Share

The demand for HOA management services is on the rise, driven by the growing number of community associations and the increased density of residents within these associations.

Since Covid, the market has seen a shift in the HOA management space, including increased complexity, growing demand for digital services, and the tightening of regulations—all of which are pushing homeowners to outsource HOA management services in order to simplify processes and adopt digital solutions to help drive internal efficiency. In addition, the HOA management services market continues to display high resilience during market downturns, largely due to the criticality of these services to community operations.

For these reasons, among others, Stax believes the HOA management services sector is highly attractive space for investors and presents multiple avenues for growth. In the following sections, we will delve deeper into the market dynamics of the HOA sector and unpack the provider landscape.

Market Overview

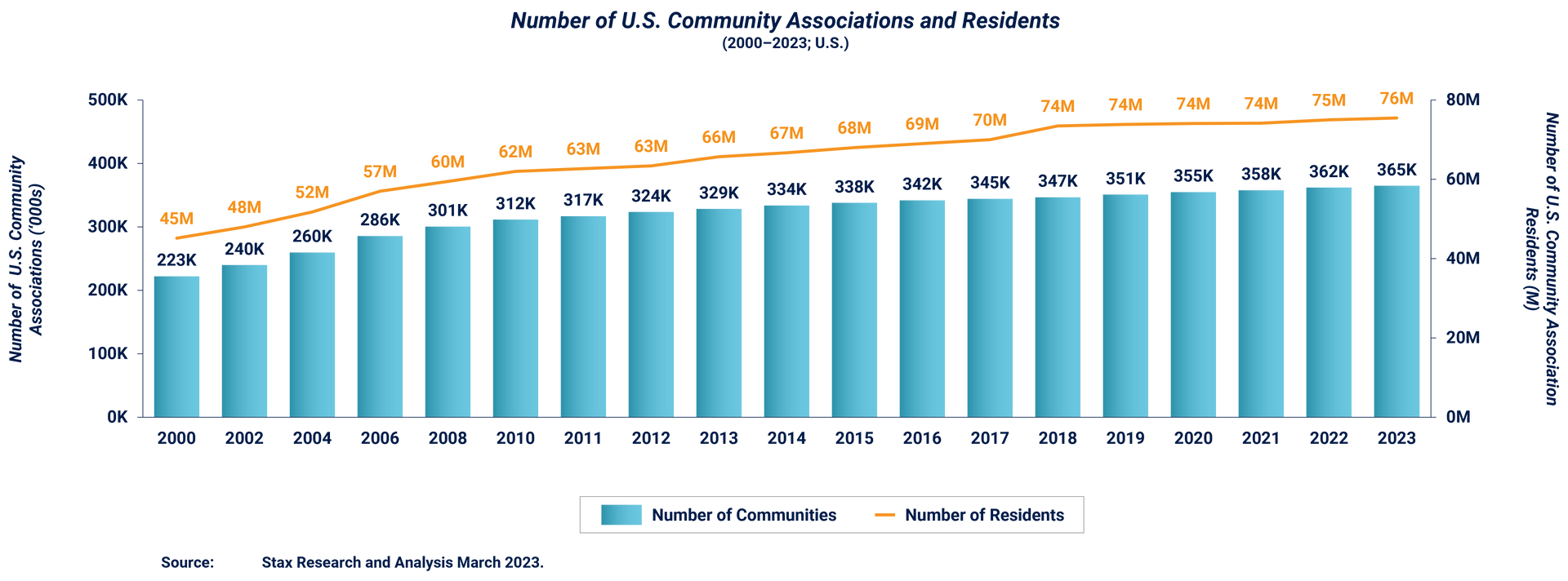

As the number of community associations and density of residents within these associations increase, demand for HOA management services continues to grow.

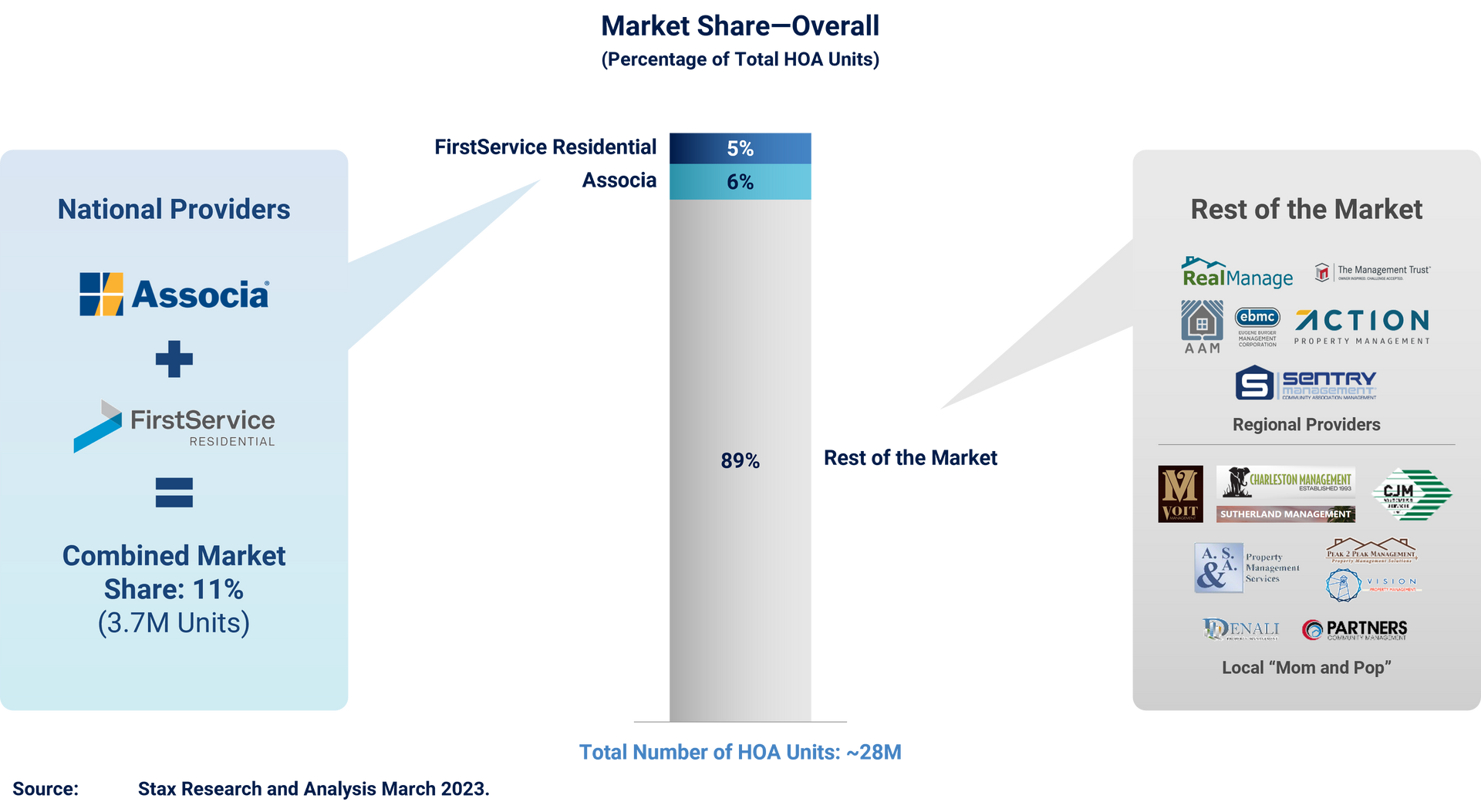

The residential property management market segments into rental and HOA management service providers, with skillsets and relationships differing between segments. Both segments are highly fragmented with a few major players that are followed by a long tail of smaller, regionally-focused providers.

Rental Management vs. HOA Management

Most rental property managers are primarily focused on building relationships with real estate developers and owners. These managers will typically develop and manage properties, both as a direct owner and for third parties, and offer a variety of property management services such as on-site maintenance and management, real estate development, etc.

Examples: FPI Management, Greystar, Lincoln Property Company

HOA management service providers tend to focus on developing strong relationships with HOAs and their board members. These companies typically act as third-party property management for communities with HOAs but are not involved in real estate development. Core offerings typically include back-office support, on-site maintenance and management, and community relations / conflict management.

Examples: Associa, FirstService, RealManage

HOA Management Demand Drivers

Post-Covid, homeowners continue to outsource HOA management services to simplify processes and adopt digital solutions, driving internal efficiency.

Growing Complexity of HOA Management

Due to an increasing number of community associations and increasing density of residents in HOA communities, the HOA management market is becoming more complex. In a recent report, The Foundation for Community Association Research reported that the number of community associations in the U.S. reached 365K in 2023 with a record 76 million Americans residing in a community with a homeowner’s association or condominium board. As HOA management becomes more involved, board members will continue to outsource HOA management responsibilities to a third-party provider, driving efficiency and simplifying internal processes.

Increasing Demand for Digital Services

The pandemic and shifting demographics of homebuyers has accelerated adoption of technology in the HOA management space, driving HOAs to continue to outsource operational tasks, but with a preference for them to be completed digitally. For example, a study by Buildium estimated that 70% to 90% of association board members preferred community association managers to handle key operational processes digitally, allowing HOAs to operate efficiently without the need to be physically present.

Further, a 2022 report by the National Association of Realtors reported that 43% of new home buyers were millennials, comprising the largest share of home buyers in the U.S. As the number of millennial homeowners increases, experts expect an increase in the number of homeowners who are likely to request technology-based HOA management processes from their community management provider.

Tightening Market Conditions

As a result of Covid, the market has seen a variety of regulatory changes, mostly at the state and local level. Over the past 3 years, homeowners and landlords have experienced eviction moratoriums, paused mortgage payments, online / virtual homebuying processes, and increased property taxes. These shifting regulations create bottlenecks in HOA management processes as homeowners continue to outsource property management responsibilities to ease the burden on HOAs and board members. Core services drive the bulk of industry revenue, but HOA management companies are trying to vertically integrate with maintenance services.

Management fees typically take up a small portion of the total HOA budget, with maintenance and operations comprising the largest share.

Additionally, the HOA management services market is resilient during economic downturns given community management services are often seen as essential by HOAs that do not have the capacity to manage communities in-house. Further, HOAs may be entrenched in providers’ systems and technology tools making it difficult to discontinue. Stax’s research has found on average HOA management service providers can expect a relatively small decline (2%-3%) in annual spend during an economic downturn.

Though generally stable, smaller HOAs with the ability to self-manage may choose to do so during an economic downturn due to budget constraints. While difficult to completely discontinue, larger HOAs may look to reduce property manager hours from a full 5-day week to reduce HOA management spend if needed.

In line with this, there are different HOA management provider types that are utilized depending on the size, location, and complexity of the HOA:

Local “Mom and Pops”

- Highly localized providers.

- Very fragmented market segment.

- Typically manage under 50 communities in total.

- Value proposition is boutique, community-focused service, and local brand equity.

- Difficult to compete with larger providers on price.

Regional, Mid-Sized Providers

- Maintain strong presence within a given state or region.

- Relatively fragmented segment.

- Served by landscape of providers that have seen success and executed roll-ups on smaller scale, often retaining local brands which carry value in the region.

- Value proposition is personalized service with added efficiencies from centralized functions.

Large, National Providers

- Maintain strong presence nationally.

- Consolidated market dominated by Associa and FirstService Residential.

- Value proposition is increased efficiencies through centralized systems and controls and brand reputation.

- Able to drive down prices in the market, putting pressure on smaller providers.

National providers such as Associa and FirstService are the major players in the market, followed by other local/regional providers. There is a very long tail of smaller regional/local competitors in the HOA management market. The vast majority of providers are small operations serving fewer than 500 communities apiece. As such, there is significant opportunity for continued growth through roll-ups of both regional and ‘mom and pop’ providers.

Conclusion

Stax has substantial experience across the HOA and property management investment landscape, and believes this is a highly attractive market for investors, today and in the future, driven by:

- Large, well-established outsourced services market with clear value proposition to HOAs.

- Resilient customer demand due to criticality of services to HOA operations.

- Highly fragmented market providing ample roll-up opportunities to scale revenue and drive operational efficiencies in an integrated platform.

- Opportunity to expand beyond core management services and capture larger share of HOA budgets in ongoing maintenance and repair spend.

At Stax, our mission is to facilitate value-creation for our clients through our actionable, data-driven insights, gathered by our team of experienced consultants. To learn more about Stax and our services, visit www.stax.com or click here to contact us.