Share

Short-Term Rental Market Overview

The short-term rental (STR) market is undergoing a transformation—driving an increased need for professional property management.

On the supply side, the market continues to see rising unit growth and rental pricing increases, all of which support a growing market for professional property managers. Several favorable trends are driving further demand, such as consumers seeking more space for their money, valuing a ‘home away from home,’ and embracing remote work, the short-term rental market continues to expand as a result of these favorable conditions.

However, there are a few risks to consider when evaluating this market, including the impact of slowing discretionary spend among consumers and the potential for local regulations to constrict the supply of short-term rentals.

Stax will explore these dynamics in more depth throughout this article.

Market Overview

Professional property managers are critical to property owners for managing all aspects of their short-term vacation rentals. Short-term rental property owners typically require some type of professional property manager when they initially purchase the property, particularly if they are located in a different region or face other constraints that limit their ability to self-manage.

Beyond handling bookings, professional property managers can help owners by navigating the process of getting a STR license, responding to complaints on-site, and coordinating vendors to clean / maintain the property, delivering significant value to the property owner.

Underlying trends in the short-term rental market create a favorable environment for property managers:

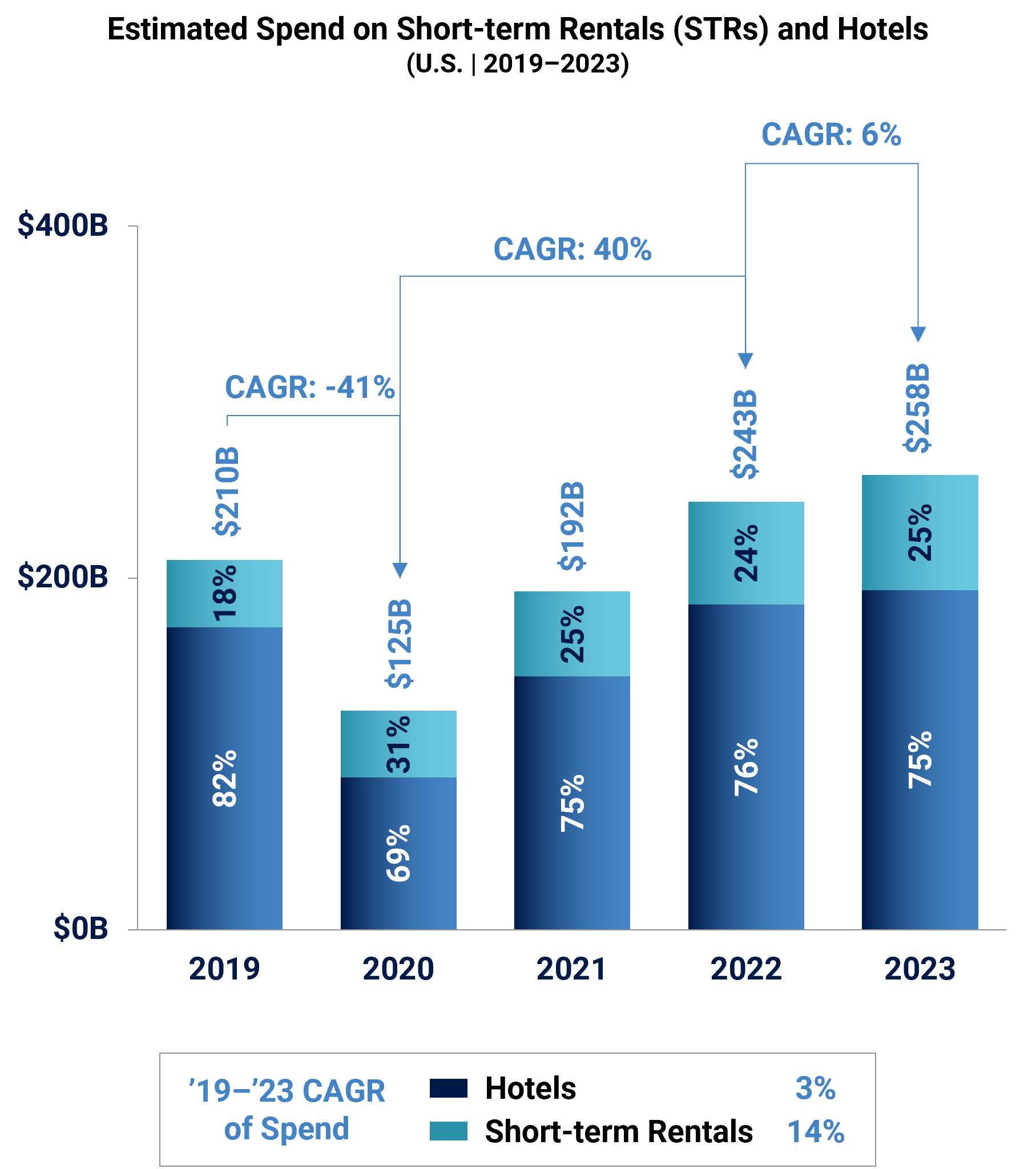

1. Domestically, short-term rentals have been taking share from hotels relative to pre-Covid levels:

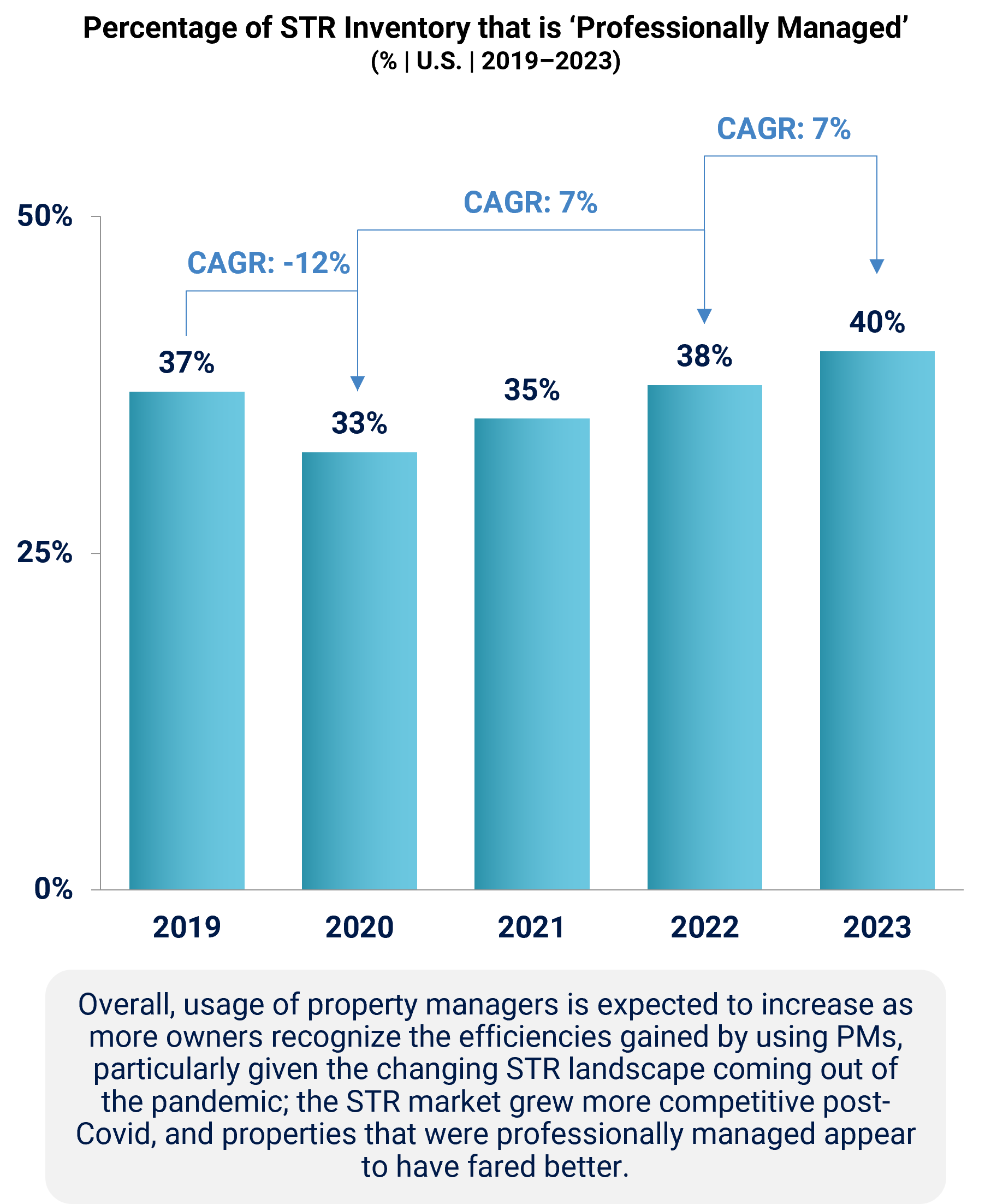

2. Units managed by professional property managers are expected to continue growing as more property owners recognize the efficiency gained by using PMs:

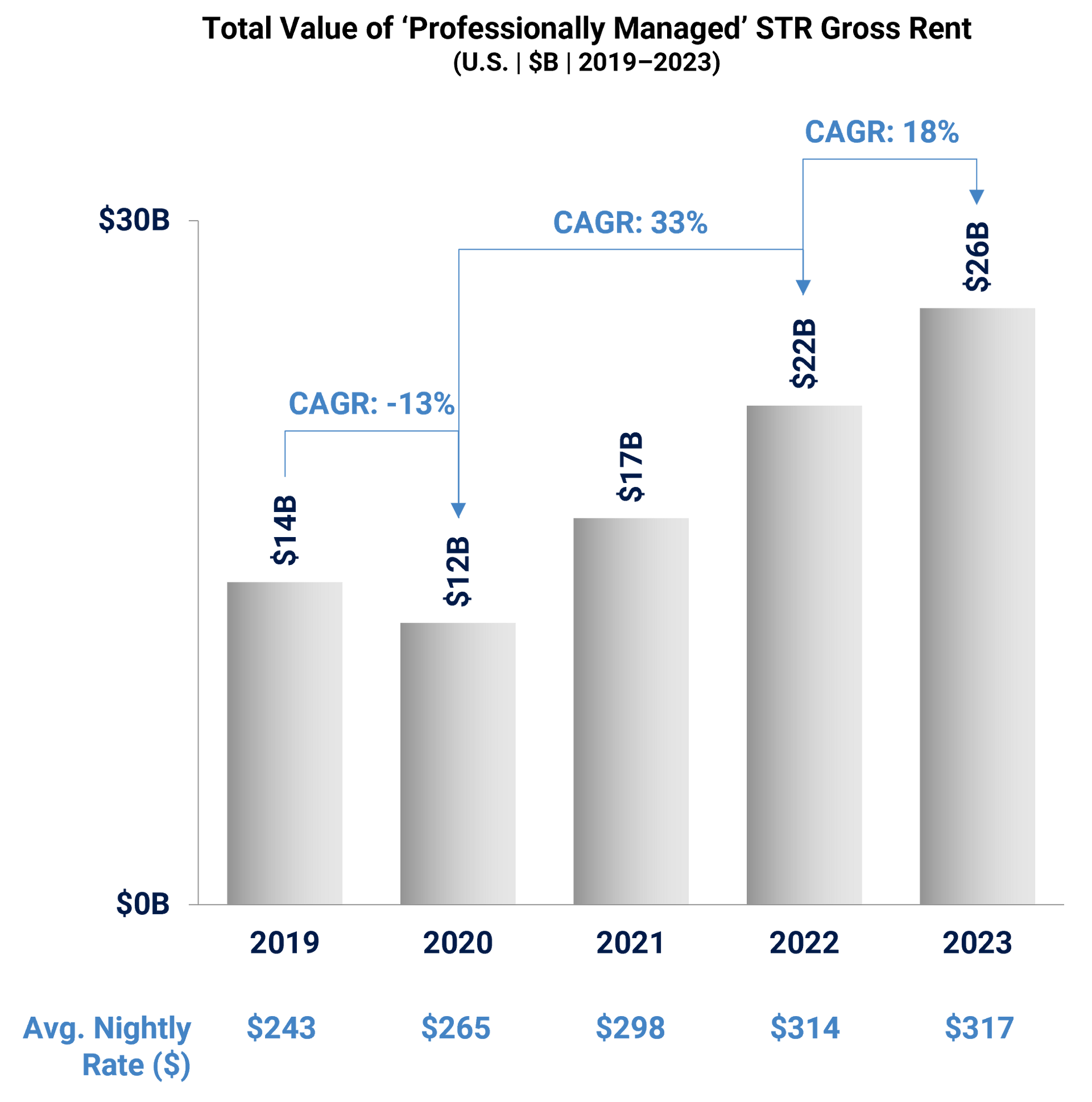

3. Gross rents handled by professional property management companies has increased, driven by the overall increase in STR room nights and average nightly rates:

While there are several factors driving positive growth for the market, there are potential headwinds in the travel industry that are worth exploring:

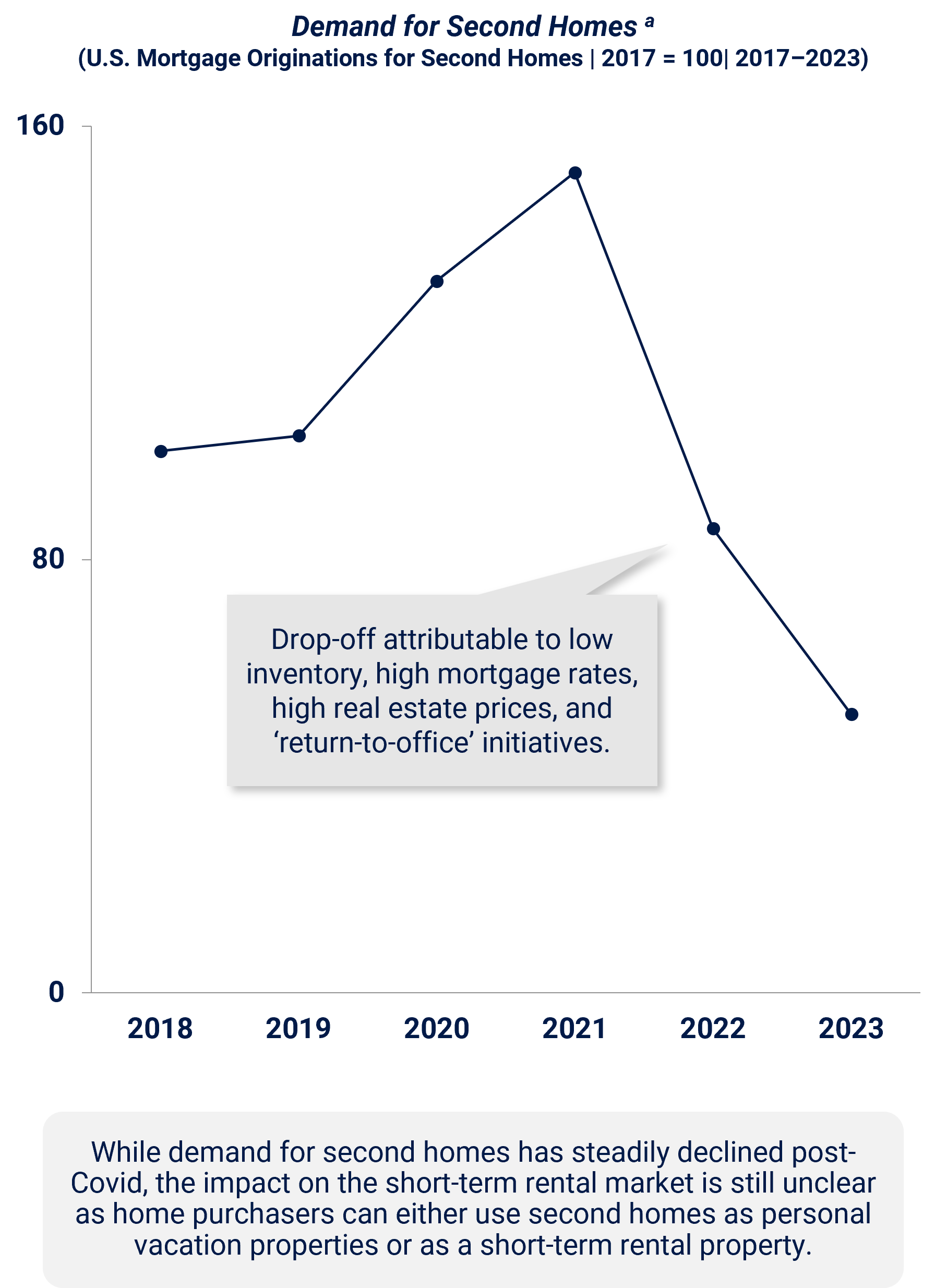

1. After a significant bump during Covid, purchasing / financing of new second homes has slowed significantly. However, the impact of this is still unclear as purchasers can use second homes for personal vacation properties or as short-term rentals:

2. While the travel industry had meaningful growth post-Covid, growth has stalled recently due to economic uncertainty and inflation:

In addition, regulations on short-term rentals could pose potential headwinds to the industry. These regulations appear to be isolated to specific cities, particularly blue cities within blue states. Some professional property managers have minimized their exposure to these regulations by focusing within red states, which tend to have more favorable dynamics for property rights, and/or cities that are well-known vacation destinations that view STRs as a key part of their economy, such as Lake Tahoe.

At the federal level, while the Biden administration planned regulations on added fees charged by short-term rentals, these seem unlikely to come to fruition under the Trump administration. In the event these regulations are passed at a state-level, property managers anticipate ADRs will increase to compensate.

Competitive Landscape

The professional property management market remains highly fragmented, with a mix of large national players and smaller local operators. Key players like Vacasa and AwayDay lead the national landscape, while smaller, regional, and mom-and-pop providers are prominent in certain local markets. The category of provider used by the property owner depends on their location, property type (luxury, highly unique, etc.), and personal preferences:

- Large National Providers: These companies benefit from operational scale, advanced technology, and access to top talent, making them well suited for large property owners who value economies of scale in operations.

- Regional and Local Operators: Smaller, localized firms have maintained a strong foothold in the market, offering tailored, community-focused services. While they lack the scale of larger players, their local knowledge and personalized approach can be a compelling value proposition for homeowners.

- Property Management Software Providers: Unlike traditional Property Managers, software providers enable self-management of STR properties. These platforms primarily serve smaller, independent property owners who prefer to maintain control over operations but seek digital support for pricing, booking, and guest communication.

Growth Opportunities for Property Managers

The growth pathways for professional property managers are extensive, presenting both organic and inorganic opportunities.

- Increase Market Penetration: As property owners continue to recognize the financial benefits of using professional PMs, there is significant whitespace for PMs to convert self-managed STRs into professionally managed properties. This opportunity is particularly prominent in areas where regulations favor professional oversight.

- Geographic Expansion: Expanding into new geographic markets with favorable STR regulations offers a substantial growth avenue. International markets could present further opportunities for established national players.

- Service Diversification: PMs can introduce new value-added services, such as insurance add-ons and accounting / tax services, which strengthen customer relationships.

- Technology Integration: Embracing property management software and advanced analytics can improve operational efficiency and enable PMs to capture more market share. Integrating technology-driven solutions can also directly increase bookings and reduce reliance on third-party online travel agencies (OTAs).

- Mergers and Acquisitions: Consolidating smaller mom-and-pop operators through mergers and acquisitions presents an opportunity for PMs to grow quickly and achieve operational efficiencies.

Conclusion

The short-term rental market is supported by rising consumer demand for STRs over hotels, an increase in professionally managed units, and a favorable regulatory backdrop in certain regions. As property management companies look to expand their market share, growth opportunities will center on geographic expansion, service diversification, and strategic acquisitions. For investors in this industry, understanding the evolving landscape, exposure of providers to city/state level regulations, and providers’ positioning within local markets will be critical for capturing the full potential of the STR market.

To learn more about Stax and our expertise, visit

www.stax.com or

click here to contact us directly.