Share

Trends in Legal Practice Management

- Legal practice management software has seen rising demand and subsequent investor interest in last 2 years.

- Law firms have highly specialized workflows and software needs, creating a dynamic where software providers can drive stronger right-to-win by building and/or buying specialized capabilities within their platforms.

- Legal payments have become a key focal point for software providers, presenting a significant and relatively untapped opportunity for monetization.

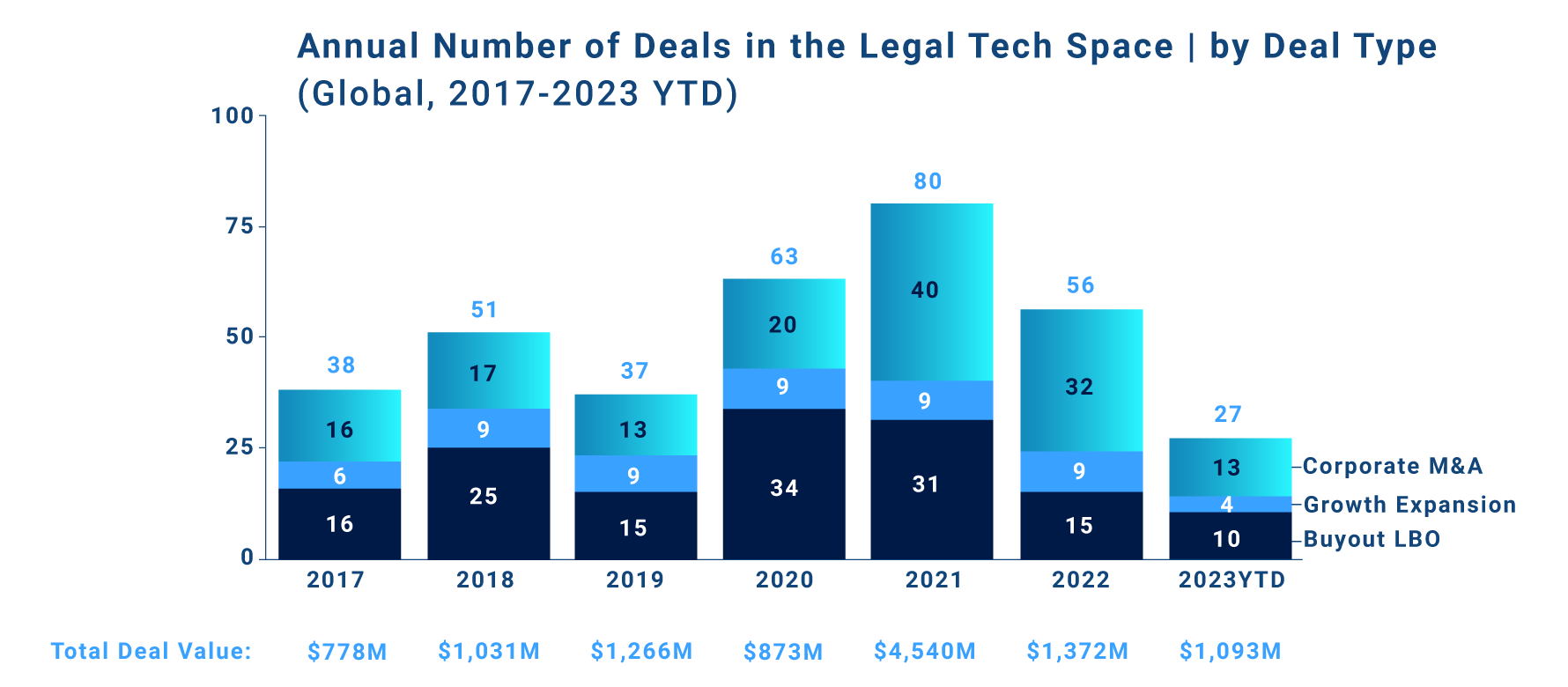

- Rising M&A activity and consolidation of tech players is being driven by large, PE-backed strategics seeking to differentiate through accelerated product expansion.

Market Growth & Trends

Stax has seen the nature of LegalTech demand evolve over time. Firms are increasingly building out their technology stacks with the explicit intent of developing connected ecosystems. More advanced firms are already leveraging centralized data analytics/reporting tools to inform strategic business decisions.

Key benefits are increasingly tied to financial performance, such as:

- Value optimization: automation of daily workflows enables firms to prioritize the value-add services and revenue-driving aspects of their business.

- Cost savings: reducing operational head count through technology (for example, AI “virtual receptionists”), as well as streamlining workflows to free up more time for client relationship-building and billables drives an ROI.

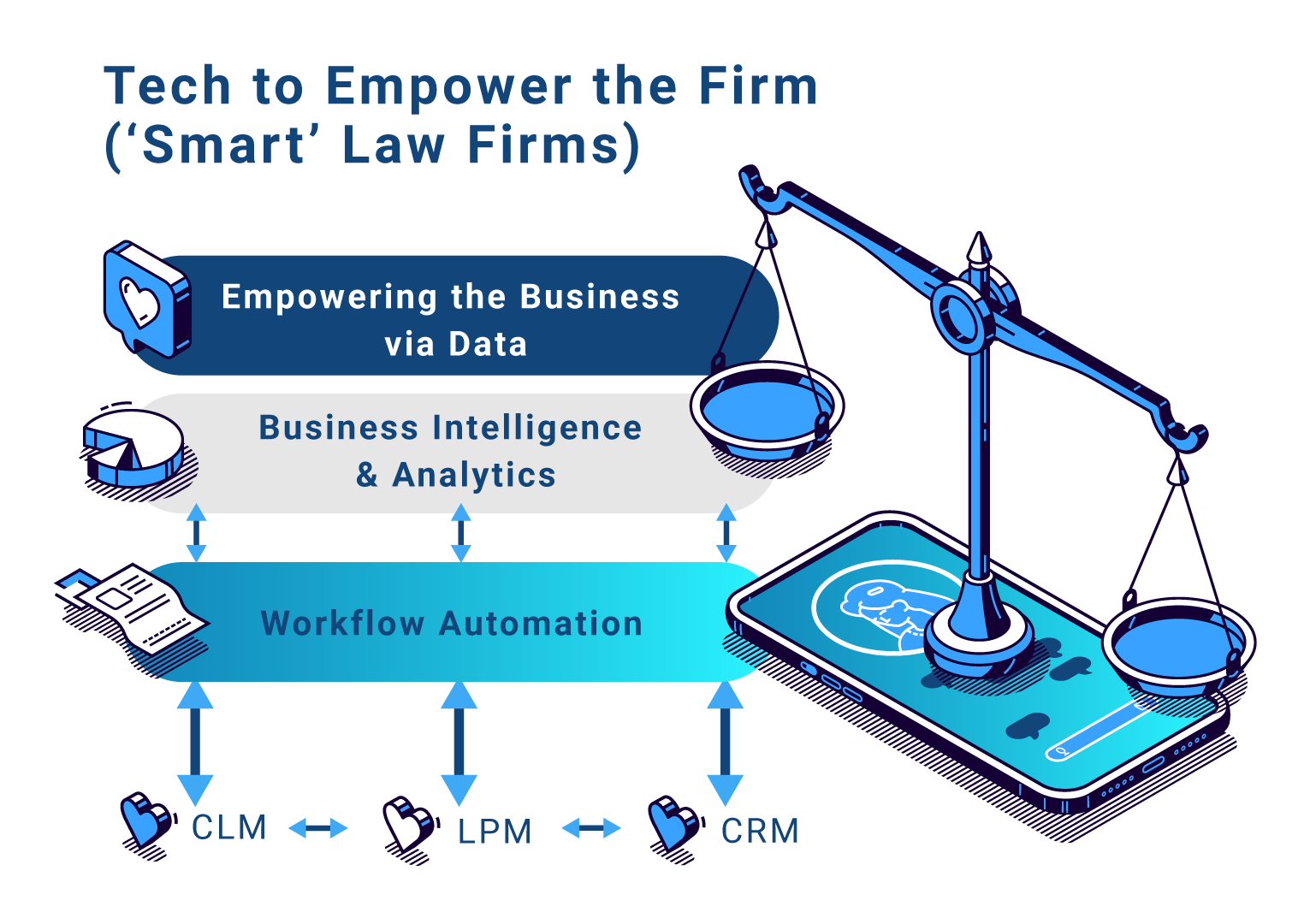

The most tech-advanced law firms continue to build a technology ecosystem that seamlessly integrates business intelligence and analytics tools with core legal software (i.e., Contract Lifecycle Management [CLM], Legal Practice Management [LPM], Client Relationship Manager [CRM]) while also establishing workflow automations to reduce the need for intervention between software. LPM is at the core of the tech stack; ancillary solutions must integrate with the LPM to ensure connectivity of the workflows and data.

Growth in Consolidation Across the Value Chain

The breadth of legal practice needs, and software product areas translates to a diverse vendor ecosystem comprised of comprehensive LPM platforms and a wide range of point tools addressing specific workflows. This dynamic has been propagated by the industry-wide lag in tech adoption across various firm size segments, with most firms adding point solutions one at a time rather than all at once with a platform vendor.

As a result, the market continues to provide ample room for consolidation—a strategy investors have increasingly pursued in recent years and is likely to persist in the coming years.

Stax Supported Deals Across the LegalTech Investment Landscape

- Stax supported Litera, a global leader in legal technology solutions, and sponsor Hg on the acquisition of Kira Systems, an industry leader in machine learning contract review and analysis software.

- Stax provided sponsor ParkerGale Capital and Raymond James with sell-side support on their transaction of SurePoint, a leading cloud provider of practice management solutions to law firms, to Aquiline Capital Partners.

- Stax provided sponsor PSG with sell-side support on their transaction of AbacusNext, a leading vertical SaaS provider for legal, accounting, and compliance-focused professionals, to Thomas H. Lee Partners.

About Stax

Stax provides value to investors and their investments through a combination of industry experience and data-driven insights to aid in decision-making. To hear more about our services and expertise, visit www.stax.com or contact us here.