Reimagining Agriculture, Farming, and Food Production With the Advancement of Technology and Data

Reimagining Agriculture, Farming, and Food Production With the Advancement of Technology and Data

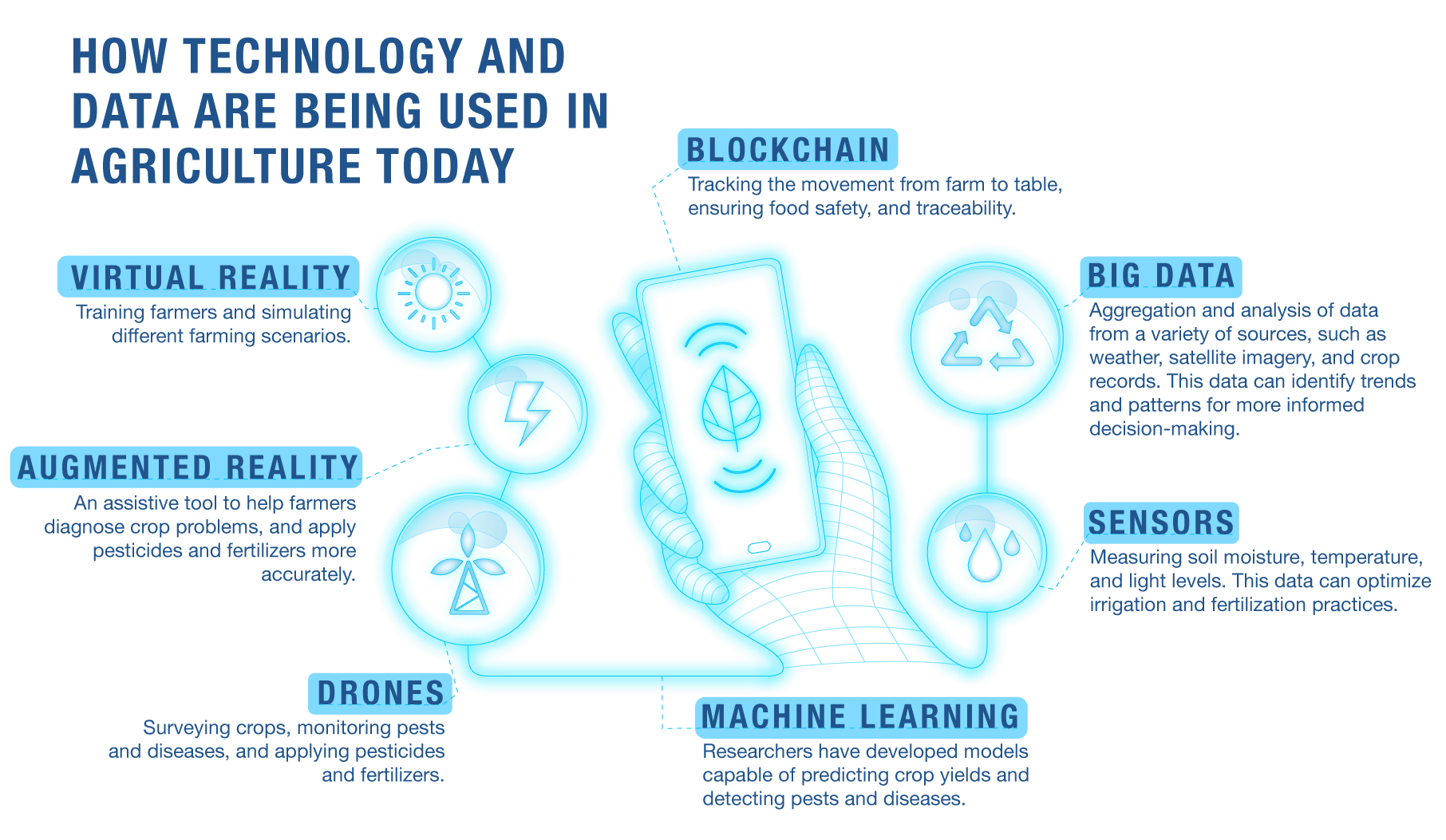

The agricultural sector is vital for providing food, fiber, and fuel worldwide, but it grapples with challenges such as climate change, water scarcity, and soil degradation. Technology and data offer several potential solutions to address these obstacles. In the case of precision agriculture, sensors and other technologies are utilized to collect data on soil conditions, crop health, and weather patterns. This data can then be used to optimize farming practices such as irrigation and fertilization to improve yields and reduce waste.

Other technologies, such as vertical farming and aquaponics, are also being developed to address the challenges of traditional agriculture. Vertical farming is the cultivation of crops in vertically stacked layers (a practice best suited for urban areas or regions with limited land availability), while aquaponics combines aquaculture (fish farming) with hydroponics (plant cultivation in water). This system can produce food more efficiently and sustainably than traditional agriculture.

Applications in the Agriculture Industry

Although the use of data and technology in agriculture is still in its early stages, there is potential to revolutionize the sector. By making farming more efficient and sustainable, these technologies can help ensure ample food supply for the expanding population.

The use of technology and data in agriculture is a rapidly growing field. As technologies continue to develop, we can expect more innovative ways to improve food production.

Private Equity Landscape

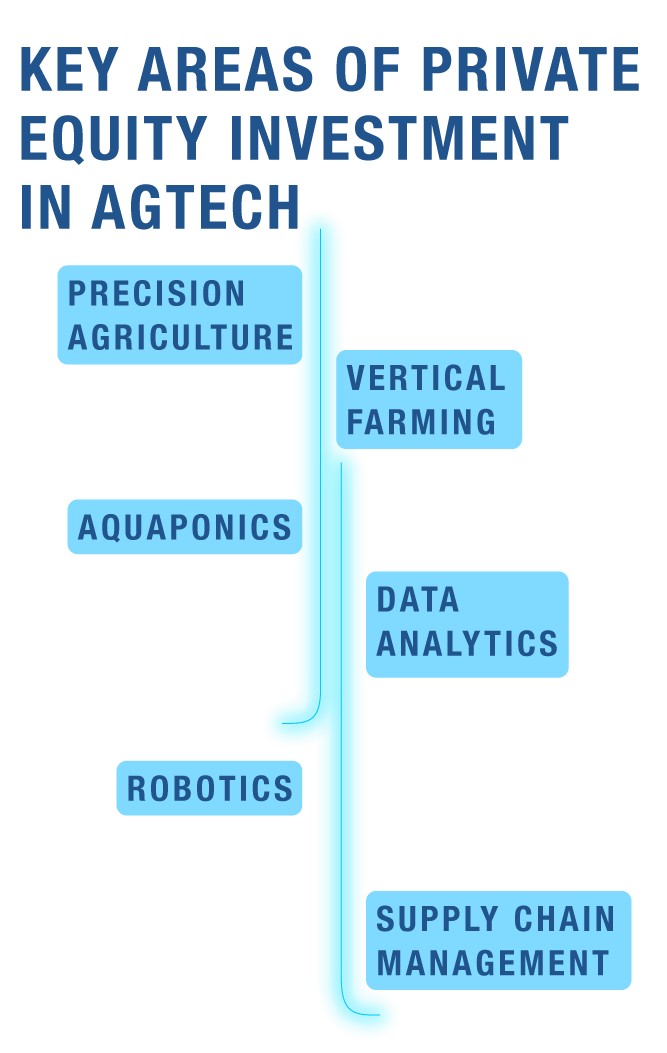

The advancement of technology and data in agriculture is having a significant impact on private equity activity in the sector. Private equity investors are becoming increasingly interested in companies that are developing and using these technologies to improve agricultural productivity, sustainability, and efficiency.

There are several reasons for this:

- The agricultural sector is a large and growing market, with global food demand expected to increase by 50%–60% by 2050.

- The sector is facing a few challenges in the form of climate change and water scarcity, creating opportunities for new technologies and solutions.

- The advancement of technology and data makes it possible to develop new business models and improve the efficiency of existing operations.

As a result of these factors, private equity investment in agriculture tech (AgTech) has been growing rapidly in recent years. In 2022, private equity firms invested $2.48B in AgTech companies—more than twice the amount that was invested in 2021.

Private equity investors are also keen on investing in companies that utilize technology to enhance the sustainability of agriculture. For instance, some investors are supporting companies developing new methods to reduce agricultural waste or produce food with a smaller environmental footprint.

The advancement of technology and data has a positive impact on private equity activity in agriculture. By investing in companies that are developing and using these technologies, investors help improve the productivity, sustainability, and efficiency of the sector. This benefits both farmers and consumers.

Lastly, private equity firms are attracted to the sector's large and growing market, its significant opportunities for innovation and growth, and its potential to generate strong returns.

Stax has deep expertise within the agriculture, food, and farming sectors, providing invaluable insights to both investors and businesses alike. Project-related experience includes comprehensive market analyses, identifying promising investment opportunities, and delivering data-driven insights. The firm serves a diverse range of investor interests, with a particular emphasis on upstream assets, including input suppliers and manufacturers. Learn more about Stax and our expertise or click here to contact us directly.

Sources

- Borkar, Sanjay.

“Data-Driven Technology: The Future Of Agriculture,”

Outlook Planet, Aug. 2023.

- “Agriculture Technology- Empowering Farmers,” Cropin.

- “Role of Modern Technology in Agriculture,” Sehgal Foundation, Mar. 2023.

- Verma, Mansi.

“Economic Survey 2023: Private equity investments in agritech surge 50% in four years,”

Moneycontrol, Jan. 2023.

- Lewis, Ian.

“In-depth: Agritech startups must adapt to a harsh new investment climate,”

impactInvestor, Sep. 2023.

- Poojary, Thimmaya.

“PRIVATE EQUITY INVESTMENTS INTO AGRITECH STARTUPS TOUCH RS 6,600 CR, SAYS REPORT,”

YOURSTORY, Mar. 2022.

- “RDIF makes giant investment into TH Group’s Russian milk projects,”

Vietnam Investment Review, May 2018.

- “Prospectus: AppHarvest,” AppHarvest, Jun. 2021.

- Heater, Brian.

“Agtech robotics firm FarmWise just raised another $45 million,"

TechCrunch, Jun. 2022.

- “Rivulis announces completion of acquisition by Temasek,”

Rivulis, Dec. 2020.

- Pollard, Amelia.

“Funding Is Drying Up for AI-Run Vertical Farms,” Bloomberg, Jun. 2023.

- Tefft, James, Marketa Jonasova, Ramziath Adjao and Anjali Morgan. “FOOD SYSTEMS FOR AN URBANIZING WORLD,” World Bank Group, Nov. 2017.

- “‘Agtech’ - Vertical Analysis”, Pitchbook, Jan. 2024.

Read More

Featured by Power Magazine: China Coal-Fired Generation Additions Tied to Economics, Energy Security

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy