Share

Market Overview and Strategic Opportunities

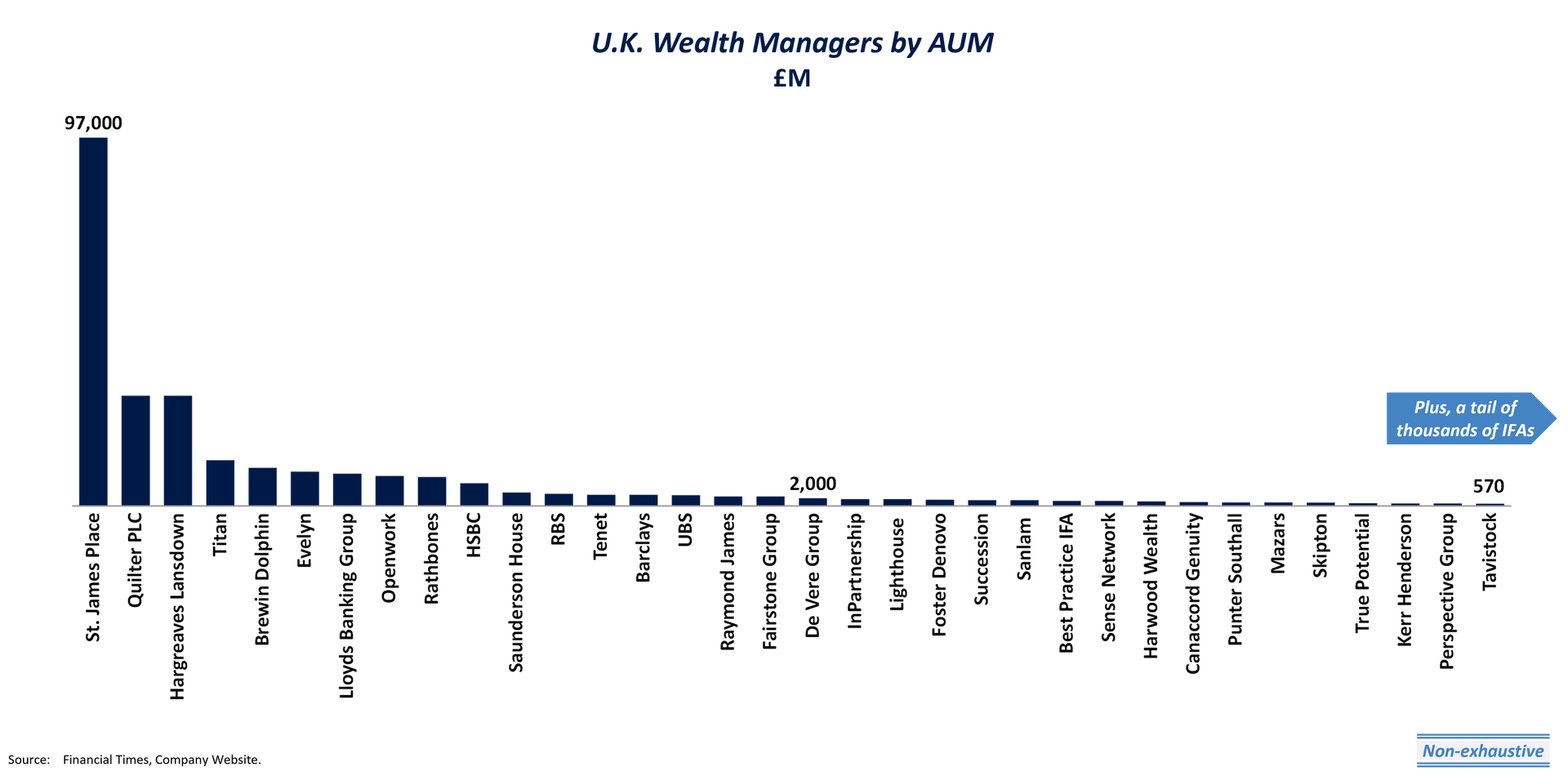

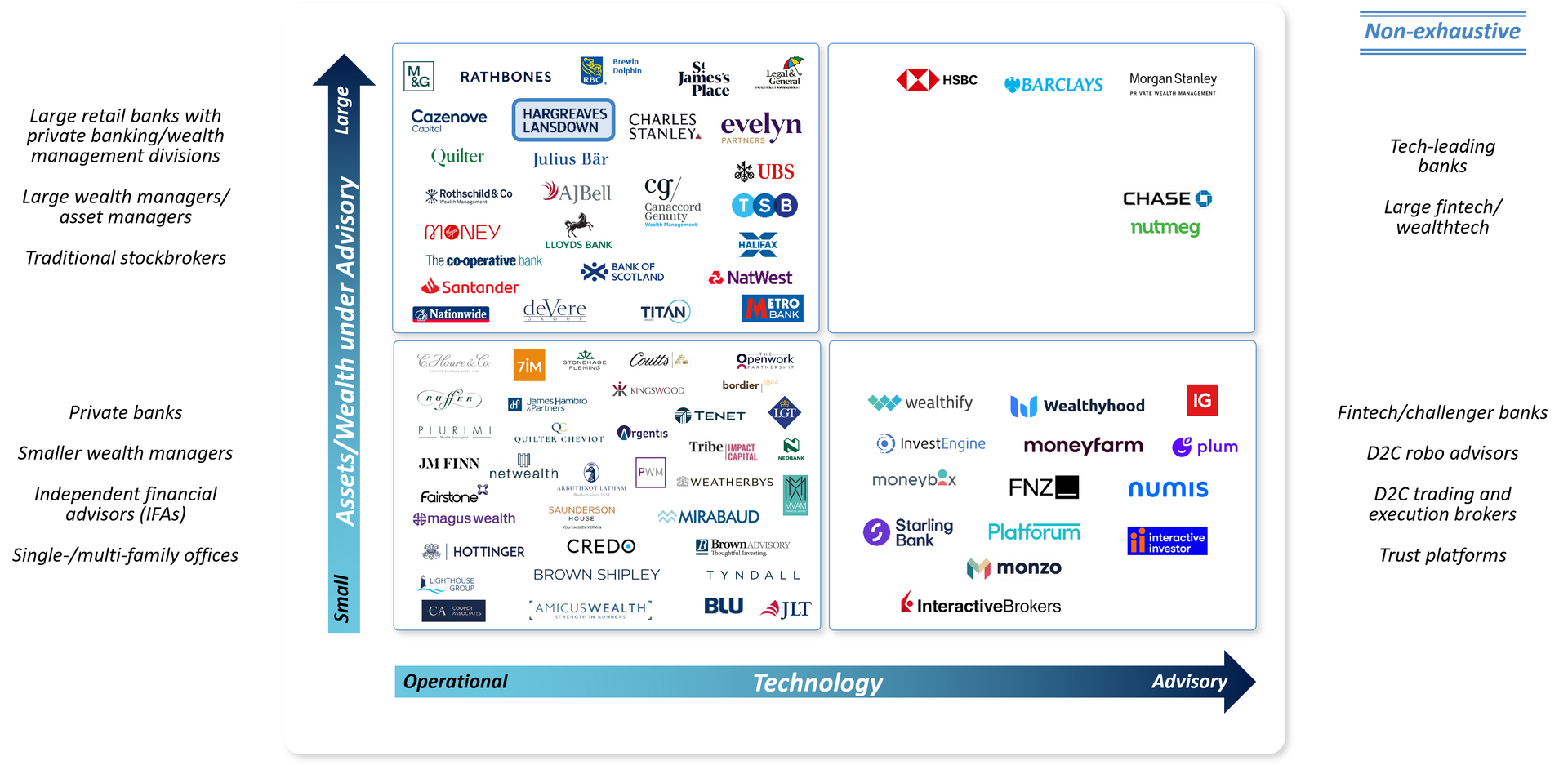

The fragmented U.K. wealth management market presents a compelling consolidation opportunity. With only 10 dominant firms and thousands of independent financial advisers (IFAs), private equity investors should assess the scalability potential of mid-sized firms, and target smaller firms seeking exits - around 500 smaller firms annually seek exit opportunities, fueling a robust M&A pipeline. Strategic acquisitions can drive economies of scale, enhance operational efficiencies, and provide access to untapped client segments. Investors must consider the long-term growth potential of a firm’s client base, product diversity, and positioning within the evolving regulatory landscape.

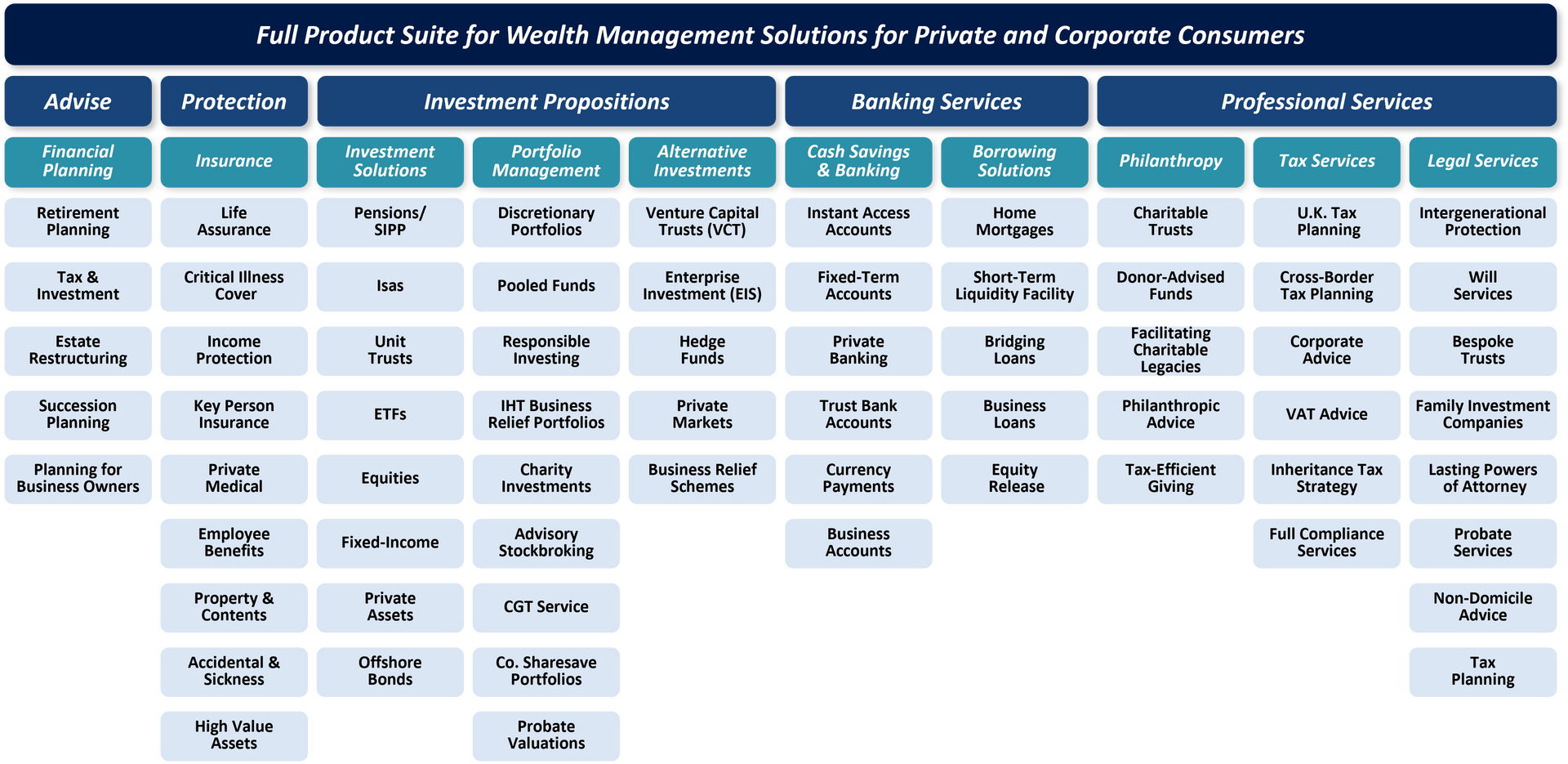

Product Offering and Differentiation

The wealth management sector offers a broad but often incomplete range of services, creating opportunities for strategic investors to back firms that can offer a full-service model. Private equity should focus on firms with the ability to identify high-growth product segments and personalize offerings for distinct client groups. An acquisition strategy centered on product differentiation will improve competitiveness and foster deeper customer loyalty—key for long-term revenue stability.

Managing Client Concentration Risk

For small and mid-sized firms, reducing client concentration risk is vital. Private equity investors must evaluate a firm’s exposure to a concentrated client base and explore consolidation as a means to diversify revenue streams. Acquiring firms with complementary client profiles or different stages of wealth accumulation can enhance stability and growth potential, offering a more balanced client portfolio across economic cycles.

Leveraging Technology and AI

As technology and AI reshape the wealth management landscape, private equity investors should prioritize firms with strong digital capabilities. An AI strategy that enhances client engagement, delivers personalized advice, and optimizes operational efficiency is critical for sustained growth. Investors should evaluate how a firm’s AI integration can drive competitive advantages and create scalable, long-term value, particularly through data-driven client insights and improved service delivery.

Stax Investment Hypotheses and Value Creation

Stax’s investment approach focuses on identifying high-growth product segments and capturing multi-generational wealth. For private equity, leveraging advanced analytics and AI to predict market trends and customer behavior will be crucial for selecting firms with the highest growth potential. Investors should consider not just current performance but the firm’s adaptability to market changes and its ability to build lasting client relationships, positioning the platform for long-term value creation.

| Investment Hypothesis | Market Opportunity | Potential Challenges |

|---|---|---|

| Growing the core business by catering to new target customer segments | Structural changes in demographics and emerging customer segments provide wealth managers with new potential target customers. Seek a platform that can develop new advice propositions. | Market volatility and high interest rates is causing a slowdown in AUM growth. You will need to contend with talent shortages and consider customer acquisition channels and the marketing investment required to win new clients. |

| Capitalizing on U.K. pricing reforms to win market share | U.K. pricing reforms pose challenges for established players who primarily compete on price. Amidst this landscape, you could seize an opportunity, leveraging existing customer relationships and trust, to deliver superior protection services, prioritizing exemplary customer service. | The growing use of Tech/AI is providing competitors the ability to design and deploy products at pace, providing customers with tailored solutions and a premium experience. |

| Expanding investment capabilities to attract different customer risk profiles and support the larger institutional investors | Private Markets and new asset classes continue to experience AUM growth as investors seek greater diversification and risk-return profiles. New investment solutions could also support wining in fast growing customer segments i.e., HNW women and the affluent and low HNW individuals. | Passive managed funds face high price competition since Vanguard entered the U.K. market. Winning higher fee active managed mandates is based on fund performance – you will need a 3yr+ outperformance track record. |

| Banking services would support in building a single wealth management platform | The emergence of FinTech/non-bank disruptors is changing the competitive landscape in financial services leading to evolving customer demands who seek round-the-clock personalized service—there is an opportunity to capitalize on this trend. | Offering direct banking services will require a banking license, balance sheet investment, and a strong GRC infrastructure. White labelling / partnerships could be a faster route to market. |

| Offering professional services would provide a comprehensive offering | Adding professional services to a wealth management offering can enhance the client experience and position you for long-term success by strengthening client relationships at key points during their financial journey (e.g. Will drafting, probate, etc). | You will need to understand how existing clients currently consume professional services and what’s required to encourage customers to switch to a ‘one-stop-shop’. |

Based on our experience in FS, we believe that CDD should start by answering:

Client Retention and Loyalty Metrics:

- What are the long-term client retention rates segmented by tiers (e.g., UHNW, HNW, affluent)?

- How resilient is the client base during market downturns, and what percentage of AUM are tied to multi-generational relationships versus first-generation wealth?

Regulatory Compliance and Risk Management:

- How robust is the internal controls, compliance frameworks, and risk management systems in adhering to both U.K. and international regulatory standards, particularly in light of the FCA’s COBS rules?

- Are there any historical or pending regulatory actions, fines, or investigations that could materially impact the company’s reputation or operational capabilities?

Revenue Quality and Fee Structures:

- How is the revenue mix structured across advisory fees, performance fees, and product commissions?

- What percentage of revenue is derived from discretionary versus non-discretionary management, and how sensitive is the fee structure to changes in market conditions?

- How transparent and competitive are these fee structures relative to industry benchmarks, and what potential exists for fee compression in the future?

Technology and AI Integration:

- How advanced is the firm's technology infrastructure, and to what extent is AI leveraged in areas such as client advisory, portfolio management, and risk assessment?

- What are the firm’s plans for future AI adoption, and how scalable is the existing platform for new tech integrations?

- How effectively are firms using AI to personalize client experiences and improve operational efficiency?

Are you interested in building a wealth platform? Speak to Ben Bugg about additional areas of due diligence critical to evaluating opportunities.

About Stax

Stax has a 30-year track record in successfully guiding management and private equity investors through value creation strategies. Our extensive experience within the financial services sector consists of multiple engagements in the banking, wealth & asset management, insurance, and broader financial technology. Visit www.stax.com or click here to contact us directly.