Share

While most people think of TIC as Testing, Inspection, Certification, at Stax, we believe "TIC" is missing a second "C." The Testing, Inspection, Certification, and "Calibration" (TICC) market represents a unique place to play for investors—more specifically within the calibration segment. Stax experts Will Barden and Sameer Tejani anticipate a surge in deal volume and a greater number of promising companies for TICC investors in the near future and offer key market trends derived from their extensive industry experience.

Calibration service providers play a crucial role within the value chain, serving traditional use cases in manufacturing and expanding applicability across various industries. Across different use cases, companies rely on calibration services for quality control, safety, and cost effectiveness. Third-party calibration service providers are essential in ensuring equipment fitness for use. The value proposition for calibration providers remains highly stable due to underlying market growth in key sectors, regulatory requirements, and overall mission criticality of calibration.

Calibration Service Providers and Equipment

Calibration service providers assess equipment performance using various metrics and make necessary adjustments to ensure correct functionality. There are several distinct types of providers (e.g., lab-based or field-based technicians) each serving a unique need for customers and clients: accredited laboratories, on-site technicians, and mobile labs.

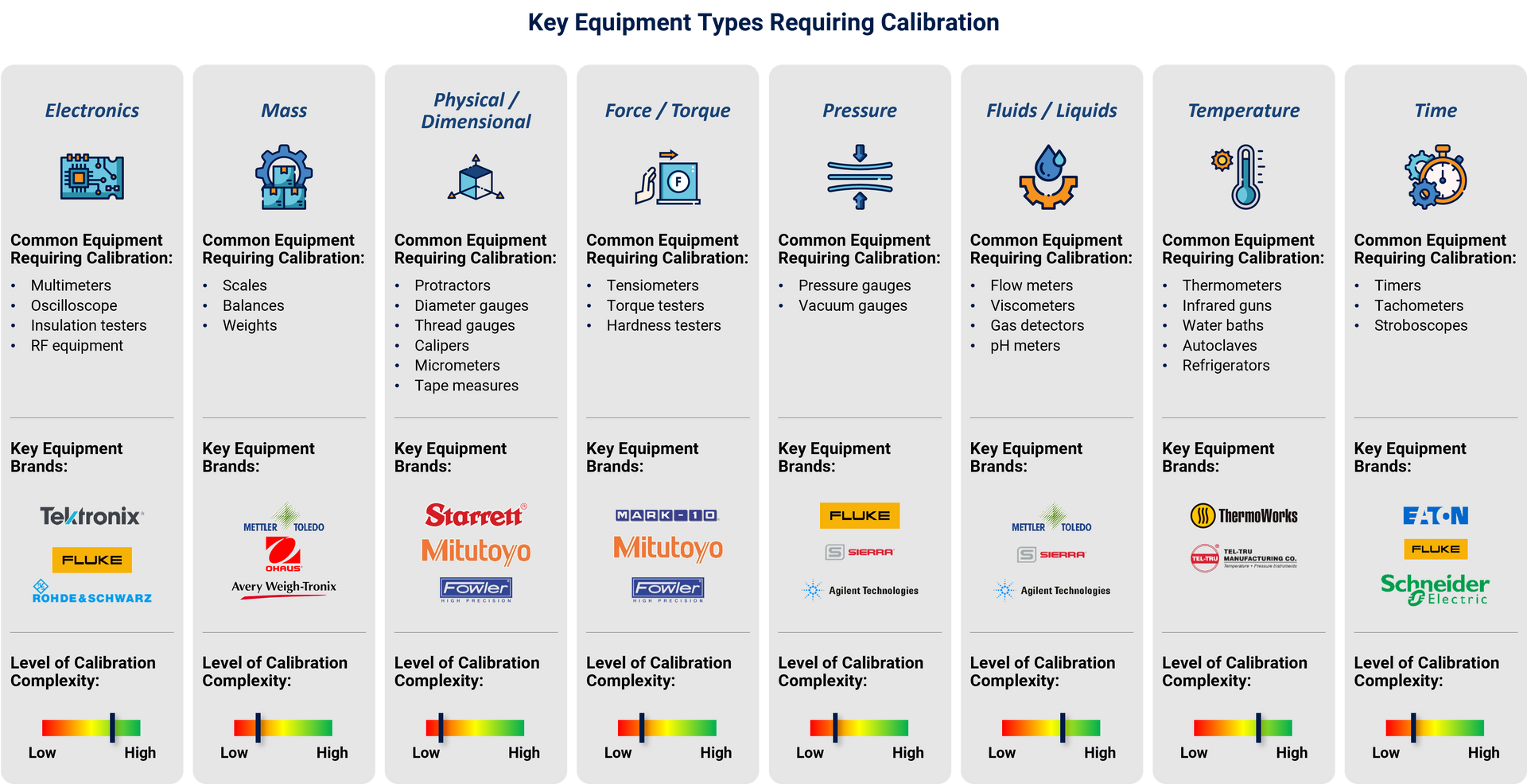

Along with distinct types of providers, there exists a wide range of equipment types that calibration service providers address, covering a broad ecosystem of equipment brands, with each type varying in complexity for calibration requirements.

For example, electronics calibrations typically require more resources than most due to the calibration of multimeters, oscilloscopes, insulation testers, and RF equipment. Physical/Dimensional equipment also has heavy calibration needs, consisting of protractors, diameter gauges, thread gauges, calipers, micrometers, and tape measurers. In contrast, pressure equipment only requires the calibration of pressure and vacuum gauges.

Landscape and Market

The competitive landscape for calibration services encompasses OEMs, distributors, and pure-play calibration service providers; and while these segments have historically been siloed, the market has seen recent consolidation with some players integrating vertically.

The calibration market consists of specialized calibration providers, capabilities within calibration tool OEMs, and distributors; while standalone providers often specialize in one calibration type (e.g., mass), they are typically OEM-agnostic to best serve customers. While not every OEM provides calibration services, many have capabilities to better serve customers and, as such, compete with pure-play calibration providers such as Transcat and Trescal for recurring business.

In general, the market is experiencing a trend toward consolidation with players like Fluke and PST, vertically integrating to not only manufacture their own solutions, but function as a distributor for other OEMs and offer calibration services across calibration types.

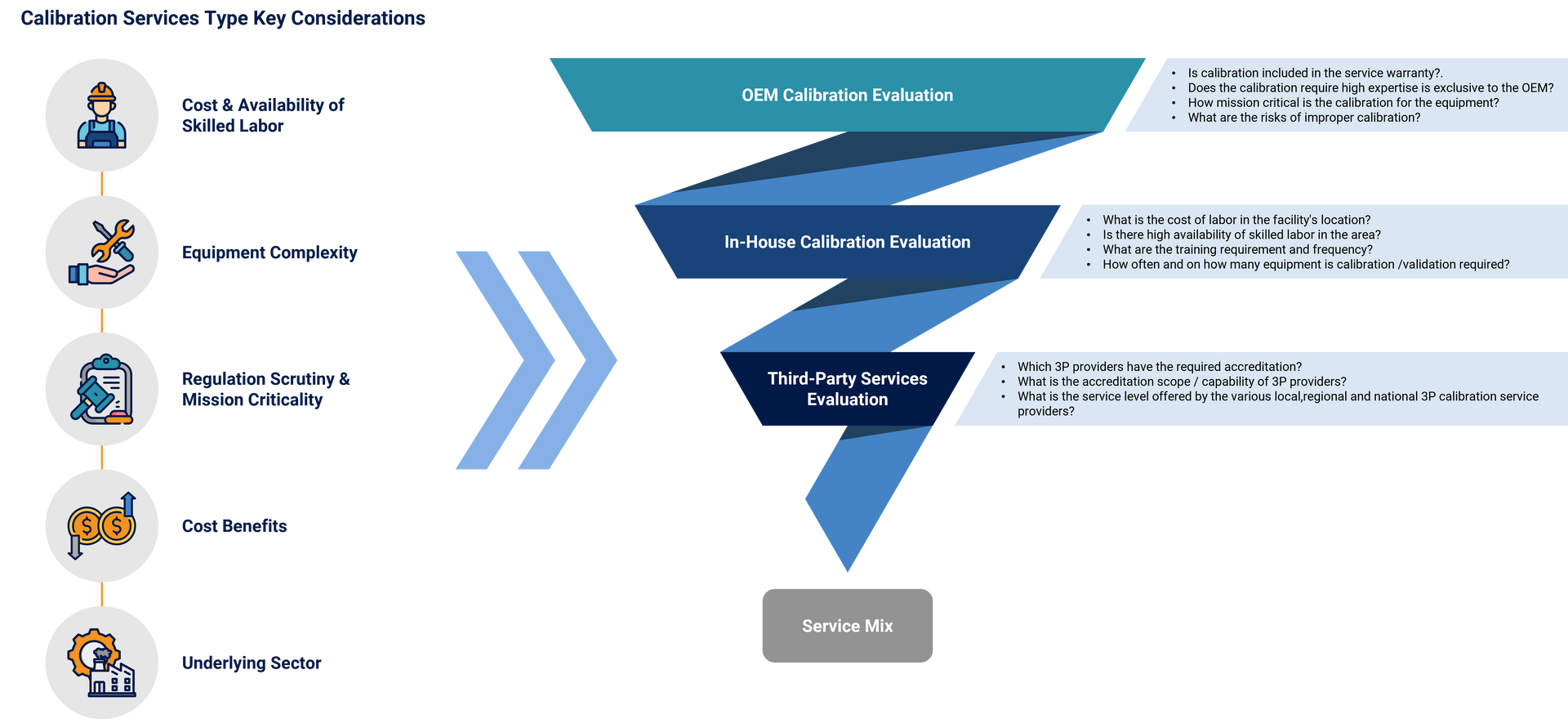

Customers will utilize OEMs for calibration under a service agreement if expertise on the equipment is limited and trust is higher for OEMs (given mission criticality of the equipment). On the other hand, in-house calibration is usually chosen for financial reasons. In cases where these criteria do not strongly dictate a choice, third-party providers typically win over OEMs in terms of price, turnaround time, and service offerings. In addition, local players have proved to be “sticky” due in part to their close connections with clients, which is a critical factor in the space.

With that being said, the growth in market share for third-party service providers has its limitations. Third parties are gaining share from in-house calibration given inflation, labor shortages, and increased costs of bringing capabilities in-house. However, there are key considerations preventing third parties from winning share from OEMs—namely expertise.

In sectors where equipment scrutiny and complexity are not major considerations, customers often transition from the OEM to a third party at the end of the service warranty period (~5 years) due to lower costs and quicker turnaround times. This has been a consistent industry dynamic and is expected to remain stable. Instead, third-party service providers are gaining share over in-house calibration, driven by labor shortages and the escalating costs of labor affecting various sectors.

Calibration Provider Types

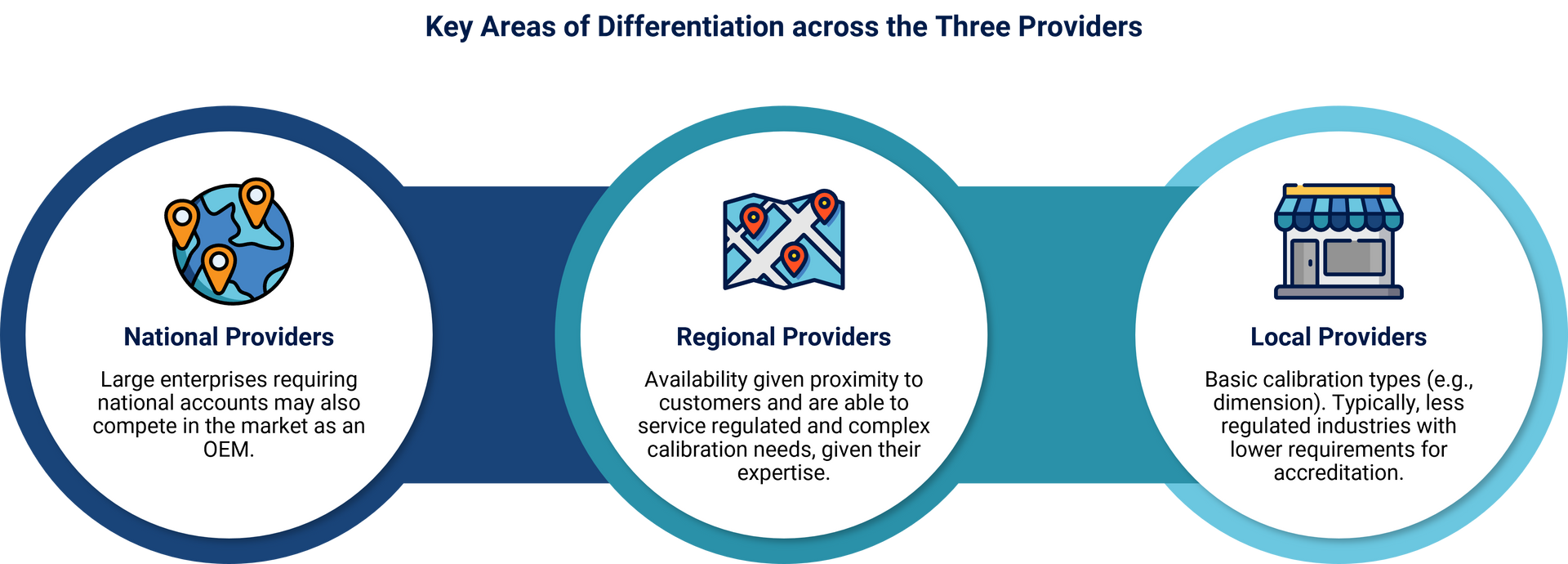

Third-party calibration service providers vary by size and geographic scope, with national providers more suitable for servicing highly regulated and complex industries. Local and regional providers have a geographic advantage where they can offer better turnaround time and availability.

When evaluating third-party calibration services providers, customers vet providers based on price, turnaround time, and accreditations; but selection is more dependent on logistics of the service and availability of additional offerings. Local providers are particularly well-positioned to service customers who prefer to have on-site repairs and avoid shipping costs.

Visibility of Process

Additionally, providers that have proprietary software for asset tracking are highly appealing to customers, providing them visibility throughout the calibration process.

Given the level of fragmentation in the market, calibration service providers should consider roll-up strategies that allow them to enhance their service offerings (i.e., types of calibrations, repairs, etc.) in addition to geographic coverage to enable differentiation and gain share.

The success of other rollups demonstrates the degree of fragmentation in the market and supports the case for an M&A-fueled expansion strategy – extending by geography and application area as well as the most attractive opportunities for expansion/roll-up opportunities.

Conclusion

The calibration market provides attractive investment opportunities with multiple growth strategies (roll-up plays for multiples arbitrage, incremental customer/regional expansion through M&A, value creation through digitization and tech-enabled offerings, etc.). As typical with many growth segments in the industrial services space, there are material investment risks related to potential concentration and available outsourcing headroom in the target end markets, as well as the quality of the asset and its ability to deliver to the evolving needs of the customer base.

About Stax

Stax, a global strategy consulting firm, specializing in commercial due diligence, value creation, and exit planning for sponsors and portfolio companies, has supported many PE firms across the size spectrum to derive optimal value of their investments in the TICC sector. Visit us at www.stax.com to learn more about our services and expertise.

Read More