Share

The growth of sports interest due to focused media initiatives is perhaps best characterized by the Netflix hit Drive to Survive, a documentary series that revived widespread interest in Formula One racing. Subsequently, several other documentary series like Break Point, Full Swing, and NASCAR: Full Speed have sought to capitalize on growing demand in sports media. Further, increased digital and social media access, the rise of sports betting and fantasy leagues, increased content creation among sports organizations, and the expanding international fan base have collectively elevated awareness and engagement in professional sports to unprecedented levels.

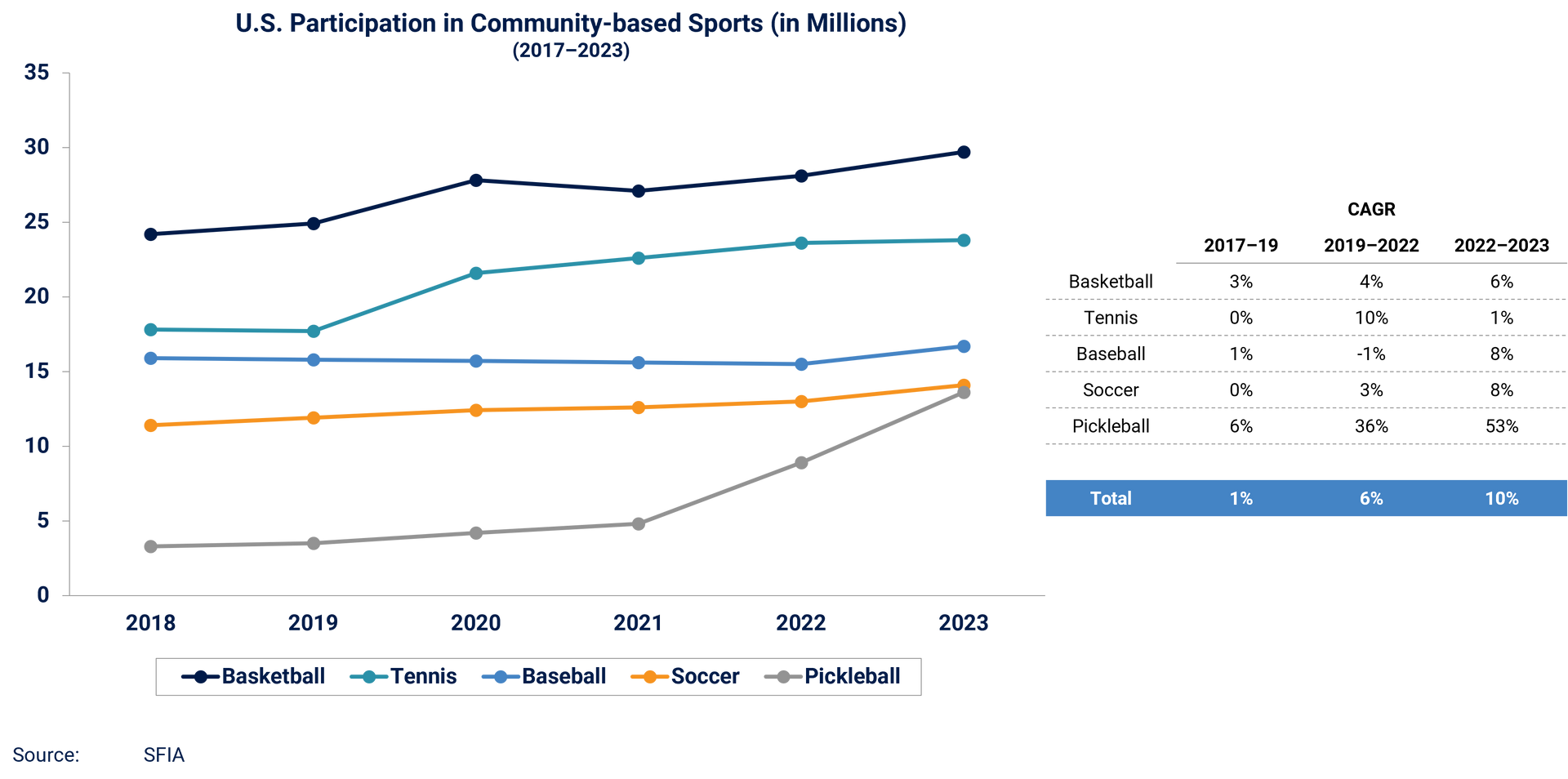

The surge in professional sports following has translated into a marked rise in engagement and participation in non-professional and community sports. This tailwind for community sports participation is expected to continue for at least the next few years, buoyed by the flurry of global sporting events in the Western Hemisphere scheduled to take place (e.g., LA 2026 being the first North American Soccer World Cup to take place in 30 years).

As participation in community sports has grown, so has adoption of technology by club administrators for club management and participant engagement – many of which are increasingly relying on third-party software to run their operations. As the demand for sports participation and technology continues to increase, the next 2-3 years provide a window of opportunity for private equity investors to capitalize on the growing sports management software market.

Stax believes the next few years will see valuation expansion in multiples for sports management software assets, supported by a growing and resilient underlying market. This bodes well for existing investors who entered the space during the Covid period, as well as new investors looking to gain exposure to the sports sector.

In this article, we will discuss the following:

- Macro trends driving growth of community sports.

- The increasing importance of technology and software in community sports management.

- Positive market tailwinds driving expansion in multiples for sports management software.

Market Segmentation

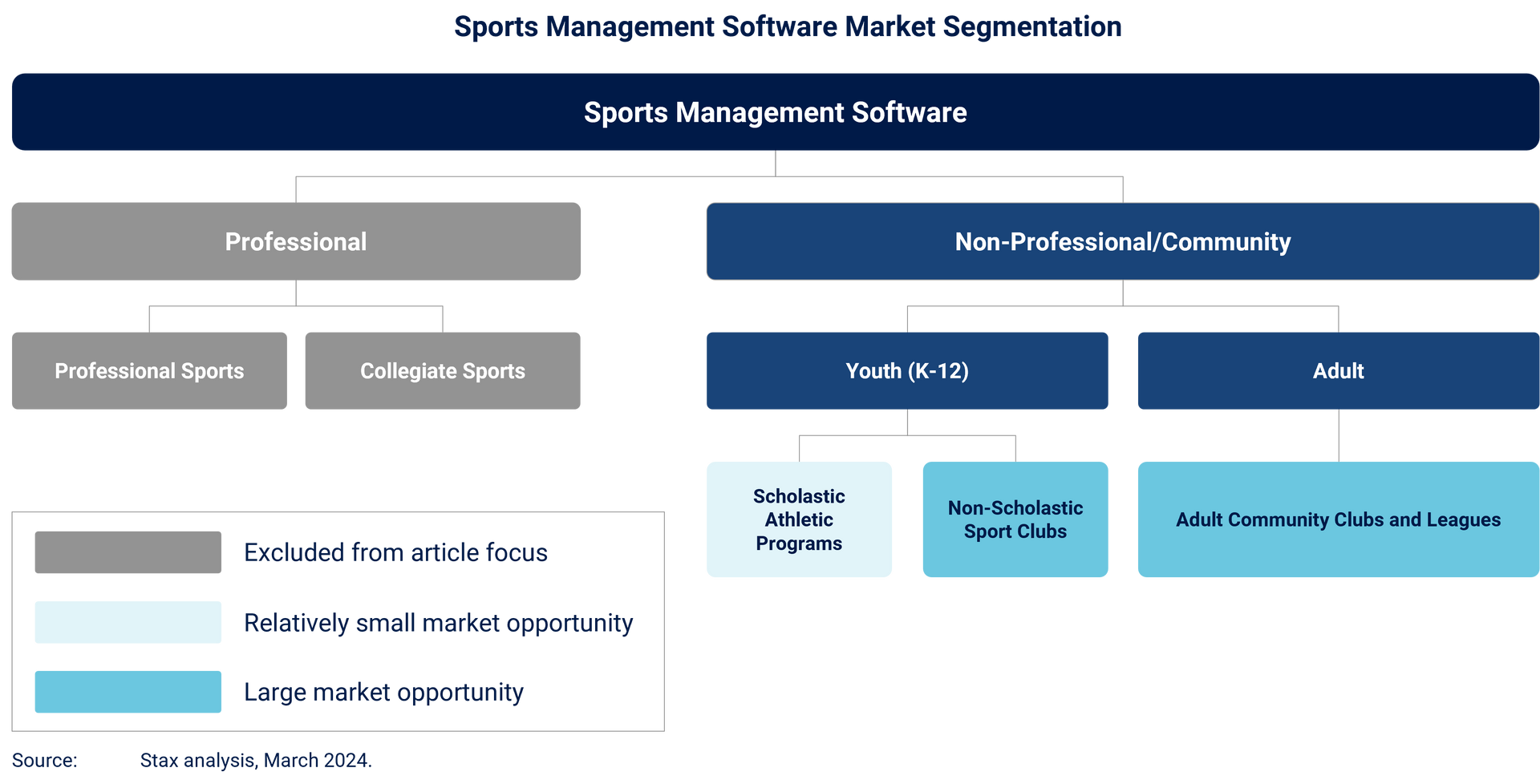

Sports management software in the U.S. is a ~$8-10B market expected to grow by double digits over the next five years. Broadly, the space can be divided into two segments: professional sports and non-professional/community sports. Both segments can be further split into performance, competition, and engagement; though the main customer groups would naturally vary (e.g., fan engagement vs. member engagement).

While professional sports management software presents a viable opportunity, this article will focus on community sports, which has seen a rapid acceleration in participation growth in recent years. There is a symbiotic relationship between professional sports and community sports—followers of professional sports are more likely to partake in non-professional/community sports in the form of gym membership, local sports leagues, after-school sports programs, etc. For example, the influx of high-profile athletes like David Beckham and Lionel Messi to the MLS has contributed to the growing popularity of soccer, resulting to increased participation in youth soccer academies across the United States.

Within the non-professional/community sports segment, non-scholastic, and adult sports clubs (i.e., privately owned) present the largest market opportunity, as the scholastic segment is largely captured by full-suite software providers that offer integrated solutions across sports and other scholastic applications (e.g., academic, music, attendance, etc.) For example, the youth league management software market alone is estimated to be worth ~$1B, driven by a strong culture of competitive team sports for children aged between 6-17 years old.

Note: Vendors play across market segments as workflows do not differ materially, e.g., non-scholastic youth clubs and adult non-professional clubs have largely similar use cases.

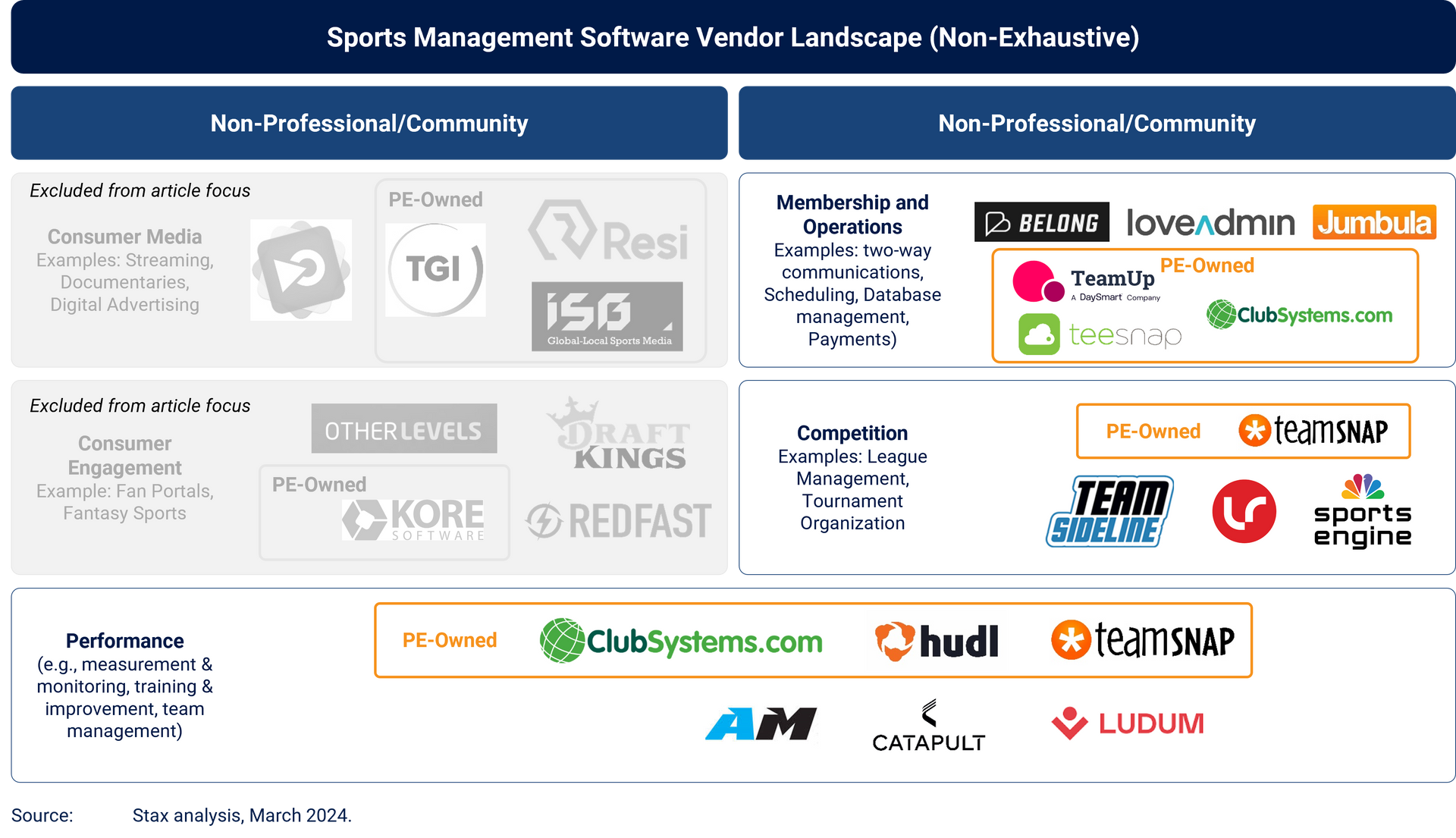

The vendor landscape in community sports management software is varied. Solutions range from full-suite platforms such as TeamSnap, which handles workflows across the entire player journey to specialized point solutions such as TeamSideline, which exclusively handles league management and tournament organization. Community sport clubs that adopt technology require a software solution for player registration. Other point solutions further along the player journey are then integrated into the database structure of the registration platform. As such, customer stickiness is highest for vendors which have registration offerings.

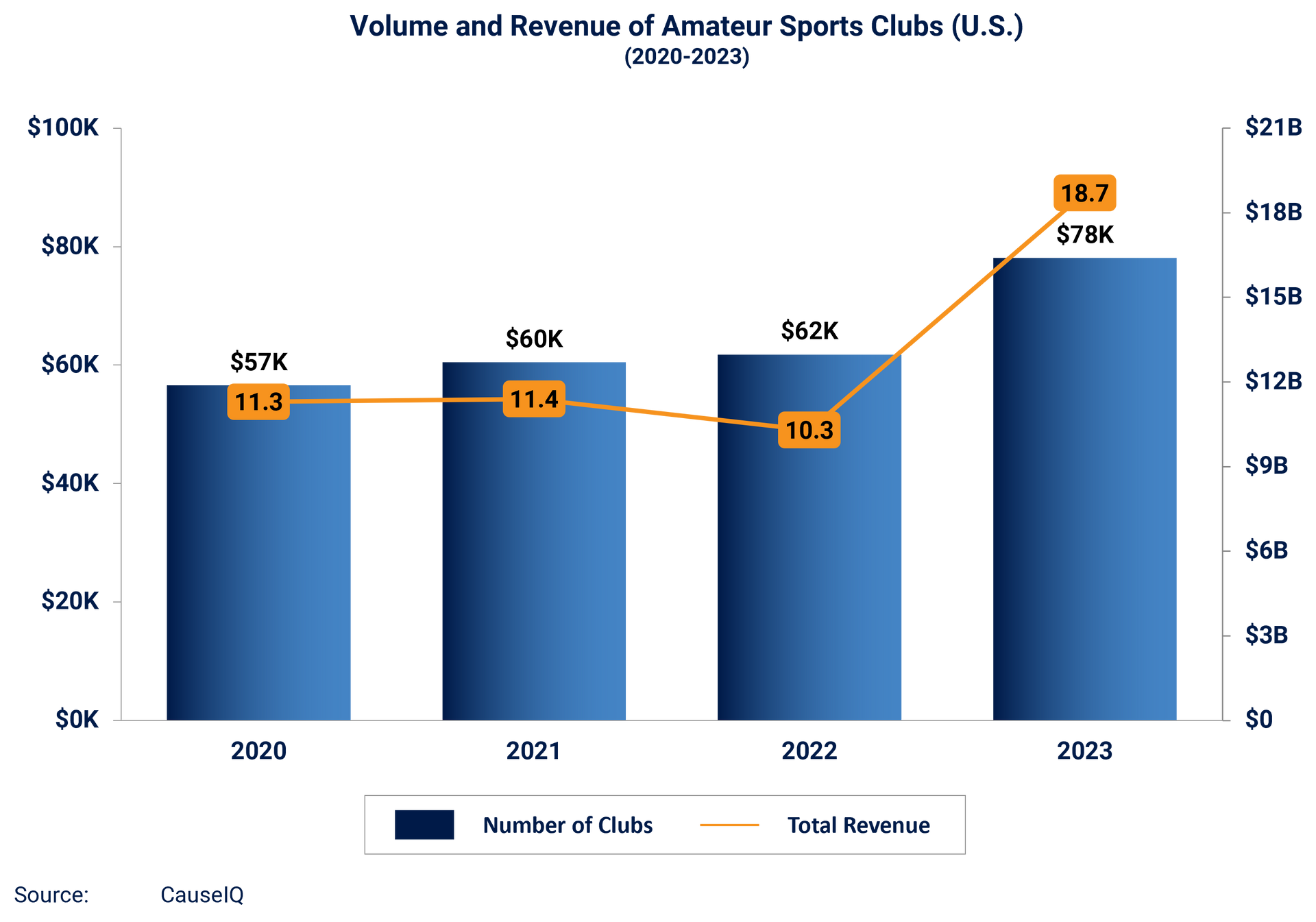

Community Sports Participation Has Grown Post-Covid

Participation in community sports among both youth and adults have accelerated over the past four years, with this trend reflecting consistently across different sports. Despite headwinds in the form of other activities competing with sports as leisure activities for youth (e.g., video games, social media, etc.), the overall outlook for participation remains positive, buoyed by the drivers outlined below. This interest has translated into a larger number of amateur/community sports clubs, each with its own software needs. The number of amateur sports clubs in the U.S. has grown from 57k in 2020 to over 78k in 2023, with total revenue growing by 65% over the same period from $11.3B to $18.7B.

Drivers:

- Post-Covid societal preference for outdoor and community-based activities

- Value of social interaction, connection and community identity/ support network

- Rising disposable income

- Growing awareness of health and fitness

- Efforts to increase the accessibility of youth sports to lower-income households

- Investment from state and municipal governments

Most of the positive tailwinds driving increased sports participation are secular, particularly within the youth segment where parents prioritize consistent and ongoing training for their children. Thus, dips in sports participation are uncommon, even in a recession.

Growth in Software Adoption

In addition to rising participation, there has been a notable increase in software adoption by club organizers and league administrators. This upswing can be attributed to three primary factors.

1. Evolution of consumer expectations

Consumers and participants expect technology and access everywhere. This includes adults participating in community sports and parents sending children to youth sports – which have evolved during the Covid period. As other aspects of consumers’ lifestyles have embedded the use of tech and mobile apps, there is now a stronger expectation for sports-related administrative tasks such as registration, scheduling, and payments to be software-enabled.

2. Consolidation of sports clubs

There has been a trend of consolidation of sports clubs under franchises / nationwide organizations. Examples include 3step (acquisition-focused) and i9 (franchise model) which operate hundreds of sports clubs across the country and specify software vendor selection at the corporate level. Given that the value proposition of such sports club collectives is built around process efficiencies and access to data, they are typically more sophisticated users of third-party software than independent mom-and-pop clubs.

3. Technological innovation

Increased sophistication of offerings has increased the value provided by sports management software. Compared to pre-Covid offerings, there have been innovations in sport-specific solutions (e.g., underwater analytics for swimming, baseball batting statistics, etc.) and customizability (e.g., a bespoke player database for association-run sports clubs). Across the vendor landscape, a prevailing trend involves investments into developing adjacent tools to allow sports management software vendors to access a larger share of the consumer wallet, such as through embedding insurance, apparel, equipment, fundraising, etc. onto the existing operations-focused platform.

Growing Investor Interest in Sports Management Software

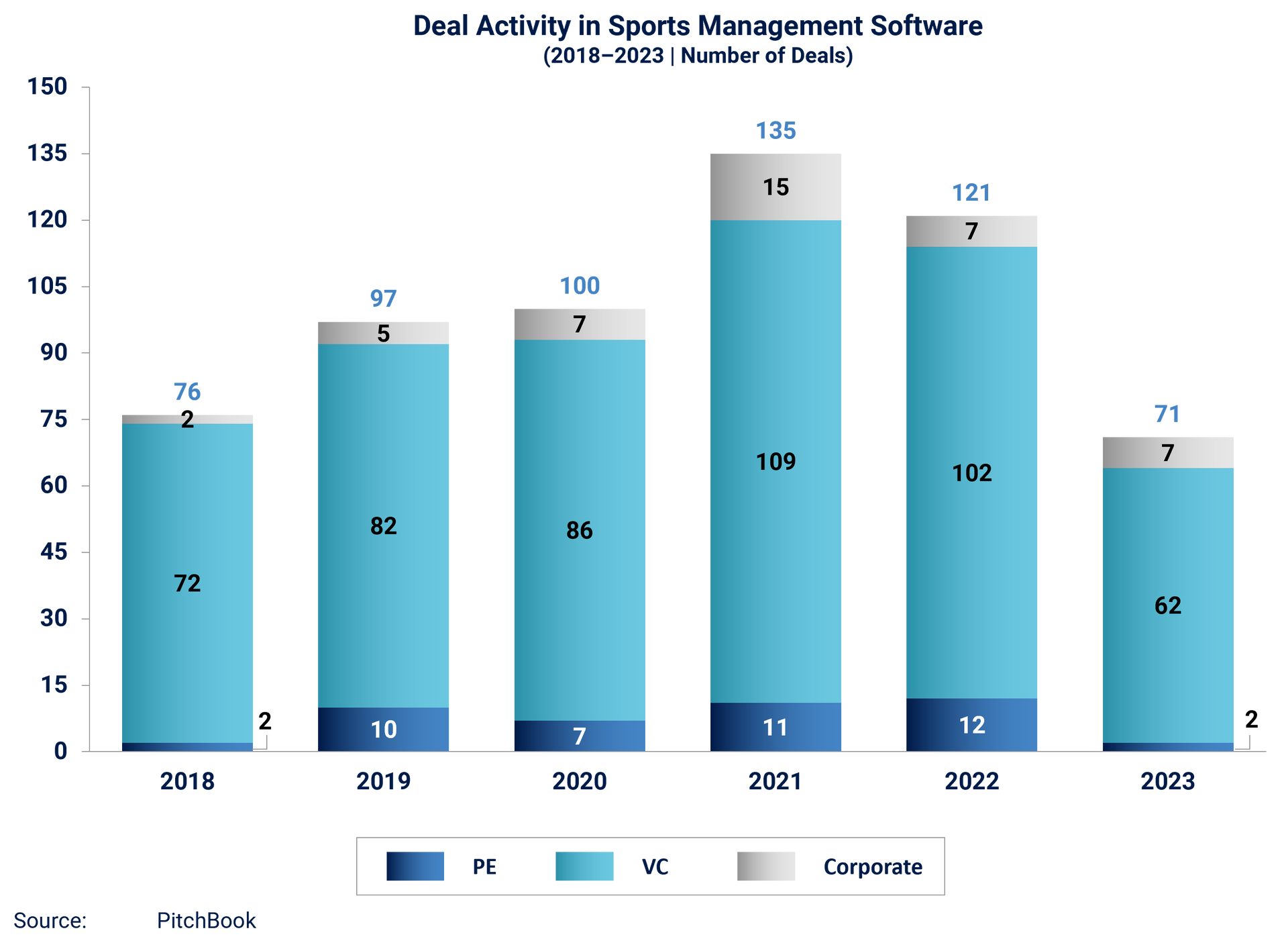

An uptick in investment from VC and PE investors drove innovation in sports management software over the past five years. This includes sports-focused funds (e.g., Arctos Sports Partners) as well as larger outfits that have signaled their confidence in the sector (e.g., Bain Capital, Apollo, EQT Partners, etc.) While PE activity remained at a similar level through 2019-2022, most completed deals towards the end of that period were add-on deals for existing portfolio companies. VC activity remained robust, with a wave of innovative new entrants seeking early funding.

Innovations in technology mean that factors once considered key purchasing criteria, such as UI/UX quality and database flexibility, have become table stakes, making product differentiation more difficult to achieve. Therefore, the strength of vendors’ go-to-market strategies has become an important differentiator. For example, GameChanger, owned by retailer Dick’s Sporting Goods, has built out a strong sales machine and customer network among baseball and softball clubs, although its software is applicable to other sports as well. Alongside a strong GTM strategy, specialized offerings (e.g., golf ball-tracking at driving ranges and underwater apparatus to track swimming strokes), and flexibility with customization (e.g., adjusting data structure to fit customer needs) are increasingly the main differentiators.

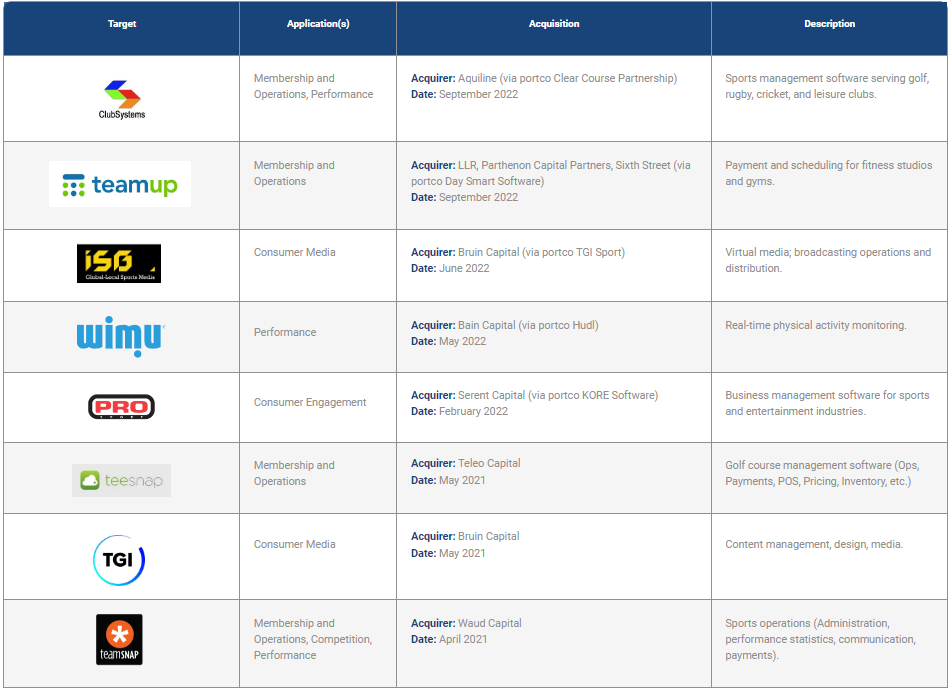

2022 saw the first substantial wave of PE add-on deals completed in the sports management software space and suggests that sponsors are preparing their portfolio companies for exit. It is worth noting that following a spike in average deal size in 2021, 2022 saw generally smaller deals, as the set of assets of suitable size for PE sponsors had been largely acquired in the years prior. As such, activity in 2023 was muted in line with broader M&A trends across sectors.

However, the maturity of assets acquired over the past five years, coupled with strong macro tailwinds, mean that deal activity is expected to pick up again in the next few years. This is particularly true for PE compared to VC as the average vendor size has grown due to increased tech adoption and consolidation in the vendor landscape.

Over the next few years, deal volumes, average deal size, and valuation multiples are all expected to increase. Consolidation could be driven by strategics, such as NBC-owned SportsEngine and Dick’s-owned GameChanger, or by the growing universe of PE investors interest in the space. This consolidation is expected to take the form of combining point solutions with complementary use cases that serve a similar customer base.

Such consolidation would allow specialization at scale – while the total addressable market (TAM) for niche subsegments (e.g., Little League baseball, amateur swimming clubs only, etc.) is not sizable enough to attract mid-market and large-cap PE interest, the market opportunity can be attractive through a roll-up of multiple assets. Although there is currently an absence of an “800-pound gorilla” in the sports management software space, continued innovation and improvement in integration capabilities may enable successful specialization at scale.

Select LBO Transactions in Sports Management Software, 2021-2022

The Global Sports Calendar Presents Timely Opportunities

In addition to regular major sporting events (e.g., Super Bowl, NBA Playoffs, MLB World Series, etc.), there is a concentration of major sporting events around the world over the next two years. As such, we expect heightened fan interest to be sustained, and continue to drive community sports participation. Specifically, the upcoming Summer Olympics and FIFA World Cup provide a window of opportunity. While these are regular events, the upcoming editions are being broadcast in time zones amenable to large U.S. and European audiences watching live. For investors seeking to capitalize on this macro trend and increase exposure to sports management software, which is predominantly concentrated in the U.S. and Western Europe, this represents an opportune moment.

| Event | Location | Sport | Date |

|---|---|---|---|

| Euros 2024 | Germany | Soccer | June 2024 |

| Cricket T20 World Cup | U.S. and West Indies | Cricket | June 2024 |

| Summer Olympics | Paris, France | Multi-sport | July 2024 |

| Invictus Games | Vancouver, Canada | Multi-sport | February 2025 |

| Summer World University Games | Rhine-Ruhr, Germany | Multi-sport | July 2025 |

| Ryder Cup | New York, U.S. | Golf | September 2025 |

| Winter Olympics | Milan, Italy | Multi-sport | February 2026 |

| FIFA World Cup | Los Angeles, U.S. | Soccer | June 2026 |

| Hockey World Cup | Belgium and Netherlands | Field Hockey | August 2026 |

Conclusion

Participation rates and consumer spend in community sports have surged since post-Covid recovery. The increased engagement in community sports—driven by social, cultural, health-related factors—and the materialization of a concentrated international sporting calendar is expected to continue driving heightened market growth.

During and post-Covid, the role of technology and software within community sports has also grown. Demand for efficient administration, improved communication, engagement, and data-driven decision-making will continue to bolster demand, adoption, and usage of community sports management software across clubs of all sizes.

Therefore, Stax believes that the next few years provide an actionable window of opportunity for investors seeking to increase their exposure to this growing market benefitting from secular tailwinds. Some key questions to consider include the trade-off between acquiring a full-suite solution and a specialized point solution, as well as non-product sources of differentiation such as the robustness of GTM strategy.

Stax has 30+ years of experience evaluating software and technology providers across verticals, including substantial experience in sports management software. This experience includes commercial due diligence across the buy-side and sell-side, in addition to value creation engagements across the private equity lifecycle. To learn more about Stax or our expertise, visit www.stax.com or click here to contact us directly.