Share

In today’s interconnected world, where businesses and individuals heavily rely on digital technologies, security and risk management have become critical factors in ensuring the safety and confidentiality of sensitive information. Cybersecurity in particular plays a pivotal role in safeguarding data and systems against the ever-evolving threats posed by cybercriminals.

Based on a comprehensive global survey conducted by Allianz, which involved over 2,700 risk professionals, cyber incidents, encompassing IT outages, ransomware attacks, and data breaches, retained their position as the top-ranked risk factor worldwide for the second consecutive year. This sentiment remained consistent across various geographical regions and company sizes, including small and medium-sized businesses. The cybersecurity market is expected to witness a CAGR of 9.63%, reaching a market volume of $256.50B by 2028.

Leveraging Cybersecurity for Effective Digital Transformations

Accenture's fifth annual State of Cybersecurity Resilience report indicates organizations leveraging cybersecurity as a differentiator to drive better business outcomes, referred to as "cyber transformers," are nearly 6x more likely to achieve highly effective digital transformations compared to others. Aligning cybersecurity programs with business objectives leads to an 18% increase in the ability to drive revenue growth, expand market share, and enhance customer satisfaction, trust, and employee productivity.

Moreover, organizations that embed cybersecurity actions into digital transformation efforts and adopt strong cybersecurity practices across the board significantly enhance the effectiveness of their digital transformations, making them nearly six times more likely to succeed in their endeavors.

Market Tailwinds and Headwinds of Cybersecurity Industry

The surge in the cybersecurity solutions industry is driven by several factors, including the growing incidence of cyber threats, expanding digital presence, adherence to stringent regulatory standards, heightened awareness of cybersecurity issues, and ongoing efforts towards digital transformation.

With data protection and online safety ranking high on the agenda for organizations and individuals alike, the cybersecurity solutions sector is well-positioned for sustained success, fostering innovation and resilience to confront the ever-evolving cyber landscape. However, potential headwinds such as the impact of AI and recessionary pressures may need to be navigated.

Notable Tailwinds

Potential Headwinds

The Human Factor: Training and Awareness

Often overlooked, the human factor can be both the weakest link and the strongest defense in cybersecurity. While advanced technologies and robust systems are essential, employees, clients, and/or users can inadvertently open doors to cyber threats through human error or social engineering tactics. Cybercriminals frequently exploit human vulnerabilities, such as clicking on malicious links, phishing emails, or unknowingly disclosing sensitive information; all to gain unauthorized access to systems and networks.

To effectively tackle this significant cybersecurity challenge, organizations must prioritize training and awareness programs. By investing in cybersecurity education for employees and users, companies can empower their workforce to actively defend against cyber threats. An effective program should encompass various topics, such as recognizing common phishing attempts, identifying suspicious online activities, safeguarding personal and company data, and promptly reporting potential security incidents. Additionally, fostering a security-conscious culture is essential for creating a collective effort against cyber threats. When cybersecurity becomes deeply ingrained in an organization's values and practices, individuals naturally adopt secure behaviors as part of their daily routines.

Deal Landscape in the Cybersecurity Space

The private equity deal space in cybersecurity is witnessing a significant boom, with remarkable growth in recent years.

In 2022, private equity sponsors and their portfolio companies have collectively supported 162 cybersecurity deals worldwide, valued at an impressive $34.9 billion, encompassing both add-on and platform acquisitions. This substantial increase is evident when compared to the 146 deals valued at $29.1 billion in 2021. The escalating threat of cyberattacks has propelled businesses to seek more sophisticated cybersecurity solutions, creating a favorable environment for private equity investors to back cybersecurity companies and fuel their growth.

The sector's declining valuations and stable business model, characterized by low client churn and high margins, have further motivated investors to engage in robust dealmaking activities, indicating a promising outlook for the cybersecurity industry in the coming years.

Future Trends in Cybersecurity

In the ever-evolving landscape of cybersecurity, industry continuously adapts to emerging threats and technologies. Anticipate these future trends to play a pivotal role in shaping the cybersecurity sector in the years to come:

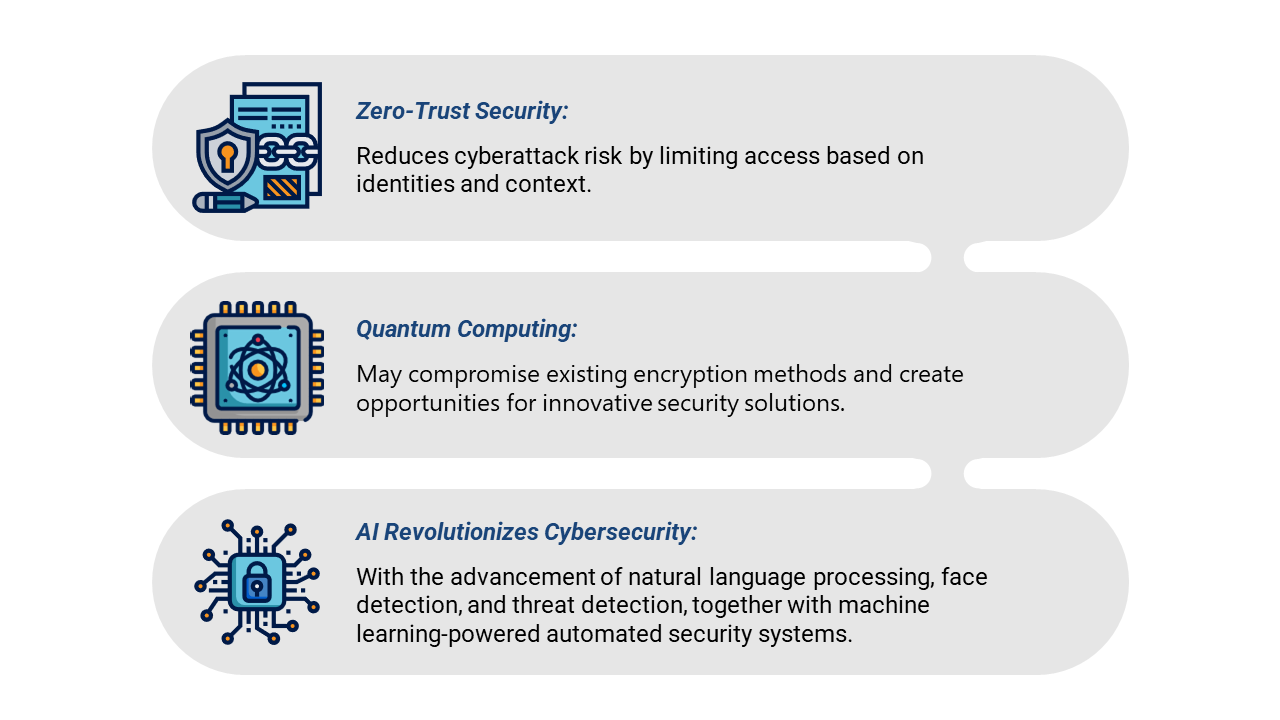

- The adoption of zero-trust security is on the rise. This security model operates under the premise of distrust, assuming no one is inherently trusted, even within the organization. By limiting access to resources and data based on individuals' identities and the context of their requests, this model effectively reduces the risk of cyberattacks for organizations.

- The growing utilization of quantum computing is becoming more prevalent. This emerging technology possesses the capability to compromise existing encryption methods, which could potentially create significant cybersecurity challenges. However, it also offers organizations an opportunity to explore and develop novel security solutions to counter these potential threats.

- The widespread integration of AI across various market segments has revolutionized the field of cybersecurity, especially when combined with machine learning. AI has played a pivotal role in developing automated security systems, enabling natural language processing, facilitating face detection, and automating threat detection.

Sources

“Allianz Risk Barometer 2023: AGCS.” Allianz Commercial, Jan. 2023.

“Cybersecurity - Worldwide: Statista Market Forecast.” Statista. Accessed Jul. 2023.

https://www.accenture.com/us-en/insights/security/state-cybersecurity

“Cost of a Data Breach 2023.” IBM. Accessed July 1, 2023.

“Cloud Computing Market Size, Growth | Trends Analysis [2030]” Fortune Business Insights, May 2023.

“Public Cloud - Worldwide: Statista Market Forecast.” Statista, November 2022.

“Cost of a Data Breach Report 2022.” IBM, Jul. 2023.

“2022 State of Operational Technology and Cybersecurity Report.” Fortinet, Jul. 21, 2022.

“Cybersecurity Quarterly Update: Fourth Quarter 2022.” Houlihan Lokey, 2023.

Shi, Madeline. “PE dealmaking thrives in cybersecurity sector.” Pitchbook, Aug. 23, 2022.

“7 trends that could shape the future of cybersecurity in 2030.” World Economic Forum, Mar. 2023.

Duggal, Nikita. “Top 20 Cybersecurity Trends to Watch Out for in 2023.” SimpliLearn, May 2023.