Share

What is DevOps?

Broadly, DevOps is a working philosophy that breaks down silos between product development (“Dev”) and IT operations (“Ops”), emphasizing collaboration, automation, and continuous improvement to accelerate delivery and improve quality.

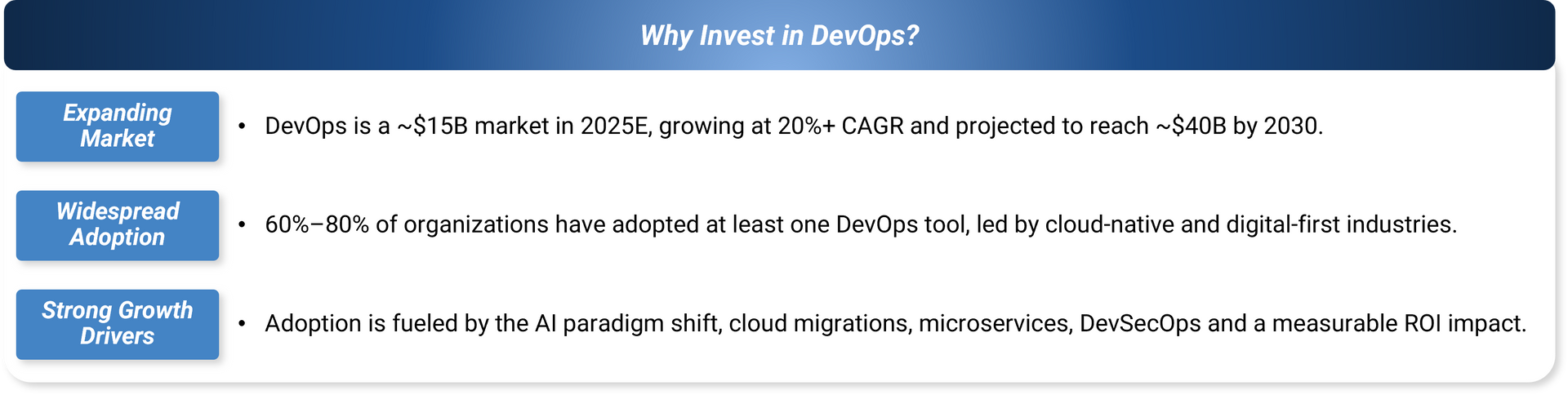

DevOps software refers to the tools that enable developers and IT operations teams to collaborate more effectively across the software development lifecycle. These tools help teams build, test, release, and run software faster, more reliably, and with fewer errors. Currently, the global DevOps market is expected to grow at ~20% CAGR through 2030, driven by the measurable ROI realized by organizations adopting DevOps solutions and best practices.

Impact of DevOps

The market is expected to see double digit growth in the long term fueled by innovation and expanding usage, underpinned by the material ROI impacts on operational efficiencies and gains in time-to-market experienced by adopters.

Cost Savings

Labor & Productivity: Atlassian and Forrester estimate that organizations that adopt DevOps see developer productivity increase up to 20% and results in time savings of ~1.5 hours per day per developer.

Technical Debt: Organizations that adopt DevOps solutions are shown to spend ~30% more time on improving product infrastructure relative to time spent troubleshooting.

Risk Mitigation: DevOps solutions and practices have resulted in faster times to market with a few examples of industry leaders below:

- Amazon’s DevOps allows it to deploy new code every 11.7 seconds.

- Netflix leverages DevOps automations to release updates daily.

- Etsy’s adoption of DevOps reduced deployment times from hours to minutes.

Revenue Generation

Product Quality: An IBM study found that fixing a software bug in production can cost 100 times more than addressing it during development. Organizations that adopt DevOps practices have been shown to improve defect escape rates by up to 40%.

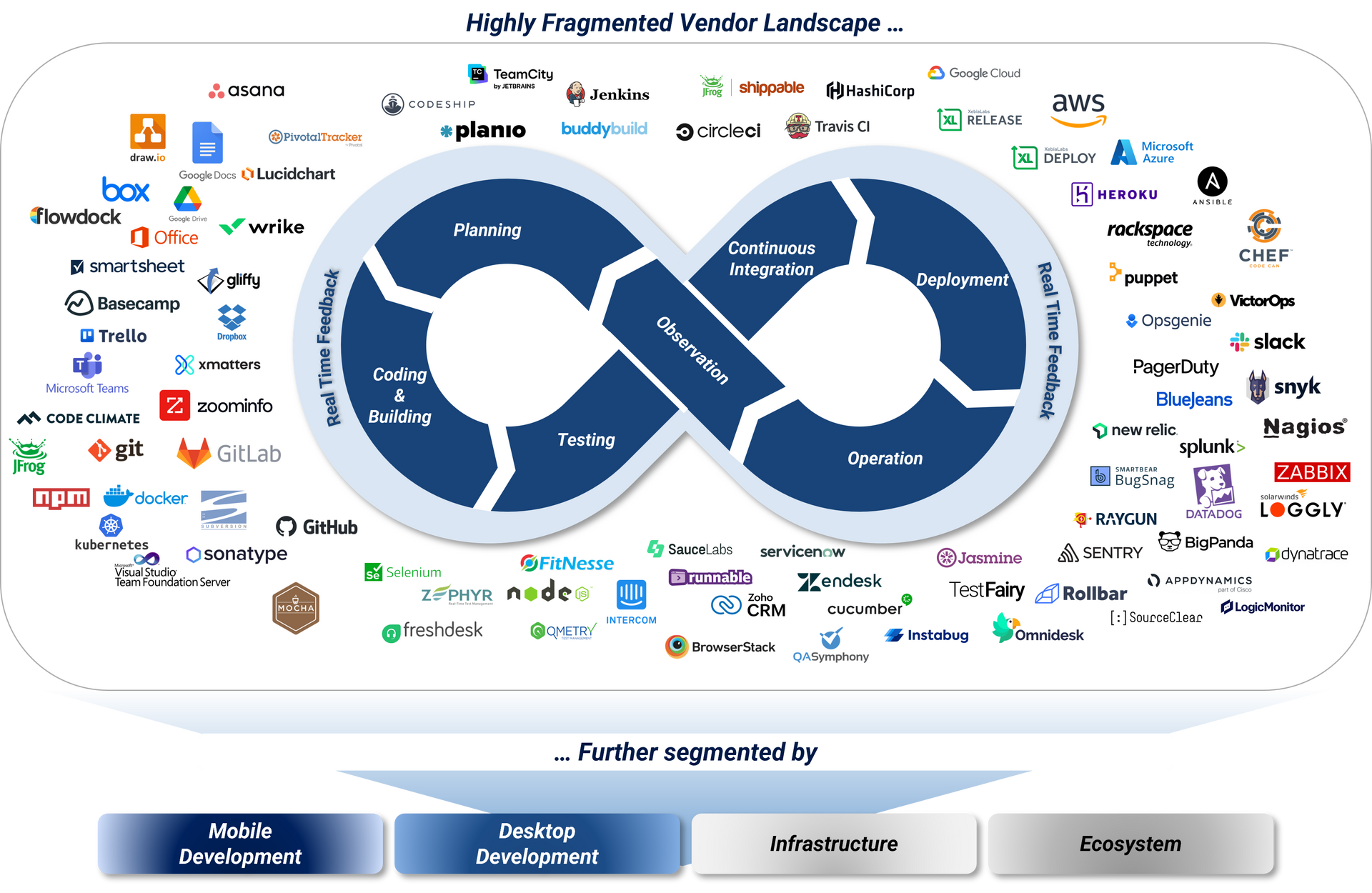

Vendor Landscape

The landscape for DevOps is highly fragmented, being further segmented by mobile & desktop development, infrastructure, and respective ecosystem (e.g., Java). Vendors tend to specialize along two vectors: ecosystem or stage of DevOps lifecycle.

Ecosystem-Tailored Solutions

These vendors are designed around specific programming languages, frameworks, or platforms. They offer tight integrations and workflows optimized for particular tech stacks or cloud environments, often resulting in faster adoption or better developer experience.

While many DevOps tools aim for broad applicability, ecosystem-aligned tools succeed because they deeply understand and optimize for specific developer needs, language behaviors, and deployment environments.

Stage-Aligned Solutions

These vendors offer focused capabilities aligned to specific stages of the DevOps cycle, such as planning, CI/CD, deployment automation, or observability. Buyers often assemble multiple tools to build a best-in-breed tool chain.

Despite the appeal of all-in-one platforms, the DevOps market today is largely dominated by modular tools, although some vendors have had success with broader offerings (e.g., GitLab, Atlassian).

Growing Investor Interest in DevOps

The DevOps market presents an attractive investment opportunity, driven by rapid growth in spend and adoption across company sizes and industries, with several emerging pockets of investor activity:

Tool Consolidation & Platform Expansion

- Buyers are consolidating DevOps tools post-pandemic, favoring full-lifecycle platforms that simplify operations and cut costs. PE-led M&A (e.g., Perforce, GitLab) reflects strong demand for end-to-end solutions.

Rise of DevSecOps & Compliance Tooling

- Growingly tighter regulations, DevOps tools that embed security, compliance, and dependency scanning early in the pipeline are seeing increased adoption.

SME & Mid-Market Expansion

- SMEs and mid-market firms are rapidly adopting DevOps to support digital transformation in sectors like manufacturing and healthcare, driving demand for SaaS-based CI/CD and infrastructure platforms.

Rise of AI‑DevOps / AIOps

- AIOps platforms are streamlining operations by automating incident response, accelerating root-cause detection, and enabling self-healing systems.

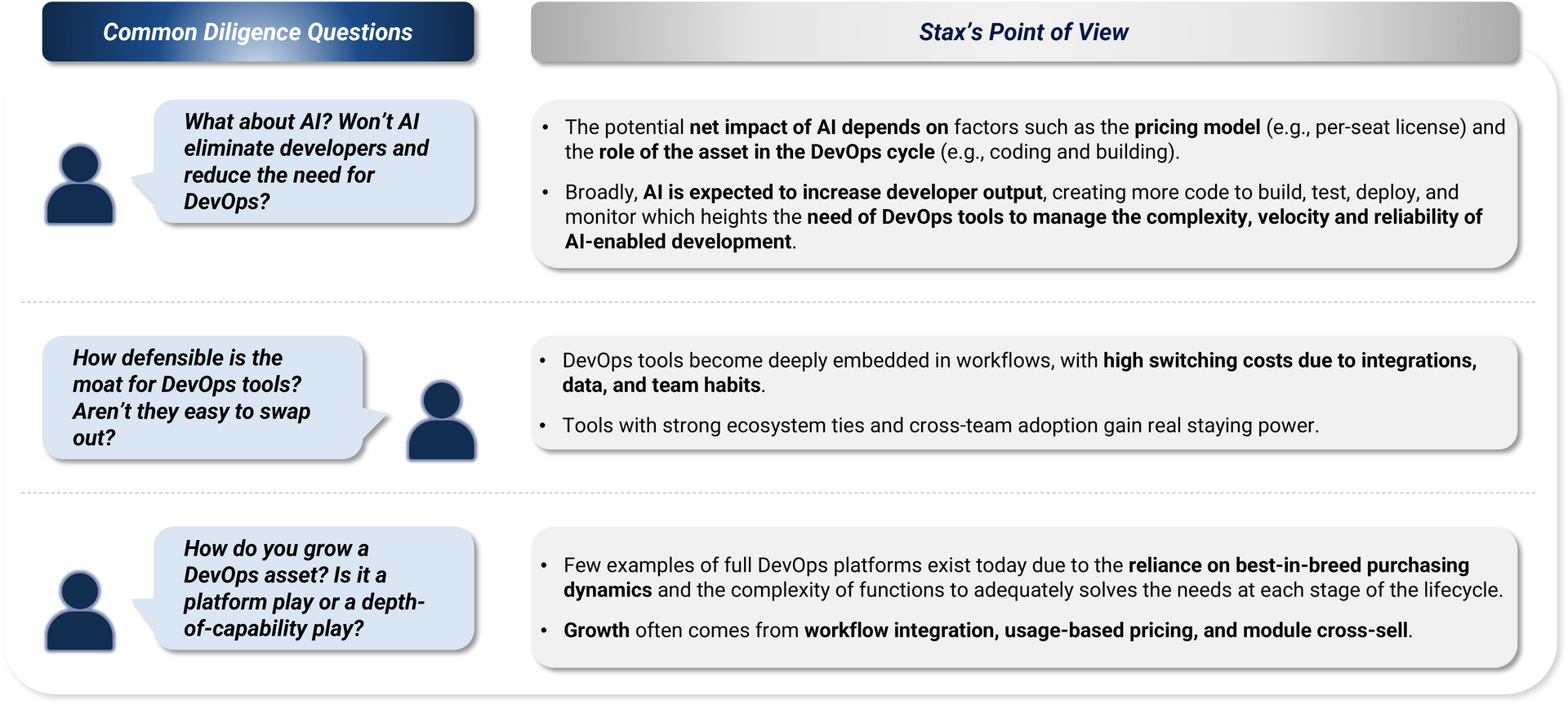

Potential investors looking to enter the DevOps market frequently express concerns in the disruption of AI, along with the defensibility of a product’s moat, and what growth avenues are available to them. However, answers to these concerns often vary by asset.

Conclusion

Stax perspectives draw from deep experience in the DevOps ecosystem, spanning well over a decade of building insight for investors and management teams. With expertise across various DevOps segments (Plan, Build, Test, Deployment, Operation, and Feedback), our team provides comprehensive assessments and tailored strategies that will expertly guide any engagement. To learn more about our services and expertise visit our Insights page or click here to contact us directly.