Share

The legal tech sector has seen significant investment over the past few years, with particular interest in legal practice management (LPM) solutions that serve the SMB market (i.e., firms with fewer than 20 attorneys). There has been much discussion around how much remaining runway is left for vendors to capture, what the drivers for differentiation are across the landscape, and if there is room for multiple winners.

Stax has extensive experience in the LPM market, allowing us to discuss the various software adoption and usage trends among SMB law firms and highlight key considerations for investors.

Market Overview

Highly critical and sticky solution:

LPM solutions are the central source of truth for law firms, tracking case timelines and progress, storing documents, entering time, and facilitating client interactions. Law firms adopt LPMs to enhance efficiency and improve client service, as they enable firms to centralize their workflows, reduce administrative burdens, and ultimately focus more on delivering higher quality services.

Practice management solutions can also provide insights through reporting and analytics, empowering firms to make data-driven decisions and optimize their practice for better outcomes. Once adopted, these solutions are

highly entrenched

due to the amount of data that sits within them.

Size of Market

Significant whitespace is still available:

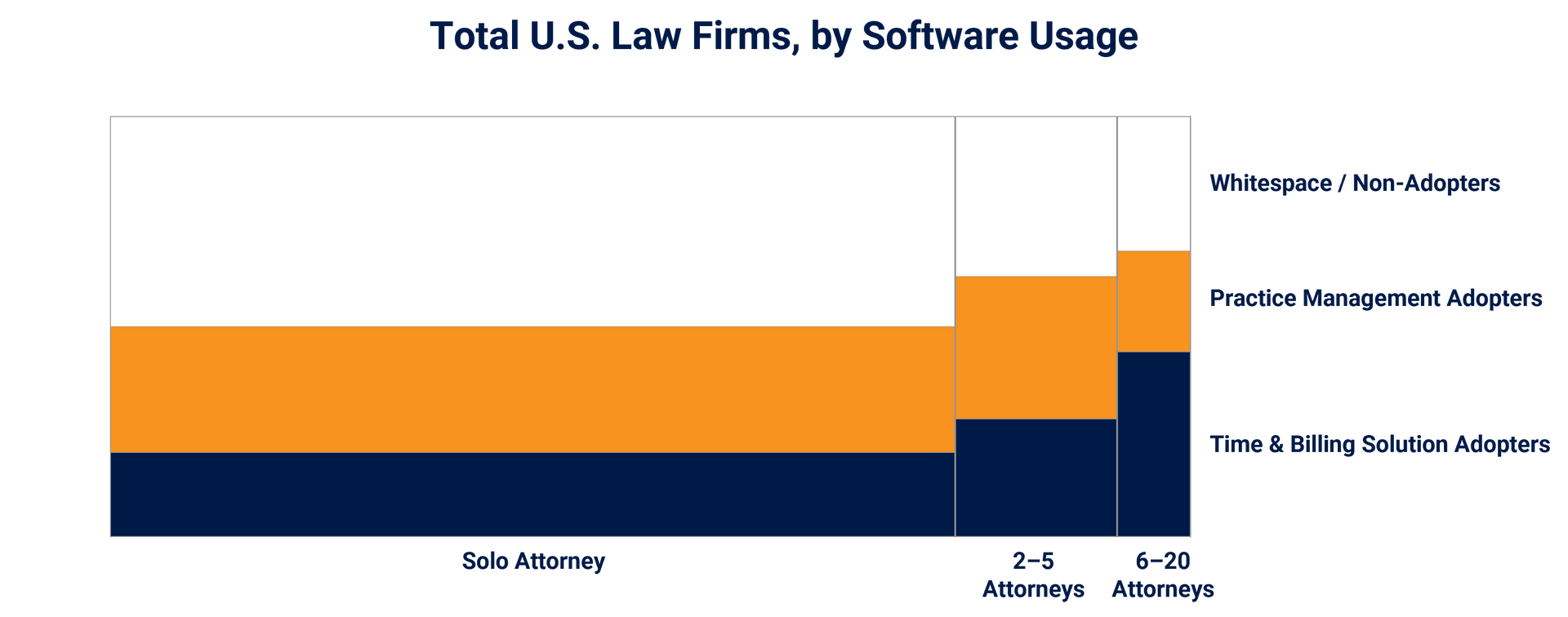

Firms with fewer than 20 attorneys make up ~95% of law firms in the U.S., and ~60% of total addressable software users (attorneys + administrative users). Stax estimates that only ~20-30% of SMB firms currently have a practice management solution in place, while another ~20-30% have just a solution for timekeeping/billing solution, resulting in a significant amount of whitespace available for PM vendors to capture.

The market for practice management solutions is expected to grow at a ~10-15% CAGR over the next 5 years, driven from a combination of new adopters and increasing ACV per customer.

Adoption growth is spurred by firms ‘outgrowing’ their manual tech stack (attorney count or case volume growth) and/or new attorneys entering the firm and recommending new solutions. ACV growth stems from both tier upsells as firms want to do more with their PM, as well as user count growth.

Decision-Making Dynamics & Vendor Landscape

Not all whitespace is created equal:

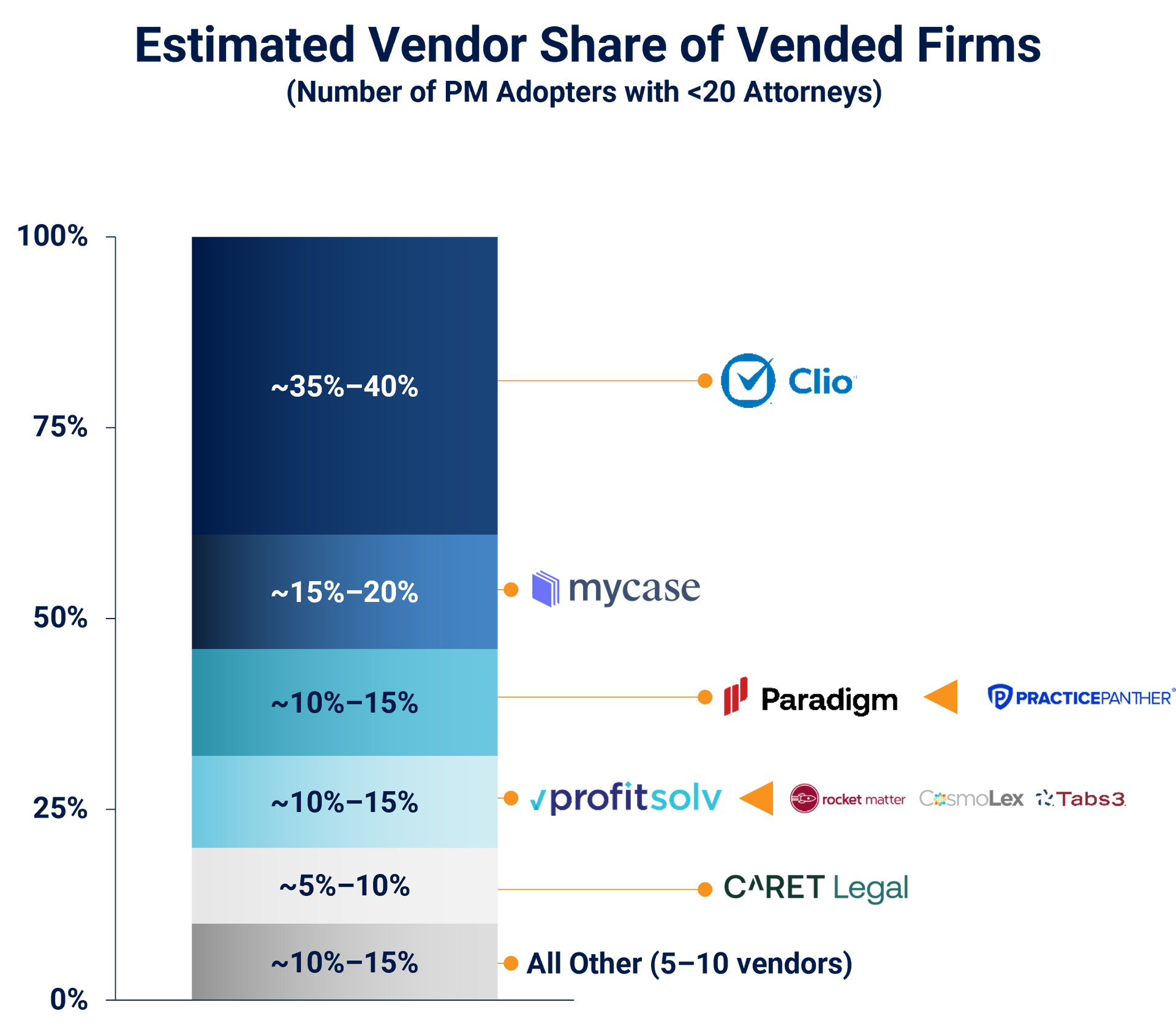

There are currently several major players serving this segment, including Clio, MyCase (AffiniPay), PracticePanther (Paradigm), ProfitSolv, and Caret.

There are varying levels of sophistication and maturity within the SMB market which ultimately drives firms to differ in what they want in a vendor. As such, there are multiple distinct segments within the SMB market, each aligning to a different set of PM vendors. Top factors that influence sub-segmentation alignment include:

- Number of attorneys: Impacts the volume of data and workflows the firm needs to manage, impacting the type of and sophistication of software needed

- Number of non-attorney staff: Impacts the number of stakeholders collaborating on a given case

- Number/breadth of practice areas: Multi-specialty firms likely need software that has greater depth (can manage multiple client types and processes) and is more configurable

- Mix of clients: Affects the need for CRM functionality, a payments processor, and the depth of configurability needed within a software

- Billing structures: Affects the need for the depth and breadth of financial tools needed, specifically billing and payments processors

Tech stack maturity is also driven by how firms prioritize what they want in a vendor. Ultimately, most firms select their vendor based on a combination of:

- Price/Total Cost of Ownership

- Includes sticker price, tiered optionality, bundling options, etc.

- Ease of Use

- Includes ease of navigation, ease of learning, UI appeal, etc.

- Breadth/Depth of Functionality

- Includes number of features, configurability, integration capabilities, etc.

Each vendor aligns to a slightly different ideal customer profile (ICP) based on the breadth and depth of their functionality, price point/structure, and how easy the solution is to use. Given the number of firmographic-/psychographic-driven segments within the SMB market coupled with the ample whitespace available, there is still room for vendors to grow down-market. And, despite a small group of highly established brands in the segment, there is still opportunity for emerging vendors to differentiate.

Emerging Trends/Shifting Vendor Dynamics

- Embedded Payments: PM vendors are continuing to promote their embedded payments solution to gain share-of-wallet away from other solutions like LawPay, PayPal, etc.

- Embedded Accounting: Some vendors have added embedded firm accounting in an effort to both 1) gain share-of-wallet from Quickbooks and 2) serve a broader ICP.

- Mid-Market Expansion: Some vendors are looking to move upmarket to compete against a less competitive vendor landscape and expand their TAM/profitability.

Conclusion

There is still a significant amount of whitespace available in the market, with vendor growth still stemming from net new adoption rather than competitive displacement. Still, it's essential to recognize the nuances within the SMB segment—not all firms are alike due to various factors. This range creates room for multiple PM winners in the market, but not all ICP TAMs are created equal. Important questions for investors to ponder when seeking an investment in the legal practice management market include:

- Who is the ideal customer profile of the vendor I am interested in?

- Based on their ICP, how big is the market they are most aligned to, and how much whitespace is available in that segment?

- What is the vendor’s right-to-win against other vendors that serve the same ICP?

- What is the opportunity to cross-/upsell current customers with payments, financial management, CRM, etc.?

Stax is a leading partner to equity sponsors and investment banks in the Legal technology sector. Our work is routed in deep sector and asset-specific experience, as we’ve continued to track and monitor the legal technology space over the past several years. To learn more about Stax and our services, visit www.stax.com or contact us here to learn more.