Financial Services and Transatlantic Ambitions: Why UK PE Investors Should Look West for Exits

Financial Services and Transatlantic Ambitions: Why UK PE Investors Should Look West for Exits

For UK-based private equity (PE) investors in financial services, the traditional approach of following regulatory guidelines ensuring returns and fostering growth across domestic and European markets is shifting. Now in 2025, a new trend is emerging; the most rewarding paths for exits may not be found in their backyard but rather across the Atlantic—within the dynamic US financial services landscape.

Before making a decision on your portfolio company take a moment to consider whether you're strategically positioning your investment to benefit from the thriving US market. Or missing out on transformative returns.

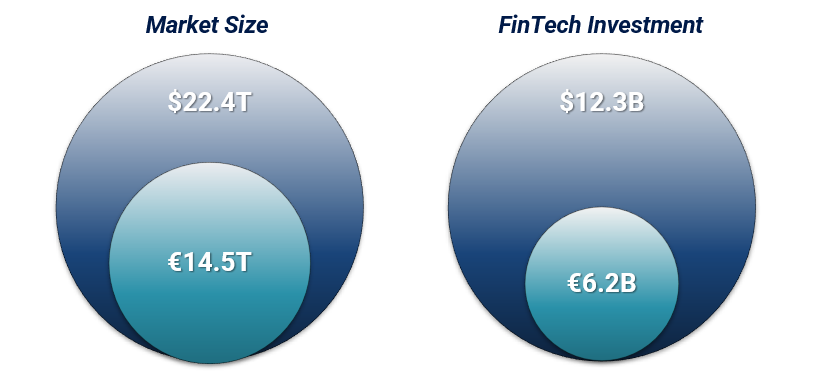

The US financial services industry is vast, with a market size of approximately $22.4 trillion in 2024 compared to the combined €14.5 trillion in the UK and Europe. This difference goes beyond size; it reflects the sector's depth, diversity, and vibrancy. American firms’ standards and markets technology spaces often provide an environment for innovation compared to their counterparts in Europe.

In 2023, US fintech companies attracted $12.3 billion in funding—nearly double the €6.2B invested in European FinTechs. These numbers suggest a real interest for innovation and mergers and acquisitions. The US offers a foundation for scaling—be it transitioning a mid-sized wealth management firm to a digital model or deploying RegTech solutions that proactively address compliance requirements.

What Factors are Driving Opportunities in the US?

Market Fragmentation:

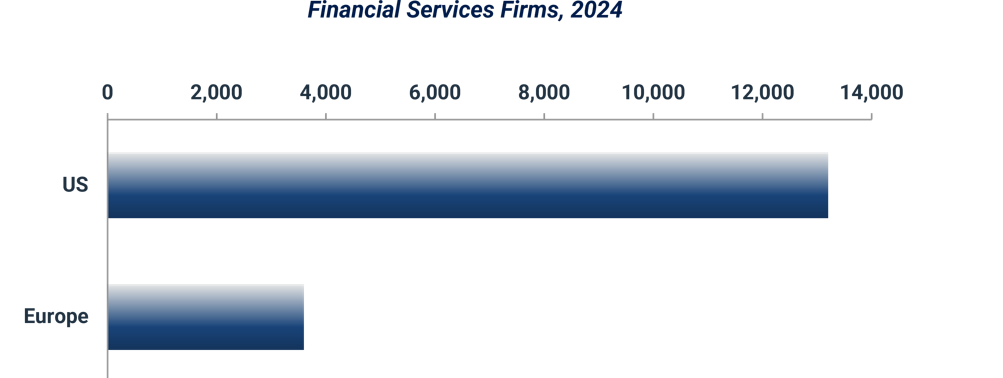

With over 4,200 FDIC insured banks and around 9,000 credit unions, the US presents a landscape ripe for consolidation compared to Europe's smaller number of concentrated financial institutions. As private equity investors seek exits, companies in the US market are often larger, better funded, and eager to acquire tech enabled solutions for scalable integration.

Navigating Regulatory Nuances:

The complex regulatory landscape in the US also offers opportunities for introducing financial technologies. By leveraging this intricacy—particularly in areas like RegTech and Supervisory Technology (SupTech)—private equity investors can increase the value of their portfolio companies. US firms are keen on adopting solutions that assist them in complying with overlapping state and federal regulations, such as consumer protections and cybersecurity measures. The growing importance placed on compliance functions is creating a favorable market for tools that enhance transparency and efficiency.

Embracing Technological Advancement and Scaling:

While European banks have been slower to embrace cutting edge technologies, counterpart institutions are often quick to adapt. For example, US wealth management firms, managing an impressive $44.5 trillion in assets under management (AUM), are rapidly digitizing their operations. The rise of platforms is witnessing an impressive annual growth rate of 22%. Private equity-backed companies that can showcase how their offerings align with the relentless pursuit of scalability, efficiency, and enhanced client experience by American firms may find themselves as exit candidates.

Impact of Interest Rates and Economic Factors:

Towards the end of 2024 the interest rate landscape set by the US Federal Reserve has shown volatility compared to the European Central Bank and the Bank of England. While higher rates may increase borrowing costs, they also enhance profit margins and potentially boost profitability in financial sectors. US financial institutions adept at navigating such economic variations often respond by pursuing acquisitions that strengthen their resilience. This creates opportunities for UK-based portfolio companies that offer efficiencies, diversification, or advanced analytics to assist US acquirers.

Specifically, are there sectors more appealing for exits in the US?

FinTech & Payment Technologies:

The US payment technology market, valued at $8.9 trillion, has seen digital payments reach 78% penetration. US investors are keen on technologies that streamline payment systems, incorporate AI-powered fraud detection and align with finance trends. A UK payment platform with cross-border capabilities and compliance features could quickly catch the attention of acquirers looking to gain a competitive edge in the US market.

RegTech & SupTech:

The complexity of regulations in the US presents a significant challenge but also an opportunity. There's a growing demand for solutions that simplify compliance processes related to Know Your Customer (KYC,) Anti Money Laundering (AML), and consumer protection regulations. In Q1 2025, US financial institutions are expected to accelerate the adoption of RegTech solutions due to changes in data privacy laws, cybersecurity standards, and reporting requirements related to Environmental, Social, and Governance (ESG) factors. UK private equity investors with top notch RegTech firms may find opportunities for exits as buyers in the US look for tools to navigate the maze of compliance requirements.

Capital Markets Technology:

Among markets worldwide the US stands out for having a sophisticated capital markets system that employs various solutions to enhance trading operations, liquidity management, and analytics—all of which are highly valued by investors. European private equity investors who have nurtured technologies in this space are likely to find a receptive audience. In the US, there is a demand from brokers, asset managers, and hedge funds seeking tools to gain a competitive edge.

WealthTech:

In the face of competition, challenges, and fee pressures, US wealth managers are turning to technologies that enhance client interactions and streamline operations. A WealthTech platform backed by UK expertise, offering features like portfolio analysis and seamless digital onboarding, could attract strong valuations.

InsuranceTech:

Within the vast US insurance market there is ample room for technological solutions that optimize claims processing underwriting or predict customer behavior. The InsurTech landscape is booming with opportunities for innovation. Private equity investors presenting proven solutions—especially those tested under regulatory standards—can capture the attention of US insurers aiming to stand out in the crowd.

How Can You Position Your Company for an Exit In the US?

1. Tailor Your Approach to US Customers

Showcase how your offerings specifically cater to American pain points. For example, focus on your solution's capacity to manage diverse consumer bases and navigate regulatory complexities. If your capital markets technology has successfully operated under rigorous regulations like MiFID II in Europe highlight its adaptability for compliance in the US.

2. Enhance Compliance and Technology Development Plans

US investors highly value technology integration strategies. Present product roadmaps that incorporate trends like AI and blockchain while also demonstrating how your portfolio company's technology reduces compliance expenditures boosts security and safeguards data privacy. Showcasing a commitment to staying ahead in addressing emerging trends, such as rising interest rates, evolving ESG standards, or changing consumer behaviors can enhance your company's valuation.

3. Tap Into Local Expertise and Collaborations

To attract investors, it would be beneficial to engage US-based strategic advisors who possess knowledge of the market's dynamics.

Firms such as Stax excel in guiding transatlantic mergers and acquisitions by offering expertise in conducting market research and fine-tuning value propositions for acquirers in the US. Taking steps towards entering the US market—whether it's by adapting marketing materials demonstrating local use cases or securing pilot clients—can significantly reduce risks during the deal process.

Is Your Company Prepared to Seize Its Worth?

The US financial services sector offers opportunities for impactful exits. The pace of innovation the appetite for deals and the scale of American buyers can lead to valuations and improved growth prospects for your portfolio companies. Instead of settling for gains in traditional markets it's worth considering the leap to explore the opportunities across the Atlantic.

It's not about capital; it's about accessing a thriving ecosystem that craves solutions for challenges while preparing for the wave of financial transformation.

For UK-based PE investors aiming to position their financial services portfolios for exits the US market holds promise. However, achieving success demands a strategic approach that comprehends US buyer perspectives, capitalizes on economic conditions, and showcases your portfolio's flexibility, compliance capabilities, and technological advantages.

About Stax

At Stax, we specialize in assisting PE investors with cross-border mergers and acquisitions. We support you in refining your strategy, identifying buyer segments, and fully preparing your portfolio asset for the rigorous scrutiny of the US market. With our expertise in services and cross-border transactions we ensure that your story resonates with potential buyers. Reach out to Stax now to chart your path towards a successful exit in the US and maximize the value of your next strategic move.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy