Share

An Introduction and Overview of the Outdoor Recreation Market

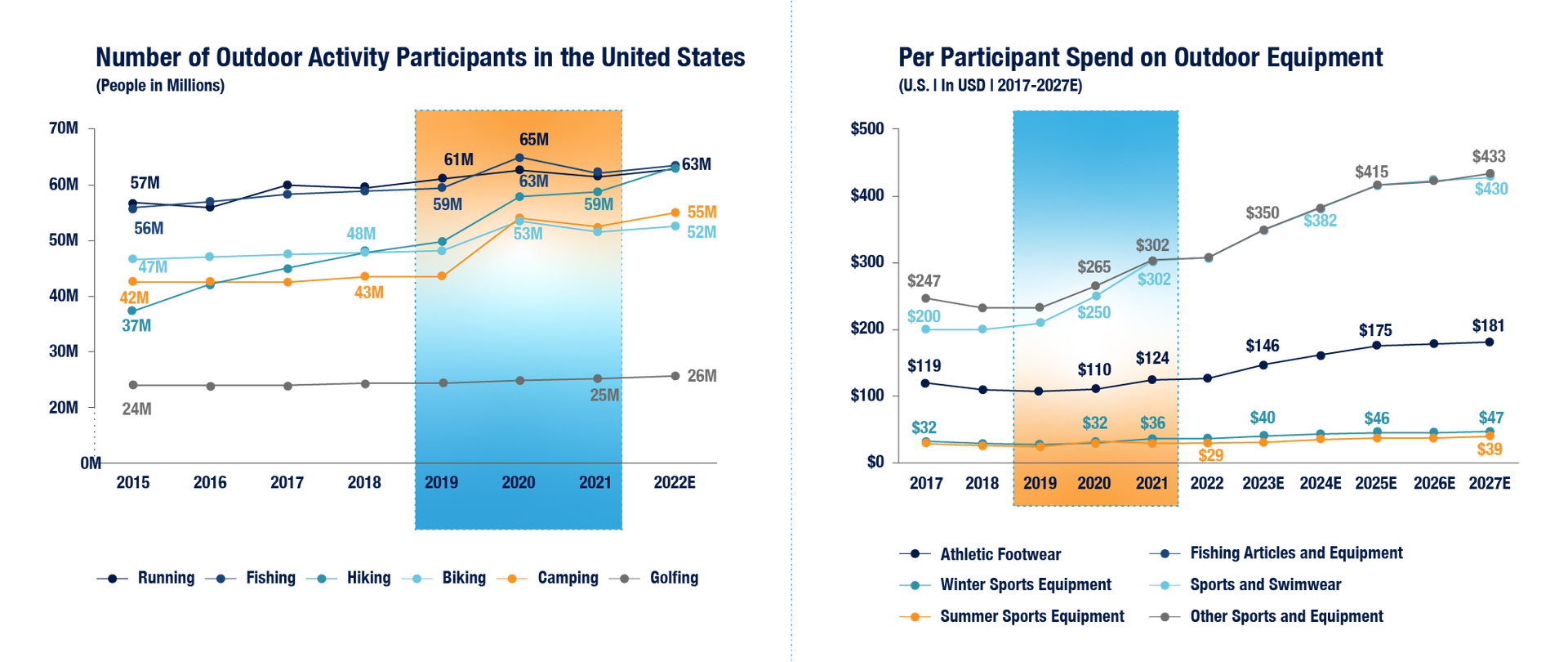

The outdoor recreation market has witnessed robust growth over the past three years, supported by outsized expansion in the participant base and spend per capita. In addition, sector growth had accelerated as a result of increased adoption in outdoor activities during the pandemic.

Looking forward, steady growth is likely to continue given consumers are increasingly emphasizing health and wellness in their daily lives and allocating larger portion of their discretionary spend towards pursuing outdoor and sporting activities.

Moreover, this sector tends to attract “enthusiasts”— i.e., those who avidly engage in hobbies such as golf, fishing, hunting, and other outdoor activities. Brands are particularly eager to attract the enthusiast segment due to their higher spend levels, strong brand loyalty, openness to test new/innovative products, and resilience during market downturns.

The following article provides supporting detail around the market trajectory and growth drivers for the outdoor recreation market and aims to illustrate key market trends based on Stax’s experience.

Growth Drivers for the Outdoor Recreation Industry

Post-Covid, Stax has witnessed three primary drivers contributing to market growth in the outdoor recreation industry:

1. Elevated focus on health and wellness

Stax has observed a growing emphasis on health and wellness among a variety consumer segments over time. The mainstream consumer has become increasingly aware of information and science around disease prevention and associated risks to general health and wellness, and as a result has prioritized their own wellbeing. Additionally, growing cases of diseases and sickness have further highlighted the need for changing daily habits and the benefits of an active lifestyle. Social media and digital marketing strategies have further helped grow awareness and interest in health and wellness activities, most notably by marketing sports and outdoor recreation and the associated benefits.

Interest in outdoor recreation activities was further catalyzed during Covid as consumers looked to remain healthy and in shape while practicing social distancing. This shift in behavior paired with Pandemic-related barriers prompted a substantial number of consumers to gravitate towards engaging in outdoor activities, some of whom even became "enthusiasts".

2. Higher diversity in the participant base

Post pandemic, the general outdoor participant base has become more diverse, attracting higher participation from minorities, women, as well as younger and wealthier demographics.

- The number of females participating in outdoor recreation has increased by 20 million since 2015.

- There has also been an 11% increase in Black Americans fishing and boating from 2020 to 2021.

- Stax has seen that the camping participants in particular are becoming wealthier, demonstrated by the segment of campers who earn $100,000 or more growing from 19% in 2019 to 37% in 2021.

General outdoor and sporting equipment brands and investors in the sector are benefiting from broader mix of participants entering the outdoor recreation market, as it allows them to diversify revenue streams and risk through new product development and adjacent product categories.

3. Sustained growth after post-Covid normalization

While Covid played a pivotal role in sparking a surge of interest in the outdoors, with the gradual reopening of businesses and establishments, the elevated growth in participation over the last few years has normalized. However, looking forward, industry growth is expected to be faster than pre-pandemic levels due to the broader group of customers that has been unlocked over the past few years, a meaningful portion of which may be considered "outdoor enthusiasts" with high levels of engagement and spend.

Furthermore, certain segments of the outdoor recreation sector did not experience a meaningful surge during the pandemic, therefore were not subject to any subsequent normalization. Social distancing restrictions dampened participation in certain group activities, such as "close contact" team sports. Further, participants faced closures or occupancy limits imposed on industry establishments such as climbing gyms and national parks, limiting the level of participation in the sector. As these restrictions were gradually lifted, Stax found that consumers have returned to these destinations/facilities at or beyond pre-pandemic levels.

How This Affects Investors:

Stax has identified three key factors for investors to consider as they evaluate this market:

1. Attractive and growing segment of enthusiast customers

Outdoor enthusiasts, a consumer segment that has been expanding during and post-Covid, is a highly coveted customer group given their high brand loyalty, influencing power, and sustained levels of spend on outdoor and sports equipment. The enthusiast customer is known for unwavering loyalty to brands, showcasing a strong commitment that extends over the long-term. Closely aligned with their high brand loyalty is the significant influence enthusiasts possess within their communities and networks. The enthusiast segment is an avenue for brands to expand into new product segments as well as grow their customer base given the continued word-of-mouth marketing and recommendations that enthusiasts provide.

Investors should also consider that outdoor enthusiasts are persistent in their willingness to spend on their hobbies and interests, even during economic downturns; given Covid-related dynamics helped convert more participants into the enthusiast category, the outdoor recreation sector has become more stable and resilient going forward. Brands that attract enthusiasts showcase greater consistency in sales performance and profitability and are able to reach new customers and drive repeat purchases in a more cost-effective way.

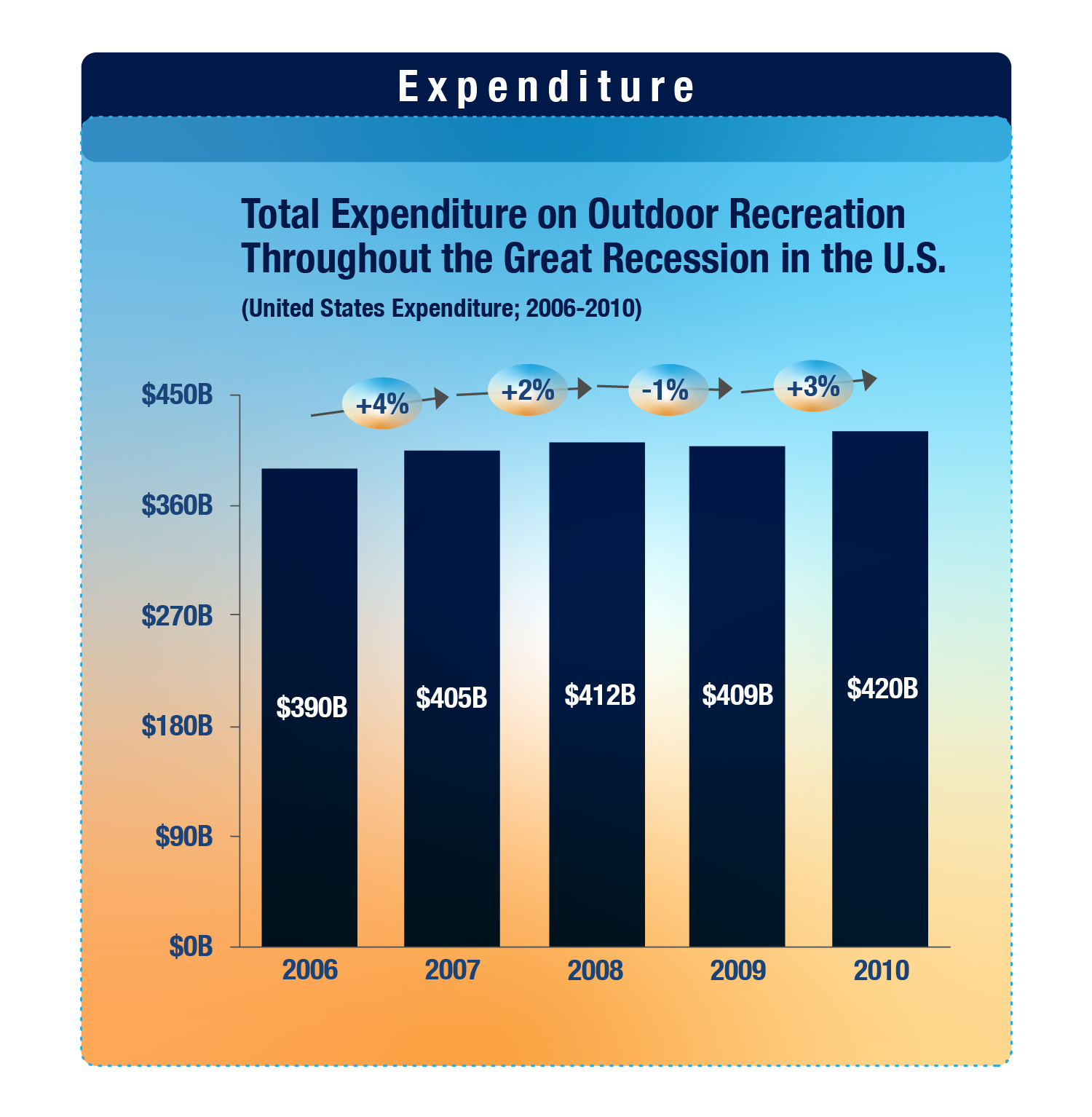

2. High market resilience amid economic downturns/recessionary periods

Even outside the enthusiast category, the outdoor recreation sector has shown signs of resilience during past recessionary periods. In fact, the downturn of the economy during the Great Recession boosted participation in core outdoor sports and activities, similarly to what occurred during the pandemic.

- In 2008, 33.7 million Americans ages 6 and older participated in camping, an increase in 7.4% from the previous year.

- In the same year, Kampgrounds of America Inc. (KOA), the nation’s largest campground chain, increased their revenue by 5.6% as camping became a cheaper alternative than hotels.

To add to the comparison in market resiliency of the sector both during Covid and the Great Recession, the market also saw a boost in healthy alternatives for daily life, such as biking instead of driving to work.

- From 2005 to 2008, traveling via bicycle increased 36%, and U.S. bike sales were higher than car and truck sales in 2009 for the first time since the 1970s.

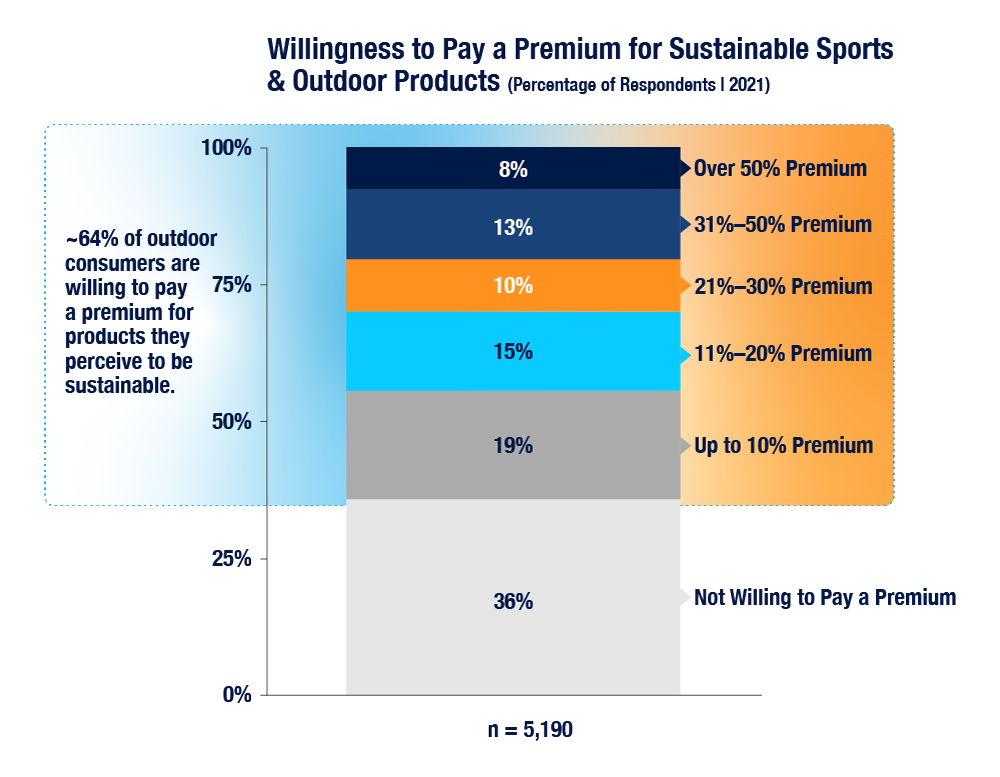

3. Brands aligning to overall sustainability trends

Within the outdoor recreation sector, Stax has identified a growing consumer concern around sustainability and environmental concerns.

Sustainability has become a greater focus for consumers—both in their everyday lives (i.e., the activities they choose to participate in) as well as the products they choose to purchase (i.e., recyclable material used to create backpacks). Sustainability is a key factor influencing consumers’ purchasing behavior across consumer sectors, though the outdoor and sports equipment sector in particular has significantly benefitted from this trend. Growing consumer awareness and expectations for sustainability in the products they purchase has led many brands to enact changes to their product make-up and/or supply chain operations.

- Earlier this year, major outdoor retailer REI tightened sustainability requirements for its 1,000+ brand partners, requiring reduced CO2 emissions and elimination of PFAS (Per- and polyfluoroalkyl substances) in products sold.

- In 2021, Adidas announced plans to use only recycled plastic in its products by 2024 and achieve total climate neutrality by 2050.

- In 2021, premium outdoor apparel brand Arc’teryx introduced a new product using upcycled materials and pledged to grow its participation in the circular economy.

Further, these same consumers are willing to pay a premium for sports and outdoor recreation products. In a recent Stax survey, Stax found that nearly 64% of outdoor and sporting equipment consumers are willing to pay a premium for products they perceive to be sustainable, indicating potential to generate higher revenue growth through sustainable product offerings, and an opportunity to use sustainability and other ESG factors as value creation levers.

To summarize, Stax has observed:

- Increased volume of participants in the outdoor recreation industry

- Greater diversity of participants, including higher participation rates from minorities, women, and youth

- Increased per-participant spend, and shift towards premium products and services

- Growth in the highly attractive ‘enthusiast’ segment that drive spend, brand loyalty, innovation and new growth

- Economic resilience and consumer appetite for allocating discretionary income towards outdoor hobbies and interests; this is supported by the growing sentiment toward health and well-being

- Growing consumer focus on sustainability and environmental concerns, which has led brands to align their value proposition and positioning accordingly

About Stax

Stax has 30+ years’ experience working across numerous deals in a variety of markets, including the sports & outdoor markets, and has continued expanding expertise. More recently, Stax has expanded its offering to include ESG and Impact advisory, which can be intertwined with our core CDD work to help investors throughout the investment lifecycle, maximizing value creation potential. To learn more visit www.stax.com or click here to contact us.