Share

This article was published by Exhibition World in September 2022.

AMR International (acquired by Stax in 2022), based in the UK, has released its annual top 20 global exhibition organisers list.

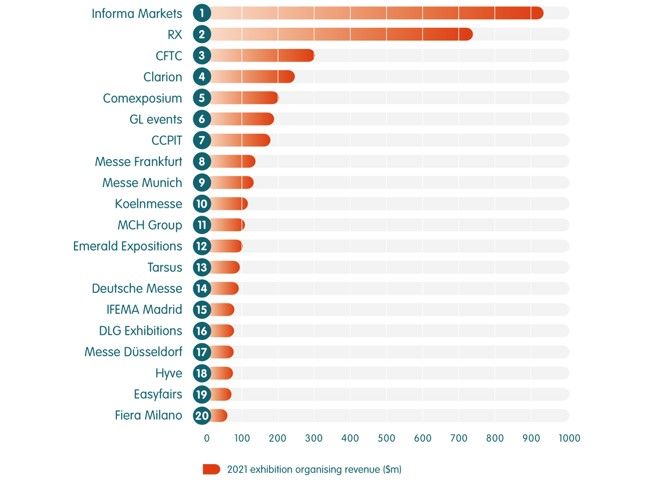

The rankings are based exclusively on exhibition-organising revenues from 2021 revenues.

There has been no change among the top three from last year. Informa Markets remains number one, followed by RX, and CFTC.

IFEMA Madrid and Shanghai-listed DLG Exhibitions debut in the AMR Top 20, while Easyfairs rejoins. Meanwhile, Italian Exhibition Group (IEG), dmg events and Messe Nuremberg drop out.

UK-based organisers Clarion, Tarsus and Hyve also all made the Top 20.

In alphabetical order, the five next largest organisers outside the AMR Top 20 this year are the Association of Equipment Manufacturers (AEM), dmg events, HKTDC, IEG and Messe Nuremberg.

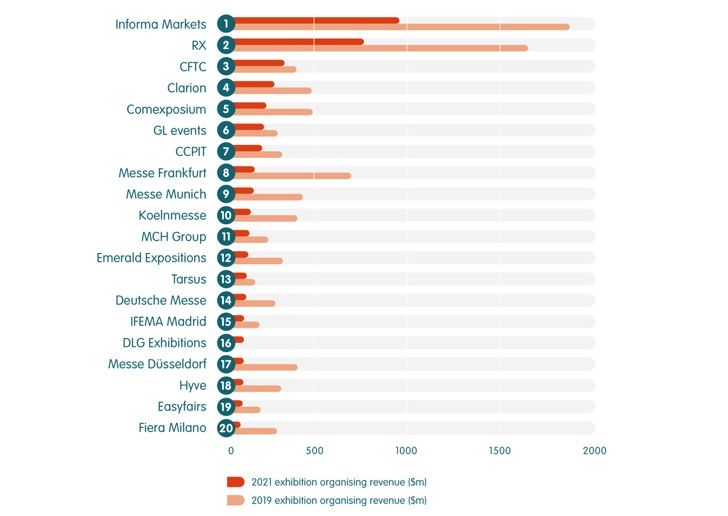

Comparison with 2019 shows the top 20 lost billions of dollars in revenue over the course of the pandemic, however, recovery has been better in 2022.

Florent Jarry, Managing Director at Stax, says, “2021 was again an exceptional year due to the continuing disruption of Covid-19. As a result, organisers with strong portfolios in countries with earlier recovery such as China performed relatively better than others. This has led to the ranking being substantially different from pre-covid years. This year’s Top 20 is a snapshot and not representative of longer-term market positions.”

“We can expect to see further changes next year as most organisers return closer to their pre-covid portfolio structure.”