Share

Over the last three decades, e-commerce has transformed our buying patterns and behaviors. Continuously adapting to fulfill consumers' demand for convenience and simplicity, U.S. e-commerce sales crossed the $1 trillion mark in 2022, representing ~21% of total retail sales, according to Digital Commerce 360 analysis of U.S. Department of Commerce figures. The rapid advancement of digitalization due to Covid accelerated the expansion of e-commerce worldwide. As we transition into a post-Covid landscape and witness the normalization of these trends, we highlight five factors shaping the future of e-commerce:

Fusion of Physical and Digital

Online players continue to add physical stores while major physical retail chains are adding online capabilities. E-commerce market leader Amazon has launched 5 different retail formats since 2015, out of which 3 formats operate currently. Amazon Go is a convenience store and Amazon Fresh offer online shopping with in-store pickup or home delivery of fresh groceries. Amazon Style, launched last year, is the company's first brick-and-mortar store dedicated to fashion. The unmanned stores are equipped with the latest technologies such as QR codes for product scanning, personalized recommendations based on past purchases and browsing history and fitting rooms enabled with virtual mirrors.

Walmart has more than 4,750 stores across the U.S., and 90% of Americans live within 10 miles of one. According to Tom Ward, chief e-commerce officer for Walmart U.S. “The store is becoming a shoppable fulfillment center,” functioning as an automated warehouse for online orders and a launch pad for drone deliveries. E-commerce now represents more than $80 billion in sales and over 13% of Walmart's total sales globally, according to company's Q4 2023 earnings call. BestBuy, Home Depot, and Macy's have also invested significantly into their online presence over the years with more than 20% of their U.S. revenue coming via online sales.

Membership to Drive Additional Revenue and Retention

Memberships provide retailers with additional revenue while improving customer retention. Amazon Prime was first launched in 2005 and currently has more than 200 million members across 23 countries, contributing more than $25 billion in membership fees. In U.S., Amazon Prime user base has grown from just under 100 million in 2017 to nearly 150 million by 2022. According to a 2022 study by Consumer Intelligence Research Partners, the primary driver for the purchase of Prime membership is free delivery, and 91% of Amazon Prime members renew their subscriptions each year.

Inspired by the success of Amazon Prime, traditional retailers are following suit by introducing their own membership programs. Walmart introduced Walmart Plus, a membership service, in September 2020. For an annual fee of $98, members can enjoy unlimited free deliveries and fuel discounts. Similarly, in response to a decline in consumer spending on discretionary items, BestBuy announced a revamped membership program in May 2023. The revamped membership program includes three tiers, with TotalTech, the highest membership tier offering free shipping (without a minimum purchase requirement), 2-year warranty protection on purchased products, and exclusive members deals at an annual cost of $199.

Online Retailers are Stamping Down on Returns

Last-mile delivery generally represents a significant portion, ranging from 25% to 40%, of the overall logistics costs that online retailers face. A growing trend, particularly among younger online shoppers, is the practice of "bracketing," which involves purchasing multiple items online with the intention of returning some of them. In 2022, U.S. consumers returned approximately 17% of their purchases, amounting to a substantial $817 billion, according to the National Retail Federation.

To mitigate the increasing expenses associated with returns, e-commerce retailers are implementing various measures. For instance, Amazon has introduced a policy where customers will be charged a $1 fee if they return items to a UPS store instead of utilizing one of Amazon's own or partner stores that are closer to their delivery address. Furthermore, Amazon has recently begun identifying and flagging products that are frequently returned on its website. Similarly, retailers such as Zara, H&M, J. Crew, Anthropologie, Abercrombie & Fitch, and others are now applying fees, ranging up to $7, for returning items purchased online.

The Rise of Social Commerce

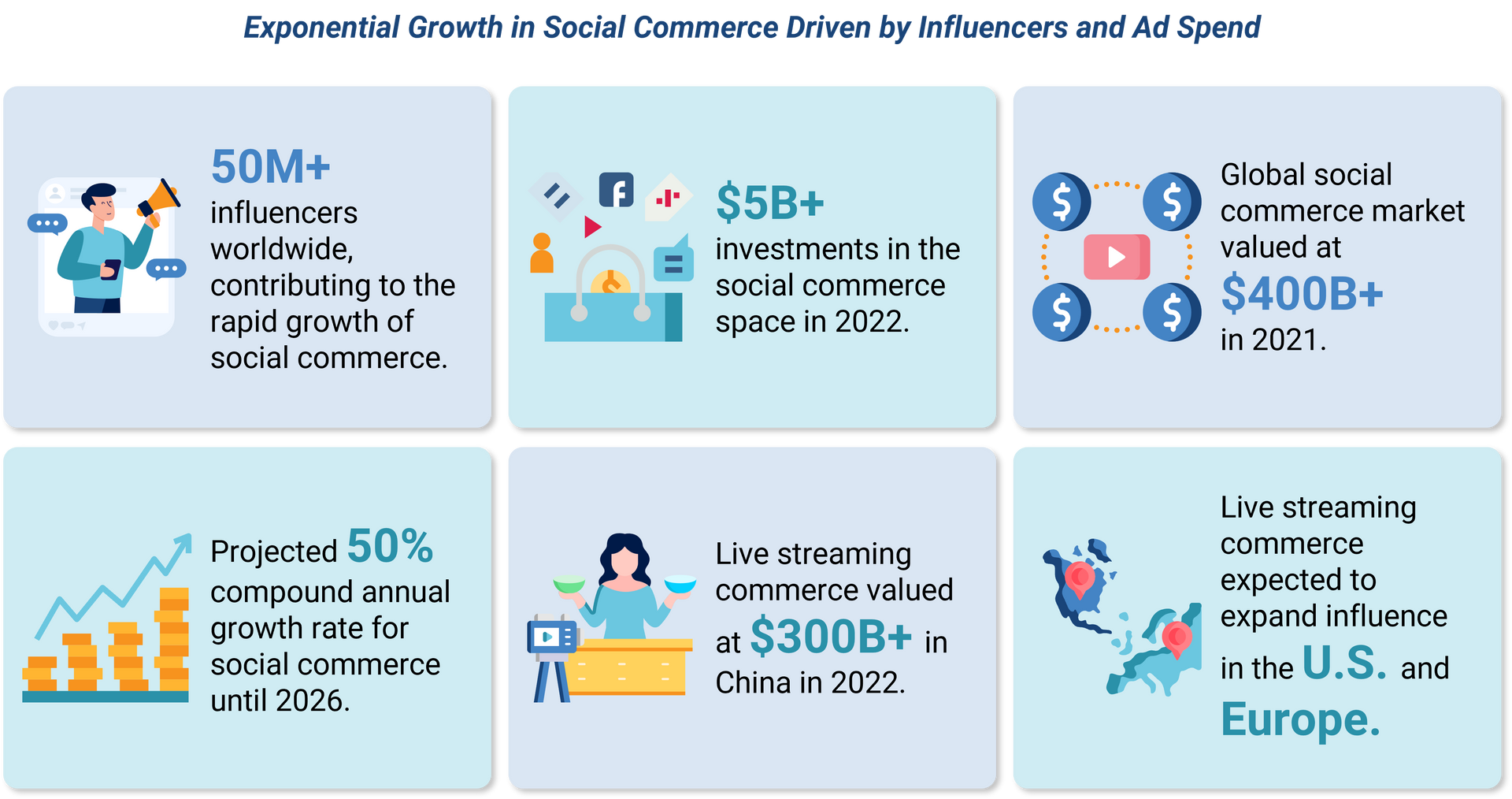

Rise of social media influencers and increasing social media ad spend have resulted in an exponential growth of the social commerce market. It is estimated that more than 50 million people across the world consider themselves as influencers and investments into this space exceeded $5 billion in 2022. ARK Research estimated the global social commerce market to be worth ~$400B in 2021 and forecasts that it will grow at a compound annual rate of 50% up to 2026.

In August 2021, social media giant TikTok announced an expanded partnership with Shopify to introduce in-app shopping. With this partnership, Shopify merchants with a TikTok For Business account will be able to add a new “Shopping” tab to their TikTok profiles and sync their product catalogs to create a mini-storefront. Shopify merchants can also tag their products in TikTok videos, directing shoppers to online check outs with a single click.

Live streaming is one of the latest innovations within social commerce. The live streaming commerce market in China was worth an estimated $300 billion in 2022. Although it is nascent in U.S. and European markets currently, its influence is likely to spread to over the coming years.

Last Mile Disruption

For several years, e-commerce players have focused on reinventing the last mile delivery due to its high cost concentration of overall transportation costs. Amazon announced its last mile drone program over a decade ago, but there has been limited progress so far. Some of the challenges in developing viable drone delivery systems are weather, noise, urban obstacles, crowded air spaces and strict BVLOS (beyond visual line of sight), especially in the U.S. and privacy concerns. Last year Amazon Prime Air launched its first commercial drone deliveries in Lockford, California and have plans to deliver 500 million packages annually via drones by the end of the decade.

Early commercial drone deliveries have focused on rural locations due to challenges of operating drones in built up areas and the cost-effectiveness of existing delivery methods. Although Amazon has so far managed to operate only 100 commercial drone deliveries, several other players have made much greater progress. For example, Walmart has partnered with drone startups Zipline and DroneUp and are currently operating thousands of drone deliveries across North Carolina, Arkansas, and Utah. Wing, a subsidiary of Google’s parent company Alphabet, has also managed to operate several thousand commercial deliveries to date.

In summary, physical stores, membership programs, and stamping down on returns will help e-commerce players to increase revenue and improve margins. Social commerce and drone deliveries are expected to reshape e-commerce over the longer term.

Sources

- Conley, Paul. “US ecommerce in 2022 tops $1 trillion for first time,” Digital Commerce 360, Feb. 17, 2023.

- Chevalier, Stephanie. “Topic: E-Commerce Returns in the United States,” Statista, Jul. 6, 2023.

- Statista. “Key Figures on Online Purchase Returns in the United States in 2022,” Statista, December 2022.

- Statista. “Market share of leading retail e-commerce companies in the United States as of June 2022,” Statista, Aug. 2022.

- McKinsey. “What is e-commerce?” McKinsey, Jun. 29, 2023.

- Gagliese, Joe. “The Rise Of The Influencer: Predictions For Ways They’ll Change The World,” Young Entrepreneur Council (YEC), Jul. 8, 2022.

- “Amazon drones make 100th delivery, lagging far behind Alphabet’s Wing and Walmart partner Zipline,” CNBC, May 18, 2023.

- Amazon Staff. “Amazon Prime Air prepares for drone deliveries,” Amazon, Jun. 13, 2022.