Share

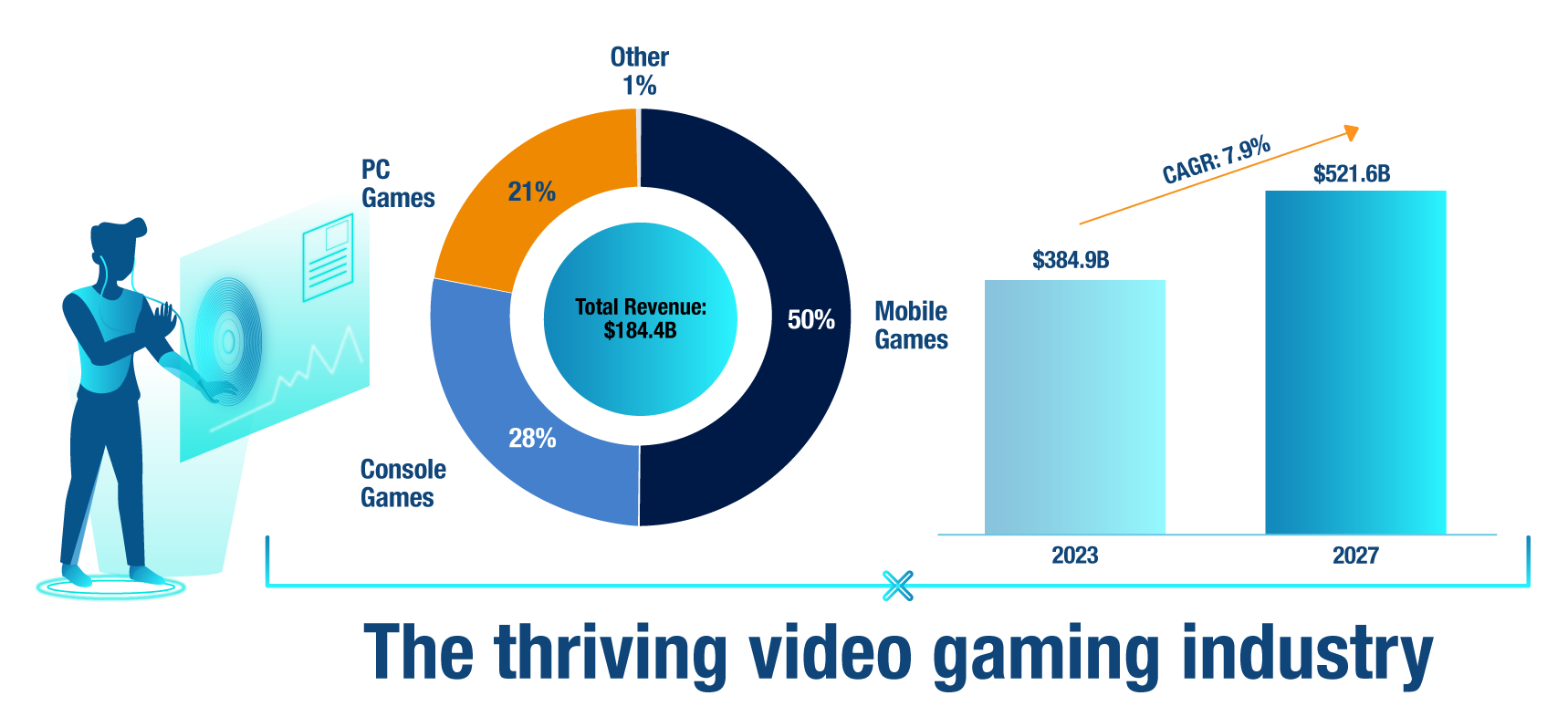

The video gaming industry is experiencing unprecedented growth, fueled by mobile gaming, esports, and cloud gaming. According to Newzoo, global video game revenue in 2022 was $184.4B. The mobile games market was the largest segment of the global video game market in 2022, generating $92.2B in revenue. Console games were the second-largest segment, generating $51.8B in revenue, followed by PC games that generated $39.4B.

The global video game market is expected to grow in the coming years—Statista forecasts that the market will reach $384.9B in 2023 and $521.6B in 2027. Alongside this growth, the video gaming industry has become a thriving marketplace for M&A, characterized by diversity and dynamism.

The M&A Video Gaming Landscape

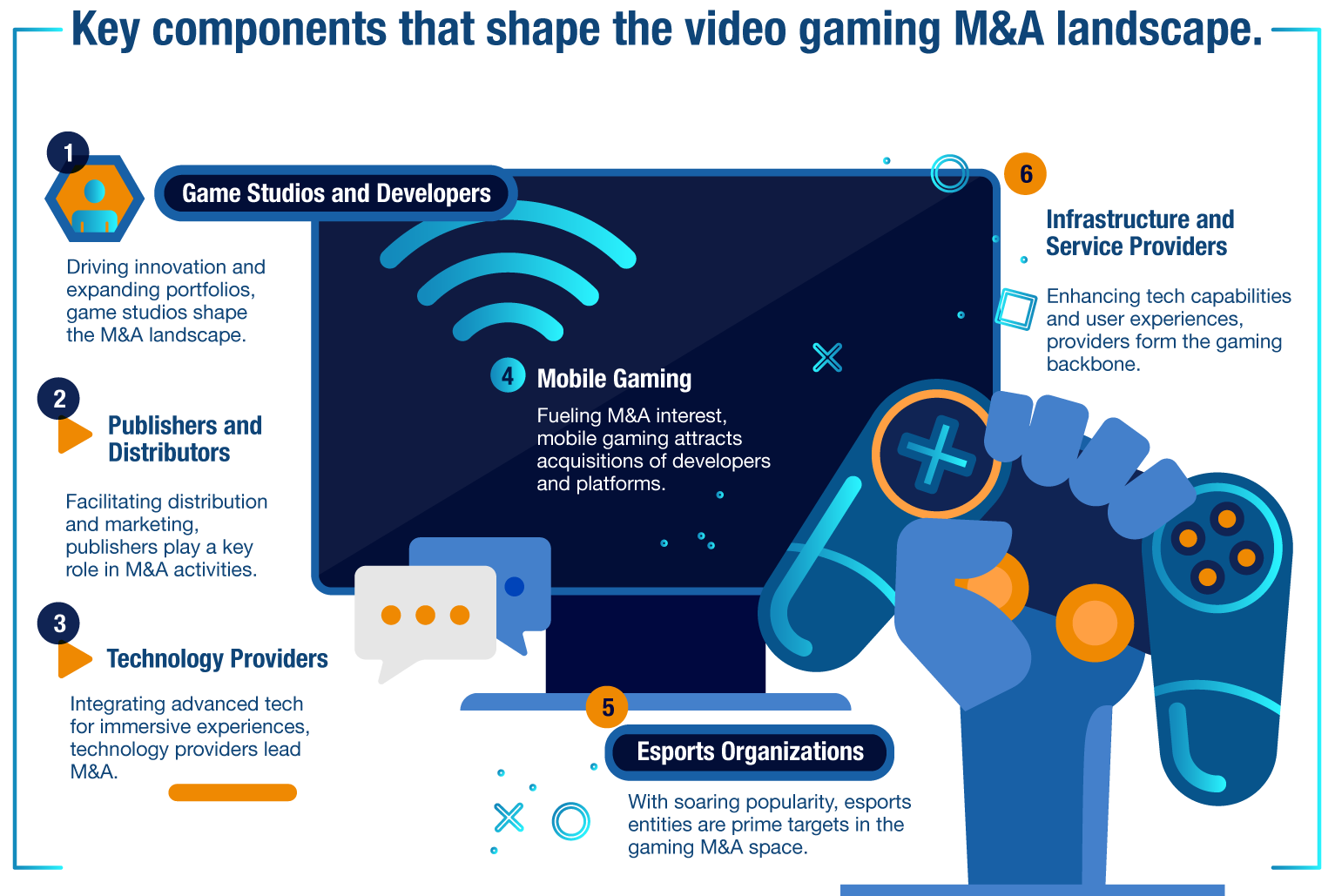

M&A deals in the video gaming industry encompass various components, including developers, publishers, distributors, technology providers, esports organizations, mobile gaming, and infrastructure/service providers. Developers are often acquired to expand portfolios and tap into talent and creative potential. Publishers play a crucial role in distribution, marketing, and financing—making them attractive targets for acquisitions.

Technology providers are sought to integrate advanced technologies into gaming offerings. Esports organizations are acquired to establish a presence in the growing esports market. Investments and acquisitions in mobile gaming are driven by its rapid growth. M&A also involves infrastructure and service providers to enhance the gaming ecosystem, offering platforms, streaming services, hardware/peripherals, payment solutions, and other critical support services.

Growth in the Video Gaming M&A market

In 2022, M&A deals in the video gaming industry reached a record-breaking $102.21B in gross transaction value, with a 75% YoY growth rate. Consolidation is a significant driver of this surge in M&A activity. Established companies aim to expand portfolios, access new markets, and absorb fresh talent and innovative ideas through strategic acquisitions. Technological advancements fuel the demand for specialized expertise, leading tech companies to enter the gaming market through M&A deals. The industry's globalization also drives cross-border M&A activity, allowing companies to enter new territories with the help of local expertise.

The Future of the Video Gaming Industry

The future of gaming holds immense potential as M&A activity continues to reshape the industry.

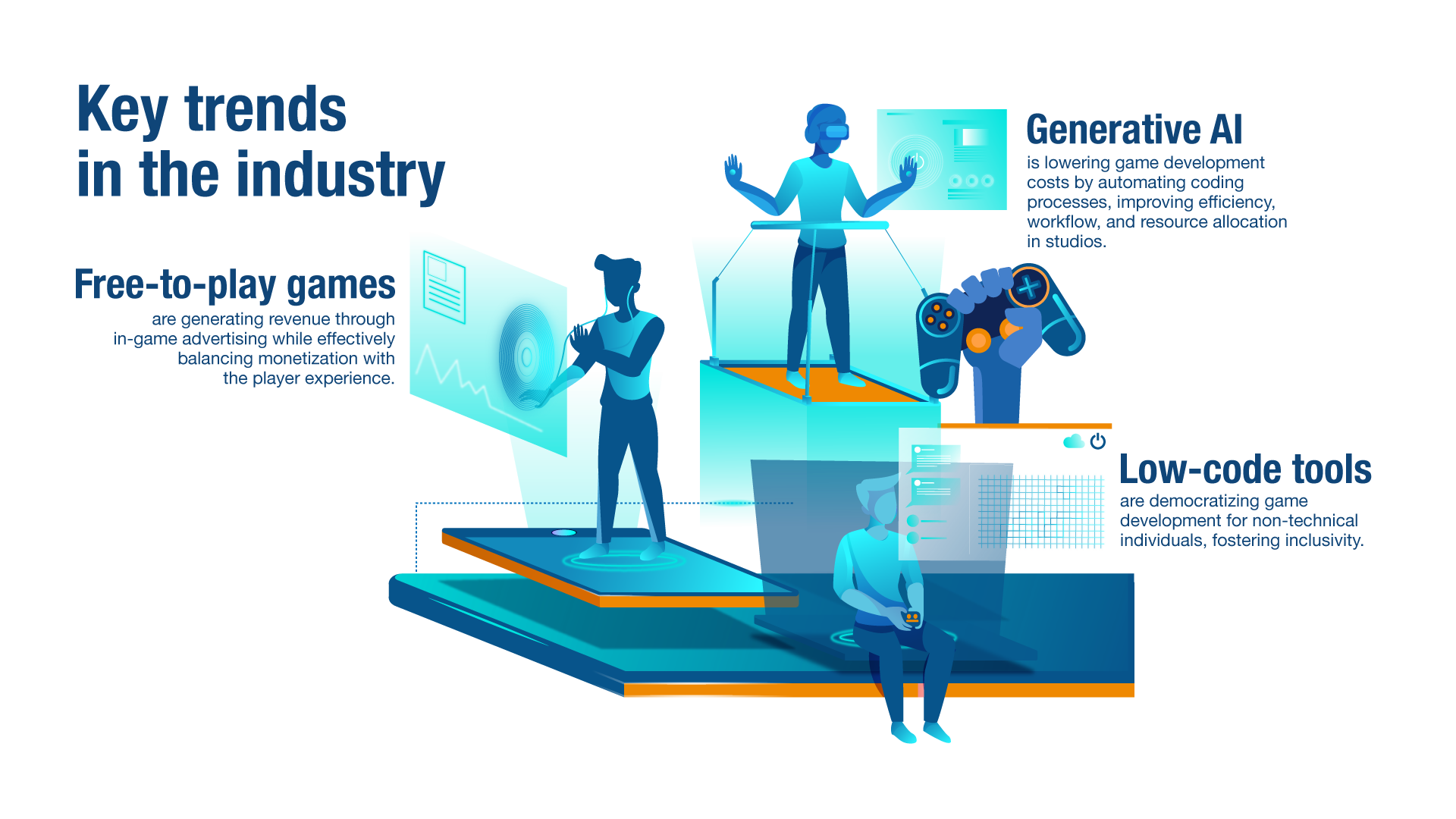

Industry consolidation will further strengthen the position of major players, driving innovation and the industry forward. Advanced technologies like AI, cloud computing, and virtual reality will broaden the horizon for immersive and engaging experiences. Future trends include the potential of generative AI to lower development costs, low-code development tools democratizing game development, the expanding audience for free-to-play games, and in-game advertising to monetize these games. Additionally, indirect revenue streams like esports, coaching services, IP licensing, and collaborations with non-gaming brands offer new opportunities for revenue generation and market expansion.

The rise of the video gaming industry and its M&A landscape reflects its growth potential and the pursuit of competitive advantages. As industry consolidation continues, the big players solidify their dominance, while tech-oriented acquisitions bring expertise and innovation. Cross-border ventures enable companies to explore new markets and adapt to diverse consumer preferences. The industry's future holds limitless potential driven by collaboration and the evolving needs of gamers worldwide.

The video gaming industry's meteoric rise and global popularity have fueled a vibrant M&A landscape. With record-breaking figures in 2022, M&A activity is reshaping the industry, driving growth, and expanding horizons. As consolidation continues and advanced technologies transform gaming experiences, the future holds tremendous possibilities. The industry's embrace of trends like generative AI, low-code development tools, free-to-play games, and indirect revenue streams further adds to the industry's dynamism and potential for innovation. The industry's M&A landscape is a testament to its ongoing evolution and its role as a key player in the global entertainment market.

Stax has extensive experience in navigating M&A deals over the course of our nearly 30 years of operation across various markets. To learn more about Stax and our expertise, visit www.stax.com or contact us here.

Sources

- Rousseau, Jeffrey. “Revenue across all video game market segments fell in 2022.” Newzoo, May 30, 2023.

- Clement, J. “Global video game industry revenue 2027” Statista, Aug. 16, 2023.

- IMARC Group. “Global Gaming Market Size, Share and Report 2023-2028”, 2022.

- Barbour, Neil. “Video game M&A in 2022 passes $100B in gross transaction value.” S&P Global, Jul. 20, 2022.

Read More