Share

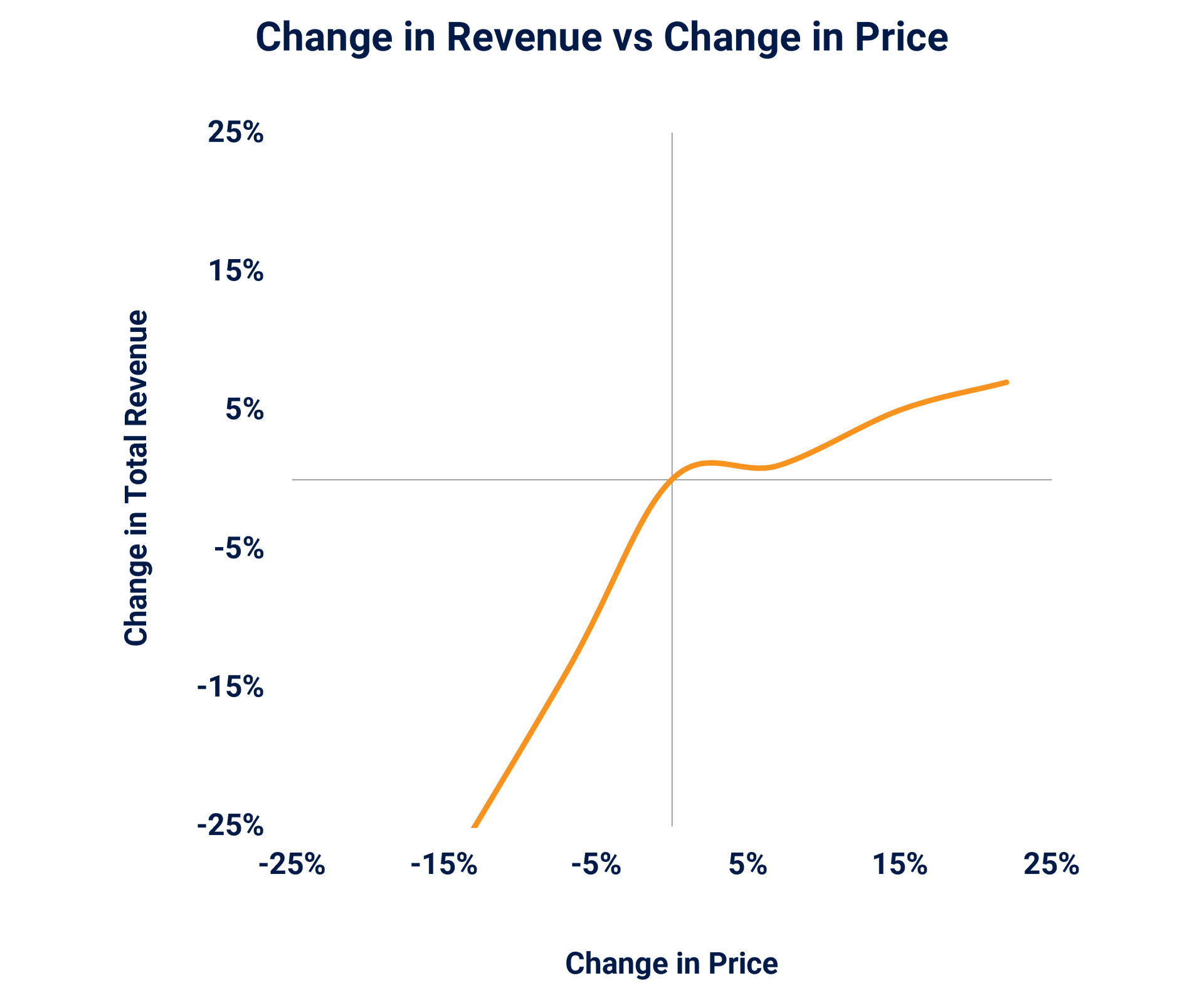

Beyond usage in pricing strategies, conjoint analysis is a useful tool for other growth opportunities, such as shaping product design and optimizing product bundles to drive maximum margins or revenue. For product design, conjoint analysis evaluates the appeal of various product features by assessing customer preferences and trade-offs. This allows businesses to tailor offerings that align precisely with market demands, enhancing the overall value proposition.

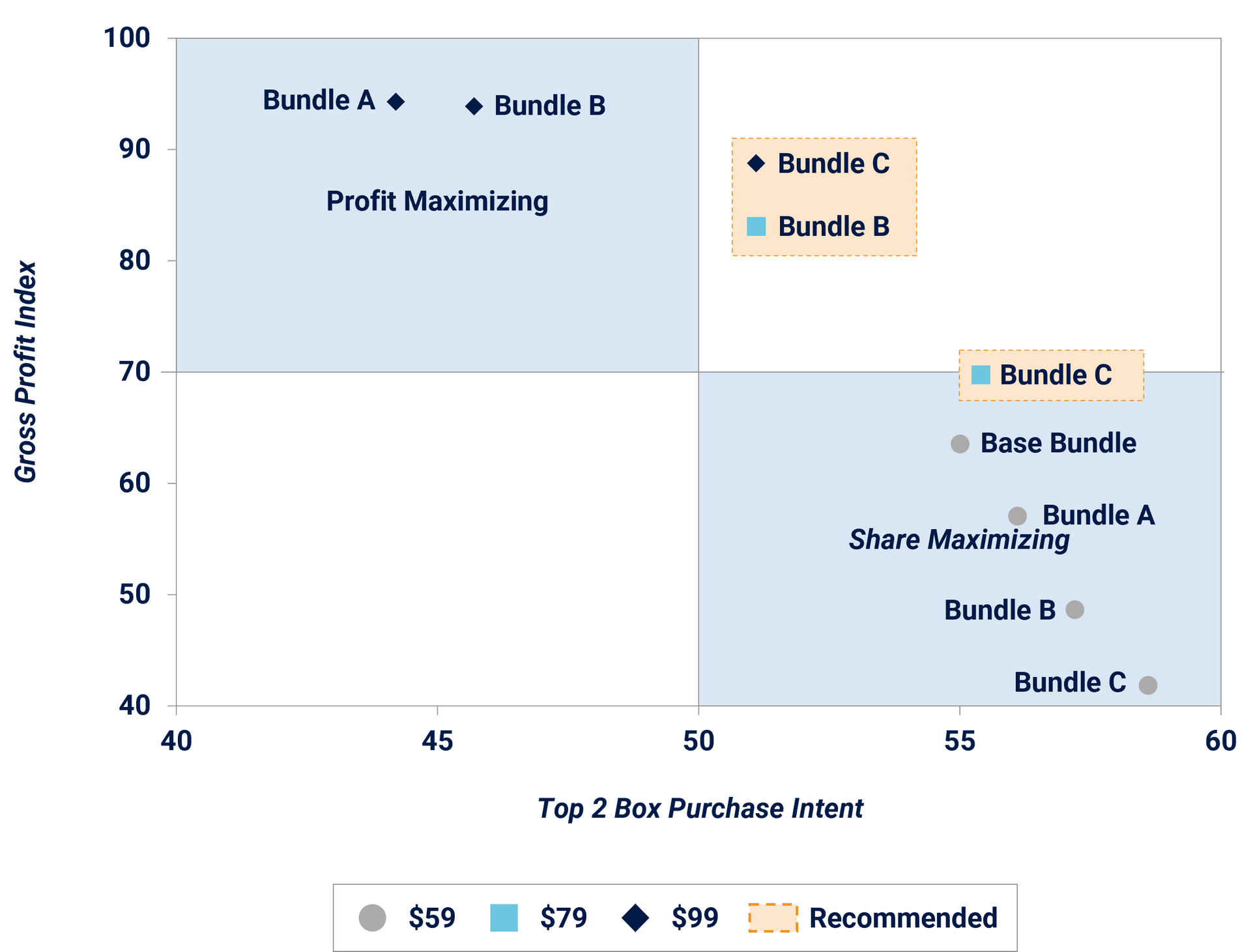

When it comes to product bundles, conjoint analysis assesses the attractiveness of different combinations at varying price points. By discerning which bundles resonate most with customers, businesses can strategically position offerings to maximize either margins or overall revenue. This nuanced approach to product design and bundling empowers companies to not only meet customer expectations but also strategically navigate the delicate balance between profitability and market share.

For example, in the case below, Stax helped a client determine which product bundles maximized profit and market share, and at which price levels:

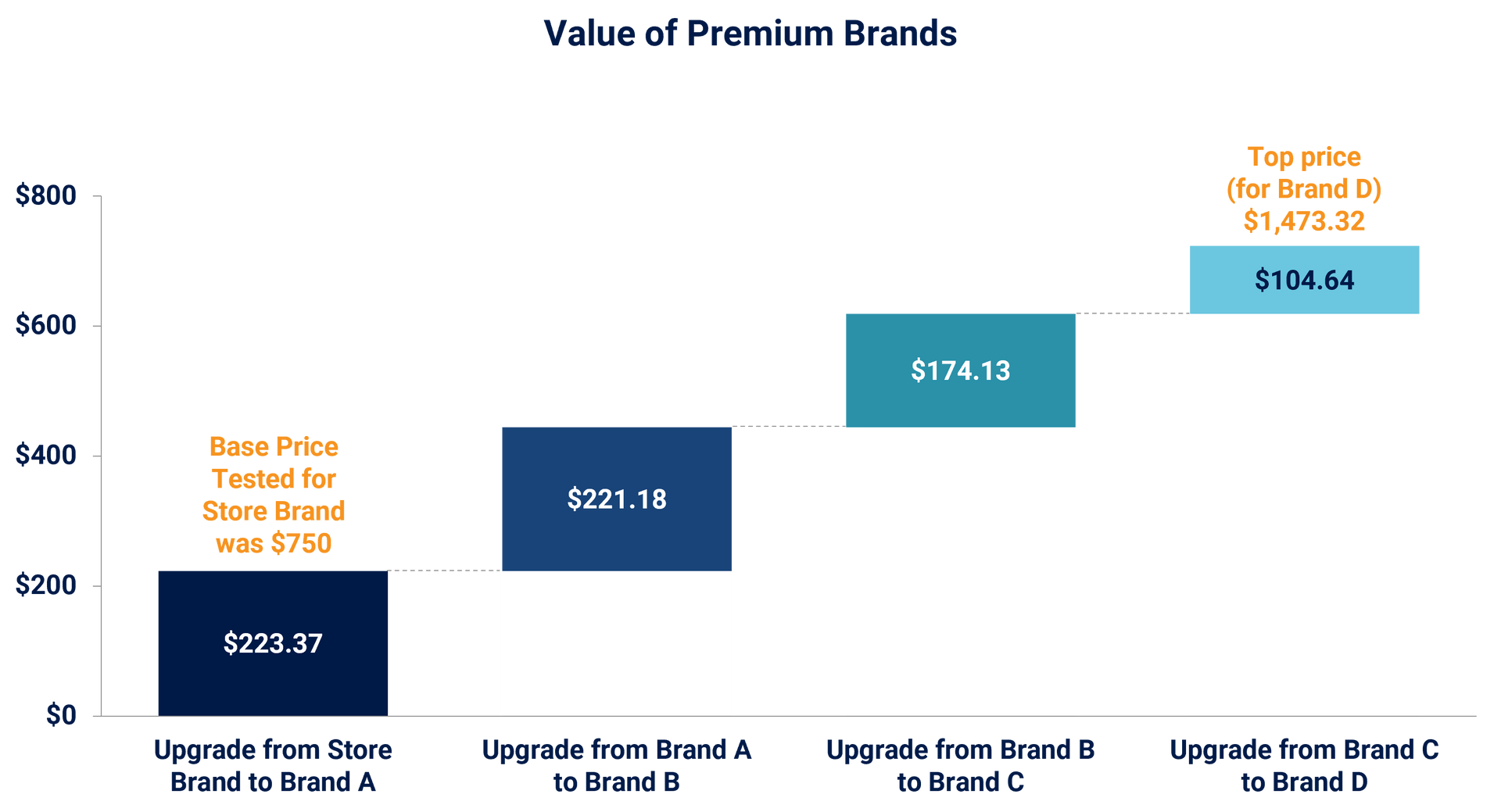

Conjoint analysis extends its versatility beyond pricing and product strategies, finding application in crucial areas such as brand valuation and understanding customer loyalty to a product category. In the context of brand valuation, conjoint analysis assesses the monetary value customers place on a brand compared to its competitors. By discerning the specific attributes that contribute to brand perception, businesses can strategically position and price their brand in the market.

In the case below, we determined the premium for a luxury brand to quantify how it could maximize its profit against its competitors:

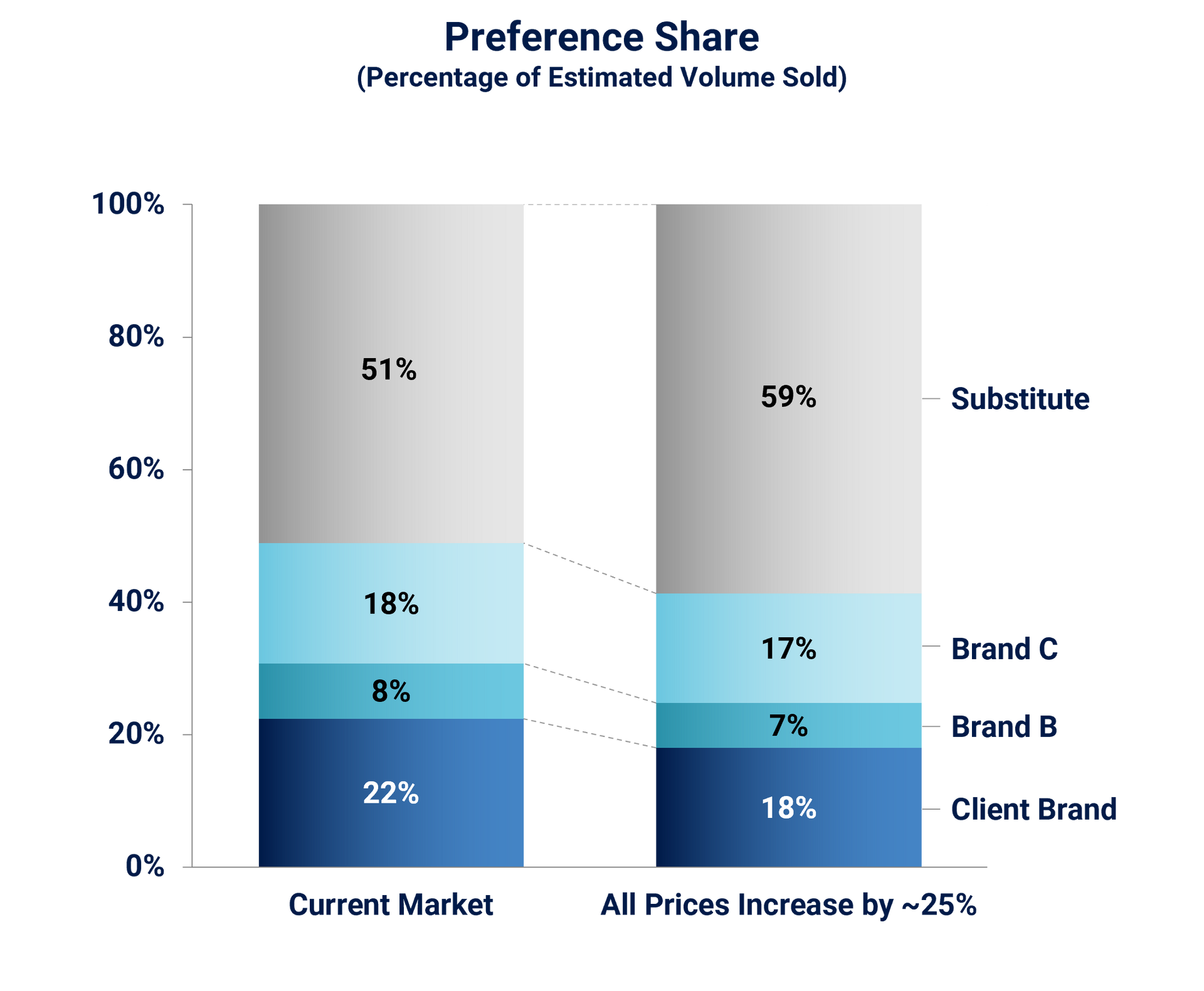

As for loyalty to a product category, conjoint analysis reveals insights into customer behavior by assessing at what price point customers might consider leaving a product category altogether. This knowledge is invaluable for businesses seeking to fortify customer retention strategies and tailor offerings to meet enduring preferences. By delving into these multifaceted dimensions, conjoint analysis emerges as a powerful tool with the capacity to illuminate various facets of consumer behavior and inform strategic decision-making across diverse business scenarios.

During a recent Stax engagement, we found that if the entire product category grew its prices by 25%, only 8% of the market would leave for substitutes.

Conjoint in Diligence

Integrating conjoint analysis into conventional CDD research unveils a cost-effective avenue for extracting profound insights into pricing and growth opportunities. By seamlessly complementing existing CDD efforts, conjoint analysis offers a more comprehensive view of customer preferences and market dynamics. This symbiotic approach not only streamlines the research process, but also enhances the strategic depth of the evaluation. The synergistic benefits become particularly evident in the cost savings arena. A conjoint study conducted during the CDD process can be much less expensive than beginning an additional research workstream post-close.

Conclusion

The strategic integration of conjoint analysis into the early stages of Commercial Due Diligence (CDD) can assist informed decision-making in private equity deals. By leveraging this powerful tool, investors gain a nuanced understanding of customer preferences, pricing dynamics, and growth opportunities—all within the cost-effective framework of the CDD process.

Crucially, conjoint analysis serves as a key validator, enabling private equity professionals to test and challenge their growth hypotheses at a stage where adjustments can be made seamlessly. This validation enhances the accuracy of strategic planning and can yield substantial cost savings by mitigating the need for extensive pricing research post-close. In the dynamic landscape of private equity, where foresight is paramount, early adoption of conjoint analysis during CDD stands as a prudent investment, offering a forward-thinking approach to navigate the complexities of market dynamics and customer behavior. This, in turn, lays a strong foundation for early value creation planning.

To learn more about value creation and the benefits of conjoint analysis, visit www.stax.com or contact us here with any questions or inquiries.

Read More