Share

Healthcare relies significantly on the pharmaceutical industry, which is made up of critical functions including research, drug development, manufacturing, and distribution. Recent years, particularly during the pandemic, have witnessed remarkable growth in this industry. Notably, the U.S. leads the global market, generating an impressive $631B in revenue in 2022, surpassing the combined earnings of the next ten largest markets. The industry is diverse, comprising biotechnology companies, drug manufacturers, and wholesale and distribution firms—each contributing to the sector's vitality.

Revenue Model

Inside the pharmaceutical industry, a well-defined revenue model drives innovation and growth. This model comprises three fundamentals that define how pharmaceutical companies generate income and sustain their operations. From the discovery and sale of essential medications to cutting-edge research and development endeavors and strategic alliances, the pharmaceutical sector's revenue model is a dynamic framework that underpins its global impact.

1. Discovery and Sale of Products: Encompasses the development and distribution of both affordable generic drugs, which provide alternatives to brand-name medications, and essential bulk drugs, serving as active pharmaceutical ingredients (APIs) in pharmaceutical manufacturing.

2. Research and Development (R&D): Pharma companies foster collaborations, partnerships, and licensing agreements with academic institutions, biotech firms, and peers. These collaborations yield upfront payments, milestone payments, and royalties from successful drug and technology development.

3. Strategic Alliances: Co-promotion of third-party drugs to extend market reach.

Outlook, Trends, and Drivers

The pharmaceutical sector is poised for transformation, marked by pricing pressures and a shift towards prevention, accurate diagnosis, and lasting cures. As healthcare demands rise and budgets tighten, cost control becomes paramount, driven by calls for drug pricing transparency. This transformation challenges the traditional fee-for-service model and fuels innovation, enabling healthcare practitioners to predict diagnoses accurately. This shift signifies a move from symptom management to proactive prevention and comprehensive cures, rendering temporary relief an outdated concept. Key trends and drivers of this include:

1. Specialty Drugs Outpacing Traditional Drugs

Specialty product growth exceeded traditional products in 2022, accounting for 51% of total non-discounted spend. Cancer is poised for significant attention in specialized drug development and is expected to be a major driver of increased drug spending over the next five years. Global expenditure on oncology-related products is projected to grow approximately 13%-16% through 2027.

2. Greater Integration of Technology

Pharmaceutical companies and medical device manufacturers are teaming up with technology firms to bring innovation to healthcare. For example, Medtronic and Qualcomm are collaborating on a continuous glucose monitoring system that provides insights for patients and healthcare providers. This partnership aims to improve diabetes management.

Wearable technology is also going beyond its traditional roles. It's not just about making and selling drugs, but also giving patients more control and insight over their health condition. Roche, a multinational healthcare company, combined its mySugr app with the Accu-Chek Guide glucose meter, offering a better way for people with diabetes to manage their condition.

3. Growing Utilization of Artificial Intelligence (AI) and Machine Learning

The pharmaceutical sector is being reshaped by AI, leading to significant advancements in drugs, trials, and supply chains. For instance, Boehringer Ingelheim, a leading pharmaceutical company, collaborated with Insilico Medicine to utilize AI for repurposing existing drugs, discovering new therapeutic applications, and expanding their current portfolio. AI also holds great promise in providing personalized treatments for chronic diseases like cancer and pulmonary fibrosis. This would include the development of customized drug combinations tailored to the unique genetic profile and disease progression of each patient.

4. Shift towards Personalized Medicine

Personalized medicine looks at a person's unique genetic makeup, lifestyle, and environment to tailor customized treatment plans. Advancements in Genomics and Bioinformatics have empowered researchers to discover genetic markers, enhancing their ability to predict a patient’s response to specific drugs, resulting in more precise and effective treatment techniques.

Biotechnology firms like Agilent Technologies and Bi-Rad Laboratories are leading the way in offering personalized medicine services, including DNA sequencing and analysis tools.

5. Growing Adoption of Immunotherapies

Immunotherapy drugs are increasingly used to treat various types of cancer. Pharmaceutical companies are also exploring their potential to address and prevent chronic conditions like diabetes, heart disease, Parkinson's disease, and Multiple Sclerosis.

For example, Cardiovax, is working on immunotherapies for atherosclerosis. These therapies may also help predict the risk of heart attacks.

While other companies like Prothena and Roche are collaborating to develop immunotherapies aimed at slowing down the progression of Parkinson's disease. These therapies target a specific protein believed to be involved in the disease's onset and advancement.

Regulatory Landscape

The 2022 Inflation Reduction Act (IRA) impacts American pharmaceutical companies, exerting pressure on specific product profitability. It allows Medicare to negotiate drug prices and mandates rebates for price increases beyond the inflation rate. Further expansion of drug eligibility for price negotiations is anticipated.

M&A Overview/Trends

In contract research organizations (CROs), contract development and manufacturing organizations (CDMOs), as well as MedTech companies, private equity firms have shown a keen interest. The shift from public to private ownership is often driven by lower public valuations. Additionally, pharmaceutical M&A are increasingly influenced by a focus on specialized treatments and gaining knowledge in genomics, diagnostics, and digital health.

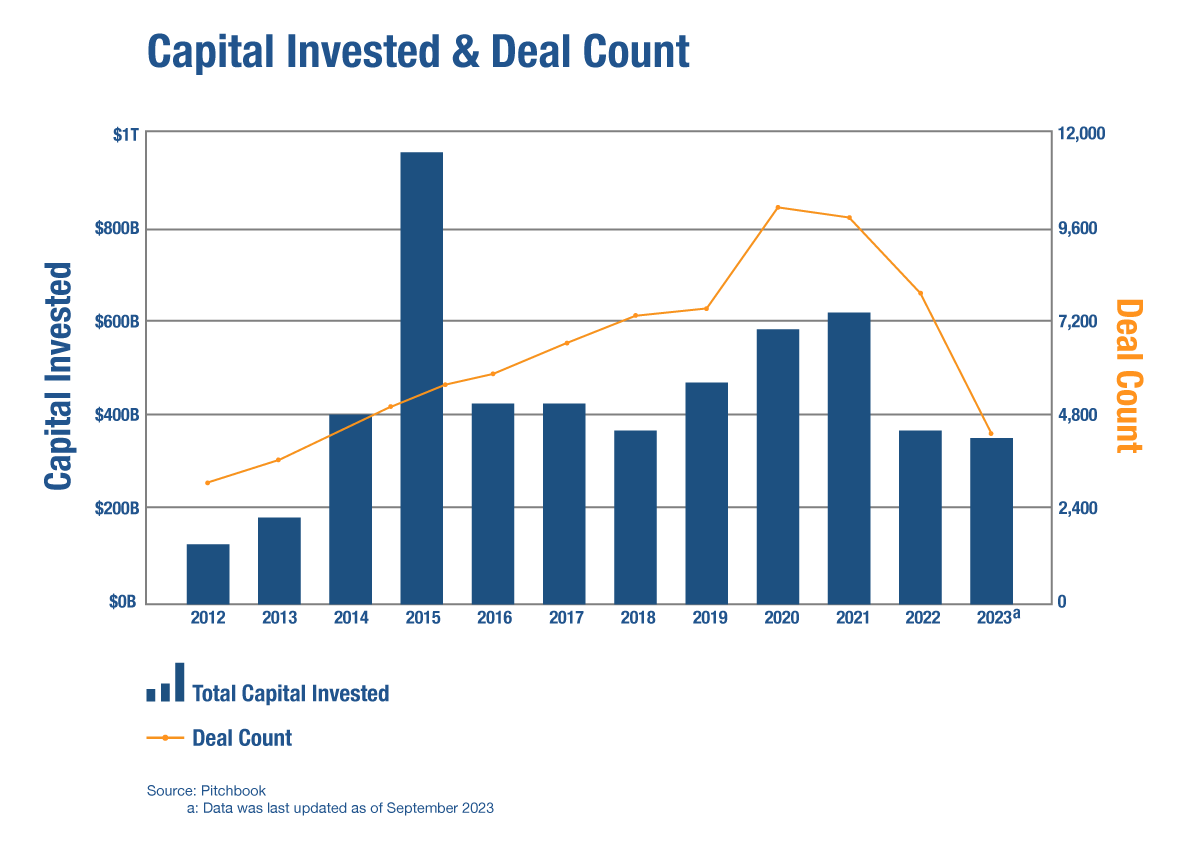

Data on pharmaceutical and biotechnology M&A activity through Q3 2023 suggests a potential year-on-year increase in total capital invested for 2023 compared to 2022. This trend is particularly noteworthy given a concurrent decrease in deal count. This pattern may indicate a shift towards larger, potentially more impactful transactions within the pharmaceutical industry.

Conclusion

The pharmaceutical industry continues to evolve, driven by innovation, technology, and a commitment to improving global healthcare. Stax has deep expertise within the pharmaceutical industry, providing invaluable insights to both investors and businesses alike. Project-related experience includes comprehensive market analyses, identifying promising investment opportunities, and delivering data-driven insights. The firm serves a diverse range of investor interests, with a particular emphasis on upstream assets, including input suppliers and manufacturers.

Sources

- KPMG. “Pharma outlook 2030: From evolution to revolution,” KPMG, Feb. 2017.

- PWC. “Next in pharma: Thriving in 2023,” PWC, 2023.

- PWC. “Global M&A Trends in Health Industries: 2023 Mid-Year Update,” PWC, 2023.

- Richards, Robbie. “8 Pharma Healthtech Trends to Watch in 2022,” Masschallenge, May 31, 2022.

- Herpel Kurt. “The Transformative Role of AI in Pharma – An Exploration,” Delta4, Jun. 20, 2023.

- Biggs, Scott, Doug Long. “Insights Into the 2023 U.S. Pharmaceutical Market,” IQVIA, Jul. 25, 2023.

- Myshko, Denise. “Specialty Pharmacy Trends to Watch in 2023,” Formulary Watch, Jan. 23, 2023.

- Mediwin. “The Future of Pharma Industry Trends and Innovations,” Mediwin Pharmaceuticals, Aug. 24, 2023.

- Fitch Wire. “U.S. Pharmaceutical Companies Under Growing Legislative and Regulatory Pressure,” Fitch Ratings, Jul. 27, 2023.

- GEP. “Mergers and Acquisitions in the Pharmaceutical Industry,” GEP, Feb. 14, 2023.