Share

LP priorities underpin the need for ESG within Private Equity and across Capital Markets

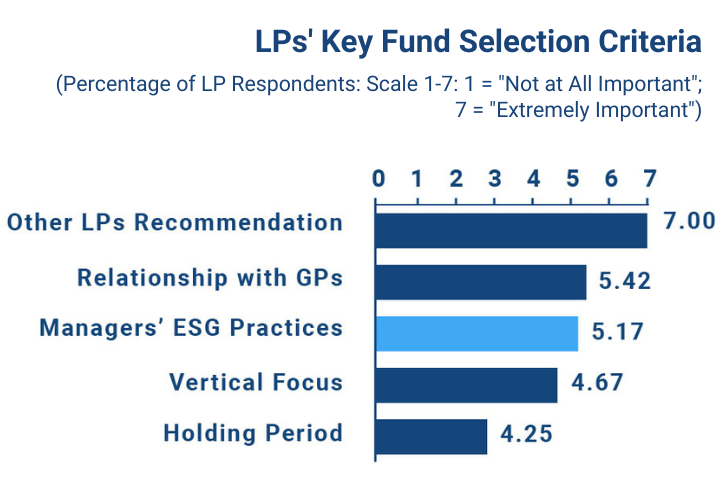

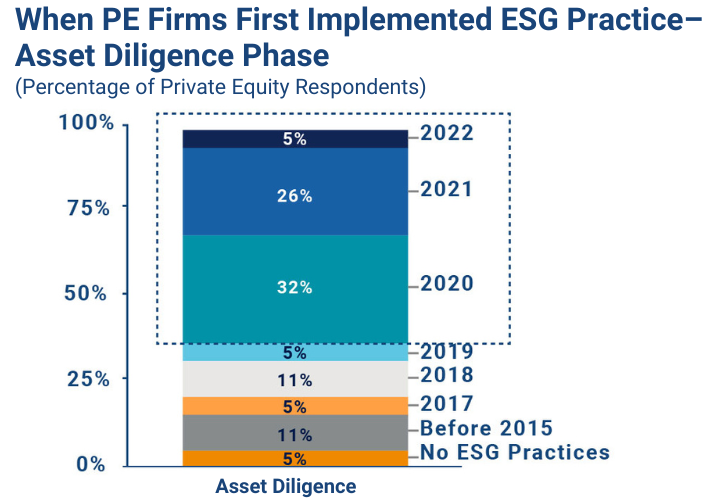

ESG assessments within capital markets have traditionally been viewed as “check-the-box” exercises for private equity firms and other asset managers to satisfy the needs of their Limited Partners (LPs) - pension funds, endowments, foundations, and other institutional asset owners. LPs increasingly view ESG concerns as existentially impacting the long-term growth outlook of the capital they are responsible to grow for their beneficiaries – pensioners, university administrators, etc. This trend has accelerated since 2020 (Figure 1), with climate, social, and data privacy/security issues ballooning over the last few years. As a result, LPs have increased pressure on their asset managers to consider ESG factors, which has reverberated across the entire capital markets ecosystem from PE firms and investment banks through to individual portfolio companies.

Private Equity firms have responded to LP ESG demands, though to varying levels of maturity

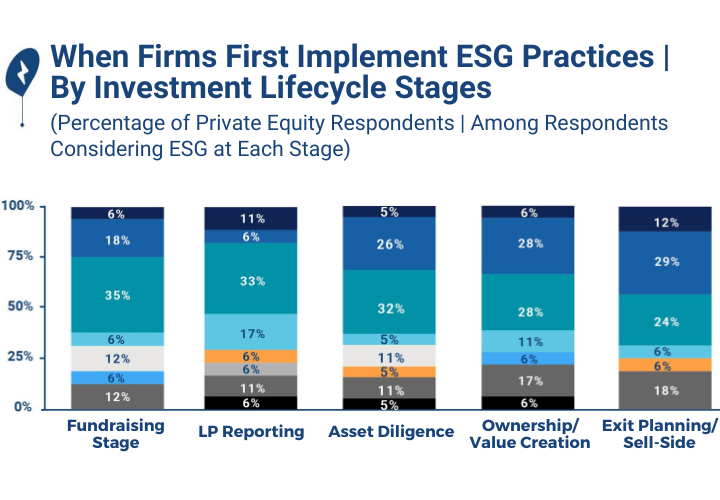

PE firms have responded to LP pressure in turn by professionalizing and expanding the scope of their ESG assessments beyond simple box checking and are now fully integrating an ESG vision into their firm strategy (e.g., fundraising, firm-level reporting) and investment processes (e.g., pre-investment screening, diligence, value creation, exit planning) (Figure 2).

The maturity of ESG practices varies significantly across the PE industry. Fully mature firms have standard ESG policies and procedures across each stage of the fund/investment lifecycle, with a dedicated team tasked with executing ESG work. Less mature ESG firms, on the other hand, frequently consider ESG factors but perform a lighter-touch effort (e.g., standard checklists) with few or no dedicated resources.

Maturity of ESG practices varies by firm size, target investment size, and vertical/geographic focus. In addition, a firm’s LP relationships and fundraising processes correlate significantly with that firm’s level of ESG maturity; firms working with the largest, most strict LPs, as well as those with frequent and more recent fundraising experiences (e.g., larger firms with many funds), tend to be the most responsive to LP needs due to the closeness of their partnerships. Most large-cap funds have an ESG philosophy and/or practice built into their fund strategy, with many mid-market funds increasingly following suit as they head out for their next round of fundraising.

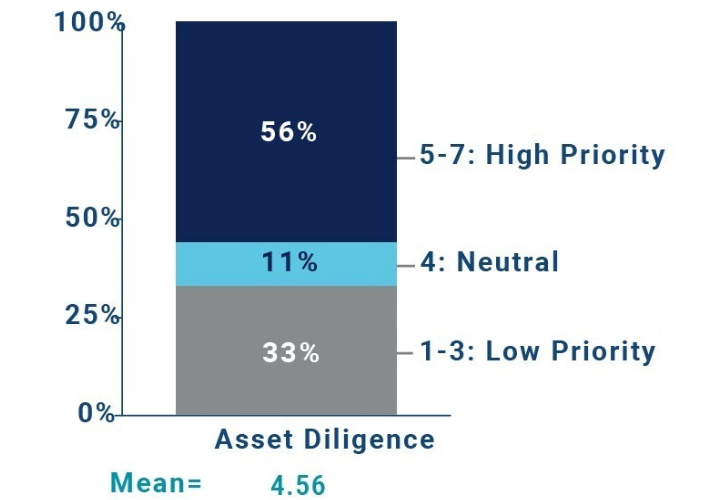

Across all maturity levels, PE firms are focused on professionalizing their ESG practices

Improving ESG practices is a significant priority for a majority of PE firms. Those at the top level of maturity today strive to maintain competitive differentiation in fundraising and investment processes by implementing already-strong ESG best practices more broadly across the firm. Less ESG-mature PE firms are newly adding ESG processes and talent as they feel pressure both upstream (i.e., LPs) and downstream (i.e., portfolio companies seeking support).

Priority of Improving ESG Practices - Asset Diligence

(Percentage of Private Equity Respondents:

Scale 1-7: 1="Low Priority"; 7="High Priority")

In addition, investment banks have begun to highlight ESG-focused content through investment materials (e.g., CIM, third-party market reports) in response to the rising LP/PE demand for ESG metrics and analyses in deal processes. This is especially true of banks serving the mid-market that find resource-constrained deal teams looking to quickly and easily make decisions based on key material concerns. This trend is expected to continue moving forward, with over half of transactions expected to have an ESG component by 2025 (Figure 4).

As ESG continues to evolve, PE will place emphasis on strategic factors underpinning business performance

ESG traces its origins to earlier movements of investors considering sustainability and social factors in investment decisions – from exclusionary industry criteria (e.g., guns and tobacco) to Corporate Social Responsibility (CSR). However, a majority of today’s ESG practices differ in that analyses are predominantly focused on understanding the material impact of ESG factors on an asset’s bottom line, rather than advancing a particular agenda. While elements of ESG are caught in a political bind today – with states such as Texas and Florida banning the consideration of ESG factors in their state pension funds – at their core, ESG practices are financial. A resilient/sustainable supply chain, satisfied employees, and tight governance policies all lead to better business performance.

These concerns and issues are only growing over time. As the culture of ESG in investing matures, the shape ESG is likely to take will continue evolving, but the growing prevalence and materiality of Environmental, Social, and Governance concerns supports a healthy long-term outlook for ESG in private equity.