Share

In Stax’s experience, investors struggle to unpack the market and business risks in managing employment. This has made its way to the forefront of investment decision-making in recent years as employers are increasingly outsourcing HR functions to streamline administrative duties and improve organizational agility. In this article, we explore the factors behind why companies are increasingly seeking HR outsourcing and the particular dynamics driving attractiveness within Professional Employer Organizations (PEOs) investment opportunities through domestic and international market trend analyses.

Outsourced HCM Services

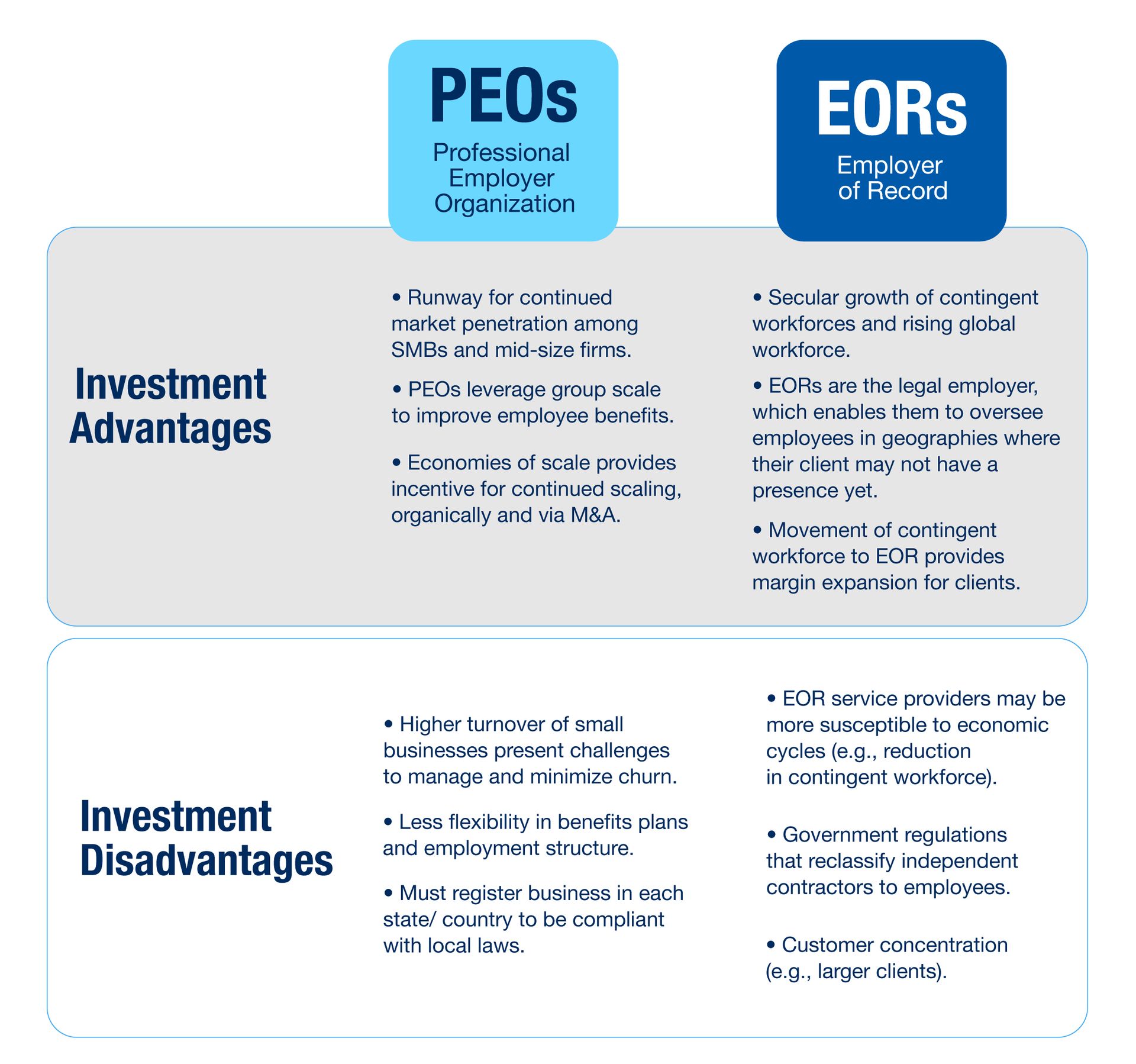

There are three main HCM service provider types: Professional Employer Organizations (PEOs), Employer of Record (EORs), and Administrative Services Organizations (ASOs). This article focuses on the key aspects and differentiators between PEOs and EORs, which both present attractive investment opportunities.

High-Level Overview:

PEOs and EORs both present attractive investment opportunities, although EORs’ exposure to contingent workforces may enable them to outpace the broader market (unlike PEOs, EORs can help clients operate in countries or jurisdictions where they do not have an established legal entity). The PEO market is large with sufficient runway for players to sustain high single digit organic growth for the next 5–10+ years. However, the market is fragmented— creating opportunities for platform players to consolidate the market.

Domestic PEO Market Landscape

The domestic PEO market has ample growth available, both organically and via acquisitions. Currently, there is remaining whitespace, as only ~6%-7% of the TAM is currently penetrated. In addition, increasing awareness among SMBs and mid-sized firms will help spur adoption. Based on prior work, there is a large base of PEOs operating in the U.S. ripe for consolidation, with opportunities to increase a company’s TAM via geographic and/or product expansion.

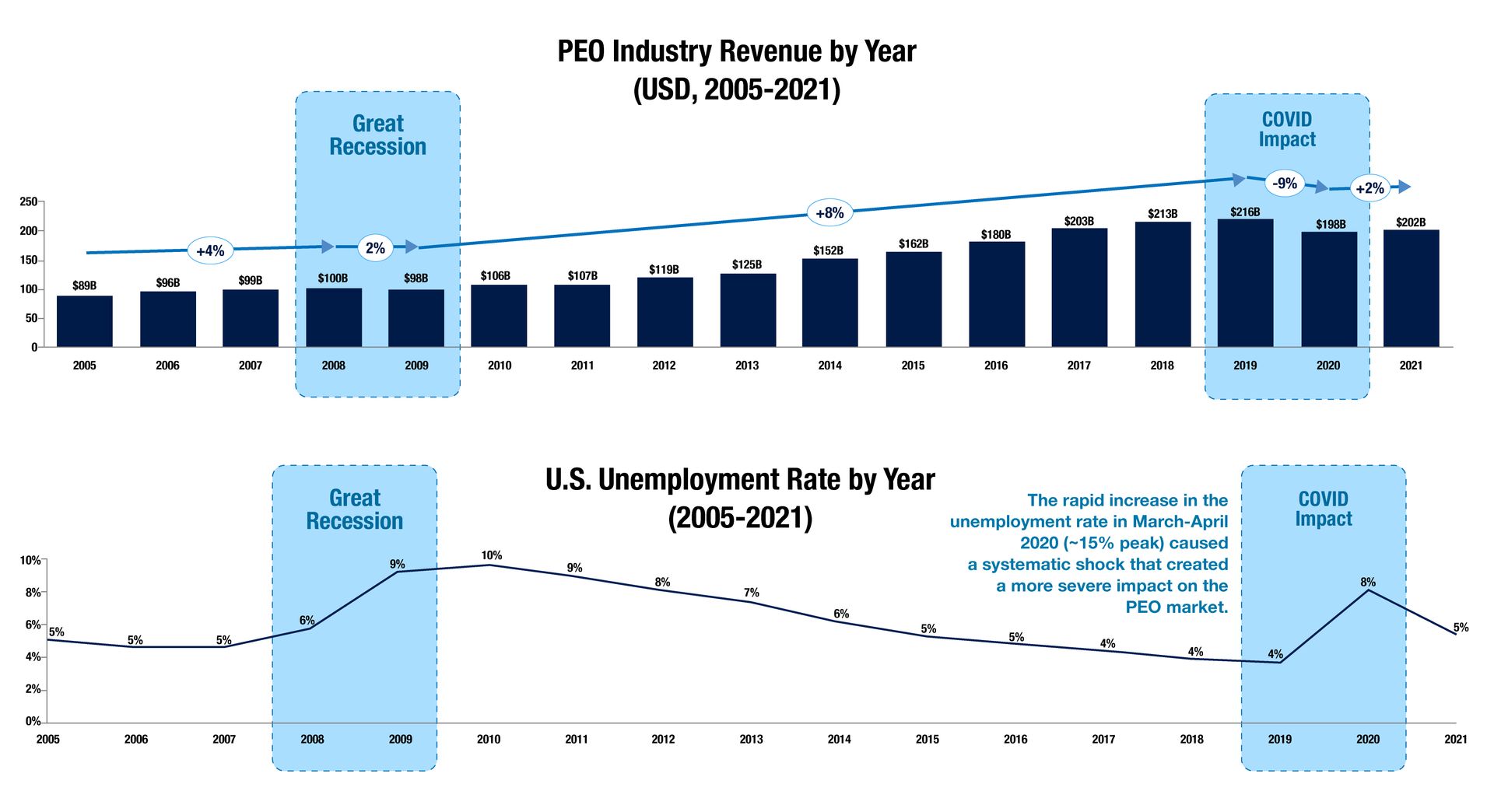

The market is also relatively insulated from economic cycles due to providers’ ability to streamline costs for their client base. Covid noticeably had a more pronounced effect on the industry compared to the Great Financial Crisis.

Increasing regulations and continued remote work have spurred demand for PEO solutions; however, the market is still largely unpenetrated. There are ~56.3M employees that work in SMB and mid-sized firms, implying a ~7% penetration rate for PEOs.

As the workforce prepares for increased regulation from federal and state governments (especially related to workforce diversity, employee monitoring, whistleblower protections, and hiring), companies will increasingly rely on PEOs to ensure they are compliant under new policies. These service providers can also help mitigate liability risks by keeping employers up to date on changing state workplace laws and regulations.

The number of U.S. remote has grown meaningfully, attributable to cost savings and efficiencies arising from adopting a remote working model. With the rise of remote workers, HR, payroll, and legal departments are expected to face heavier burdens to ensure compliance with local labor laws. Companies are expected to continue to leverage PEO services to ease these pain points amid expansion.

PEOs have provided their solutions to SMBs who can leverage such services to focus on their core business as opposed to internally handling administrative tasks. Usage is also expected to continue among large business and enterprise segments as they are mainly interested in PEOs that can assist with compliance in industries known for having heavier regulations.

Global EOR/PEO Market Overview

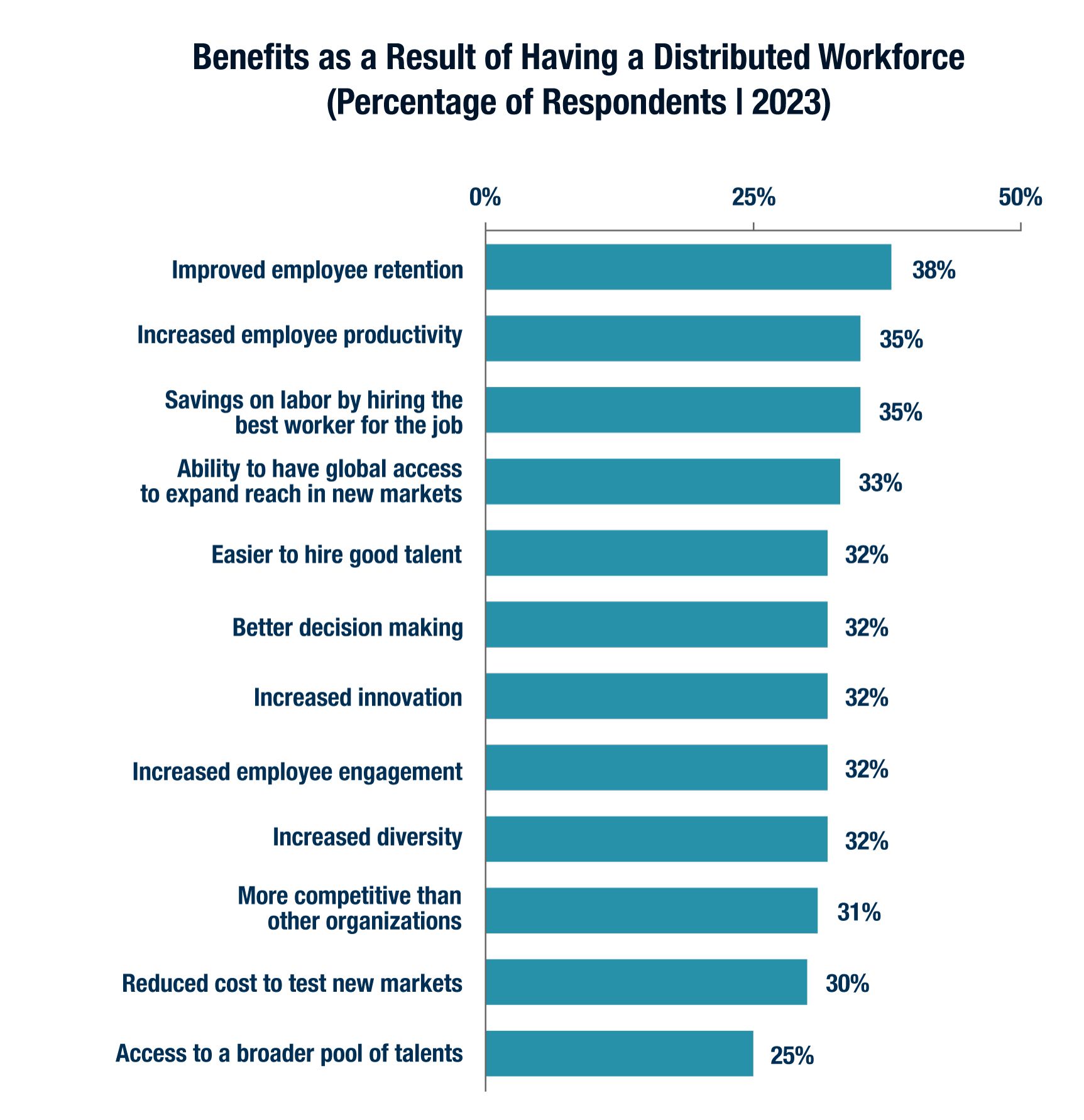

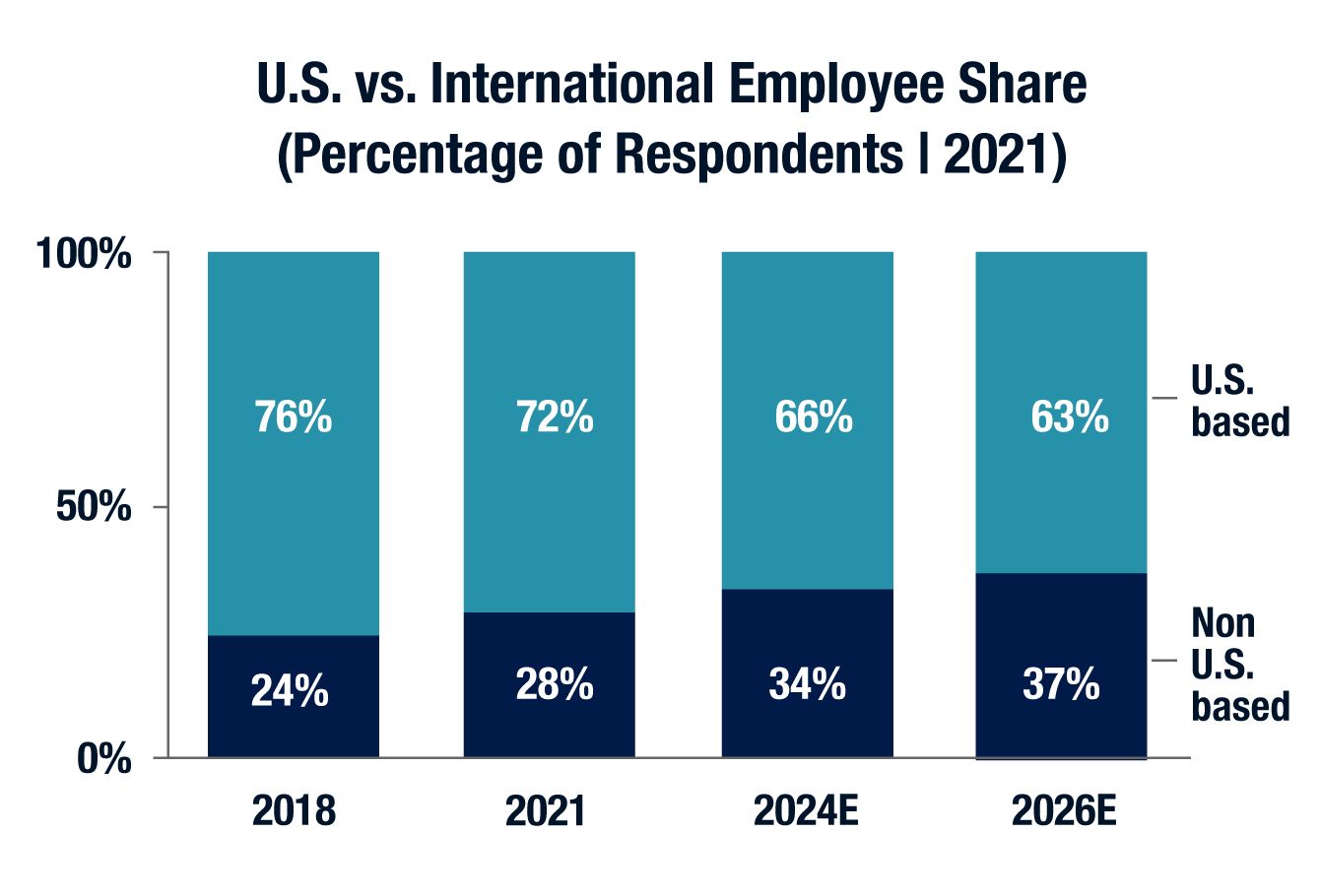

The increasing demand for Global PEO and EOR services is driven by the global surge in talent acquisition and remote hiring practices. As organizations recognize the value of remote international recruiting in a labor-constrained market, attracting high-quality applicants worldwide becomes a competitive advantage—especially in growing industries like technology and software development.

Global PEOs and EORs play a crucial role in addressing compliance challenges related to global remote work, offering comprehensive solutions for evolving working policies and ensuring compliance across diverse remote teams. In this transformative landscape, global PEOs and EORs are strategic partners, facilitating efficient compliance management, global talent access, and embracing the flexibility of a distributed and diverse workforce.

The hiring of distributed remote workforces is also increasingly being viewed as a competitive advantage, irrespective of candidates’ geographic location. Furthermore, opening roles to international candidates and adopting a distributed remote model workforce was leading to higher quality applicants per open role.

Global employment platforms have emerged to address employer hiring needs across borders, providing better technology and scale than incumbent legacy providers. These platforms are targeting organizations that possess global workforces and are scaling.

Conclusion

Stax believes there is a strong growth trajectory for both domestic and global PEOs. Domestically, the PEO market is well-established but is still highly fragmented and represents a small share of the potential SMBs in the United States. Globally, PEO/EOR services are relatively newer and have seen tremendous growth over the last 5+ years. Despite this strong market growth, global PEO/EOR usage is still relatively low providing meaningful runway for continued adoption and growth among both current users and potential users of these services.

Stax is equipped with extensive HR tech and services experience supporting sponsors across the investment lifecycle— buy-side, value creation, exit planning, and sell-side support. We have done recent work in the EOR/PEO, HR management systems, and employee screening services sectors across a multitude of HR service vendors. To learn more about Stax, our services, and our experience serving the HR market, visit www.stax.com or click here to contact us.