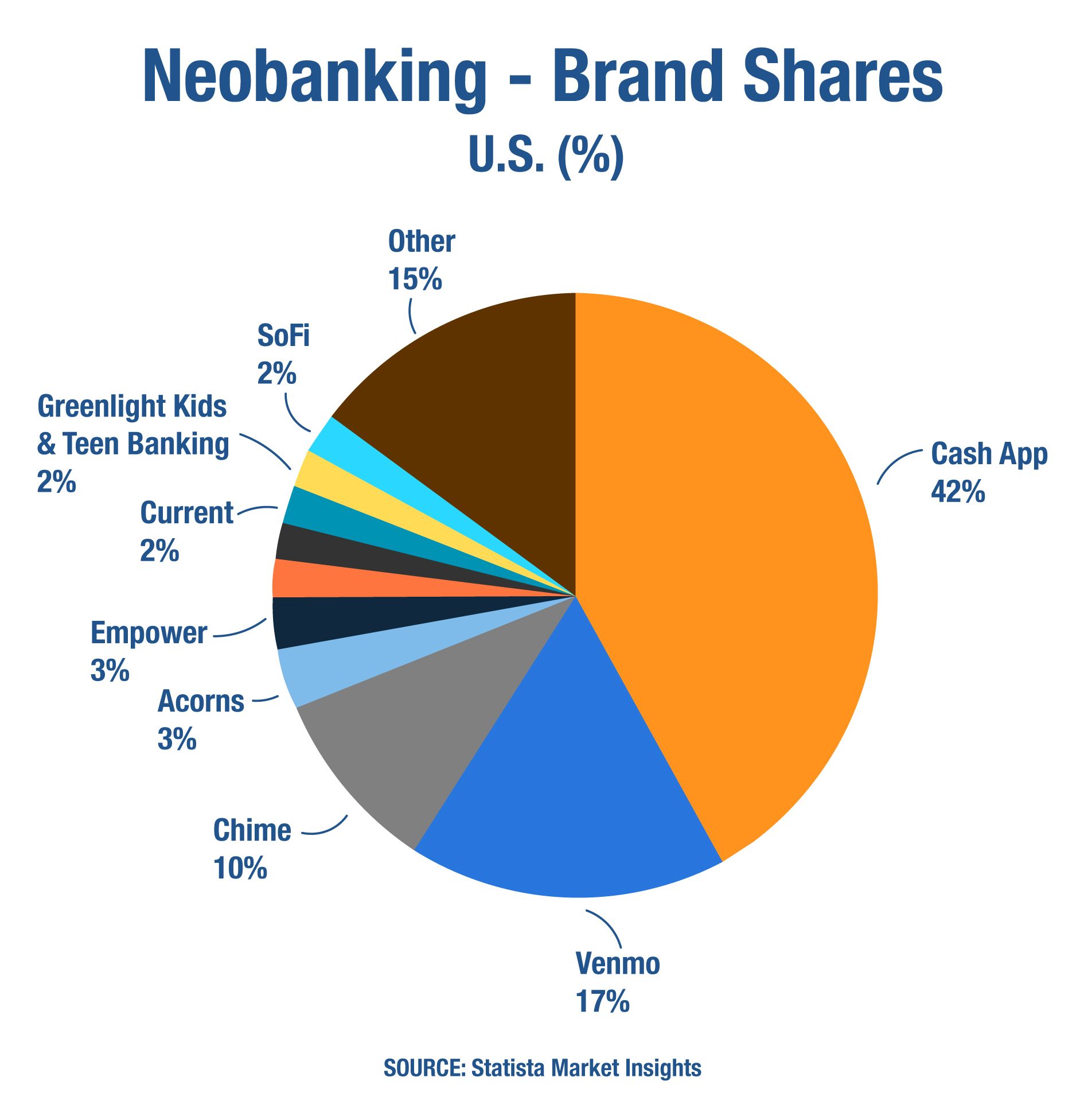

Market Share Estimates:

Trends & Drivers

Artificial Intelligence and Machine Learning

Neobanks are integrating AI and machine learning to offer personalized banking insights. AI algorithms analyze customer spending, creating tailored budget plans for improved money management. This approach focuses on maximizing customer value through spending data while reshaping consumer perceptions and fostering a more positive view of neobanks compared to traditional banking.

Cryptocurrencies and Blockchain Technology

Certain neobanks are embracing cryptocurrencies and blockchain tech. For instance, Revolut enables users to trade and send crypto via their app without additional charges. As the crypto market expands, more neobanks are likely to pursue similar capabilities, signaling a growing trend in the integration of cryptocurrency features.

Digital Wallets and Payments

With digital wallets, customers can store their payment information securely and use it to make transactions with just a few clicks. Peer-to-peer payments allow users to transfer funds instantly to friends and family members, even if they don't have an account with the same bank.

Frequent travelers benefit from cost-effective international money transfers with favorable exchange rates, offering convenience and savings when using neobank cards abroad, eliminating the need for large cash amounts.

Open Banking and API Integrations

Thanks to open banking and user-friendly API connections, neobanks can enhance their apps with additional features without inconveniencing users. Neobanks leverage open banking to seamlessly integrate with financial services like investment apps and Buy Now Pay Later (BNPL). Through open banking, neobanks enable users to see all their bank accounts in one place, eliminating the need for direct customer authentication management and addressing compliance issues related to the Payment Services Directive (PSD2) and the General Data Protection Regulation (GDPR).

Instant Loans and Credit

Neobanks streamline the traditional process of securing loans with near-instant approval times, providing quick access to funds based on a customer’s spending data. This user-friendly approach encourages neobank card usage, benefiting both revenue and customer experience.

Large Neobanks Rival Traditional Counterparts' Scale

20 major neobanks have more than 10 million customers each, and 39 others have over 5 million customers—positioning several among the top 5 or 10 largest banks in their countries, challenging incumbent players.

M&A and Consolidation Trends

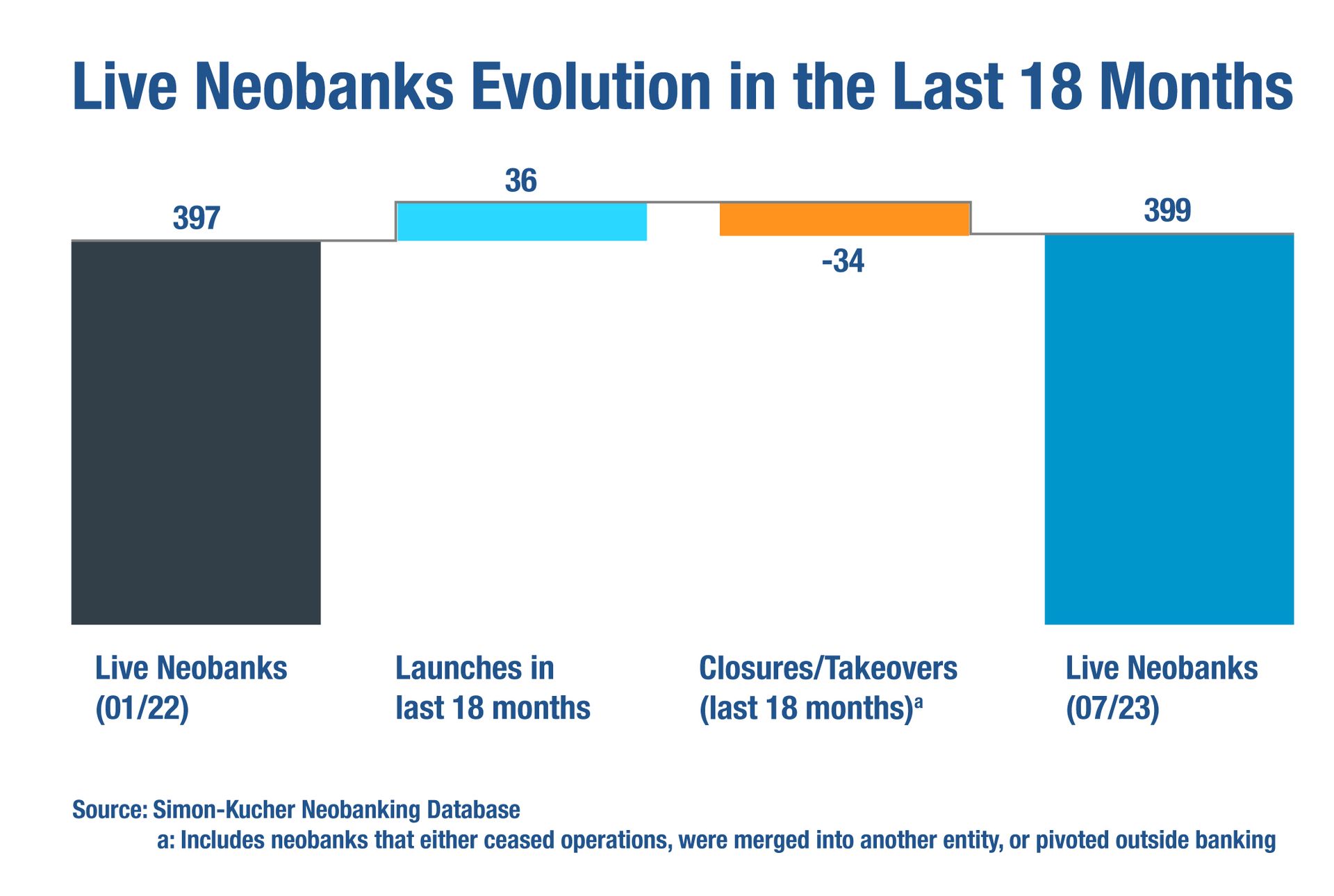

Closures and Takeovers

Despite the disruption of the banking landscape, consolidation is on the rise in the neobanking sector, with new launches nearly offset by closures and takeovers in the last 18 months. Funding challenges have led to closures globally, prompting new launches to seek backing from established financial groups. For instance, Volt Bank and Bank North faced shutdowns due to insufficient capital, illustrating the trend of existing financial groups supporting new ventures in 2023.

Deal Activity

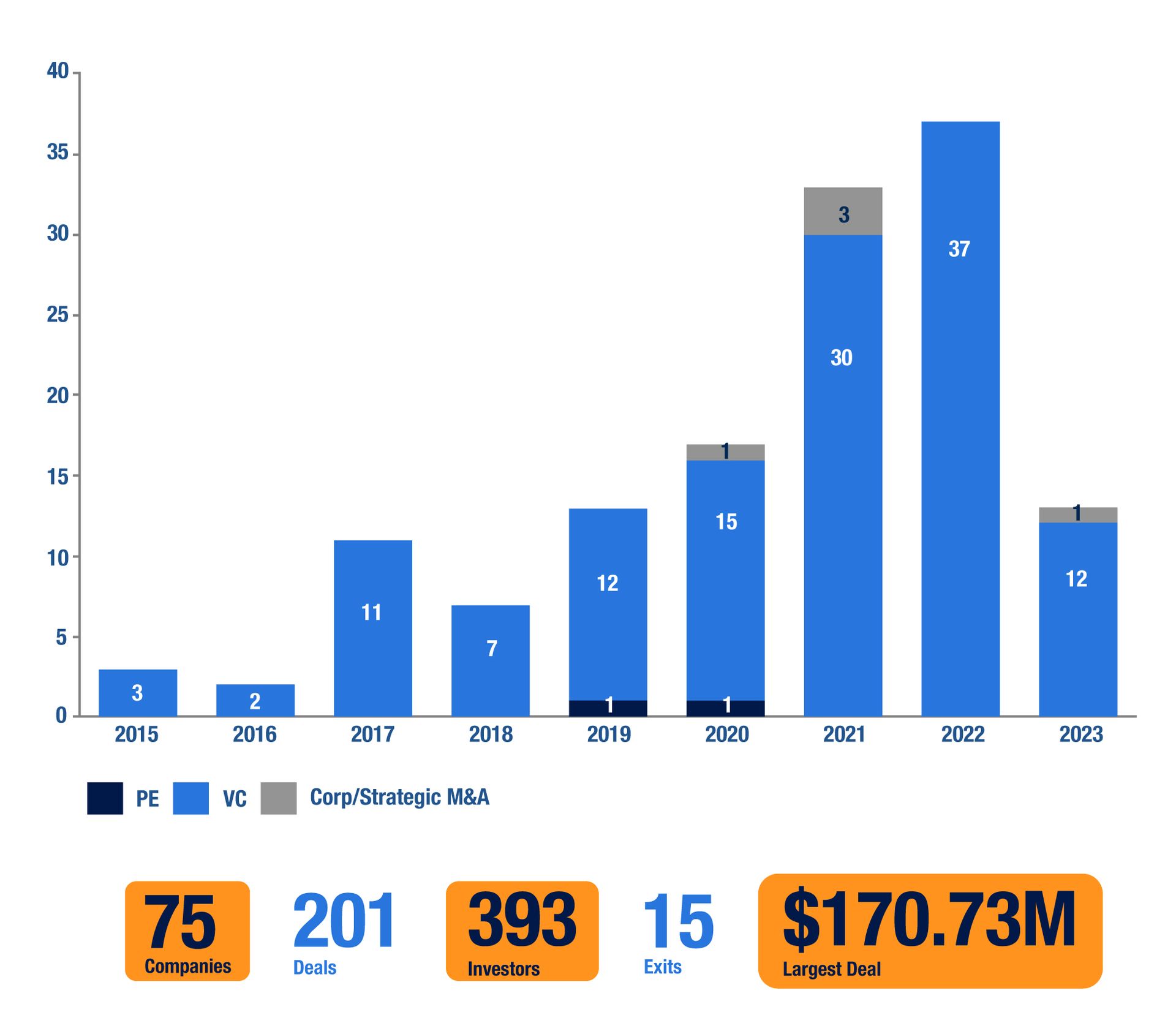

Deal activity in neobanking is heavily concentrated in venture capital, with the majority of all deals over the last few years being VC deals.

The landscape of digital banking is evolving with new features that surpass traditional offerings. Both traditional and non-banks recognize the potential of digital banking, leading to increased competition for independent digital banks to stay innovative in the years to come. However, focus on profitability and diverse revenue streams is crucial.

Stax has deep expertise within the digital banking industry, providing invaluable insights to both investors and businesses alike. Project-related experience includes comprehensive market analyses, identifying promising investment opportunities, and delivering data-driven insights. The firm serves a diverse range of investor interests, with a particular emphasis on upstream assets, including input suppliers and manufacturers.

With a comprehensive understanding of the digital banking ecosystem, Stax stands as the leading strategy consulting firm for comprehensive market outlooks and stability trends. Learn more about Stax and our expertise or click here to contact us directly.

Sources

- Grand View Research, “Neobanking Market Size, Share & Trends Analysis Report By Account Type (Business, Savings), By Application (Enterprises, Personal), By Region (Asia Pacific, Europe), And Segment Forecasts, 2023 – 2030,” Grand View Research, 2023.

- Spherical Insights. “Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032,” Spherical Insights, October 2023.

- Statista, “Neobanking – Worldwide,” Statista, 2023.

- Afshan Dadan and Kshitija Kaur, “2021 FinTech Roundup: Top 20 Independent Digital Banks,” Whitesight, December 2021.

- Anubhav Bhattacharjee, Violet Chung, Shwaitang Singh and Renny Thomas. “Building a winning AI neobank,” McKinsey & Company, November 2022.

- Leigh Carrington. “Staying Ahead of the Curve: The Latest Trends and Innovations in Neobanking,” Tillo, April 2023.

- Christoph Stegmeier, Madhavan Ramanujam and Jorge Alcala, “Neobanking report 2023,” Simon Kucher, November 2023.