Share

From Disparate Data to Actionable Insights: Healthcare Investing Perspectives

By Mark Bremer, President, Stax

Over the last several years, Stax has worked with investors and management teams across more than 100 healthcare engagements, with a concentration in provider businesses and supporting technology, software, and services. Deep experience and broad exposure provide Stax with a unique perspective to observe market developments and trends, challenges for investors and management teams, and how our investor clients are approaching opportunities to overcome these. We see several important themes running through our work.

Alignment of incentives and opportunity around lower cost treatment settings and models

While the complex incentives of our largely third-party payer structure still create inefficiency across the healthcare landscape, there is a clear area where payer (both private and public), provider, and consumer incentives are aligned. And that alignment continues moving care away from higher cost, acute care, centralized treatment settings and toward lower-cost settings that are more convenient, closer to the consumers’ home, or even in the consumers’ home.

Payers look for lower cost care models. Consumers want a better and more convenient experience. Providers look for profitable ways to gain share, align with payers, and better serve consumers. This ongoing shift is creating opportunities across numerous specialties and settings, from post-acute care to specialty clinics to home care technology and services. Private capital has responded, with investment flowing towards these models, helping to precipitate and accelerate the shift.

Challenge to management of distributed, decentralized care

With this beneficial shift come significant challenges. Managing decentralized care across distributed locations, providers (sometimes mobile), and patients is challenging. An increasing desire to better manage both care and provider performance, adds to the challenge for provider businesses.

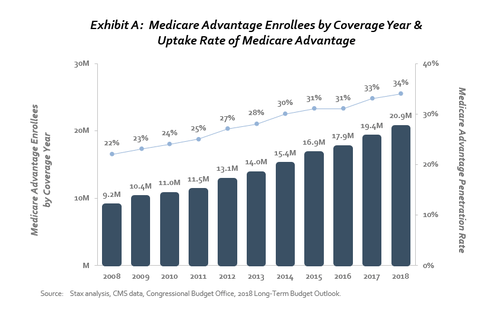

Payers with large amounts of Medicare and Medicaid dollars are shifting from traditional federal and state-administered fee-for-service programs toward Medicare Advantage and Managed Medicaid programs, with private administration and strong incentives for cost management (see Exhibit A).

Poor data management and structure

These shifts create significant opportunities for investment in distributed care provider models. But they often occur within the context of poor data and poor visibility into basic business and care metrics.

Many distributed provider businesses have been built by acquisition and as a result are operated on a range of underlying clinical, financial, and marketing systems. The very characteristic of distributed care models that make them attractive for investment also makes them a mess from a data perspective. We have seen highly distributed providers where underlying data issues made it difficult to evaluate variability in site-level performance or in one case even to definitively identify closed locations.

As a result of data dynamics, many attractive provider businesses are undermanaged. It is difficult for potential investors to fully understand performance across locations and providers. There is an opportunity here for those that can navigate the landscape.

Resulting investment opportunities

There are strong opportunities for investors who can quickly navigate opaque data in distributed providers and emerging investment opportunities in the technology and services that are helping to solve the problem for provider businesses. In our experience, we have seen private equity investors prosper in both scenarios. To do so requires specific capabilities in evaluating and managing provider businesses and those that serve providers.

Premium on understanding large data streams in short timeframes

To understand distributed provider businesses in compressed diligence timeframes, investors must be able to decipher large amounts of data and rapidly evaluate data quality, structure, and linkages and identify insights rapidly. There is a real edge in competitive processes to those that can accomplish this quickly. It is often not a skill set that resides in deal teams. We have seen deal teams struggle as they try to apply to traditional tools (largely Excel) to data problems of a completely different scale and complexity. It is critical that your diligence partner have specialist analytics and data management skills, and that they closely collaborate with your deal team in the interest of visibility and speed.

Premium on understanding growth

Another element critical to investing in distributed provider businesses and those that support them is an understanding of near and mid-term growth potential, in addition to current stability. The technologies and services that support provider businesses are often growth equity investments, where the need is to understand the future state and conduct a realistic evaluation of adoption over time. In many ways, this is more difficult than traditional buyout due diligence. It places a premium on integrating field research findings and direct feedback from customers, provider groups, and competitors, with the data analytics diligence stream. Both are critical to accurately decipher growth potential.

There is a strong future for distributed provider businesses and the technology and services that support them. That future is matched by an opportunity for investors who can accurately and rapidly understand these businesses – seeing through convoluted data to understand real-market position and growth potential.