Share

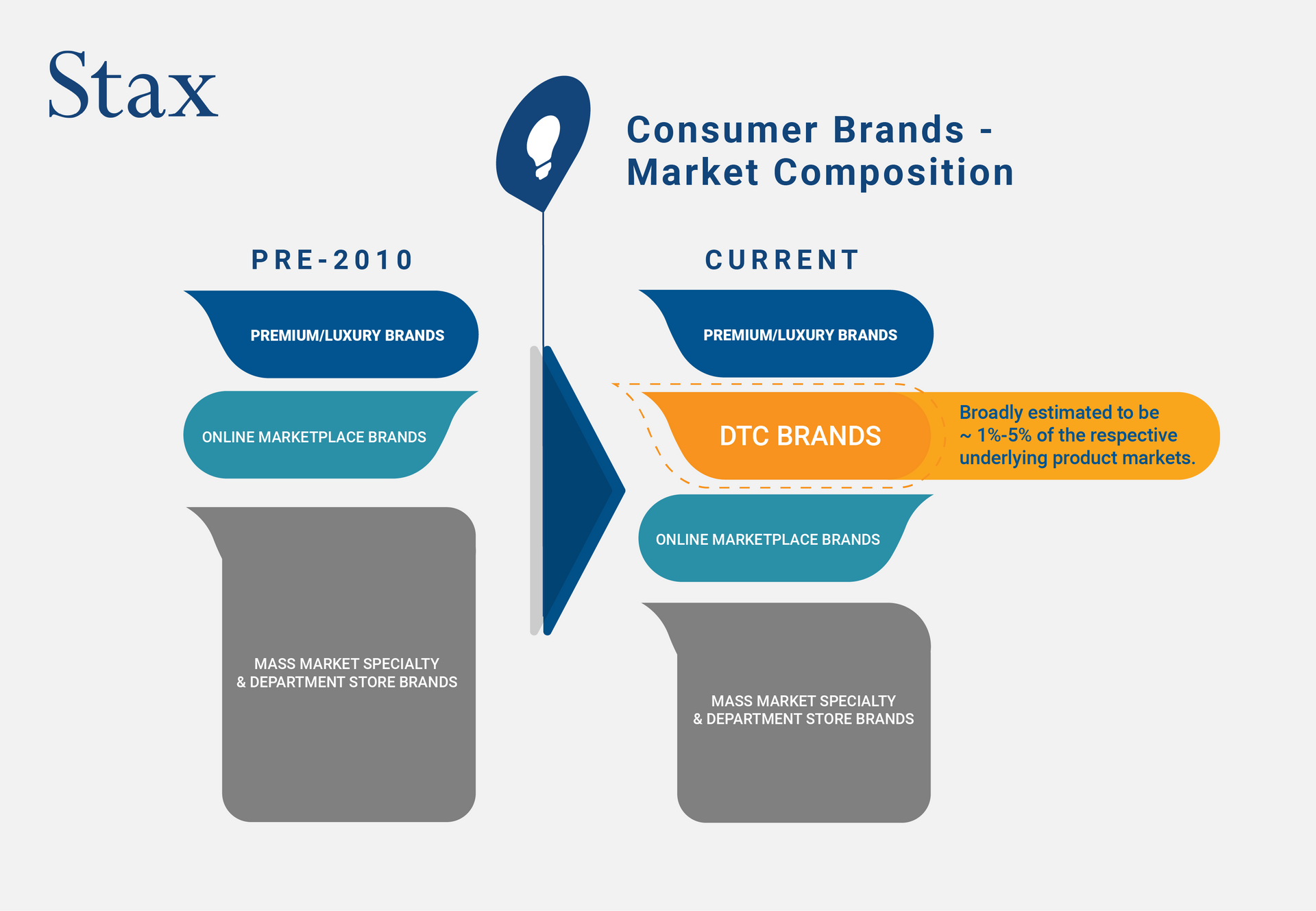

Modern digitally native direct-to-consumer (DTC) models enable consumers to purchase products directly from the brands and eliminate the middlemen, such as wholesalers, distributors, brick and mortar establishments and large retailers. While the origins of modern-day DTC can be traced back to pre-2000s, it wasn’t until after the great recession that DTC startups started making inroads and have attained scale. These brands were buoyed by the growth of online marketplaces such as Amazon and Wayfair, as the new consumer became comfortable with online purchases.

Flash forward to the 2020s, the DTC market grew substantially as consumers shifted purchases online even in categories such as furniture, home décor, and food which were traditionally considered as ‘ecommerce resistant’. So even though the broader economy went through a recession, DTC markets were generally insulated despite the pandemic-induced shift to online purchases as well as the underlying growth in discretionary income, coupled with consumers spending more time at home (and researching more online).

With current market uncertainty, we revisited our recent experience in the DTC markets, as well as the longitudinal trends gathered through Stax’s history of work in the broader consumer and retail markets to help investors understand how a potential future recession will impact this space.

A future potential recession could likely be the first-time current DTC brands will face challenges similar to the traditional business models. We would expect DTC to trend more in-line with the underlying product markets in which they operate. As DTC models have matured, they have expanded into more channels / product categories and become more aligned with the larger competitive landscape and the pressures faced by those businesses in a recession. Traditional businesses, on the other hand, have also adapted their strategies to gain a foothold in eCommerce channels (typically the primary area of competition for DTC).

DTC Market and Key Strategies

That said, the trend is clear – DTC brands as a whole will continue growing, similarly to the broader market shifts from traditional department and specialty retailers to those primarily focused on online platforms. The key differentiators for the DTC brands (vs. their other online counterparts) are that they typically employ the following key strategies:

- Obsessive focus on the customer experience to ‘wow’ the customers and build an engaged, loyal customer base that drives repeat businesses while also developing strong brand equity

- While Warby Parker offered price-accessible and high-quality prescription glasses, its success can be traced back to an in-depth focus on offering a frictionless customer experience from accessing the website to understand the offerings to placing an order by including the relevant prescriptions, all supported by top-notch customer service

- Even when faced with adversities, these companies never lose focus on putting the customer first – as demonstrated by the recent apology sent by Graza (DTC brand offering affordable high quality olive oil) to all its customers due to its delivery mishaps during the peak holiday season

- Deep digital engagement to communicate its brand messages to a targeted community of consumers and further enhance its reach through ‘word-of-mouth’, while still using social media and digital tools to build the top of the funnel

- Allbirds uses social media for new product launches and collecting consumer perspectives on product development so that sales pitches are targeted to its core customer segments and with on-time messaging – all while limiting customer acquisition costs

- Glossier, a beauty and personal care products brand, shares its customer content on daily skincare routines across its channels thereby generating strong affiliation / connections with its customers at a personal level

- Targeted product offering typically starting from a niche product to establish the brand and then expanding into natural adjacencies:

- Casper started with mattresses and when adding new products, still maintained its focus on bedroom furnishings and accessories

- Harry’s started from shaving products and then built out its offerings for the personal care and facial grooming market

- Continued focus on growing its brand awareness by strategically expanding its channels while still maintaining its digital roots:

- Parachute's retail strategy is focused on building consumer education / awareness of the brand by locating in select premier shopping avenues rather than a primary source of retail sales

- Sugarfina added pop-up locations at select Nordstrom stores to supplement its brand building efforts and only added retail ‘boutiques’ after achieving meaningful scale

Recent Consumer Shifts Supporting DTC Growth

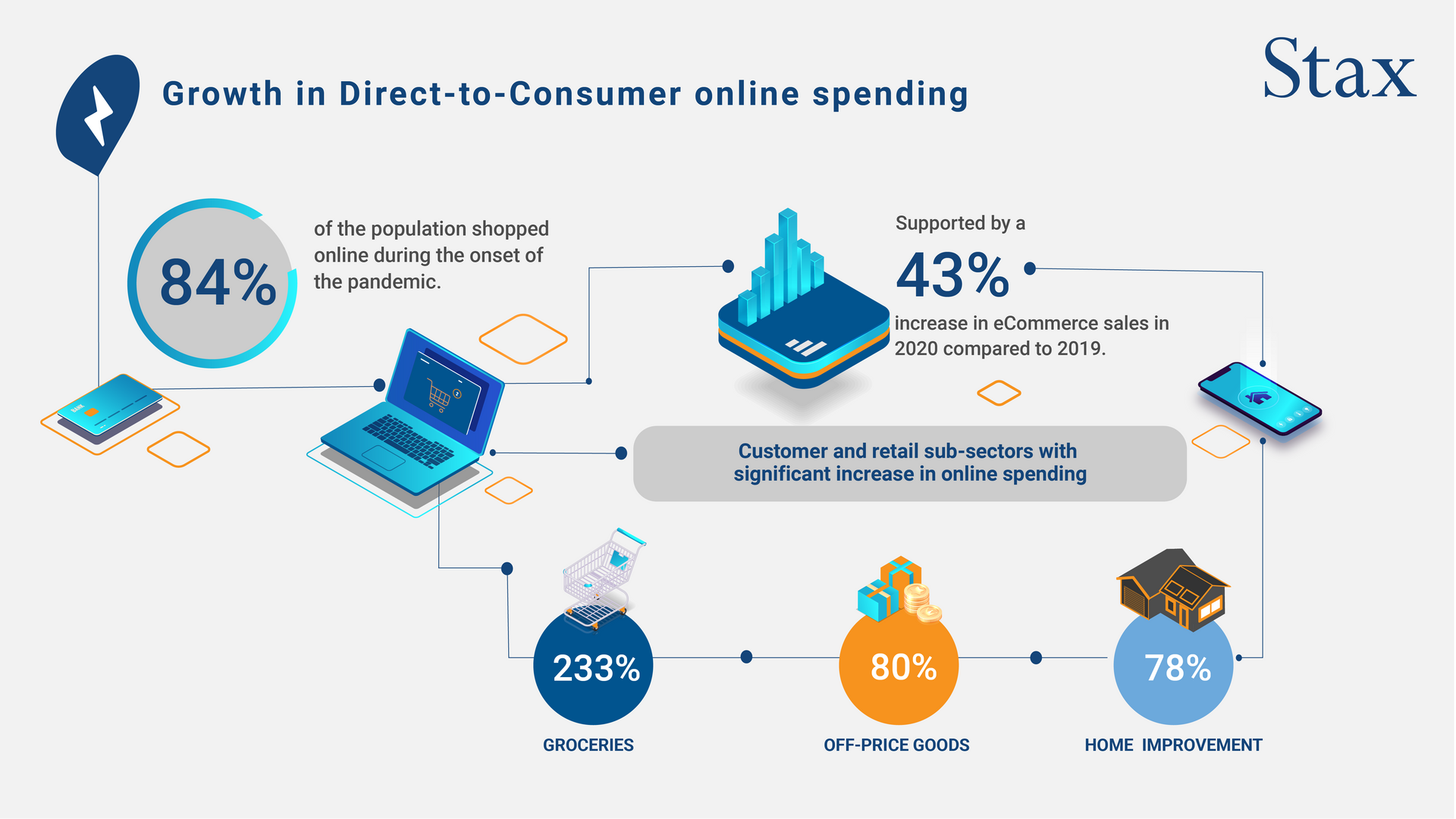

Consumer spending habits shifted during the pandemic as more consumers began to shop online— boosting demand for D2C brands. According to the Annual Retail Trade survey, e-commerce sales increased by 43% in 2020 compared to 2019 and at the onset of the pandemic, meaning nearly 84% of consumers shopped online. Online spending grew significantly across customer and retail sectors with YOY growth in online spending for groceries, off-price goods, and home improvement sub-sectors increasing by 233%, 80%, and 78%, respectively.

Online purchases gained share over traditional retail across all categories, and the bulk of these share gains are expected to be permanent. The pandemic, in essence, provided a one-time lift in online share growth while still maintaining the longer-term trend. For instance, online furniture sales received a 5-10PP bump in share and is expected to continue the pre-pandemic share gains of 1-2PP for the foreseeable future. Similar trends are seen in product markets as varied as cookware, home furnishings, home décor, fashion, and several others that were traditionally seen as ‘ecommerce resistant’.

More importantly, consumer awareness of DTC brands increased substantially yielding conversion to more purchases from DTC brands during the pandemic. Our case work in fashion, furniture / furnishings, home décor and other related spaces showed that as consumers were forced to move away from their traditional sources of purchase, they researched more, spent more time online, and as a result came across more DTC brands than otherwise in the purchase journey. In particular, millennials and high-income earners shopped more online across all retail categories than other consumer segments. These trends also ensured that customers experimented with more new concepts and further boosting newer DTC brands.

All of this is to say that the shifts to online are sustainable and provide a great foundation for continued DTC growth in the future. Across our consumer / retail studies, we have seen future consumer intent to purchase from DTC brands from 5% to 60%+, depending on the underlying product category.

Market Headwinds

A key driver of DTC success historically has been brands’ ability to deliver price-accessible products through a convenient, easy-to-use website that also allows consumers to customize and get better control of their purchases.

As the DTC model matured, traditional competitors evolved focus to provide an omnichannel (including ecommerce) presence thereby appealing to the same consumer needs. These players are much more competitive to the DTC brands today than ever in the past.

- For instance, during the pandemic, several legacy brands shifted focused more on online DTC sales. PepsiCo launched Pantryshop.com and Snacks.com for consumers to directly order products. Kraft Heinz also launched its “Heinz to Home” website to offer its products directly to consumers. Impossible Foods also created a DTC website during 2020 to help bring their food to more homes.

- Much before the pandemic, Nike had already begun to shift its sales to the online DTC model. The pandemic provided an additional boost with DTC accounting for more than 35%-40% of sales currently, as compared with ~15% in 2011.

Further, there has been a significant proliferation of DTC brands over the last 5 or so years. Given rising focus on online purchases and lower barriers to entry in the DTC segment, some categories have seen more 800-1000+ new brands popping up in short timeframe. This places a premium on the brand’s ability to differentiate itself from multiple others with similar or overlapping niches.

Recent shifts have also transitioned industry-wide marketing dollars to online channels, and with more business demand, the traditionally lower customer acquisition costs have also gone up substantially, particularly when using platforms such as Facebook ads, Instagram, and other social media advertising / SEM tactics.

While more transitionary, the pandemic-induced supply chain issues have also driven up shipping and import costs, with DTC brands most heavily impacted by this given their reliance on lower cost manufacturing overseas.

These headwinds have also impacted market stalwarts like Warby Parker, Allbirds, and Stitch Fix, all of which faced declining profits in 2022.

Conclusion

While DTC may have a good track record so far, the impact of a recession is likely to depend on the product category. Brands that sell more essentials are likely to perform better during the recession vs. brands that primarily sell non-essentials, and price will gain in importance across consumer segments.

However, based on our experience, there are other key traits of DTC that may also define those that are better place to survive (or even thrive) vs. those that fold during the next recession.

- Highly engaged and loyal customer base, that serves as ambassadors for continued growth and word-of-mouth awareness for the brand

- Deeply ingrained customer centricity that allows the brand to continually ‘wow’ the customers and differentiate itself from the broad landscape of consumer / retail brands

- Well-defined target customer segments to focus brand messaging and product targeting

- Product innovation and continued evolution of offerings within natural adjacencies that allow the brand to meet evolving consumer needs and yet maintain brand focus

- Evolution of delivery models, such as subscriptions, buy-now-pay-later or rental offerings, that ease upfront cost of purchase for customers while limiting the need for discounting and sales promotions

- Physical store footprint strategy that focuses more on generating awareness and brand building rather than focusing primarily on driving store-level sales

- Financial stability to weather near-term headwinds, in a market where new brands pop up every day but most are yet to attain scale and / or profitability

About the Author

Sameer Tejani is a Director at Stax, with over 12+ years of experience in helping corporate and

private equity clients solve their most critical business challenges and position companies to deliver

sustainable profitable growth. Sameer’s experience includes advising client organizations across multiple industries with a focus on developing

data-driven and actionable strategies that impel management action.