Share

Introduction: Why Are Strategic Risks Escalating Now?

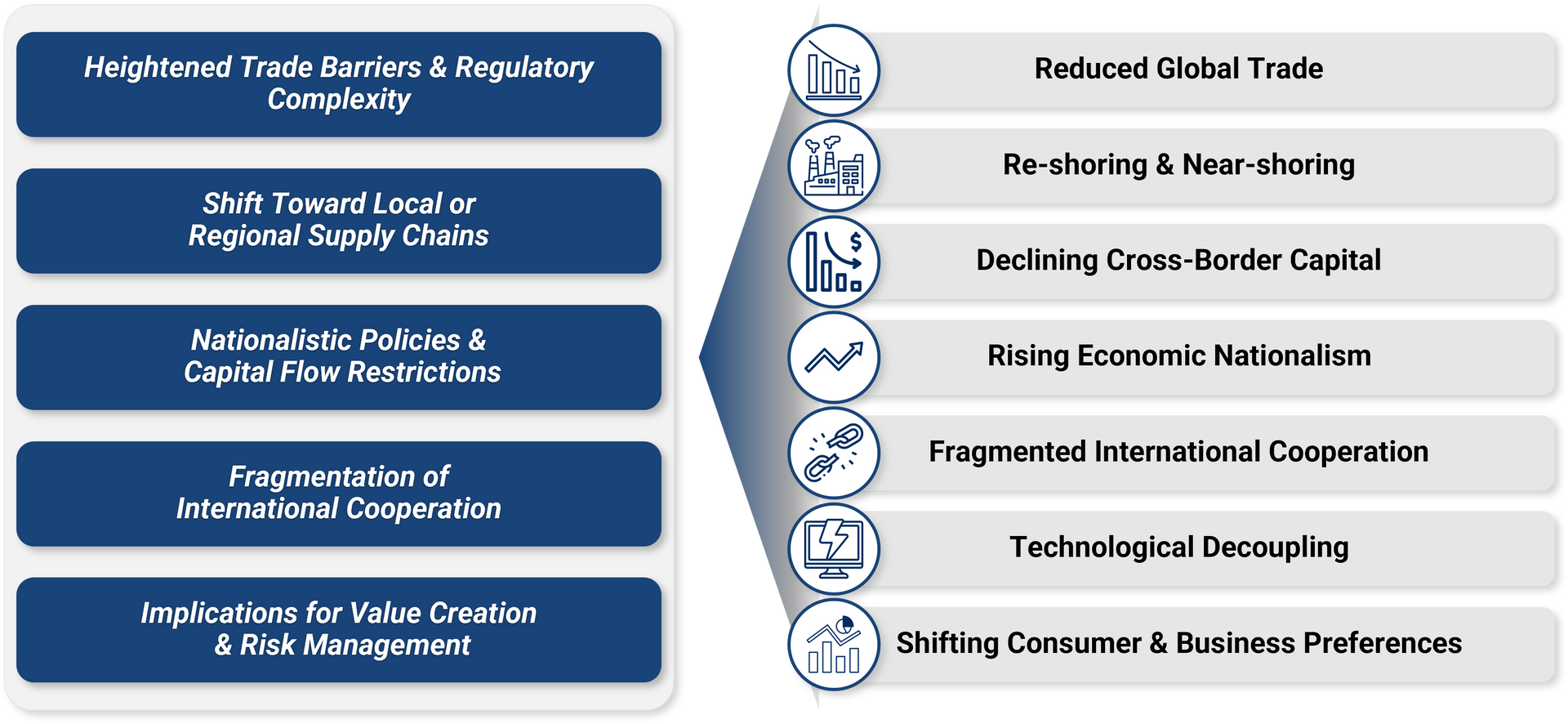

As de-globalization reshapes international trade, supply chains, and investment flows, heightened trade barriers, shifting political alliances, and economic nationalism have become top-of-mind for businesses worldwide. At the same time, sustainability and ESG considerations, which were once seen as peripheral, now feature prominently in everything from regulatory mandates to consumer expectations. Taken together, these forces can significantly affect portfolio company performance particularly for firms with global footprints or cross-border supply chains, where even small shifts in regulation, trade policies, or stakeholder expectations can ripple across operations.

For private equity (PE) deal teams and portfolio company executives, failing to anticipate and address these intertwined risks can quickly erode returns and hinder competitiveness even in the short to medium term. This article introduces Stax’s holistic risk framework, which integrates geopolitical insights with ESG considerations, to help investors navigate an evolving global landscape and protect long-term value.

Defining Strategic Risks: Why Is a New Approach Urgently Needed?

For decades, companies and investors operated in an environment of deepening globalization. Market barriers steadily fell, cross-border cooperation grew, and geopolitical concerns, for the most part, only played a marginal role in business strategy. However, as global tensions rise and protectionist policies gain traction, particularly in the US, the longstanding ‘givens’ of open markets, stable supply chains, and predictable regulatory regimes are no longer assured.

Simultaneously, ESG and sustainability, once viewed as separate or peripheral initiatives, have become integral to strategic planning. As regulatory volatility, geopolitical tension, and shifting stakeholder expectations converge, they can significantly disrupt a company's business model, with impacts spanning the short, medium, and long term. Recognizing these risks and the opportunities they present has become essential to maintaining a competitive edge. Common examples include:

- Regulatory & Policy Changes: New tariffs, tax reforms, labor or climate legislation.

- Geopolitical Shifts: Leadership changes, sanctions, or conflicts that disrupt key markets.

- Market Disruptions: Rapid technological advancements (e.g., AI) and shifting consumer behaviors.

- ESG/Sustainability Factors: Evolving reporting requirements, stakeholder imperatives, and climate pressures.

Identifying Companies Most Exposed: Where Should You Focus?

Certain attributes make a company more vulnerable to strategic risks:

1. Industry & Sector Analysis

Highly regulated industries (defense, energy, tech) often face political and compliance pressures, while high-innovation sectors (fintech, mobility) can be quickly upended by new entrants or technology leaps.

2. Geographic Footprint & Supply Chains

Heavy reliance on single-source suppliers or politically unstable regions magnifies exposure to trade disputes or local crises.

3. ESG & Sustainability Alignment

Businesses without robust ESG frameworks or clearly defined sustainability objectives risk failing to meet emerging standards and can encounter reputational or regulatory challenges.

4. Stakeholder Sensitivity

Consumer-facing brands and companies subject to heightened public scrutiny (whether for labor practices, environmental concerns, or data privacy) are at greater risk of reputational damage.

Integrating Geopolitical & ESG Perspectives: How Do We Turn Risks into Opportunities?

At Stax, we’ve developed a proprietary methodology that merges sustainability frameworks with enterprise risk management, ensuring that geopolitical and ESG factors are assessed within the same lens. Removing these silos helps to reveal synergies that might otherwise go overlooked; for example, localizing production to mitigate geopolitical exposure while simultaneously reducing carbon footprints and aligning stakeholder expectations for more responsible operations.

With this type of integrated approach, strategic risks don’t have to be treated solely as defensive concerns. Actions such as near-shoring, adopting cleaner technologies, or capitalizing on shifting regulations can transform into growth levers provided they are approached holistically.

Where Do You Go from Here?

In a world where geopolitical tensions and ESG mandates will increasingly converge, taking a holistic view of strategic risks is essential to value protection and creation. By proactively identifying, prioritizing, and mitigating these risks, PE deal teams can strengthen portfolio performance even in volatile market conditions.

If you’d like to explore how this integrated approach can be tailored for your needs, please contact us here to learn more.