Share

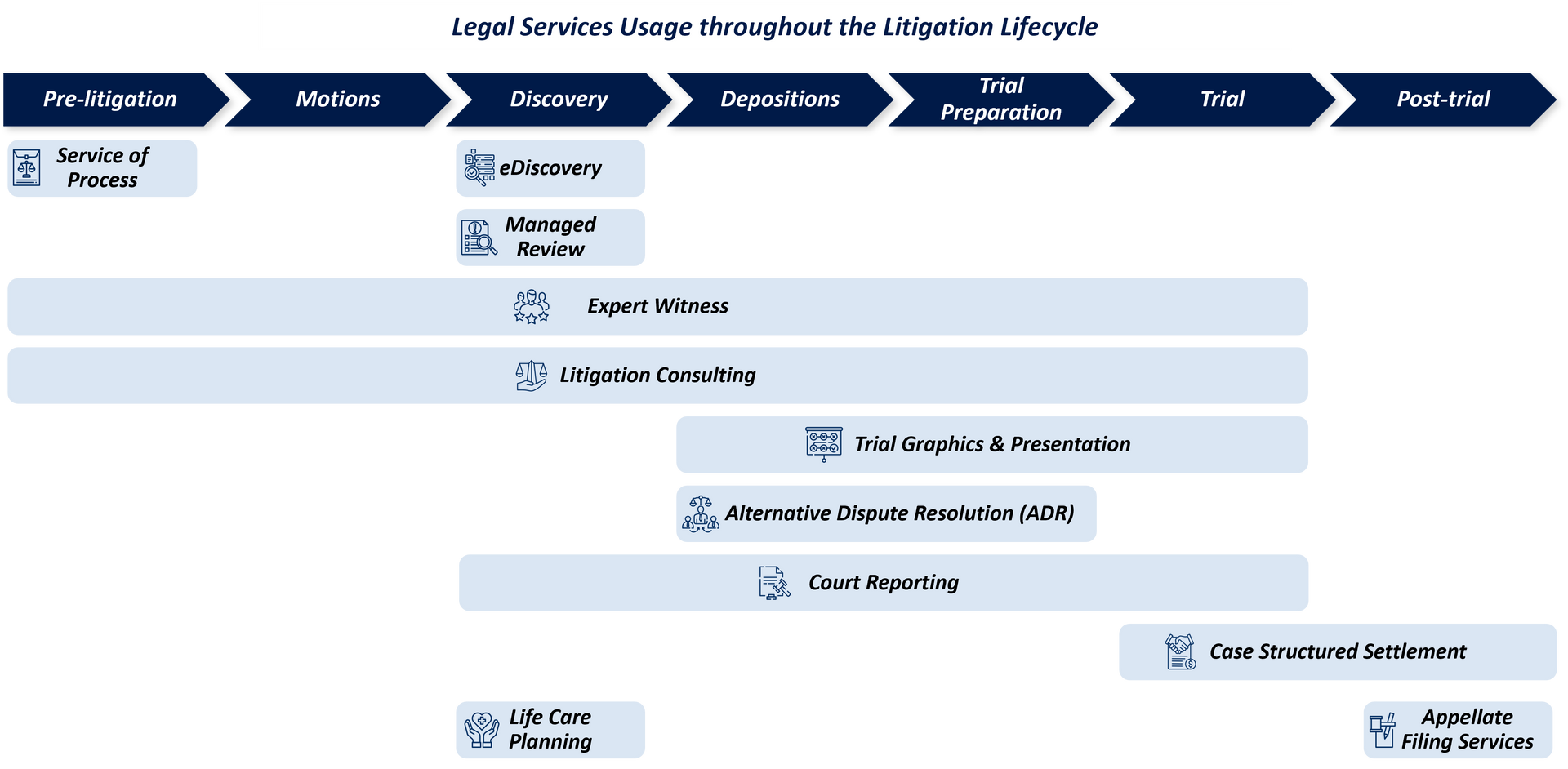

Private equity investors have historically focused within deposition services, though there is growing interest in expanding investments into other areas of the legal service's ecosystem. Areas that have seen increased investment over the last year include:

- Expert Witness Services

- Litigation Consulting

- Trial Graphics & Presentation

- Alternative Dispute Resolution

- Case Structured Settlement

There is opportunity for deposition platforms to diversify into the broader range of services or for investors to create new standalone platforms, given these matter-related services offer a high potential for differentiation and low risk of AI disintermediation. Stax has recent experience in the legal services markets, evaluating a range of providers within deposition services as well as providers of other matter-related services.

Market Perspectives

Expert witness services, litigation consulting, trial graphics, and ADR comprise a meaningful portion of the legal services market and serve as a primary focus for investors. Law firms are increasingly turning towards third-party providers for these services to access individuals with strong expertise, supplement in-house capacity, and streamline costs. As a result, the serviceable opportunity across these services is estimated to be ~$23B.

Key Market Trends

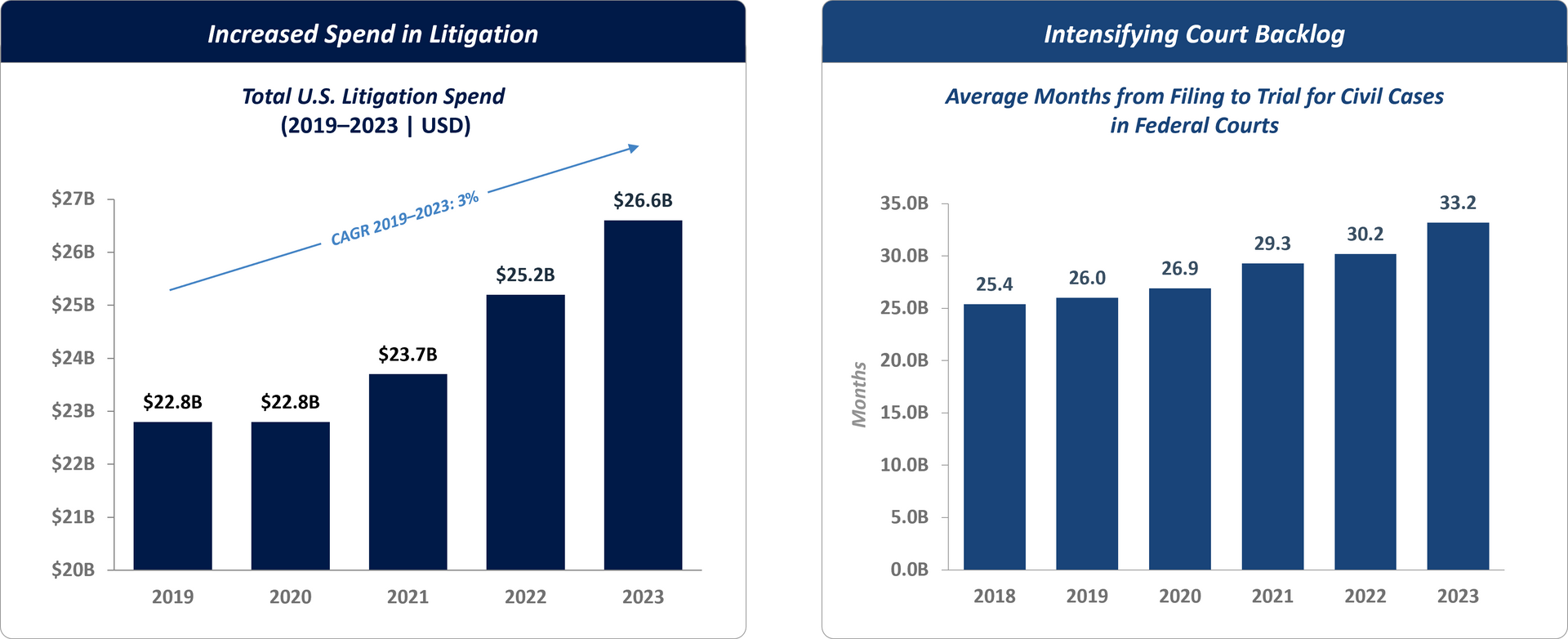

The market for legal services will benefit from a range of tailwinds driving growth in the overall legal market and increasing the prevalence of outsourcing.

Increase in Case Volumes: Overall growth in civil cases has been growing ~2% annually between 2020–2022.

Price Increases: Regular price increases in line with inflation are common across litigation services industry. Due to the critical nature of these services, clients are willing to accept price increases and pay premiums to access top-quality service providers.

Uncertainties in Trial Outcomes: Given the uncertainty of trial outcomes, legal teams are increasingly seeking to settle before trial and are willing to invest more in litigation services, such as expert witnesses and ADR, to facilitate the settlement process.

For cases that proceed to trial, legal teams recognize the growing risk of an unexpected outcome. As a result, they are investing more in services like litigation consulting to ensure thorough trial preparation.

Court System Backlog: The time it takes to go to trial can be burdensome, sometimes taking multiple years before a case is heard in a court room, thus pushing more cases towards ADR.

Changes in Technology Used at Trials: Trials are increasingly taking place virtually, which prompts legal teams to turn towards third-party trial graphics / presentation providers to help navigate the technologies used during these virtual trials. The shift towards virtual trials has also enabled neutrals to mediate a greater number of cases, increasing the capacity of ADR providers.

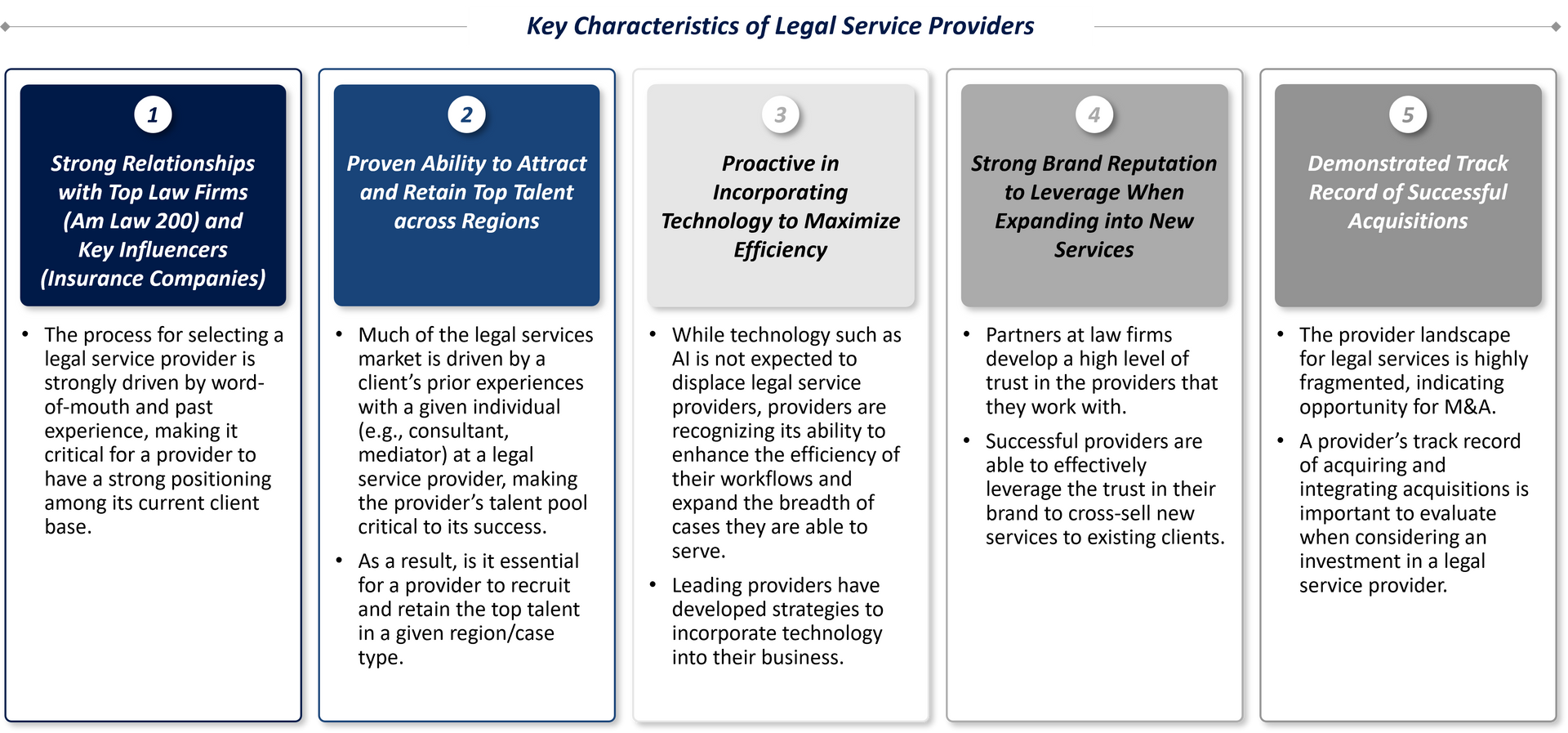

Underscoring these trends is the increasing use of AI to supplement and enhance the legal services market. AI is beginning to be used to automate administrative tasks as well as expand the applicability of legal services into lower complexity cases. While AI will augment legal services, it is unlikely to displace providers due to the complexity of cases (nuanced legal issues, multiple parties, high dollar value at stake, etc.) paired with a reluctance in the legal industry to adopt new technology.

Key Characteristics of Successful Legal Service Providers

Many matter-related services are critical to the outcome of the case, making client relationships and trust critical to the selection process. This differentiates providers and creates a high-level of stickiness among clients. These relationships can be leveraged to cross-sell other matter-related services, providing another avenue of growth for broad platforms. In addition, there is a high level of fragmentation across matter-related services, creating ample runway for continued M&A.

Conclusion

Through our significant experience across legal services, Stax believes this will continue to be a highly attractive market for investors, driven by:

- A sizeable market opportunity with sustainable growth drivers.

- Insulation from economic downturns.

- Ample room for organic and inorganic growth.

Stax is a leading partner to equity sponsors and investment banks in the legal market. Our work is rooted in deep sector and asset-specific experience, as we’ve continued to track and monitor litigation services and the broader market. With over 30 years of serving clients invaluable and actionable insights, visit www.stax.com or contact us here to learn more about our services and expertise.