Delivering Higher Sales Growth in a Downturn

Delivering Higher Sales Growth in a Downturn

What Can I Learn from the Fastest-Growing SaaS Companies?

Sales and marketing leaders are facing quite the quandary as the U.S. likely heads into a recession. No matter if you believe whether we are technically in a recession or not, there is no question that most industries will experience either slowing growth rates or demand contraction over the next 12 to 18 months. How can sales and marketing leaders meet the challenge of selling in a softer market environment? With fewer customers willing to buy, each opportunity is a bigger dogfight— and it’s always better to be prepared.

At Stax, our experience across industries and, particularly our depth of work in software (100+ software projects in the past 24 months) has taught us that there’s much to be learned about a set of companies that consistently put up high-growth numbers in the face of increasing competition and slowing markets.

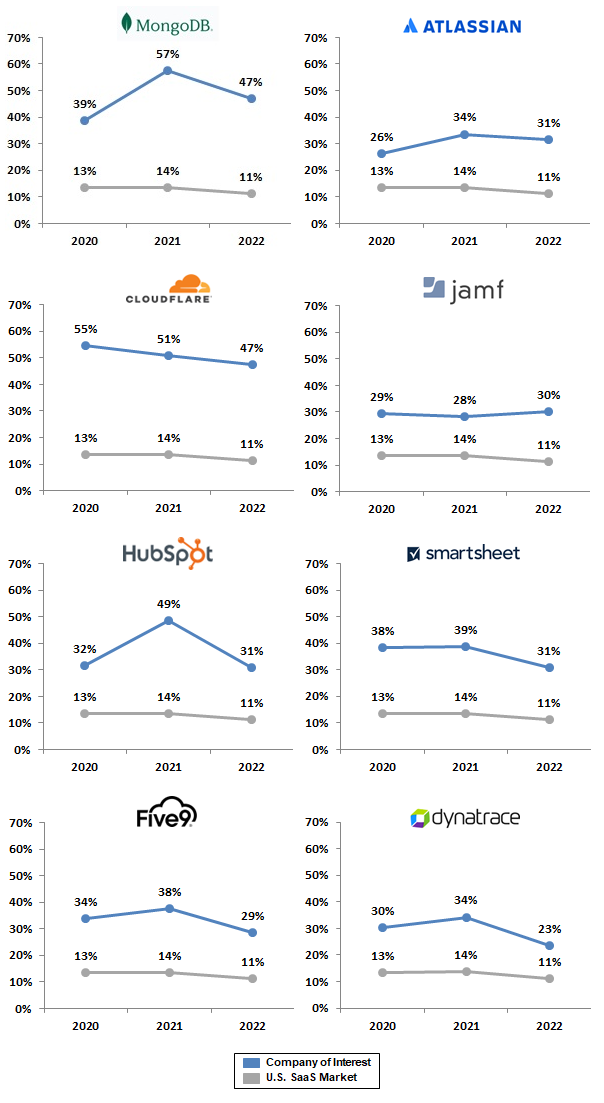

Look at the following leaders for B2B software and their ability to maintain above market organic growth rates; even through the tail end of 2022. These SaaS market leaders, even at scale (all above $300M in revenue), have maintained growth rates beyond 20% to 40%— which is 2 to 3x the market.

Stax Analysis December 2022

It is easy to say that these leaders aren’t fit for comparison to other industries. After all, software is a growth industry. Yet, these firms have grown much faster than the software industry overall, and, in most cases, they face formidable, larger competitors with distinct advantages in both scale and breadth of applications offerings. From the Stax viewpoint, sustaining high growth while scaling demand capabilities is highly impressive.

What then, can we learn from these SaaS market leaders? Better yet, what techniques, capabilities, and proven methods for driving demand can companies in more traditional industries learn and adapt to accelerate revenue in a declining market environment?

Here are a few top learnings that we believe apply across industries. Ask yourself or your sales leaders, how well you do any of the following?

- Maintain a maniacal focus on your ICP (Ideal Customer Profile) – This presumes you have identified your ICP. An ICP simply is the customer which is both most valuable to you long term (Customer Lifetime Value) and where you stand the greatest chance of success to win. Easy to say as a strategy, but tougher to implement.

The best SaaS companies utilize predictive intelligence to target and directly point both sales and marketing to potential customers that match their ICP. They use predictive analytics based on historical won/loss rates, intent signals (e.g., such as ABM), retention potential, and estimated ACV (contract value) as components for ICP prediction. They believe that poorly rated targets should not be chased and are typically not worth the opportunity cost vs. winning with top prospects.

A senior executive at a leading fintech SaaS company, which recently sold for a $1B, shared their thoughts with us: “We have every single potential customer (~100,000) in the U.S. mapped to profiles. We rank them from A to D, and only incent our salespeople on A and B accounts. We know that not going after our ICP means we are trading off a higher probability opportunity for a much lower one.” - Establish a repeatable formula and reinforce winning behaviors – SaaS growth leaders stick to their knitting, and train and incent SDR’s and AE’s (reps and account leaders) to follow the program. Getting to this formula, especially with new products, is often an exercise in trial and error. Once it works, it is meant to be followed. SaaS leaders don’t just incent for quota attainment; they monitor, record, and analyze sales activities from each customer interaction to define and solidify best practice. One of the most valuable outcomes from the digitization of sales motions is faster learning. Top SaaS growth leaders are foremost learning organizations, backed by hard data.

- Build an always expanding lead gen engine through multi-channel testing – No doubt that keeping the top of the funnel healthy becomes tougher in a downturn. The learning from SaaS growth leaders is the need to consistently expand the pool of qualified leads, regardless of market conditions. Growing 20%+ year over year is impossible from current accounts alone, so each of our SaaS leaders has mastered the ability to grow their lead pipelines without breaking the bank on marketing. A good ratio to manage is for each sales rep to have an opportunity pipeline that is at least 3x their target.

This means establishing a model to test, learn, and optimize different methods of outreach to generate and nurture leads at the highest ROI. For example, despite all the advances in inbound marketing, many of our clients are surprised that direct calling still has a role for lead generation. If your target customer is not in front of their computer all day, then you may be better off trying their cell phones. A recent ZoomInfo study (a leading B2B sales intelligence SaaS company) found that over 25% of prospects answered their cell phones directly when contacted by their sales team. - They anticipate and manage sales force churn through risk monitoring and proactive territory alignment – It’s highly unlikely that you’ll be able to maintain a high-growth rate if territories remain uncovered due to rep attrition. A recent study found 45% of top performing sales reps have looked for opportunities at other firms in the last six months (Gong’s Reality of Sales Talent Survey, 2022). Interestingly, most sales organizations are in a better position than they think to predict sales rep churn (both good and bad) through quota and territory analytics.

A leader at a $1B+ tech company offered a seldom used best practice, “We moved to difficulty adjusted territories by being able to accurately predict and monitor the revenue potential of reps including lost income from customer loss. This helped us anticipate churn in our salesforce and take pre-emptive action to help strong performing reps make up any gaps.” - Don't forget the back end and be flexible – It makes little sense to invest more heavily to acquire new customers if unhappy customers are leaving. The best firms get the balance right between the cost of acquisition vs. optimizing full customer lifetime value. In other words, the old mantra is still true, keeping a customer is often cheaper than bringing a new one in the door. Preventing customer defection, including share of wallet loss, is an all-hands-on deck issue. SaaS leaders utilize predictive analytics and monitoring of customer activities on their platforms to flag ‘at risk’ accounts. Renewing accounts is not just the job of downstream customer success teams. Sales account executives and even sales leadership should be accountable for keeping customers happy.

Learnings – A common theme across these five best practices is the increasing use of predictive intelligence and analytics, utilized tactically to guide sales and marketing activities. It’s no surprise, given that these leading SaaS companies are rooted in digitally enabling their own customers.

For traditional companies, with more legacy-oriented sales capabilities, incorporating digital and analytics-based best practices is harder, but not insurmountable. We find that the key is to start small and put points on the board quickly. The harder part is initiating change with the right use case, and an earnest willingness to get the sales force to try new behaviors. With the current downturn, there’s also no better time to start.

Vince Zosa is a Managing Director at Stax in the Boston office. He leads value creation projects across both private equity owned portfolio companies and Fortune 1,000 corporates.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy