Share

What is Robo-Advisory

Robo-advisory services generally refers to an automated digital investment advisory program. They provide automated and algorithm-driven financial planning services with minimal human supervision. Investment considerations provided by robo-advisory platforms are based on real-time statistics and current economic scenarios, which enables clients to make accurate financial decisions reducing the credit risk associated with investment decisions. Robo-advisory allows clients to customize their online investments to align with their long-term financial goals and short-term investment strategies. It also enables cost-effective delivery of financial advice by reducing administrative expenses, making them accessible to clients at a lower cost.

How Does a Robo-Advisor Work?

A standard robo-advisor interacts by posing inquiries regarding an individual's financial standing and future aspirations through an online survey. Subsequently, it leverages the collected data to provide personalized advice and effect automatic investments. Engineered to comprehend investor requirements, robo-advisors formulate investment and allocation strategies, execute chosen allocations, oversee outcomes, and execute portfolio rebalancing according to the predetermined plan.

This service offers a multitude of benefits, notably cost-effective portfolios characterized by superior quality, secure investments, and efficient tax-loss harvesting. Depending on the platform, robo-advisory services assume various roles, often encompassing:

Portfolio Management

Robo-advisors employ algorithms to forge and oversee investment portfolios, tailored to the investor's risk tolerance, time horizon, and financial objectives.

Rebalancing

Automated portfolio rebalancing ensures continuous alignment with the investor's risk tolerance and objectives.

Tax Optimization

Robo-advisors aid investors in optimizing portfolios for tax efficiency.

Goal Tracking

These advisors facilitate the tracking of progress toward financial milestones.

Educational Resources

Robo advisors offer informative resources on investing and financial planning to enhance investors' knowledge.

Through this comprehensive suite of services, robo-advisory platforms empower investors to make informed decisions, navigate market dynamics, and pursue financial objectives with greater precision and efficiency.

Growth Trends in the Robo-Advisory Market

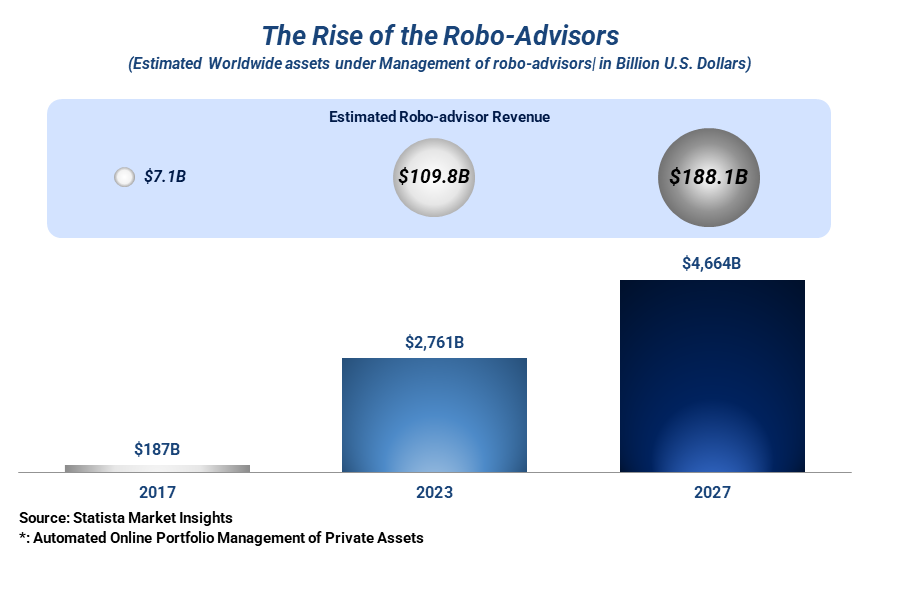

According to data from Statista Market Insights, an estimated $2.76T will be managed by robo-advisors in 2023. By 2027, assets under management are expected to reach just past the $4.6T mark. Estimated total revenue of robo-advisors has also seen explosive growth over the past six years. While in 2017 the figure was just $7.1B, by 2023 the market is expected to generate revenue of almost $110B.

What led to the growth in robo-advisory?

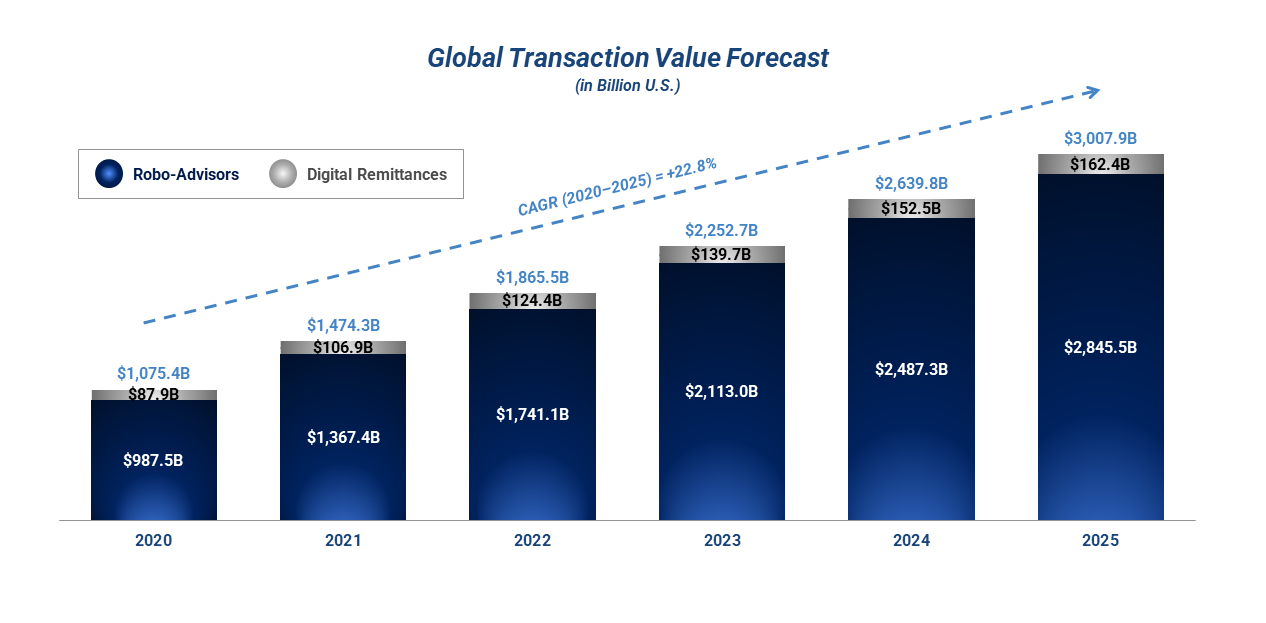

- As robo-advisory services are tailored for the post-Covid online landscape, it's unsurprising this asset management segment has flourished recently and is poised to do so for the foreseeable future.

- The global robo-advisory market thrives in the wake of a burgeoning financial industry, driven by relentless organizational efforts to adopt cost-effective, efficient technologies for financial service delivery.

- Projections indicate substantial revenue growth in the global robo-advisory market, driven by platforms' attributes such as top-tier quality, economical portfolios, and secure investment options.

- Rapid digitization and the increasing integration of Artificial Intelligence (AI) are slated to bolster the growth of the global robo-advisory market, offering advanced solutions during the forecast period.

- Government initiatives encouraging the digitization of services are predicted to be a driving force behind the market's expansion throughout the forecast period.

- The global adoption of robo-advisory services continues to expand, creating opportunities for providers to tap into previously untapped markets, particularly in emerging economies with burgeoning middle-class populations and growing internet accessibility.

- Collaborative efforts between conventional wealth management firms and robo-advisory platforms pave the way for hybrid models, melding human expertise with technology-driven, automated solutions.

- Incorporating robo-advisory capabilities into existing wealth management portfolios holds the potential to broaden firms' client base, enrich service offerings, and amplify overall client satisfaction.

M&A Investment in Robo-Advisors

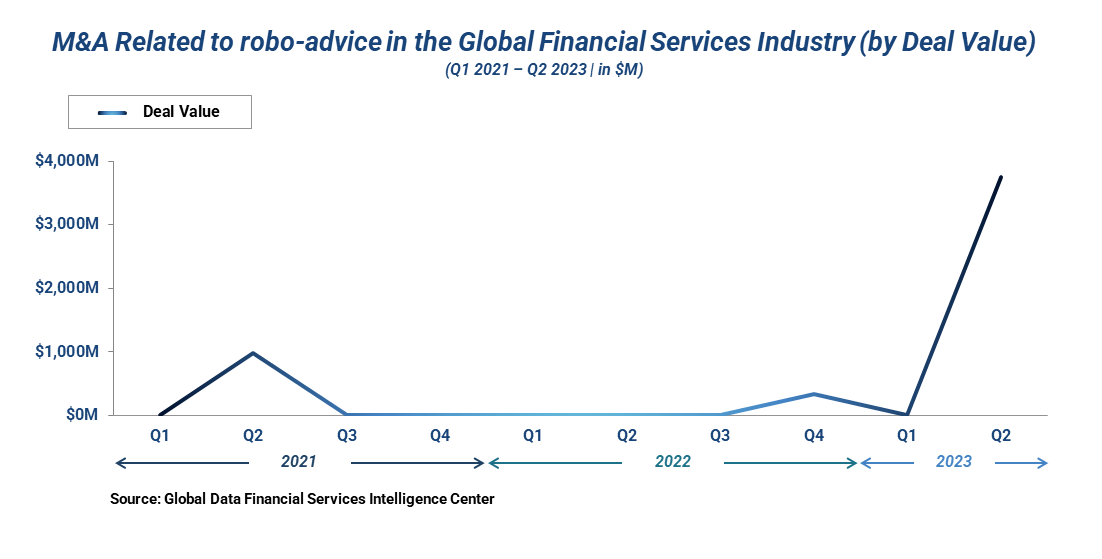

Wealth management platforms were a niche space prior to 2020, Covid accelerated the growth of the market with increased digital adoption. By 2020, the number of global deals in the WealthTech space increased significantly by ~24% from the 2019 levels. In value terms, robo-advice related deal activity increased by 15,064% in Q2 2023 compared with the previous quarter’s total of $24.4m. Related deal volume increased by 9% in Q2 2023 versus the previous quarter and was 2300% higher than in Q2 2022.

Players in the Robo-advisory market

The robo-advisory market is set to witness intensified competition in the coming years, driven by a rising awareness of services among individuals. As more people recognize the benefits of robo-advisors, the demand for their offerings is poised to surge.

This uptick in demand, in turn, will fuel heightened competition as both new entrants step into the market and established players endeavor to safeguard their market shares. Prominent figures in the field, including key and emerging players, have garnered attention and been profiled for their contributions.

Notable names include: Wealthfront Inc. (United States), Betterment Holdings Inc. (United States), Charles Schwab & Co. (United States), Bambu (Singapore), Hedgeable, Inc. (United States), WiseBanyan, Inc. (United States), Ally Financial Inc. (United States), AssetBuilder Inc. (United States), SigFig Wealth Management (United States), and Blooom, Inc. (United States) stand at the forefront of this dynamic landscape.

Looking Ahead

The rise of robo-advisory services marks a new era of automated investment guidance, driven by data insights. These platforms offer convenient algorithmic financial planning, aligning with both short-term tactics and long-term aspirations. By utilizing real-time data, users make informed choices, lowering credit risks. The operational process, including data collection, automated advice, and portfolio management, showcases the tech-finance blend. Portfolio rebalancing, tax optimization, goal tracking, and educational resources all help to enrich the client experience.

The robo-advisory market's growth potential is significant, powered by digitization, AI integration, and governmental support. The pandemic expedited digital interactions and investments, highlighting robo-advisory services.

Looking ahead, competition will spur innovation, broadening access to top-notch advice and democratizing investing. Key players adapt to this expanding market, while collaborations between traditional wealth management and robo-platforms offer hybrid models, uniting human expertise with automation. In essence, robo-advisory services redefine investing, merging technology, and the generation of insights for efficient, comprehensive financial guidance.

Sources

- Schmidt, Hilary. “Robo-Advisory Usage Expected to Surge Throughout the Coming Decade,” International Banke, Dec. 2022.

- GlobalData. “How robo-advice M&A performed in the financial services industry in Q2 2023,” Retail Banker International, Aug. 23, 2023.

- AMA Research & Media LLP. “M&A Activity in Robo-advisory Market to Set New Growth Cycle | Blooom, Bambu, Hedgeable, WiseBanyan,” openPR, Jul. 27, 2023.

- Deloitte. “The expansion of Robo-Advisory in Wealth Management,”,Aug. 2016.

- GlobalData. “How robo-advice M&A performed in the financial services industry in Q2 2023,” Private Banker International, Jul. 2023.