What Makes Buy and Build an Effective Strategy for Maritime Software Investments?

What Makes Buy and Build an Effective Strategy for Maritime Software Investments?

The maritime software industry has experienced a recent “rising tide” as attractive opportunities for investors have surfaced. Stax has leveraged our experience within the broader maritime ecosystem to provide this framework for value creation and growth through a buy and build strategy.

Across the maritime software space there are a number of industry trends which favor investment:

1. Underlying growth in seaborne trade and the global merchant fleet

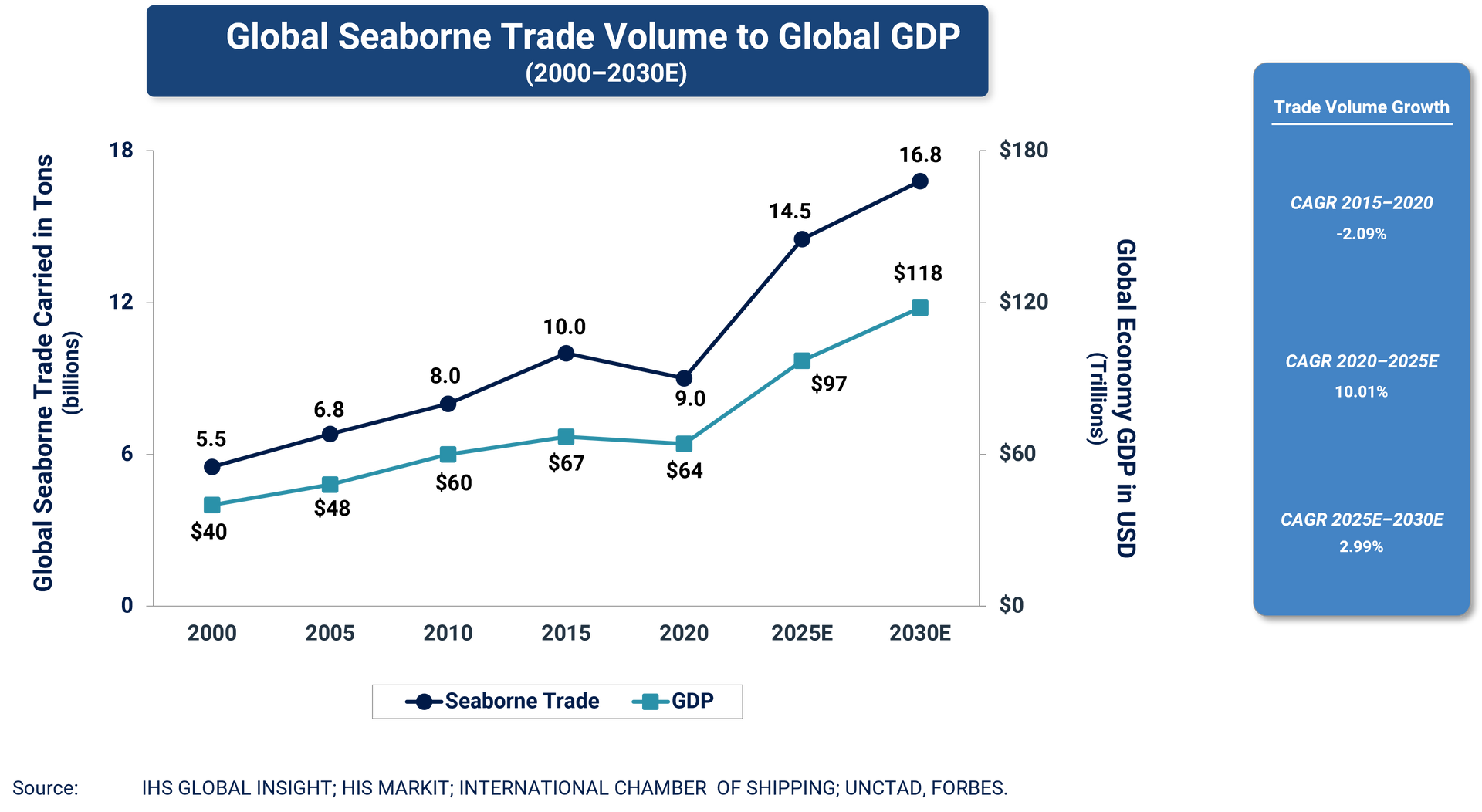

The maritime industry serves as the backbone of global trade and the world economy. Historically global seaborne trade has exceeded world economic growth and this is likely to continue, despite global supply chain disruptions, increased geopolitical tensions and protectionism. Indeed, supply chain disruptions, like the recent Houthi attacks in the Red Sea, increase the value of technology solutions that can nimbly re-route vessels and optimize fuel consumption as ships avoid trouble spots. Furthermore, while geopolitical tensions and protectionism will impact trade, the main effect is likely to be shifts in trade inter and intra-regionally as supply chains adjust to new realities. This underlying growth in seaborne trade translates into growth in the global merchant fleet which ultimately drives many maritime software verticals.

2. Maritime industry economics

The maritime and shipping industry has long struggled with poor profitability due to factors like fluctuating freights and fuel prices, overcapacity, and changes in regulations. This historical challenge should encourage shipping companies to be more open to adopting new technology solutions. Innovations such as advanced analytics, automation, and blockchain can streamline operations, reduce costs, and enhance transparency. For instance, predictive maintenance can minimize downtime, while improved digitalization can improve supply chain traceability. By embracing these technologies, shipping companies can not only improve their bottom line but also gain a competitive edge in an increasingly digital world.

3. Software adoption immaturity

While the industry has every economic incentive to digitalize, it is relatively immature in its adoption of technology solutions, although this varies by sub vertical. This has been driven by the relatively conservative nature of the industry but this is changing as modern seafarers are entering the industry with a heightened familiarity and comfort with digital tools, automation, and artificial intelligence, which they expect to make their work lives more efficient and productive. In addition, more modern Software as a Service (SaaS) business models are proliferating as the industry modernizes.

Build and Buy Approaches

There are many sub verticals in the maritime software market – many of them relatively small in addressable market terms.

Given this “Buy and Build” is an obvious strategy to pursue but investors should:

- Understand the maritime software landscape and potential market opportunities by sub verticals

- Understand consider adjacencies carefully – both in maritime and beyond

- Consider starting with a leader in an attractive sub vertical although beware genuine disruptive new entrants

- Assess how the complex customer decision making environment impacts product market fit and cross sell opportunities

- Consider where the target is on the legacy software to SaaS transition journey technology implications of combining multiple platforms

About Stax

Stax’s perspectives are informed by deep experience across the broader maritime ecosystem and specifically maritime software. With prior work including analysis of the maritime passenger segment, commercial lines, as well as offshore, we are prepared to support any buy and build strategies.

To learn more about our expertise, experience, and how we curate tailor-made buy and build playbooks through diligence, visit www.stax.com or click here to contact us directly.

Read More

Featured by Power Magazine: China Coal-Fired Generation Additions Tied to Economics, Energy Security

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy