Share

Summary & Current Environment:

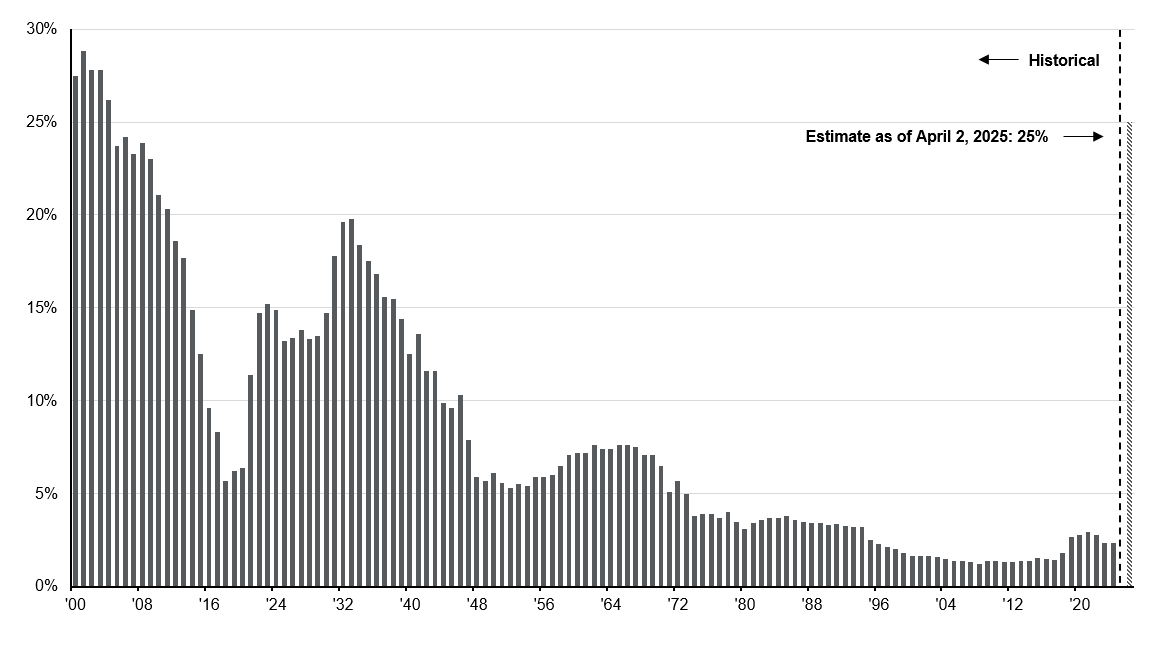

The past 40 hours have provided time to digest the unprecedented tariff actions, which have pushed the effective US tariff rate to 25%, the highest level since 1904.

Immediate market reactions have been significant: interest rates on Treasurys are dropping, credit spreads widening, and inflation concerns rising sharply. The result is an increased likelihood of a stagflationary environment.

Despite some predictions of imminent rate cuts, such actions seem unlikely in the near term. Additionally, the US dollar has weakened, and commodities, notably Brent crude oil, have fallen sharply, nearly 14%, since the tariffs were announced, reflecting the market pricing in an increased likelihood of a recession.

Analysis of Tariff Approach & International Response:

The new "reciprocal" tariffs announced by the administration were unexpectedly high and applied haphazardly, including to small, developing nations and even uninhabited territories. This reinforces longstanding concerns about the administration’s grasp of nuance and the broader implications of such policies.

Consequently, international partners perceive these tariffs as punitive rather than strategic opening positions for negotiation. These actions reinforce the broader trend toward de-globalization as countries increasingly resort to protectionist measures.

China's immediate and robust response, a 34% tariff on select US goods, export curbs on rare earth minerals, import suspensions, and the categorization of certain US firms as "unreliable entities," sets the stage for prolonged tensions. Simultaneously, other nations are coordinating retaliatory tariffs and strategically shifting trade relationships away from the US, as they perceive America to be an unreliable trade partner.

Forward-looking Impact on Global Trade & M&A Activity:

Given the heightened uncertainty, we anticipate a short-term slowdown in global M&A activity as companies pause to assess the evolving trade environment. Deal-making will likely resume once a clearer "tariff equilibrium" emerges, though recovery will vary significantly by region and sector.

For private equity firms and their portfolio companies, the implications are multifaceted. Increased operational costs due to tariffs can erode profit margins, particularly in sectors with complex international supply chains, potentially leading to lower valuations and extended due diligence processes. Industrials will likely face considerable margin pressures from higher raw material and component costs. Consumer goods sectors may experience reduced demand due to higher prices passed on to customers. Conversely, sectors such as healthcare, business services, software (less impacted) and IT hardware (likely impacted), and events, generally less exposed to tariffs on physical goods, may present more resilient investment opportunities (although there are ongoing impacts to healthcare from cuts in government spending).

PE firms should strategically assess portfolio vulnerabilities, consider nearshoring to reduce risks, and enhance operational efficiencies to mitigate potential impacts.

As the global trade environment continues to shift, staying informed and proactive will be critical. Our team remains available to support clients navigating these challenges, whether through strategic risk assessments, sector-specific insights, or tailored guidance. If you are evaluating potential exposures or considering how these dynamics might impact your investment or business strategy, we welcome a conversation.

Source: Goldman Sachs Investment Research, United States International Trade Commission, J.P. Morgan Asset Management. For illustrative purposes only. The estimated weighted average US tariff rate includes the latest tariff announcements, even if they are not fully in effect yet. Estimates about which goods are USMCA compliant come from Goldman Sachs Investment Research. Imports for consumption: goods brought into a country for direct use or sale in the domestic market. Figures are based on 2024 import levels and assume no change in demand due to tariff increases. Forecasts are based on current data and assumptions about future economic conditions. Actual results may differ materially due to changes in economic, market, and other conditions. Data are as of April 2, 2025.