How Variations Affected the AMR Top 20

How Variations Affected the AMR Top 20

Florent Jarry, partner, AMR International (acquired by Stax in 2022) offers some extra insight into the recent publication of the AMR Top 20 exhibition organisers by 2021 exhibition-organising revenue

Since we released the AMR Top 20 exhibition organisers in September, there’s been a lot of interest in the rankings from across the industry. It’s a case of who made it and who didn’t.

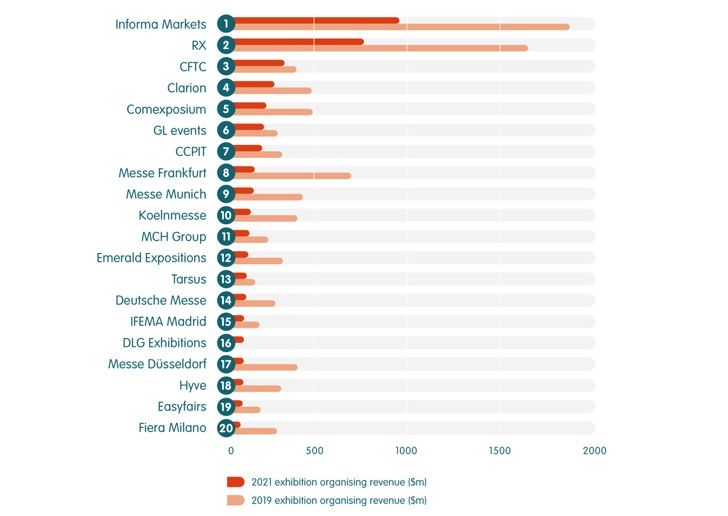

Now in its sixth year, the AMR Top 20 is the only global ranking that is based exclusively on exhibition-organising revenues. This latest ranking takes into account 2021 revenues.

Just to recap, we saw no change among the top three from last year: Informa Markets remains number one, followed by RX and CFTC. But exceptional circumstances make for exceptional results: IFEMA Madrid and Shanghai-listed DLG Exhibitions make their debut, while Easyfairs rejoins. However, Italian Exhibition Group (IEG), dmg events and Messe Nuremberg drop out.

So, what happened?

The strong variation in organiser recovery, ranging between 20% of their pre-Covid size to around 80%, is largely dependent on portfolio exposure, e.g., 2021 was a much stronger year for those with events in China than those with large international shows in Europe. Based on our Globex market forecasts, in 2021, China was the clear leader globally in terms of market recovery, rebounding to 87% of pre-Covid highs. This was predominantly driven by the relaxation of domestic Covid restrictions earlier than anywhere else. Meanwhile, Germany, known for its large international trade shows, reached a paltry 26% of its pre-Covid size.

The success of digital initiatives will also have contributed to support the position of some organisers, although this had a more marginal revenue impact.

Covid and the geopolitical situation have taken a new course in 2022, so next year’s rankings will likely look different again.

At AMR International we closely follow organiser strategy as part of our research for Globex – it also includes coverage on 20 markets and forecasts up to 2024. Globex 2022 will be released on 31 October.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy