Share

Key Findings

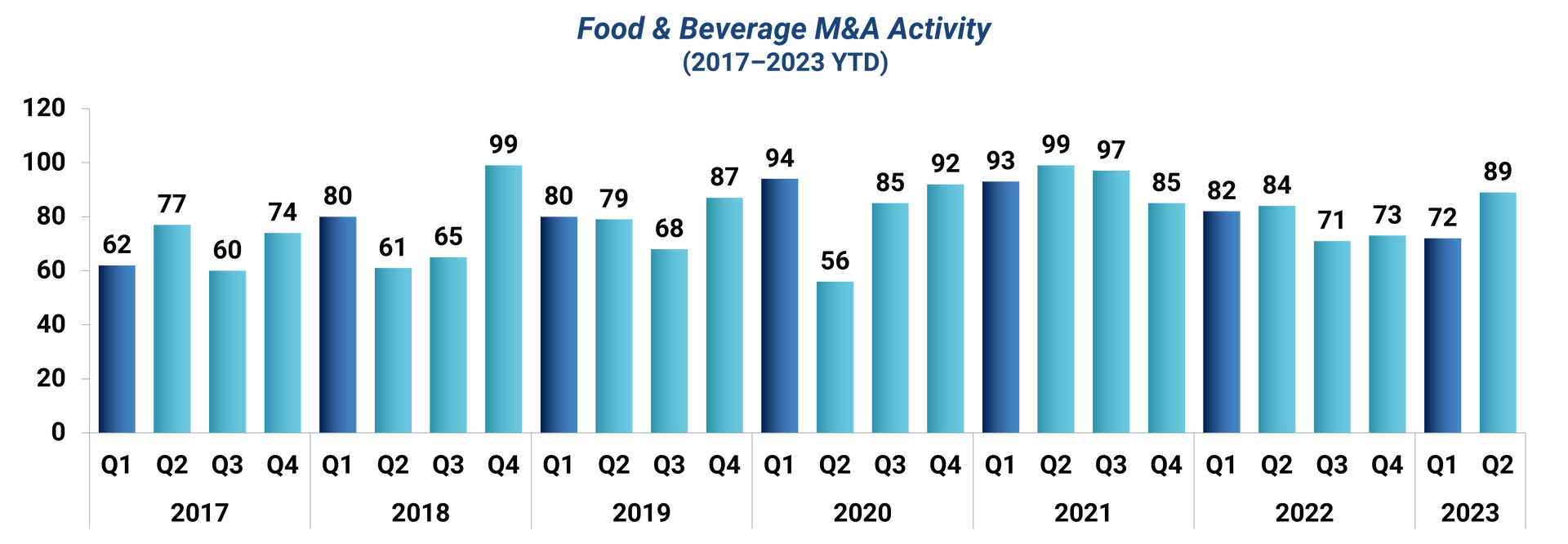

- Deal activity in Food & Beverage (F&B) has leveled off following post-Covid highs, warranting a deeper look at the areas where there remains a strong undercurrent of investor interest.

- Stax has seen a convergence of interest in upstream F&B assets, especially those in Private Label (PL) manufacturing.

- The Private Label category continues to witness share growth versus name-brand products, coinciding with the broadening of private label offerings to include “premium” products.

- Key questions for investors to consider:

- To what extent are these growth trends sustainable?

- How are retailer strategies towards private label offerings evolving, and what opportunities do they create in the near-term and longer-term?

Takeaways From Current Deal Landscape

Overall F&B deal activity has plateaued from the post-Covid highs, mirroring the broader consumer and retail industry segments. Food & beverage brand deal activity is predominately driven by strategic acquisitions, as established brands seek to apply their operational/distribution scale as a way to increase market penetration and shareholder value.

Amid the adjustment/rebalancing of food & beverage deal activity, our private equity clients have become increasingly selective about what deals they choose to undertake in the space.

Stax has seen growing investor interest in deploying capital towards upstream food & beverage value chain stakeholders, most prominently, manufacturing assets. Such increased investment is driven by a variety of market dynamics:

- Shifting consumer preferences towards private label offerings; driving investor interest towards manufacturers that specialize in this type of production

- Increasingly sophisticated retailer private label strategies; indexing opportunity for manufacturers that can meet this demand for innovative/quality-driven offerings

- Investor interest in the sales insulation of manufacturing assets in capitalizing on category tailwinds, relative to the potential volatility of brand-specific exposure

Private label vs. Name brand

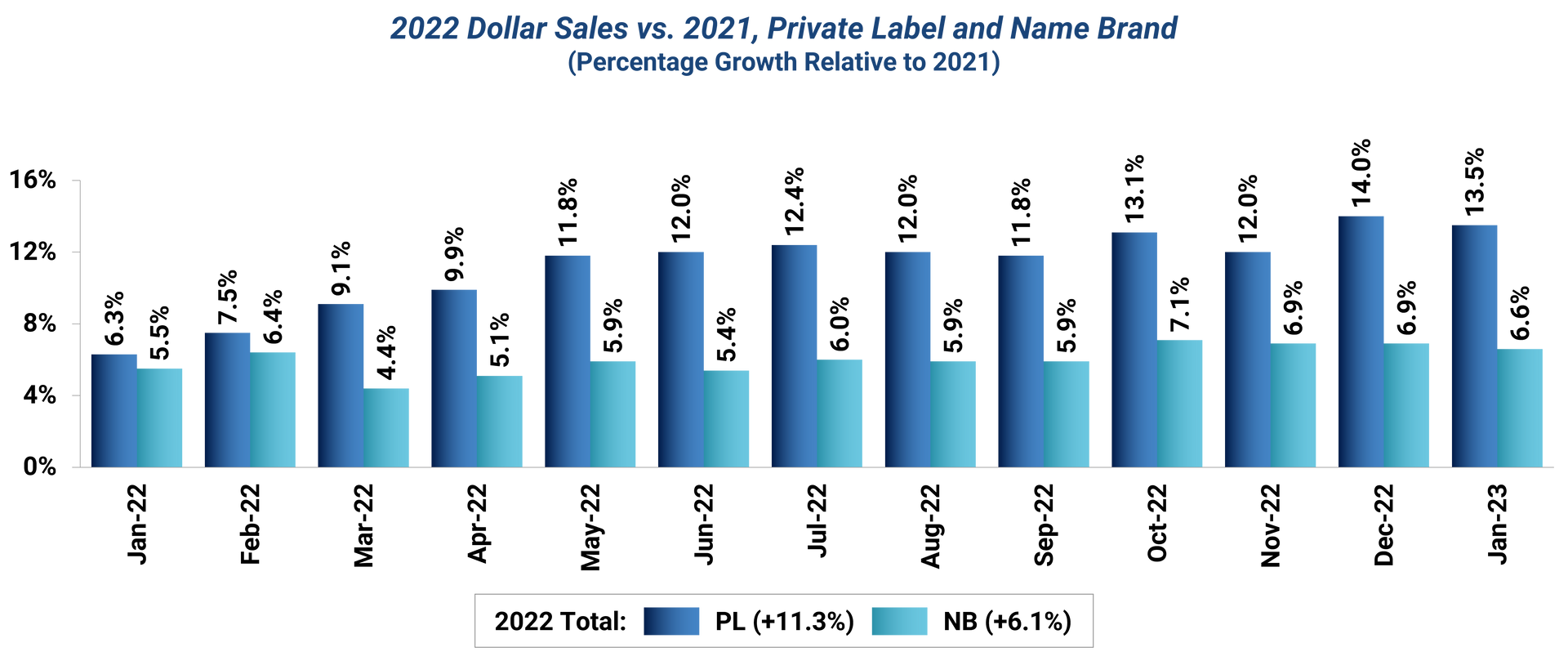

Sales data collected across U.S. grocery retailers demonstrates private label’s continued share gain from name brand offerings across multiple F&B categories. The Private Label Manufacturers Association (PLMA) estimates private label products accounted for 29% of all new dollar sales entering the U.S. retailing industry in 2022. In aggregate, private label sales growth consistently outpaced that of name brand offerings in 2022, with strong indications of this trend persisting into 2023.

Further, this trend is apparent across categories but most pronounced in F&B departments, inclusive of those that already see significant private label sales. Growth is not limited to segments in which private labels offerings are underpenetrated.

Current inflation has accelerated the trend towards private label goods, driving consumers toward more budget-friendly options. However, the factors which underpin this shift in consumer preferences are not a flash in the pan and have, to some extent, long-term staying power. Part of this trend is due to consumers maintaining the habits they formed during Covid. In addition, supply chain constraints during the pandemic required that consumers seek out private label offerings in-lieu of more name brand options. This helped lessen the stigma of store brand alternatives through exposure to comparable quality and lower price point.

This “comparable quality” comes as a function of a more concerted effort among retailers to close the gap on name brand products and invest in the roll-out of ‘premium’ private label offerings. But why are retailers looking to roll out these premium offerings when name brand options are more readily available?

In part, this uptick is a response to rising consumer openness to private labels. In addition, there has been a natural progression in retailer strategy towards private label in which these offerings are viewed as a driver of consumer loyalty and repeat business (as opposed to being rolled out solely to compete on cost against name brands). Lastly, the continued emergence of private label-heavy retailers (Trader Joes, Aldi) is another driver, spurring other retailers into action.

Key Themes and Investor Questions

Across these engagements, recurring themes have emerged that reflect the growth hypotheses underpinning investor interest in the space. Similarly, these themes make evident the areas that investors need to de-risk, largely focused on potential macro downside.

Stax analyzes various industries to locate key investment opportunities for clients, along with market outlooks designed to provide peace-of-mind with any long-term investments. Our experts conduct research to produce actionable, data-driven insights that investors can act with and depend on. To learn more about Stax, visit us at www.stax.com or contact us here.

Read More