Share

Paws for Thought: Identifying Disruptive Forces in the U.S Pet Industry

In a recent article, we discussed how the U.S. pet industry, comprising of related sub-industries, offers an array of products and services that cater to the various needs of pet owners. The pet industry in the U.S. is a dynamic and evolving market, driven by various trends and drivers. Some of the major trends and drivers which have significantly shaped the current landscape are highlighted below:

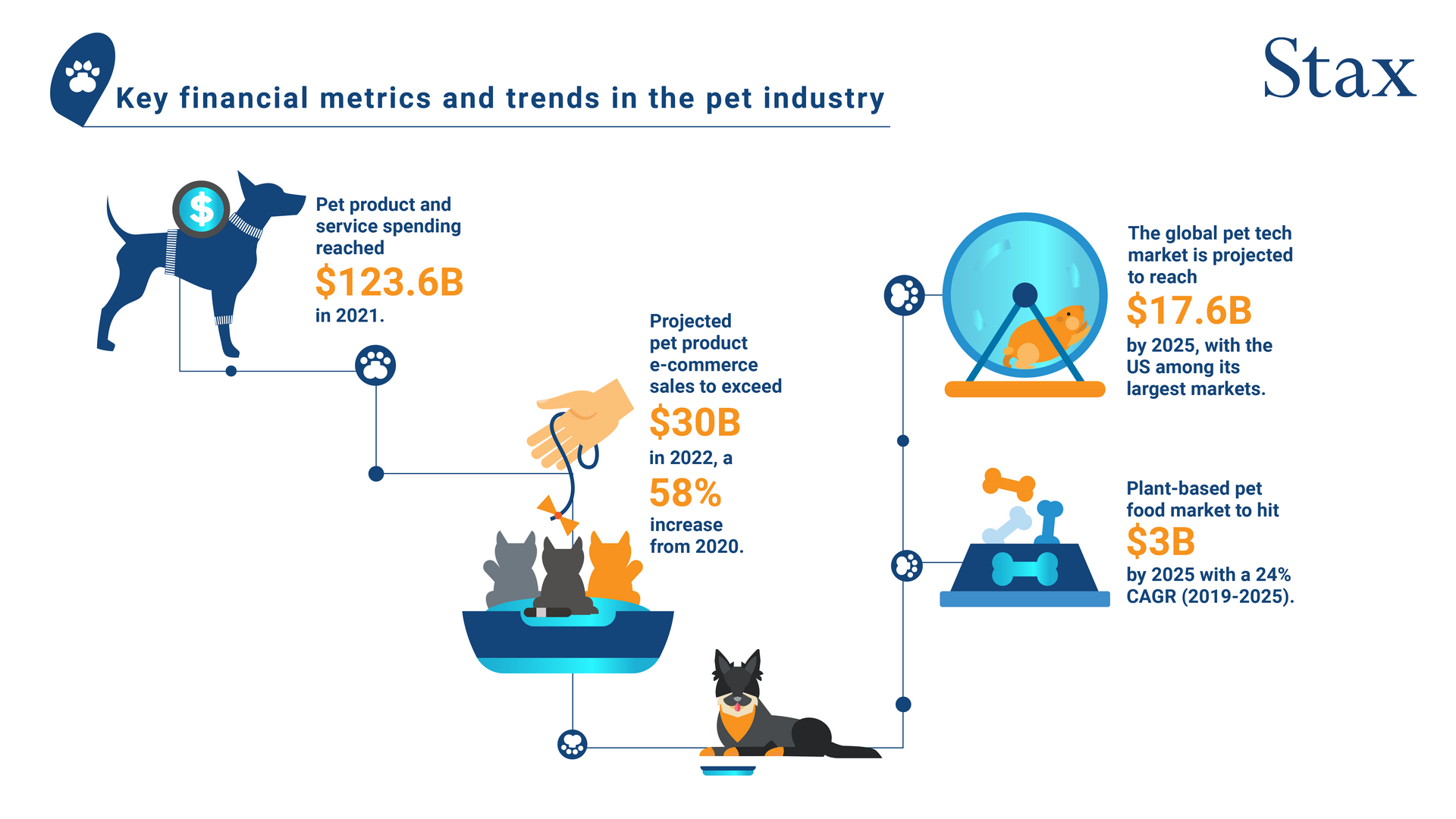

- Humanization of pets, where pet owners are treating pets like family members, has led to growth in demand for high-quality pet products and services— according to the American Pet Products Association, spending on pet products and services in 2021 has reached $123.6B.

- Growth in e-commerce is a major driver, with pet product e-commerce sales surpassing $30B in 2022— a 58% increase from 2020.

- Focus on pet health and wellness has driven spending on veterinary care— reaching $34.3B in 2021.

- Growth in pet technology, which includes smart collars, feeding devices, pet cameras, and mobile apps, has been driven by the need for pet owners wanting to monitor and interact with their pets constantly—the global pet technology market is expected to reach $17.6B by 2025, with the U.S being one of the biggest markets.

Clawing for Opportunities: Private Equity Firms Eyeing the U.S Pet Industry

While the pet industry has experienced significant growth in recent years, as new products and services have been rolled out to meet the evolving needs of pet owners, there still are potential disruptions that could significantly impact the market.

For example, the growth in alternative proteins, i.e., products made from plant-based proteins and cultured meat products, could potentially cause disruptions to the pet food industry. A recent report by Packaged Facts indicated that the plant-based pet food market is projected to reach $3B by 2025, reflecting a compound annual growth rate of 24% between 2019–2025. The report further indicated that few prominent pet food companies have already invested in alternative proteins, suggesting that this trend is likely to continue.

Ruffling the Fur: The Fallout of Short-Sighted Private Equity Moves in the U.S Pet Industry

Despite the potential disruptions in the pet industry, the market still has significant growth potential, which has attracted a considerable amount of Private Equity investment. Investments by Private Equity firms in a number of pet-related sub-segments have enabled businesses to scale up their operations, expand their product offerings, and strengthen their marketing strategies.

Here are a few examples of high-profile Private Equity investments in the pet industry:

- On February 20, 2023, it was announced that General Atlantic, a global growth equity firm, has invested in Village Pet Care, a new pet care services platform which owns and operates 17 pet care services centers across six states in the U.S., providing pet boarding, daycare, grooming, and training offerings. With the investment from General Atlantic, Village Pet Care intends to accelerate its growth through local and regional acquisitions of single and multi-unit providers, broaden service offerings, and enhance business operations, with a vision of building a trusted national platform catering to the unique needs of pets and their owners.

- In 2018, veterinary service provider PetVet Care Centers received a $700M investment from Private Equity firm KKR. This investment helped PetVet to expand its operations and advance its technology and marketing capabilities. According to a report by IBISWorld, PetVet's revenue reached $1.2B in 2020, representing a year-over-year growth of 9.1%.

Examining the Consequences of Irrational Decisions Made by Private Equity Firms in the U.S Pet Industry

Despite significant Private Equity investment in the pet industry, not all investments have been successful. Some have failed and can be attributed to the lack of proper due diligence, insufficient use of data analytics, and absence of crucial assessments that are typical in today's business environment.

Conducting proper due diligence before making investment decisions, especially in a dynamic and evolving industry such as the pet sector, is critical to an investments success. Considering the high degree of competition and rapid technological advancements, it is vital for Private Equity firms to carefully evaluate potential investments and mitigate any risks to maximize their returns.

Sources

- Village Pet Care Launches Boarding, Daycare, Grooming Platform with Strategic Growth Investment from General Atlantic, Pet Age, 2023

- KKR to Acquire PetVet Care Centers, Business Wire, 2017

- Natural, Organic, and Eco-Friendly Pet Products in the U.S., 7th Edition, Packaged Facts, 2012

- Packaged Facts: E-Commerce Pet Product Sales Surpassed $30B in 2022, Pet Age, 2023

- Pet Products and Services, Packaged Facts, 2023

- Industry Trends and Information, American Pet Products Association, 2023

- New APPA Study Reveals More Than 65% of U.S. Households Own a Pet," American Pet Products Association, 2022

- General Atlantic invests in Village Pet Care, PE Hub, 2023

- PetSmart/Chewy, BC Partners, 2023

- PetSmart Deal to Go Public Could Trigger Dog-Eat-Dog Competition, Forbes, 2022

- PetSmart to Be Sold for $8.7 Billion, Entrepreneur, 2017

- Exclusive: PetSmart hires advisers to explore sale - sources, Reuters, 2014