Share

What do past recessions and current market conditions tell us about near-term expectations in the restaurant sector? With economists expecting a potential recession within the next year, at Stax we reviewed our past casework in the space to understand how historical recessions have impacted the restaurant industry and explored how current market conditions could shape the future.

Recession Trends in the Restaurant Industry

Historically, when analysts have assessed the restaurant industry the main conclusions have centered around the industry being relatively insulated from recessions. This makes sense, considering people still need to spend on food, and even when considering discretionary spend, consumers still prefer dining out at restaurants as a distraction from their daily lives.

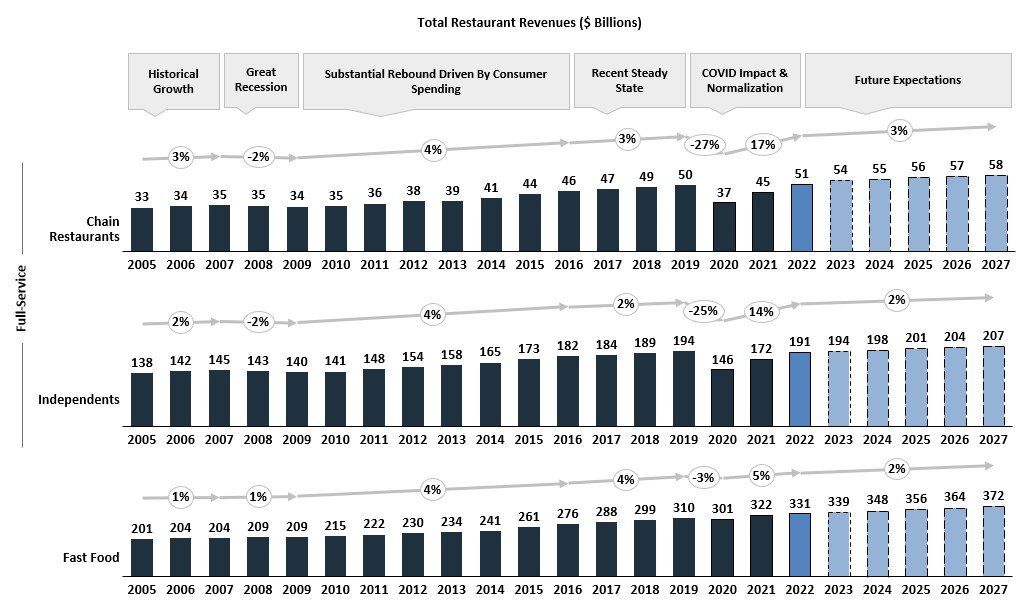

However, deeper analysis of this indicates that it’s the fast food / Quick Service Restaurant (QSR) segment that generally weathers economic cycles well. Full-service restaurants go through the same recessionary pressures as many other CPG markets, as consumers downgrade their spending habits to lower-cost alternatives (fast food, food-at-home, etc.).

Figure 1: Restaurant industry performance over the past 2+ decades

Source: IBIS World Data, Stax Analysis

Covid Impact and Current Market Conditions

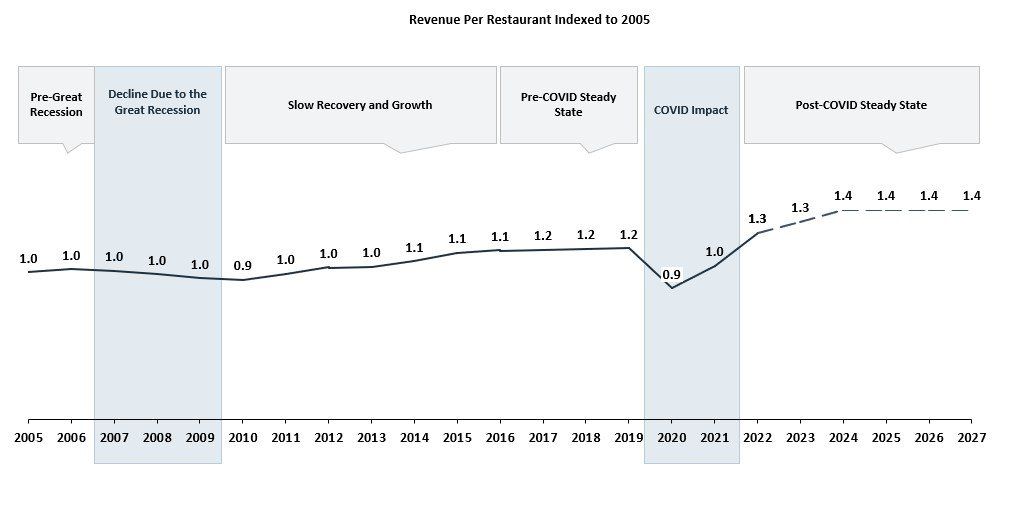

Post-Covid, chain restaurants are beginning to return and are expected to fare better than independent restaurants going forward. This is because the pandemic fundamentally altered the full-service restaurant landscape with lower profit margins of independents unable to handle the market shifts of rising supply/ fixed costs and volatile demand changes. As a result, the number of restaurants that permanently closed doors was up by 10%+ during the pandemic, over the already high closure rates in the industry. However, surviving restaurants will achieve a higher revenue base as consumer demand continues to return to pre-pandemic levels, easing the pressure put on operational margins to an extent.

Figure 2: Trends indicate surviving restaurants will gain a one-time share uplift post-Covid before stabilizing

Source: Stax Research and Analysis

As a result of their experience during the pandemic, restaurants have also adapted their operations to aid in alleviating these margin pressures. There has been a greater emphasis on off-premise sales, with most restaurants offering their own channels or third parties to fulfill this new market. Further, businesses have embraced technology to reduce labor requirements and improve customer experience.

While these have proved important, operators continue to face headwinds around supply chain and labor shortages raising their input costs while still trying to maintain their positioning in the landscape.

Near-Term Expectations Under a Potential Recession

In many ways, the industry is expected to perform similarly to past recessions. A deep recession will have some impact on all parts of the industry, with full-service restaurants facing the brunt of the impact. A milder recession will have a limited-to-no impact on the industry overall.

However, given that many of the less profitable businesses already folded during the recent pandemic, and surviving businesses focused on limiting their costs basis, we would also expect the impact to be somewhat subdued compared to similar past recessions. So, if the restaurant industry was historically insulated from economic cycles, it would be even more insulated in a near-term recession.

Further, some of the current state constraints around input costs and labor supply may further ease during an oncoming recession, further protecting industry margins. Businesses that have best adapted to current market conditions, and those that continue to evolve by managing their cost basis and expanding their target markets will prove successful even in recessionary times.

Our experience indicates that these businesses will have several of the following five attributes:

- Differentiated and compelling value proposition for their targeted customer segments

- Brand-relevant usage of off-premise venues (e.g., delivery, pick-up only storefronts, virtual restaurants with no storefronts, etc.) based on the related customer value proposition

- Demonstrated ROI from incremental technology investments – both in cost savings through labor optimization, as well as increased foot traffic through better targeting

- Continued growth in footprint and store density to spread out overhead costs and deliver incremental margins

- Demonstrated ability to grow unit sales / average revenue per location

Conclusion

As the economy moves closer to a potential recession, there are key indicators private equity investors should consider in the restaurant investment landscape. Understanding how past recessions have impacted the restaurant industry, specifically how fast food/ quick service restaurants have fared vs. full-service restaurants will be critical as investors discern what investment assumptions should be made considering past recessions, post-Covid, and under current market conditions. Stax has developed a unique framework to address industry questions for our private equity clients and the management teams of their portfolio companies.

About the Author: Sameer Tejani is a Director at Stax, with over 12+ years of experience in helping corporate and private equity clients solve their most critical business challenges and position companies to deliver sustainable profitable growth. Sameer’s experience includes advising client organizations across multiple industries with a focus on developing data-driven and actionable strategies that impel management action.